Derivatives in Bitcoin & Crypto: Futures, Perpetual Swaps and Options

Let’s start with what derivatives are.

These are financial products with values based on another asset. Derivatives can be securities or contracts, deriving their values from traditional fiat currencies (FX), Digital currencies (Cryptocurrencies), commodities, bonds, interest rates, and the stock market, to mention a few.

Coming back to crypto derivates, they are financial products with their values derived from a crypto asset, which can be either Bitcoin or any of the top altcoins in the crypto market.

Bitcoin BTC, Ether ETH, and Litecoin LTC regular and perpetual Futures contracts are typical examples of Derivatives.

Their market prices are derived from underlying instruments, i.e., the corresponding digital/crypto asset.

It simply means that with crypto derivatives, you can participate in the cryptocurrency market and speculate on the huge price fluctuations, without holding on to any crypto keys.

What are the common forms of derivatives in crypto?

Derivatives are increasingly popular in the crypto industry offered as Futures contracts, perpetual futures contracts, forwards, swaps, and options.

Futures Contracts

Futures contracts are agreements between two entities or individuals to buy or sell a particular crypto asset on a specific date and at the agreed price in the future.

They are variants of derivatives, as their value is derived from the underlying cryptocurrency, where the exchange date and price of the asset is fixed.

In the case of a regular futures contract between Mr. A and Mr.B, where MR. A is the buyer of Bitcoin BTC at $5000.00 and MR. B is the seller, Mr. A may make a profit if Bitcoin’s price closes above the $5000.00 mark, and Mr. B makes a loss in this scenario.

They can be traded on crypto exchanges like BTCC exchange, Binance Exchange, and so many more.

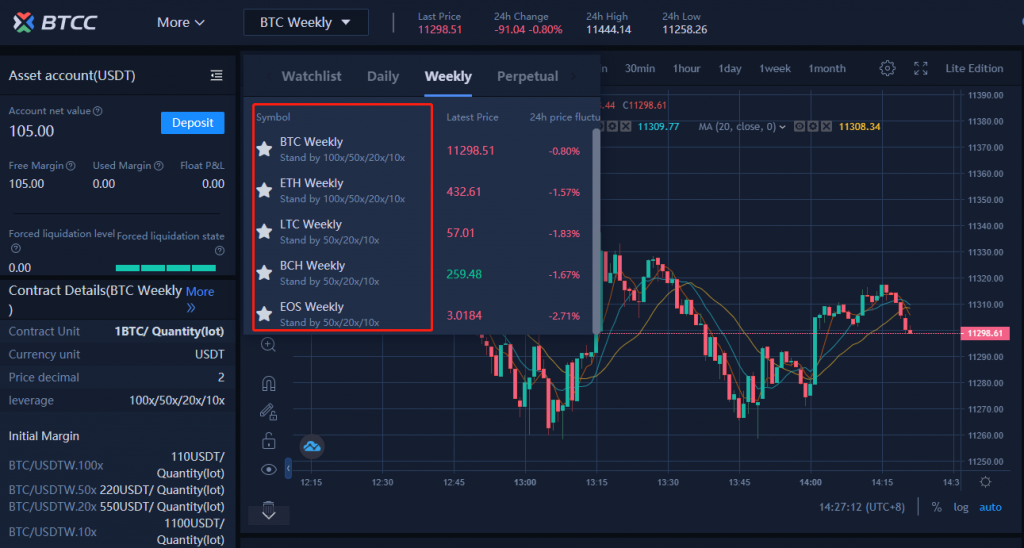

BTCC crypto exchange offers trading of regular daily and weekly futures on popular cryptocurrencies like Bitcoin BTC, Ethereum ETH, EOS, Litecoin LTC, to mention a few.

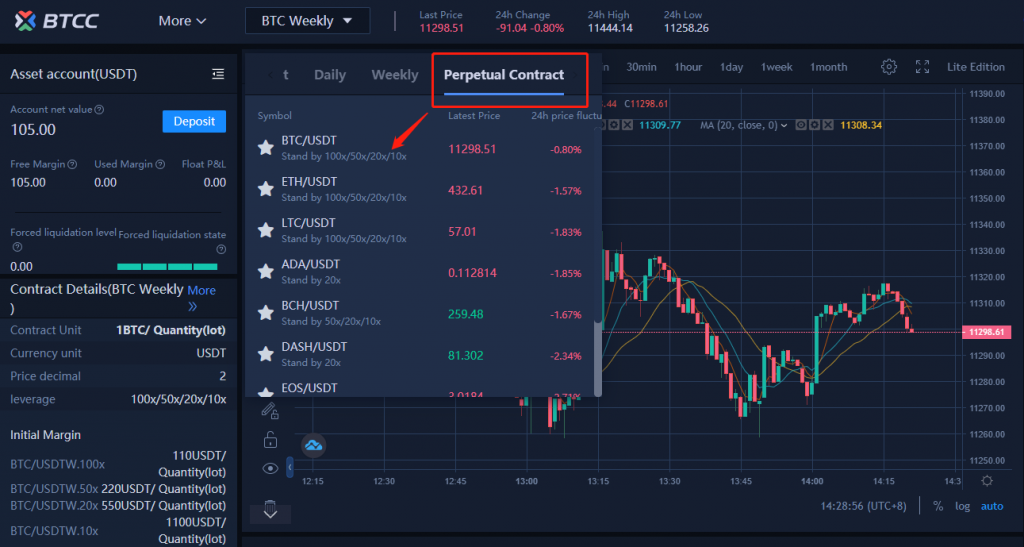

Perpetual futures contracts

These are like regular futures contracts, the difference being that the trader can hold on to the trade as long as the minimum requirements such as liquidation and margin requirements are met.

Perpetual futures contracts do not have an expiration date; thus they can be held till the trader decides to close in profit or get liquidated by the broker in a situation where the account goes below the allowable margin level.

Regular and perpetual futures contracts are generally traded on leverage, allowing the trader access to funds, therefore boosting his profit margin, not forgetting to mention an equal increase in risk.

Swaps

It involves the exchange of one crypto asset for another with the goal of making profits in a future date/time.

The explosion of decentralized finance DeFi has mad the swapping of cryptos popular, accessible and decentralized, with UniSwap being one of the industry leaders.

Forwards

It’s a contract similar to futures contracts in the form of agreements between two individuals, or entity, buying or selling an asset for profit at an agreed price, and expiration date/time.

The significant differences between futures and forwards contracts are that forward contracts are negotiable, are customizable, and traded over the counter OTC.

Forwards like most CFDs are utilized for speculation purposes. They are more similar to perpetual futures contracts in the sense that they can be closed before the expiration date, as a way to minimize loss.

Options

Again, these are financial products that operate like a futures contract. For a bitcoin BTC option, a trader pays a premium with no obligation to buy BTC at a set date or time, in a similar way to regular call or put options.

Some exchanges even offer binary options for cryptocurrencies where trade must close above a specified price level within a set expiration period to make a profit.

Why would a crypto trader use derivatives?

There are several reasons for traders to deploy derivatives in their trading portfolio, the fundamental purpose being a hedge against risk. The second is for speculation on the fluctuation of the underlying asset.

In the Bitcoin mining industry, miners can use derivatives in the form of futures contracts to hedge against the risk of exposure on declining miners’ revenue, decreasing Bitcoin price, or increasing electricity and maintenance costs.

Speculation is a common way traders and investors utilize derivatives as crypto markets see considerable fluctuations in price, giving room for profits in between.

Where can I trade crypto derivatives?

There’s been a massive demand for crypto derivatives since the 2017 crypto bull run.

The Chicago Mercantile Exchange CME and Chicago Board Options Exchange CBOE launched Bitcoin futures trading in 2017.

Traditional broker/exchange companies that can be regulated and the unregulated exchanges now offer to trade crypto derivatives.

LedgerX and Bakkt are crypto exchanges that offer crypto derivatives at an institutional level.

Traders can also trade cryptocurrency derivatives on the BTCC exchange, Binance exchange, Huobi, and Bitfinex, etc.

On these exchanges, traders have access to a wide range of cryptocurrencies, altcoin and tokens, where they can aim to buy at a low price and sell at a high price in a future date/time, either long or short term holding.

With crypto derivatives, traders can now short a rising or declining cryptocurrency trend to profit from the price slump. An example is the 2018 crypto winter, where the total crypto market cap slumped by -92.6%, falling from 496.945 Billion USD to 36.75 Billion USD in 12 months.

Trading Derivatives on BTCC.com Trading terminal

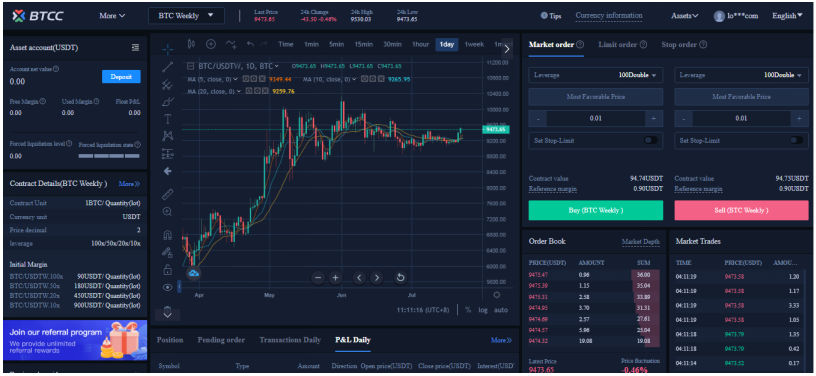

It takes three quick steps to trade crypto derivatives on BTCC after making a deposit.

PROMOTION: Trade with Up to 2,000 USDT Deposit Bonus on BTCC

1 Select your analyzed crypto asset from either the daily/weekly futures contract or the perpetual futures contract.

2 Set your lot size, leverage, stop loss, and take profit levels.

3 Click the buy or sell button based on your trend projection.

The downsides of trading crypto derivatives?

Although trading crypto derivatives have its advantages in terms of allowing traders to participate in the crypto market without necessarily holding private keys of the crypto or any other technical features; A way for crypto HODLers to mitigate against risk in the event of massive price fluctuations, or a bear market.

Trading products that offer leverage on asset price fluctuations carry a substantial risk level too, not forgetting to mention that a high number of crypto exchanges are unregulated.

Top on the list of risk concerns when trading crypto derivatives is vast volatility, which often comes as flash crashes, and massive slippages.

Taking on huge leverage when trading on margin often amplifies losses in such scenarios when volatility increases. Traders may even experience wide slippages during such events.

Market newbies should have a full understanding of how the different crypto derivatives work on their chosen broker.

You can achieve this by subscribing to brokers that have demo/practice accounts and bonuses upon subscription.

An understanding of regulations around your chosen crypto derivative exchange is also essential as different countries show caution towards crypto futures and other related CFDs.