What Are Bitcoin Futures & How Do Bitcoin Futures Work?

Everybody wants to earn an extra income for affording their luxuries! In the world of financial markets, if you are looking to trade to make yourself an excess amount; trading bitcoin futures is amongst the most excellent ideas.

Why bitcoin for trading and not other assets/commodities may be a question that hits your mind now! The fastest-growing digital asset is considered king to the crypto-world and offers you enough volatility to make money – like none other. Not the crypto-world moves BTC, but it is vice-versa. BTC moves the crypto-world.

BTC futures are the future options which allow traders and investors to take exposure of the underlying asset (BTC in this case) without having to hold the asset. Similar to other available future contracts for different assets, commodities and indices, the bitcoin futures offer the traders to speculate on the movement of BTC and make money for themselves!

How do the bitcoin future work, and what is the leverage?

Bitcoin futures are futures contracts of bitcoin. When the price of the bitcoin moves, so does the contract-price of its futures. For example, if the bitcoin’s price starts to rise; similar movement will be witnessed in its futures (with small volatility due to the demand/supply pressure).

There are leverage options available where, according to your risk-bearing and speculative nature, you may trade as much as 100x to the value of the position you hold in assets! For example, if you have $1,000 available in your margin-trading account and you are willing to use (let’s say) 50x of the exposure (which is 50 times the value of your account), you can buy bitcoin futures worth $50,000. Assuming you purchased 5-lots (contract size is 1BTC) for BTC-future at $10,000, and the price fluctuated to $10,500 (assumption) which is only 5% of the value, you will end up making $2,500 on your account which only had $1,000. Potentially, according to this small 5% trade; a speculator made a 250% return in a single day!

Now comes the most critical question – where to trade the BTC futures? You can’t just decide to put your assets in an insecure place. So, we need an exchange that offers you enough liquidity, a safe-environment, has minimum potential susceptibility to being hacked and yet provides an affordable price!

There you go – the BTCC Crypto exchange is the answer to you.

Apart from the CME offering the bitcoin futures, there are many other platforms which are now operating to provide the bitcoin-related future contracts to individuals and corporates. Out of all of them, the BTCC exchange has been selected after careful consideration of all the options. Let’s tell you WHY BTCC Exchange.

The exchange that has served over 06 million users globally since 2011 remains the longest-serving digital currency exchange of the globe! With enough liquidity being offered to the traders (as this piece is being written, the 24-HR volume is 147,782 in the BTCC-bitcoin futures while the 24-HR BTCC-Delivery volume is 8,858BTC which is amongst the highest for the operating exchanges!) BTCC-index combines the spot prices of multiple exchanges and then offers the quote – which keeps its customers safe from any manipulation from a single mainstream exchange. The platform depth is so deep that the exchange can easily manage to take an order up to 500BTC in a single go!

BTCC exchange has been amongst the largest-yet fewest which have managed to provide a safe environment to its customers. Through innovative technology and independent trading systems, BTCC has managed to create multi-layered walls to protect the client’s assets. For the last 08 years, BTCC has managed to take pride in “no-incidents” timeline within its history!

BTCC-platform uses the professional technology that ensures extreme market conditions are taken care of, well. To your wildest thoughts, if the customer makes a loss on the user’s position entry since vigorous fluctuations were going on, the market fluctuations are borne by the platform and are allocated permanently! What more could the exchange offer its customers!

Guess what? The exchange offers you to activate your account only with $100! Not just that, it allows you to trade with as minimum as 0.5btc/trade. With various leverage options, you can take the opportunity of leverage to as much as 100x! With nine major currencies-backed contracts being offered, there are 14-pairs which can be traded on long-side as well as short!

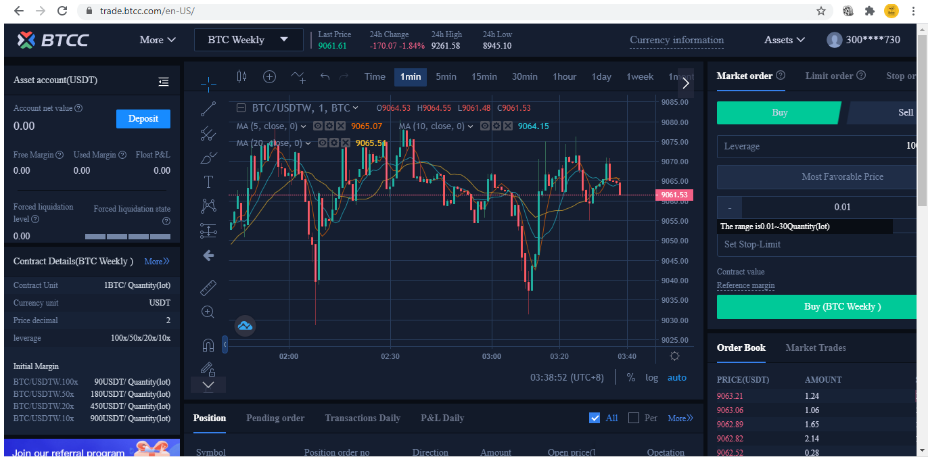

Offering multiple languages to find ease, the trade screen has all the requirements that you would need in a single display. Have a look:

Not just the order book available, the exchange shows us the market trades as well. With available live charts to use for the customer’s ease, the charting tools within the same screen give the customer an edge to make quick & handy decisions.

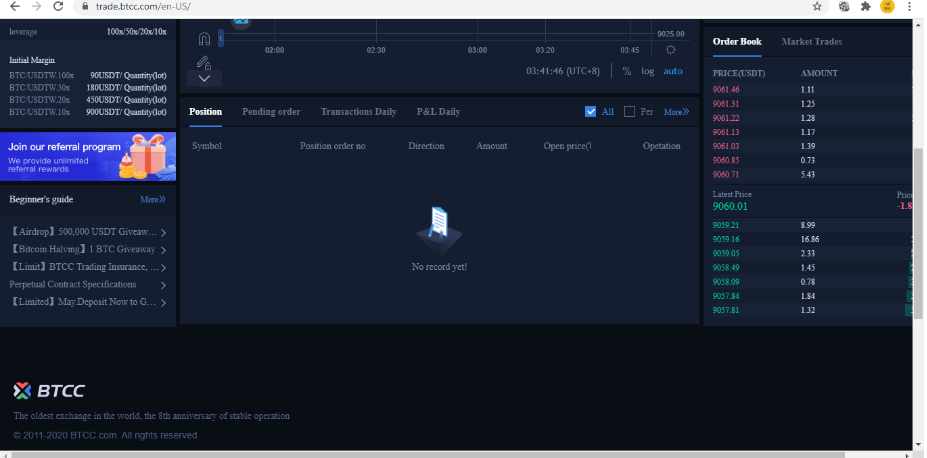

The lower end on the screen is shown below:

This portion shows you your current position, your pending orders, your transactions for the day and your P&L as well. How convenient!

Not to forget, you can also join the referral program on the exchange to earn rewards for yourself.

Enough of the excellent characteristics mentioned about the exchange, let us now take a peep into how you can trade at the BTCC exchange.

How to trade the Bitcoin futures on the BTCC-exchange:

You will not believe – creating an account on BTCC platform only takes 30 seconds to be functional. YES – that is only half a minute. How convenient. Below are the steps mentioned once you have registered yourself a new user:

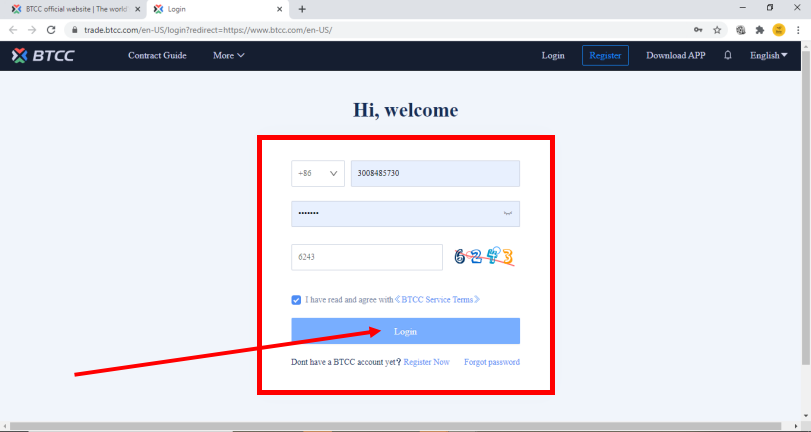

Step 1) Login into your account. This will open up the English version of the platform for your ease. Once you are in, press on the login option shown below:

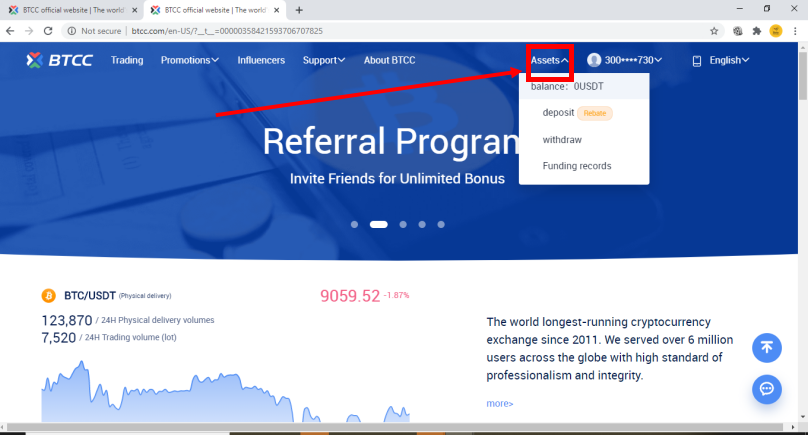

Step 2) Once you have logged in, you are on the platform. From here, you can check your assets and enter the trading screen, which will allow you to trade. For checking your assets or to make deposits/withdrawal, you can check the below snapshot:

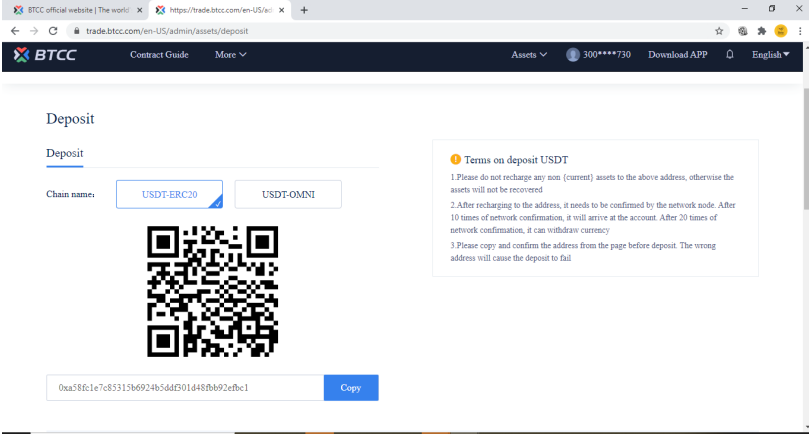

Once you press on it, a screen like this should open up for you which should allow you to make deposits as well. The depositing address may be used for the depositing purpose.

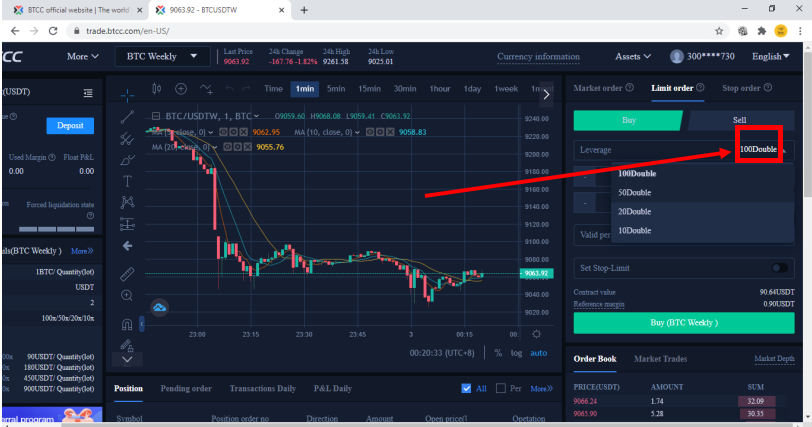

Step 3) Now, you are ready to get yourself on the trading platform. See how the trading screen looks like. The selection for x-times of leverage is marked for you to find.

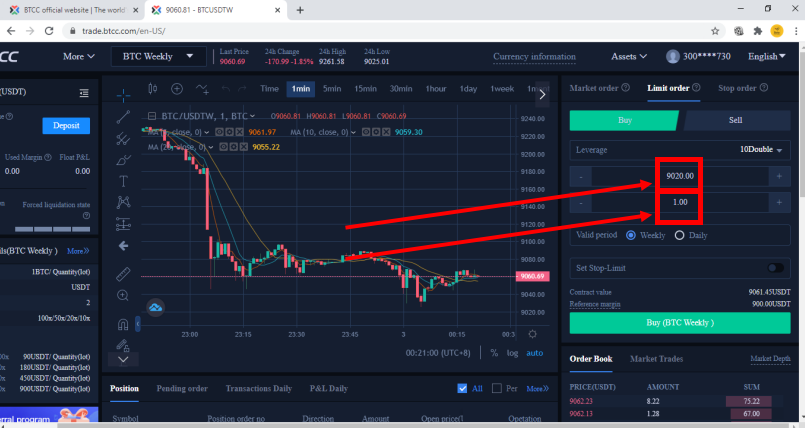

Step 4) Enter the price you are looking to enter into and the number of contracts that you are willing to buy.

PRESS BUY! There you go. You are done!

Could it be more comfortable than this? I doubt.

Make Your First Bitcoin Futures Contracts Trading on BTCC Today!

Disclaimer: There are risks attached in investing, trading and speculating. With hefty gains, there is always a risk of losing your money given that you are not adequately taking care of it. It is still the right attitude to ensure that you follow safety measures which could include using technical entries, stop loss(es) and targeted exits. Understanding leverage is significant. Consulting your independent financial advisor before entering into any commercial trade may remain an excellent option to consider.