How to Buy Litecoin (LTC) with Leverage / on Margin

So you want to trade Litecoin with Leverage? Well, first you have to understand how leverage and margin trading works, it’s pros and cons, and why you have to find a sweet spot to avoid the dreaded margin call.

Let’s get started.

Margin trading Litecoin Futures contracts on a leveraged account allows a trader the opportunity to control more funds in terms of amplifying his position size. The client’s fund, in this case, serves as collateral to access a larger contract size.

Leverage has a multiplier effect on the traders’ account balance, and Litecoin Futures trading is offered in ratios 1:100, 1:50, and 1:20, which also varies on if you are trading a Litecoin weekly Futures contract or a Litecoin perpetual contract.

Choosing a leverage for a Litecoin Futures trade can also be viewed as a contract sent to your broker, in this case, BTCC exchange, specifying the level of risk you want to be exposed to your trading account.

A higher leverage implies a quicker rate of hitting margin call and consequently forced the closure of trade, should the crypto access go contrary to your predicted direction.

Let’s take an example:

Say you have $500.00 in your trading account. Taking trades on a 1:100 leverage allows you to trade LTC Futures contracts size of a $50,000.00 account. Now that is some super power, but with power comes responsibility. Now, what do I mean by that?

What this implies is that you must pick a leverage that suits your risk appetite, and trading strategy. If you look to hedge your trades when a loss is anticipated, then you may want to utilize the maximum 1:100 Leverage.

However, if you look to close trades with a stop loss and take the opposite direction of an LTCUSD trade, then, you may look to use the low Leverage, as you also won’t get to have huge risk exposure by controlling a large contract size.

Benefits of using leverage.

Although we mentioned the risk implications of trading with Leverage, here we’ll go into the benefits of using Leverage.

- Higher Return on Investment (ROI)

- Hedging Strategy

- Deploying an Anti-Martingale or Martingale money management

Higher Return on Investment (ROI)

Picture a scenario where you have a trading strategy with very low drawdown and low maximum adverse excursion on winning trades, giving you a 10% monthly return on investment with a 1:20 leverage. Well, it will make sense to trade with a higher leverage, say 1:100, to boost your monthly return to say 50%.

Hedging Strategy

By trading Litecoin CFDs on Leverage, traders who do not fancy closing trades in a loss can decide to hedge their position by taking an opposite direction with a slightly higher lot size, then take the loss trade out as soon as the trading account attains the breakeven point.

Deploying an Anti-Martingale or Martingale money management

Trading with Leverage allows you to deploy the anti-martingale strategy, which involves increasing your lot size when in a winning streak, and doubling down in a losing streak.

Though not my favorite, the martingale strategy is often used when hedging on a loss or increasing the lot size when in a losing streak.

The strategy for trading Litecoin LTC using leverage.

In this section, we’ll be looking at a simple trading strategy based on price action around a Japanese candlestick pattern called the Harami, otherwise known as the Inside-bar.

We may have mentioned this in one of our posts; however, let’s do a quick recap on the Harami/Inside-bar candlestick pattern and how we can apply it into a trading strategy.

Harami in Japanese means pregnant, so from a candlestick like in the chart below, the child bar, which is the smaller candlestick, has its open, high, low, and close within the high and low of the mother bar.

Now, the child-bar in an inside bar candlestick can be of a different color to its mother bar. However, we favor similar directional closing inside-bar candlestick pattern where both the mother bar and inside bar close bearish like in the illustration above.

So, a breakout of the child bar resistance like in the example above will confirm a signal to enter a long position on a Litecoin LTC weekly or perpetual contract on a 1:50 leverage.

The buy order is valid as long as the daily candlestick does not close below the inside-bar support.

There’s an opportunity to scale into the buy trade after the LTCUSD exchange rate closed within the child bar resistance and support, allowing for more profit going forward, and targeting a reward to risk ratio of about 8X.

A brief guide on how to trade Litecoin using leverage on BTCC which provides up to 100x leverage on Litecoin weekly/perpetual contracts.

In this section of the post, we’ll show you how easy it is to trade Litecoin weekly or perpetual Futures contracts on BTCC exchange.

Let’s dive into it.

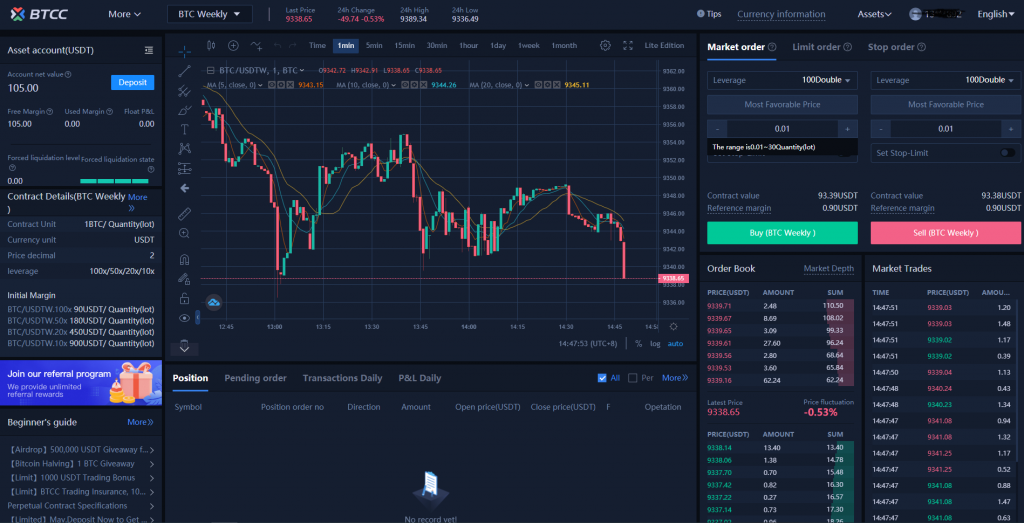

Click to open the Tradingview main chart window on BTCC.

Click on the Market watch combo box, which is set to BTC Weekly by default and select the type of Futures contract (weekly or perpetual contracts) you want to trade.

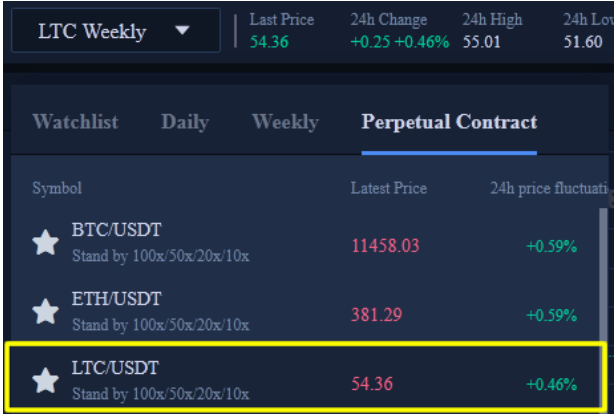

Trading the LTC Weekly Futures contract

After clicking the combo box, we select the LTC Weekly contract like shown below to start trading Litecoin Futures on the Tradingview main chart window.

So we select the LTC weekly futures contract highlighted in yellow on the illustration below.

The Tradingview main chart window is now set to LTC/USDTW as shown below, and we can move on to analyze the crypto asset using the strategy described in the strategy section.

Litecoin Weekly Futures Trading

The BTCC Tradingview platform has different tools for chart analysis ranging from trend line tools, Geometric shapes, Gann and Fibonacci tools, prediction and measurement tools, annotations, and patterns.

Although the daily time frame is recommended, the strategy described earlier can be analyzed on the hourly or daily time frame.

Placing trades

After analyzing the LTCUSDTW Futures chart, the next step is to place a buy or sell order, using a Market order, Limit order, or a Stop Order.

The market order type is an instant order sent to the BTCC server and executed life, while the Limit and Stop orders are pending orders, which are only fulfilled if the LTCUSDT exchange rate attains the set price mark.

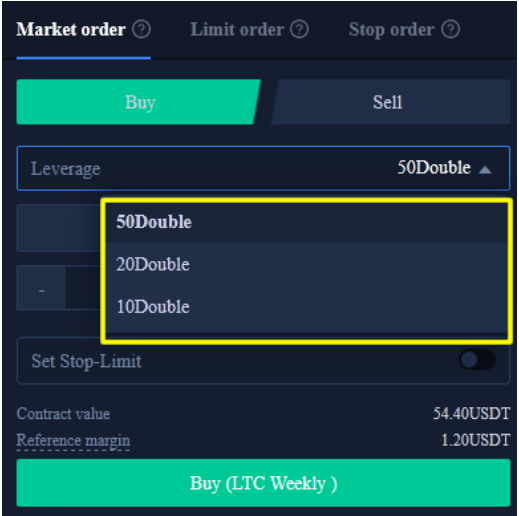

Select a Leverage Ratio

The Leverage available on the LTC Weekly Futures contract are 50Double (1:50), 20Double (1:20), and 10Double (1:10).

Click Buy or Sell Order

After confirming the market direction and selecting an order type, you can proceed to click the buy button for a bullish trend, or the sell button for a bearish trend.

Another option is to trade LTC/USDT Perpetual Contracts.

To do this, click on the Perpetual Contract Tab from the same market watch combo box, and the Tradingview main chart window is switched to LTC/USDT for you to start analyzing and executing trades.

Litecoin Perpetual Futures Trading

The BTCC Tradingview window is now set to LTC/USDT, where you can go ahead to analyze the charts as mentioned earlier.

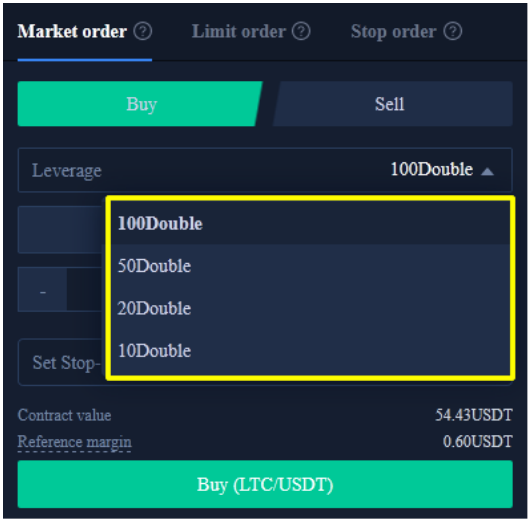

Chose Order Type and Leverage

Similar to the LTC Weekly Futures contract, the LTC/USD Perpetual contract has options to select a Market order, Limit Order, or a Stop order. However, with the LTC/USD perpetual contract, you have more options for Leverage up t0 100Double (1:100).

Upon selecting an order type, leverage stop-loss, and take profit levels based on the direction of the LTC/USD, you go ahead to click on the buy or sell button.

Modifying or Closing Open Trades

Let’s say you didn’t set your stop-loss and/or take-profit levels. Well, this is done by you picking the order you wish to modify and proceed to set the stop-loss level, to reduce your risk when the trade does not go in your favor or set the take-profit when the trade goes in your projected direction.

Conclusion

So there it is, following this guide, you can start trading Litecoin LTC Futures on BTCC.com and start earning on the bullish and bearish trend cycles. However, we’ll recommend that you do this following a proper risk and money management strategy.

For the money management system, we’ll suggest you follow a fixed fractional money management approach, where you only expose a percentage of your trading capital.

The anti-martingale money management is also recommended and you should also look out for trades that give you greater than or equal to 2X reward to risk ratio.

If you’re just starting out in trading crypto futures, we lastly recommend you start small with low Leverage of say 1:10 or 1:20. You can increase the Leverage as you gain more experience along the way.

On the other hand, if you are an experienced Futures trader, then we welcome you to take advantage of the 1:100 Leverage and maximize your wins trading Litecoin CFDs and other crypto assets.

Open A Free Account on BTCC and Make Your First LTC Futures Contract Trading Today!