Trading Bitcoin Cryptocurrency CFDs – Ultimate Guide 2020

Cryptocurrencies are successors of earlier digital currencies traded in exchange for other digital currencies or traditional fiat currencies by digital currency exchanges or crypto exchanges. These exchange service providers were either online or brick and mortar businesses.

Issues such as centralization and regulations around 2004 lead to a collapse of digital currency exchanges.

Unlike the pioneer centralized digital currencies, cryptocurrencies are mostly deployed using a distributed ledger technology, otherwise known as the blockchain, protected using strong cryptography.

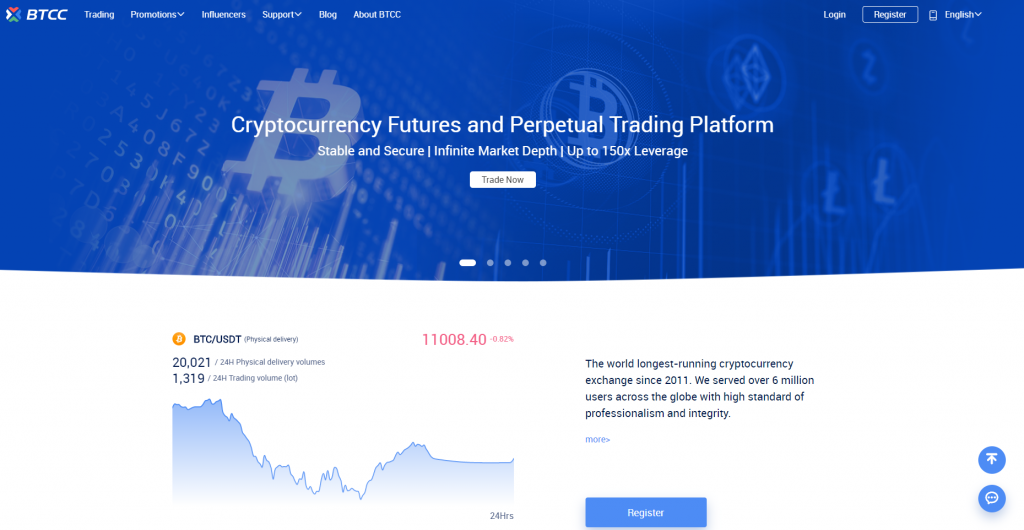

The launch of the first successful decentralized cryptocurrency, Bitcoin BTC, in 2008 led to an emergence of different online crypto exchange platforms with Mt Gox as a leader.

Mt. Gox, the number one cryptocurrency exchange at the time, collapsed due to a security breach of its’ hot wallet, consequently leading to their filing for bankruptcy. The event was a wakeup call for today’s crypto exchanges like BTCC exchange, Binance Exchange, etc., who now allow for trading crypto via CFDs.

Why trade cryptocurrency with CFDs?

Back then, the only option available to traders was to hold the private keys of their crypto assets either on a physical hard wallet or an online hot wallet, in a way, be in control of their cryptocurrencies.

Today, however, traders can use CFDs for cryptocurrency trading, where they do not have to hold any private keys and have more options to either enter long or short positions, speculating on whether a cryptocurrency would appreciate or decline in value.

Other than the flexibility to speculate on the increase or decline of a crypto asset, traders are also offered leverage up to 1:500, allowing them to control more funds than their initial deposit. We’ll talk more on the subject of leverage and how it relates to risks under risk management.

Trading crypto CFDs allows traders to opt for crypto Futures contracts with a fixed expiration period, often a day to a week, or trading perpetual contracts, where there are no limits to the holding period (Be mindful of margin call when trading perpetual contracts).

The strategy for using CFDs for Crypto trading and risk management

Regardless of whatever strategy we’ll be adopting, let’s first emphasize that the best time frames to use CFDs for cryptocurrency trading are the daily, weekly, and monthly time frames.

With that said, let’s move on.

There are three primary methods to consider when developing a strategy for trading crypto volatility: they are mean reversion, contrarian, and trend following methods.

Also, note that either of these three trading approaches may adopt some form of price action study when deploying them.

We’ll be looking at a trend following strategy with a breakout or breakdown of Inside-bar support or resistance as an entry signal into either a bullish or bearish trend.

We take this approach considering that most cryptocurrencies tend to trend more than they enter a range-bound market structure.

Let’s proceed.

A breakout of Inside-bar Resistance

First, we identify an inside bar candlestick pattern.

An Inside-bar candlestick pattern involves two candlesticks of the same period. The first candlestick in an inside-bar candlestick pattern is considered a mother-bar, while the second is regarded as a child bar. The image below is an example of Inside-bar candlestick formation.

Same directional closing Inside-bar candlestick patterns (Inside-bar pattern where the mother-bar and the child-bar close in the same direction, e.g., bullish-bullish or bearish-bearish) have proved to signal high probability breakout or breakdown into a trend.

The daily chart illustration above shows how to Trade ETH CFDs of the daily futures contract. It shows a breakout of Insider-bar resistance, where both the mother-bar and child-bar close in the same direction forming an Inside-bar candlestick pattern.

The breakout of resistance from the daily chart illustration above shows how to Trade ETH CFDs of the daily futures contract. It shows a breakout of Insider-bar resistance, where both the mother-bar and child-bar close in the same direction forming an Inside-bar candlestick pattern.

The breakout of the Inside-bar pattern establishes a support zone where a price correction into the area can be considered an opportunity to scale into the breakout trend direction.

Attaching the 20-period Moving Average to the chart can give a visual guide of the trend build-up.

We should expect a risk to reward ratio of 1.5 with the stop loss placed at 92.00.

A breakdown of either a bullish-bullish or bearish-bearish Inside-bar candlestick formation will signal a bearish trend direction, opposite to the bullish trend example above.

Looking to trade Bitcoin CFDs, well the same trading strategy can be deployed for identifying significant trend reversal and continuation.

Risk Management

Most newbie traders pay more attention to trading indicators for entries and give little or no importance to risk management, forgetting that risk management is the key to capital preservation.

The three essential components of risk management we want to point out here are Leverage, Capital exposure in percent, and exits (Stop loss, price breach of a threshold, trailing stop).

Leverage

Although leverage is often advertised as a loan to have more control of funds than your initial capital, it’s not exactly like that.

Leverage is an instruction sent to your broker, stating the maximum lot size you want to control, i.e., your level of exposure to risk.

Higher leverage will quickly expose your trading account to margin calls. With access to more leverage, you are exposed to more risk in your capital. Therefore, leverage of 1:50 is less risky compared to the leverage of 1:500.

Capital Exposure

We’ll suggest that you do not expose more than 1% of your capital on a crypto asset, and not more than 5% exposure on your entire capital. Following this method will prevent you from quickly entering into a margin call.

Exits:

Stop Loss:

Always have a stop loss level established at a predetermined price below significant support or above a resistance level, depending on your trade direction. Your open trade will be closed automatically in loss, avoiding further loss to your account.

Trailing Stop:

It is a way of controlling risk by bringing your stop loss to the entry price level (the breakeven point) when the price moves in your direction. It is done to prevent winning trades turn to lose trades.

Price breach of a Threshold:

By setting a threshold before your stop loss level is also a good way to control risk. If the price close below or above this level (depending on the trade direction), we should consider exiting the trade and cut our loss before it hits the stop loss level.

A step-by-step guide on how to trade Crypto CFDs at BTCC

Trading cryptocurrency CFDs at BTCC crypto exchange can be done in 5 steps.

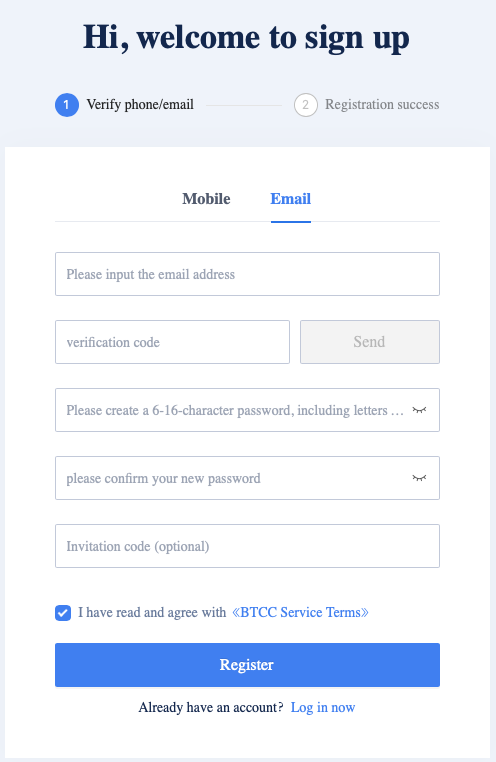

- Sign up for a trading account at BTCC

- Login after successful signup and Deposit funds

- Analyze your preferred crypto pair

- Set trade parameters

- Close open Trades

Sign up for a free trading account at BTCC.

Login after successful signup and Deposit funds

Once the registration process is completed, the next step is to log in and proceed to make a deposit, and unlock the different benefits available to trade cryptocurrency with CFDs.

Analyze your preferred crypto pair

Following the breakout/breakdown strategy described earlier, you can proceed to analyze the available BTCC cryptocurrency futures like the BTC daily/weekly futures, ETH daily/weekly futures, BCH daily/weekly futures, LTC daily/weekly futures, EOS daily/weekly futures.

You may also opt for the BTCC perpetual contracts such as the BTCUSDT, ETHUSDT, BCHUSDT, ADAUSDT, XRPUSDT, LTCUSDT, EOSUSDT, DASHUSD, FILUSDT, and XLMUSDT.

Set trade parameters

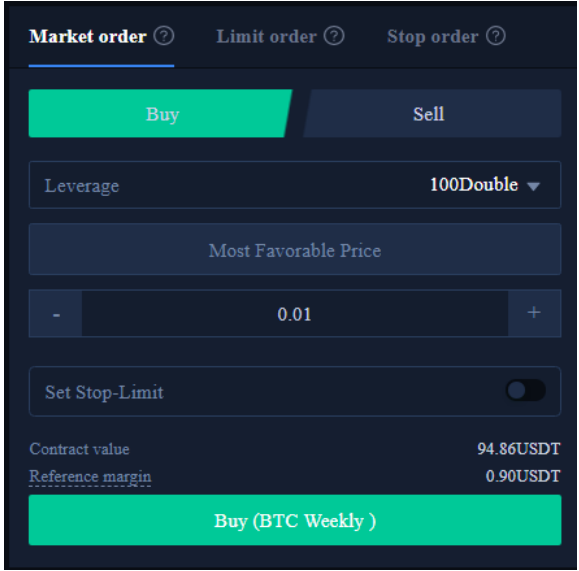

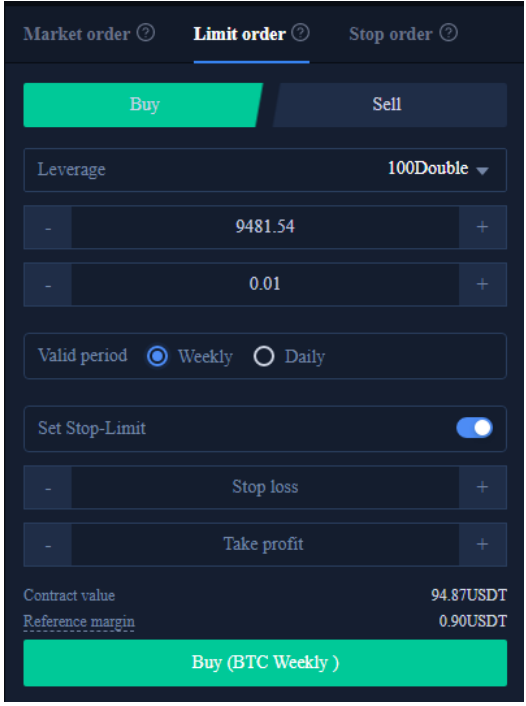

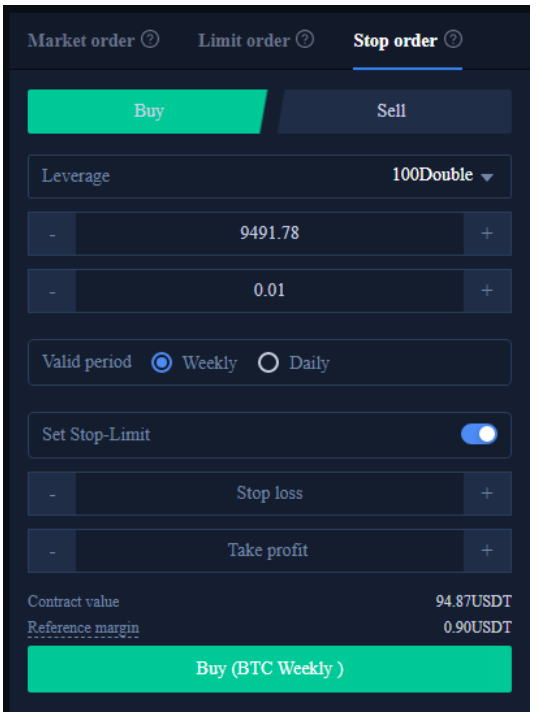

After identifying trend Direction and entry price zone, you can proceed to enter a trade using an instant market order, or go for the pending stop or limit orders.

Market order: These are instant buy or sell orders sent to the BTCC exchange server.

Limit Order: This is a pending order entered when you anticipate the crypto asset may bounce off a particular price level. It can be of type buy limit and sell limit.

Stop order: This is a pending order placed at a particular price level, which should be triggered in anticipation of a price breakthrough that level. It can be of type buy stop or sell stop.

Whether you chose to enter a trade using an instant or pending order, you will have to set leverage, lot size, take profit and stop loss levels for the chosen crypto asset.

Close Open Trades

Once you have trades running, it’s not enough to leave them on autopilot. You have to monitor them for at least once a day to check for conditions to exit the trade for an early loss, or perhaps exit in profit.

Conditions to exit your open trade for an early loss may be a price close below, or above a significant threshold, depending on the type of order you have opened (buy or sell).

If the price close takes effect before price hits your stop loss level or take profit levels, it’s best to exit the trade, as it helps control your exposure to risk or perhaps quickly lock in profits.

Go For A Free Account In Seconds At BTCC And Try Your First Bitcoin CFDs Trading Toady. New Users Will receive Up To 2,000 USDT Bonus!