Bitcoin Halving 2024: What You Need to Know

The next bitcoin (BTC) halving is expected to occur in April 2024, and it might have a significant impact on the cryptocurrency‘s price. Learn all you need to know about the next Bitcoin halving, including what it is, why it is happening, and how to trade it.

Trade on BTCC with 10 FREE USDT.

Sign up today to redeem your bonus.

What is a Bitcoin Halving?

When the reward for mining new blocks is cut in half, known as a “halving” or “halvening,” miners receive 50% fewer bitcoins for validating transactions. Bitcoin halvings are planned to happen once every 210,000 blocks, or around every four years, until the network has produced all 21 million of the cryptocurrency.

Because they lower the quantity of new bitcoins being created by the network, bitcoin halvings are significant occurrences for traders. Because of this, there can be a surge in prices if demand for the coins doesn’t decline.

Although this has occurred in the months prior to and following previous halvings, driving up the price of bitcoin, each halving’s circumstances are unique, and demand for bitcoin can vary greatly.

How Does Bitcoin Halving work?

Mining is the mechanism by which a distributed network of validators confirms each Bitcoin transaction. As part of Bitcoin’s proof-of-work system, they receive 6.25 BTC if they are the first to utilize complicated math to add a batch of transactions to the blockchain.

As an incentive for miners to maintain adding blocks of Bitcoin transactions operating smoothly, the current price of 6.25 BTC is worth almost £300,000.

There is a half-reduction in the incentive for miners for every 210,000 blocks created, according to the Bitcoin algorithm, and these blocks of transactions are added about every 10 minutes. This occurs around every four years, and it’s not uncommon for Bitcoin’s price to be quite volatile during those times.

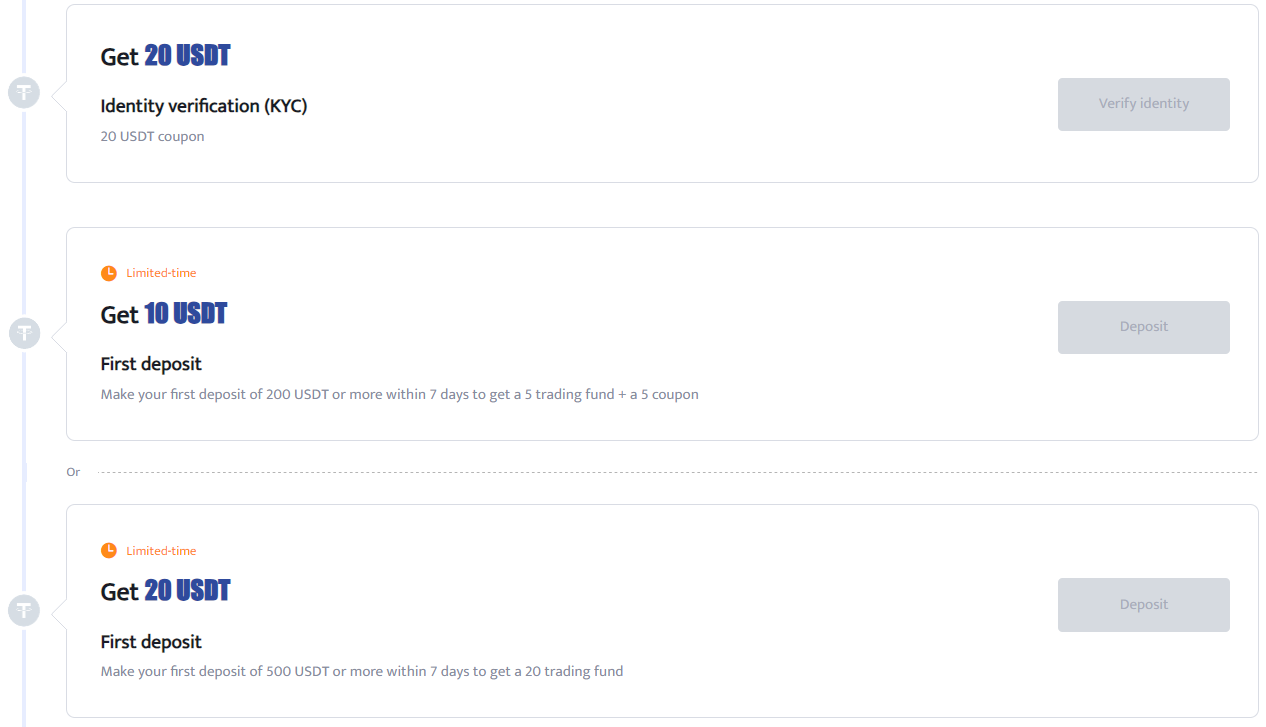

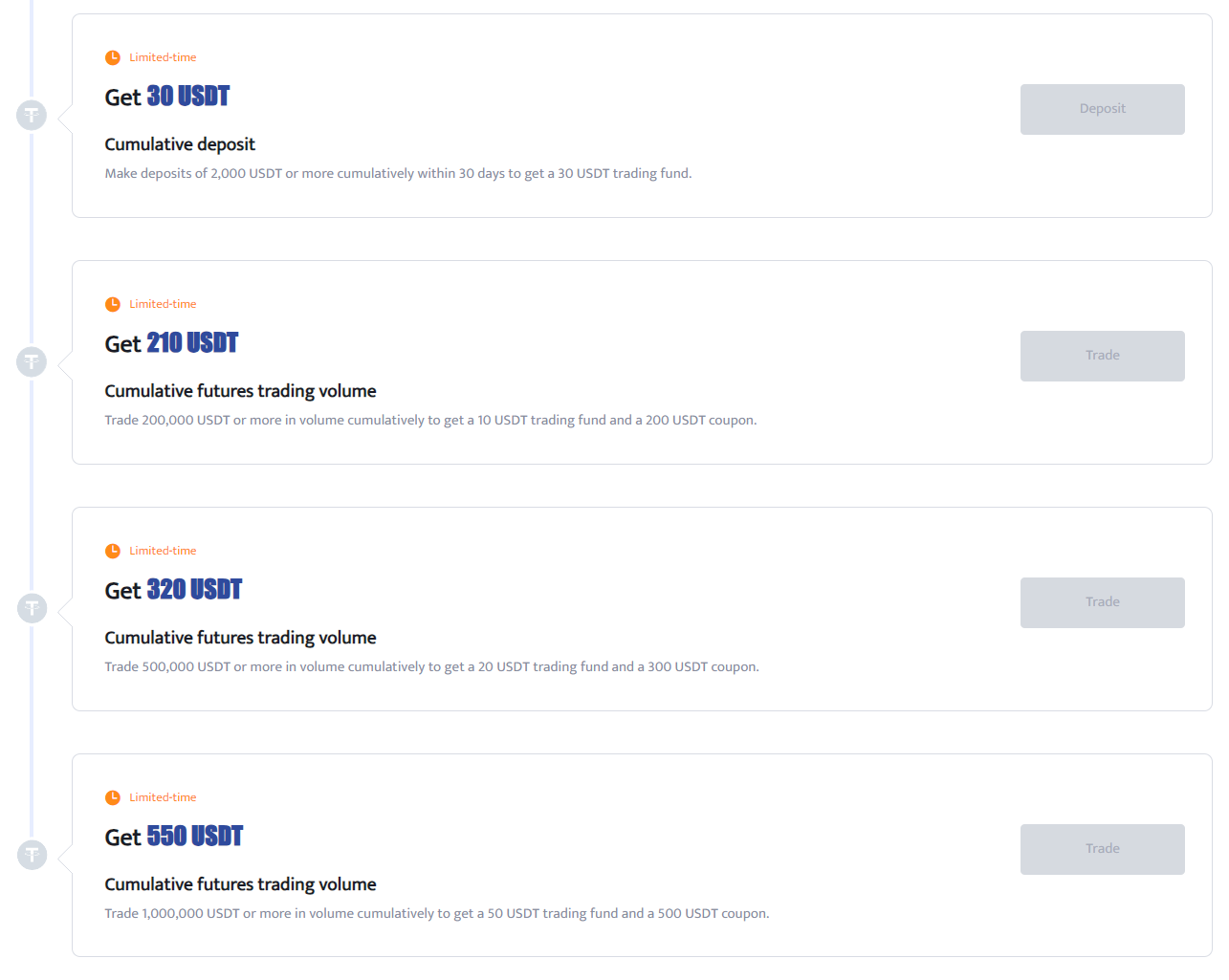

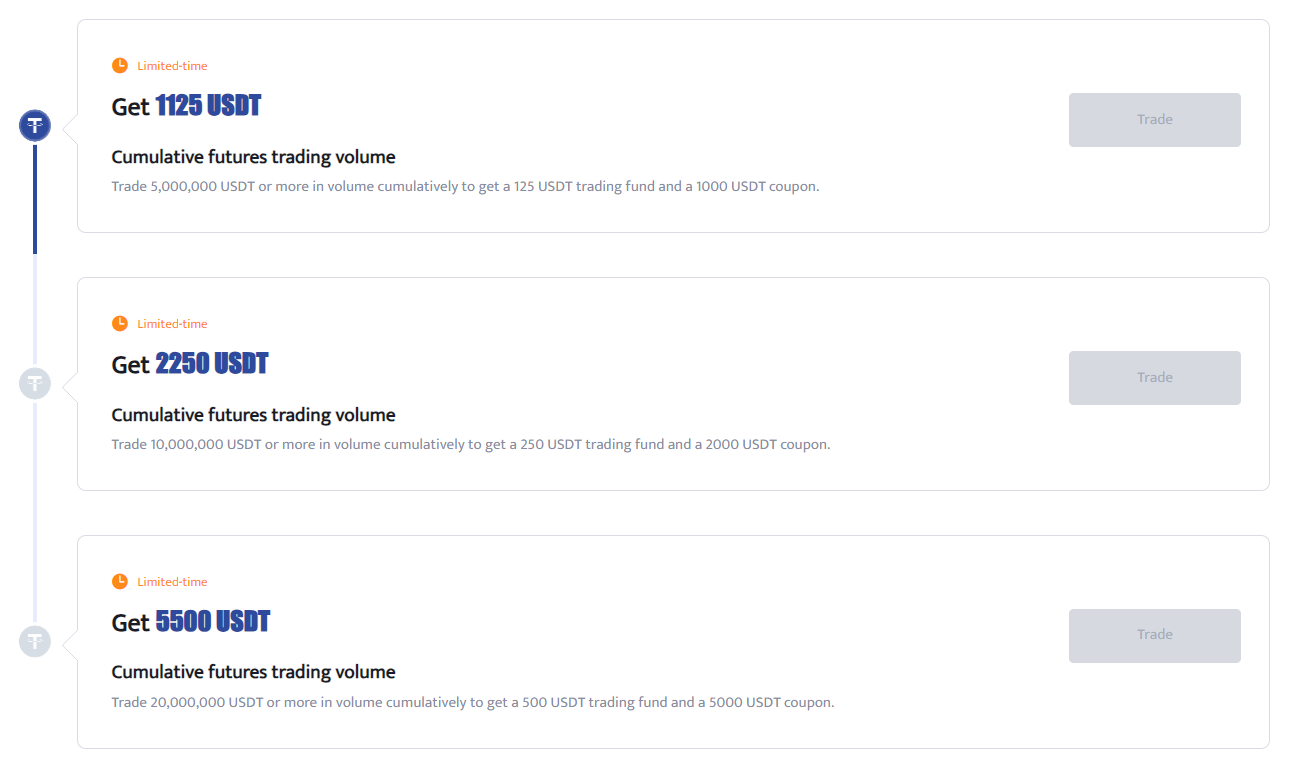

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

Bitcoin Halvings History

Since2009, the supply of Bitcoin has been half every four years to compensate miners for adding blocks of verified transactions to the blockchain.

Fifty bitcoins (BTC), the starting prize, is now worth almost one million pounds (£1,000,000). Currently, the payout is 6.25BTC, or about £224,693.

In each of the four years since Bitcoin’s launch, the reward has decreased in the following ways:

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

How might the Bitcoin Halving Affect BTC Price?

The effect of the upcoming halving on the price of bitcoin is uncertain at this time. Given the limited amount of new coins, many analysts predict that the price will rise following the event, just as it did following the previous three halvings.

Any increase in price, however, will be contingent upon the nature of bitcoin demand during the halving. Given the market’s maturity since the last halving in 2020 and the proliferation of well-established cryptocurrencies vying for users, it’s quite unlikely that demand will rise or even stay constant.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

What Causes Bitcoin to Halve?

A unknown individual or group operating under the assumed pseudonym ‘Satoshi Nakamoto’ designed the software that Bitcoin uses, and this is why Bitcoin’s value has dropped in half.

Many have hypothesized that Satoshi intended to distribute coins more rapidly in the beginning to encourage people to join the network and mine new blocks, even though he hasn’t officially stated the reasoning behind halvings. The idea behind this was that the value of each coin would likely grow as the network grew larger, thus the block rewards were set to half at regular intervals.

The quantity of newly-minted coins every block may be fixed in advance, according to an alternative hypothesis that proposes implementing deflationary mechanisms into the coin through the halvings. In contrast to the fiat monetary system, where central banks run the danger of overprinting and causing a currency’s value to fall over time, the fixed total supply of bitcoins and the predetermined rate of bitcoin printing mitigate this risk.

Some feel that the design of Bitcoin, with its halving and limited supply of 21 million coins, promotes hoarding rather than spending, as users hold on to the expectation that their coins will appreciate in value with time. Hoarding coins for the sole purpose of cashing out at crucial levels may have contributed to boom and bust cycles in the past.

For similar reasons, some have likened Bitcoin to a pyramid scheme, claiming that the system’s architecture has unfairly benefited early adopters.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

When will Bitcoin halves again?

The Bitcoin algorithm specifies a specific block creation time as the trigger for halving. If things continue as they are, the next halving should take place sometime around April 15, 2024.

Because they depend on the present volume of transactions, halving dates can only be estimated. The halving date will be advanced in the event that the transaction rate accelerates.

According to experts, Bitcoin halvings were intentionally planned to be fairly predictable in order to avoid a significant shock to the network.

That being said, it is still possible that Bitcoin’s next halving will cause a trading frenzy.

According to Rob Chang, CEO of privately held Bitcoin miner Gryphon Digital Mining, “Historically, there is a lot of Bitcoin price volatility leading up to and after a halving event.” But a few months later, Bitcoin’s price usually ends up much higher.

Although there are numerous other variables that affect Bitcoin’s value, it appears that halving events typically bode well for the cryptocurrency once its early volatility subsides.

When it comes to the upcoming Bitcoin halving, Baker warns investors to proceed with caution. Price appreciation can be driven by scarcity, although a levelling down of prices could occur if mining activity is curtailed.

“Investors should focus on the growth of the network overall, not on the specific dates of halving events,” Weisberger argues. “The possibility of Bitcoin realizing its promise as a worldwide store of value grows as the network keeps expanding.”

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

How to Trade the Bitcoin Halving

When Bitcoin undergoes a halving, the rate of supply effectively decreases by the same amount. When there is a reduction in supply and demand for an asset, the asset generally experiences an increase in value.

Traders might attempt to capitalize on this phenomenon by allocating funds towards Bitcoin prior to the anticipated halving in April of next year, with the expectation that doing so will enhance the worth of their investments.

FAQs

How do I trade the Bitcoin halving?

Derivatives like contracts for difference (CFDs), which allow you to bet on bitcoin price swings without assuming ownership of the underlying coins, are the most straightforward way to trade bitcoin during the halving. Purchasing bitcoins directly through an exchange is an alternative. This method requires you to create an exchange account and be in charge of keeping your bitcoin tokens safe in a wallet. Any earnings would likewise be liable to regular taxes.

Can I profit from the BTC halving?

Certainly, betting on changes in the price of bitcoin in the weeks and months leading up to the halving will let one to profit from the event. Because they allow you to go long or short on bitcoin prices, contracts for difference are a popular option for bitcoin price speculation.

It’s crucial to keep in mind nevertheless that trading involves risk in any case. Therefore, even while there will be chances to make money, you should never take on more risk than you can bear to lose. You may always close your trade at the exact level you designate using IG’s guaranteed stops, which will let you know exactly how much you’re risking on each trade. In the event that a guaranteed halt is activated, a minor premium is due.

What will the Bitcoin price be after halving?

Many have predicted that in the weeks leading up to and following the event, the price of bitcoin will increase. This is partly because fewer new bitcoins will enter circulation as a result of the halving, which is also anticipated to raise awareness of the cryptocurrency. Any increase in price, though, will be contingent upon how the demand for bitcoin develops during the halving. This has historically fluctuated greatly, so there is no certainty that it will increase or even stay steady.

You will be speculating on the price of bitcoin using CFDs when you trade with IG. This implies that you can trade regardless of whether you anticipate a gain or decrease in value.

How can I lower my bitcoin trading risks?

By betting on the price of the cryptocurrency with CFDs, you can lower some of the risks involved with trading bitcoin. Because they are derivatives, you can profit from fluctuations in the price of bitcoin without assuming the risk of holding the underlying coins. This way, you avoid the expenses related to maintaining an exchange account or wallet.

You can also employ guaranteed stops with IG, which guarantee that your trade will close at the precise level you set. Even in the event of unfavourable price fluctuations, guaranteed stops will limit your losses, regardless of any liquidity issues in the underlying market. In the event that a guaranteed halt is activated, a minor premium is due.

How to Trade Bitcoin Futures on BTCC?

Now you can trade BTC on BTCC. BTCC supports a diverse selection of cryptocurrencies for trading. This includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and others. BTCC also offers products such as crypto, gold, and tokenized stocks to help investors rationally allocate their assets.

1. Register an Account

Join BTCC now and get up to 10,055 USDT when you deposit and trade. Click the button below to sign up now.

2. Deposit Funds

Once your account is set up, you’ll need to deposit funds into your BTCC account. BTCC may offer various deposit methods such as bank transfers, cryptocurrency deposits, or other payment options. Choose the method that works best for you and follow the instructions provided to deposit funds into your account. BTCC mainly offers USDT margin and future trading. Therefore, you need to buy USDT before trading.

3.How to trade BTC?

Here are the steps to trade BTC on BTCC

1) First, tap “Futures” on the website homepage

2) Select a product you would like to trade from the list here. BTCC currently offers daily and perpetual futures

3) Check time to settlement. The settlement time of these futures type is different, you can check the time for settlement for each product here.

4) After choosing product, you can decide whther you would like to buy or sell it. You only need to own USDT to trade USDT-margined futures. That is to say you can sell BTCUSDT futures without owing any BTC Coin.

5) Then select your order type, and choose your leverage.

If you choose Limit or SL/TP order, you will need to enter your order price here.

Enter the quantity or choose the percentage under the quantity field.

You can also set up stop loss or take profit targets to limit losses or maximise earnings.

6)After everything is set up, Buy or Sell to play your order. A confirmation window will show up, check if all info is correct and click [Confirm] to open the position.

BTCC FAQs

1.Can U.S. traders use the BTCC exchange?

Of course, BTCC accepts US traders on its platform. They can sell, purchase, or trade bitcoins in the excess marketplace using the BTCC exchange. And, of course, any USD deposits must be KYC-verified first.

2.What can you trade on the BTCC?

BTCC allows users to trade over 300 crypto futures, including USDT-margined and coin-margined options. Traders can use up to 225x leverage to enhance their trades. Furthermore, the site provides handy choices for both cryptocurrency and fiat deposits.

3.Is BTCC the ideal exchange for you?

If Bitcoin trading is your top priority, BTCC is definitely the finest exchange for you. This company has been focused on Bitcoin since 2011 and provides a user-friendly platform for all types of traders, both experienced and new.

4.Is the BTCC Exchange trustworthy?

BTCC has a 13-year track record of secure operations, with zero security problems. Along with this, it has adopted current security measures, making it a safer and more trustworthy environment than its contemporaries.

BTCC Pros

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike

Apecoin Price Prediction 2022, 2025, 2030 – Will Apecoin Go Up?

Ripple (XRP) Price Prediction 2023, 2025, 2030 : Why Are XRP Prices So Low?

Solana (SOL) Price Prediction 2022,2050, 2030-Future of Solana?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (Uniswap (UNI)) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?