Nvidia (NVDA) Stock Price Forecast 2025–2028 | AI Infrastructure Growth Outlook for Investors

This article provides a comprehensive Nvidia (NVDA) stock price forecast for 2025–2028.

Table of Contents

- Nvidia’s 2025 Financial and Market Overview

- Analyst Consensus and Target Price Forecasts (2025–2028)

- Nvidia vs. Competitors: AMD, Intel, and Broadcom

- Technical Analysis: NVDA Stock Trend 2025

- AI Infrastructure and Sovereign AI Projects: The Next Growth Wave

- Risk Factors to Watch (2025–2028)

- Expert Opinions: Institutional and Analyst Insights

- Nvidia (NVDA) Stock Forecast Summary (2025–2028)

- Long-Term Investment Outlook

- Conclusion

- How to Trade Crypto on BTCC?

- BTCC FAQs

Nvidia’s 2025 Financial and Market Overview

According to Nvidia’s latest fiscal report (Q2 FY2025, ended July 2025):

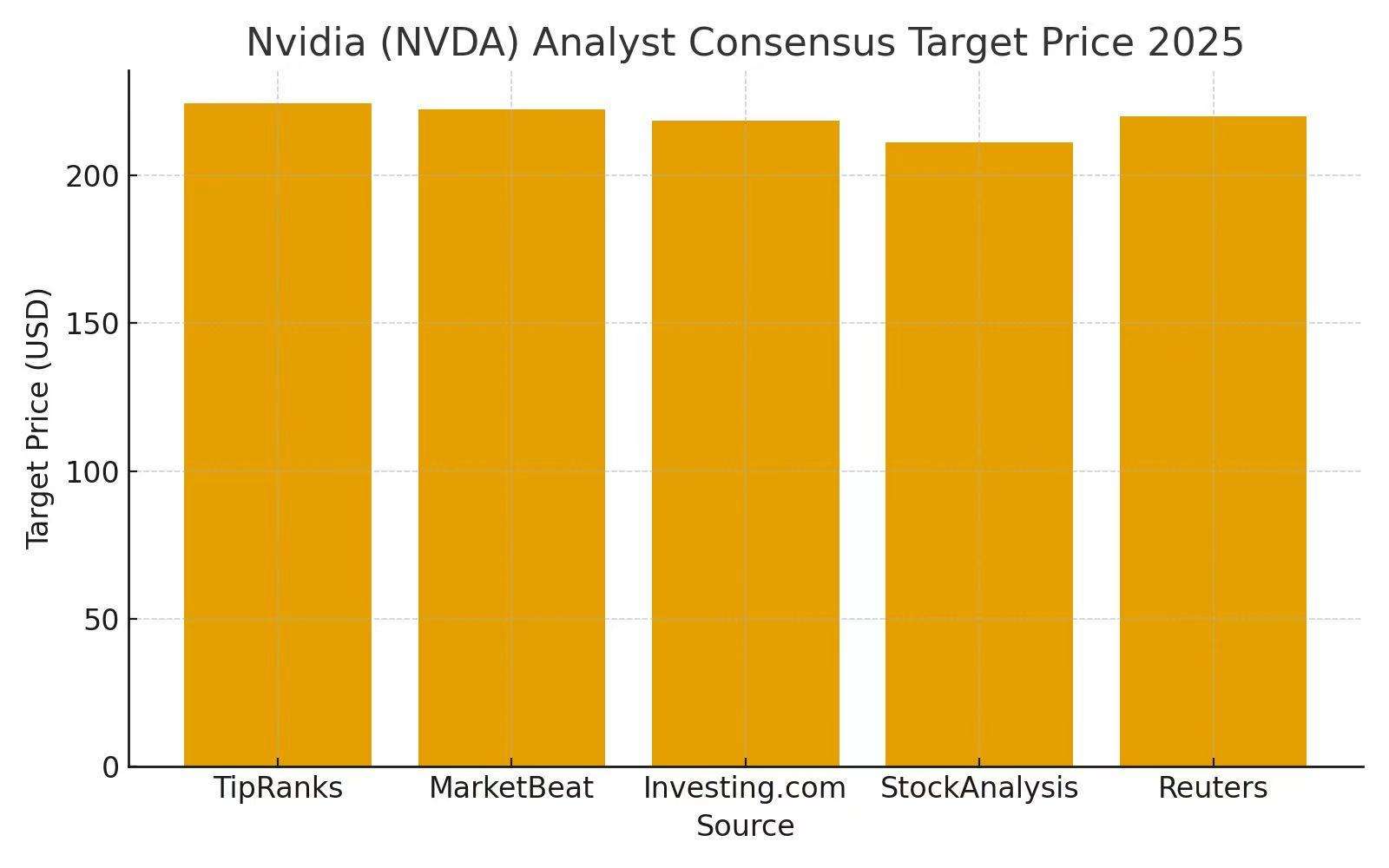

Analyst Consensus and Target Price Forecasts (2025–2028)

| Source | Avg. Target Price (USD) | Upside Potential | Analyst Rating |

|---|---|---|---|

| TipRanks (Oct 2025) | $224.38 | +22.4% | Strong Buy |

| MarketBeat | $222.23 | +21.7% | Strong Buy |

| MarketWatch | $218.51 | +19.3% | Buy |

| StockAnalysis.com | $211.14 | +15.2% | Buy |

| Reuters Consensus | $219.80 | +20.1% | Outperform |

Key Takeaway:

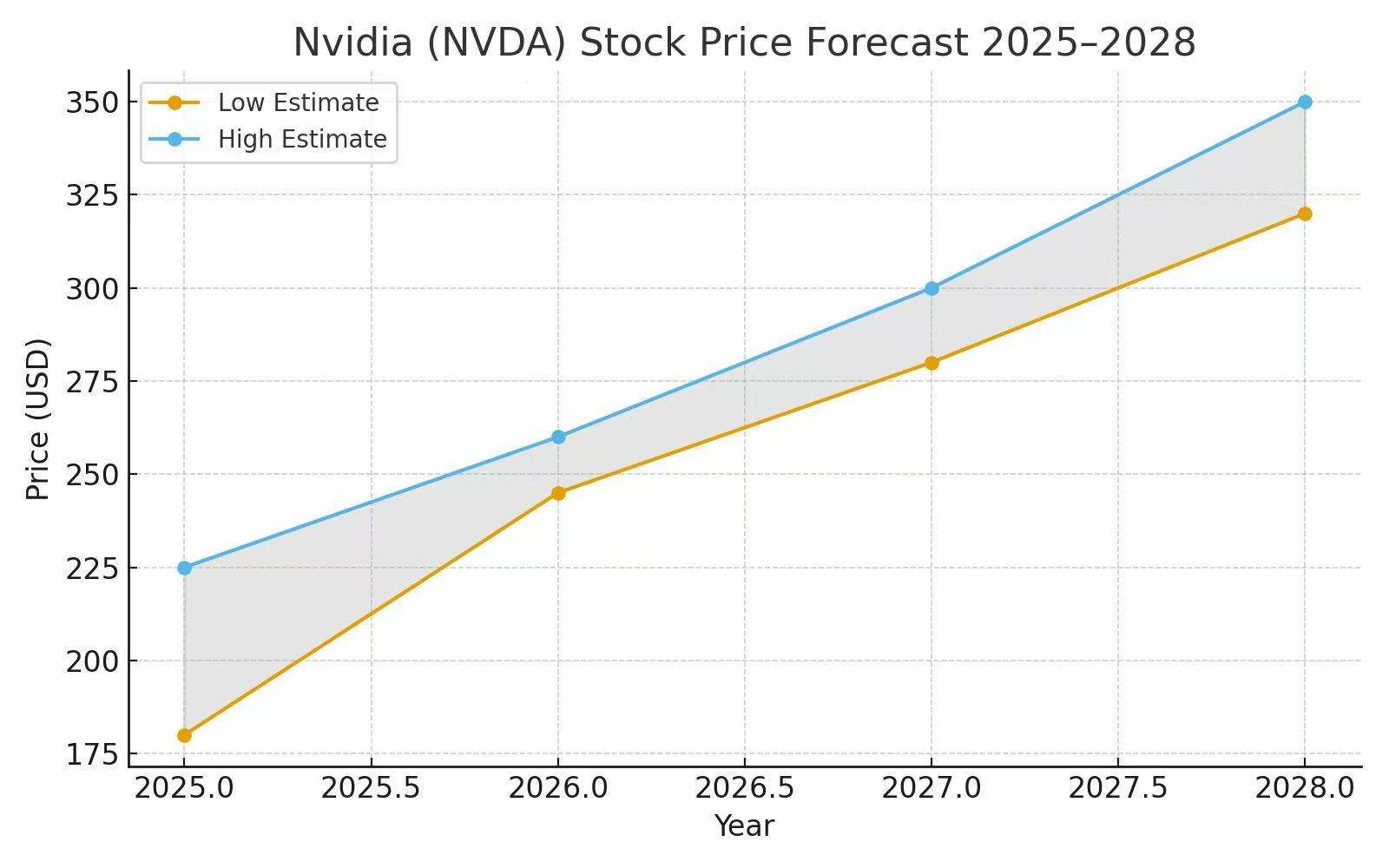

Long-Term (2026–2028) Forecast

/ You can claim a welcome reward of up to 10,055 USDT🎁\

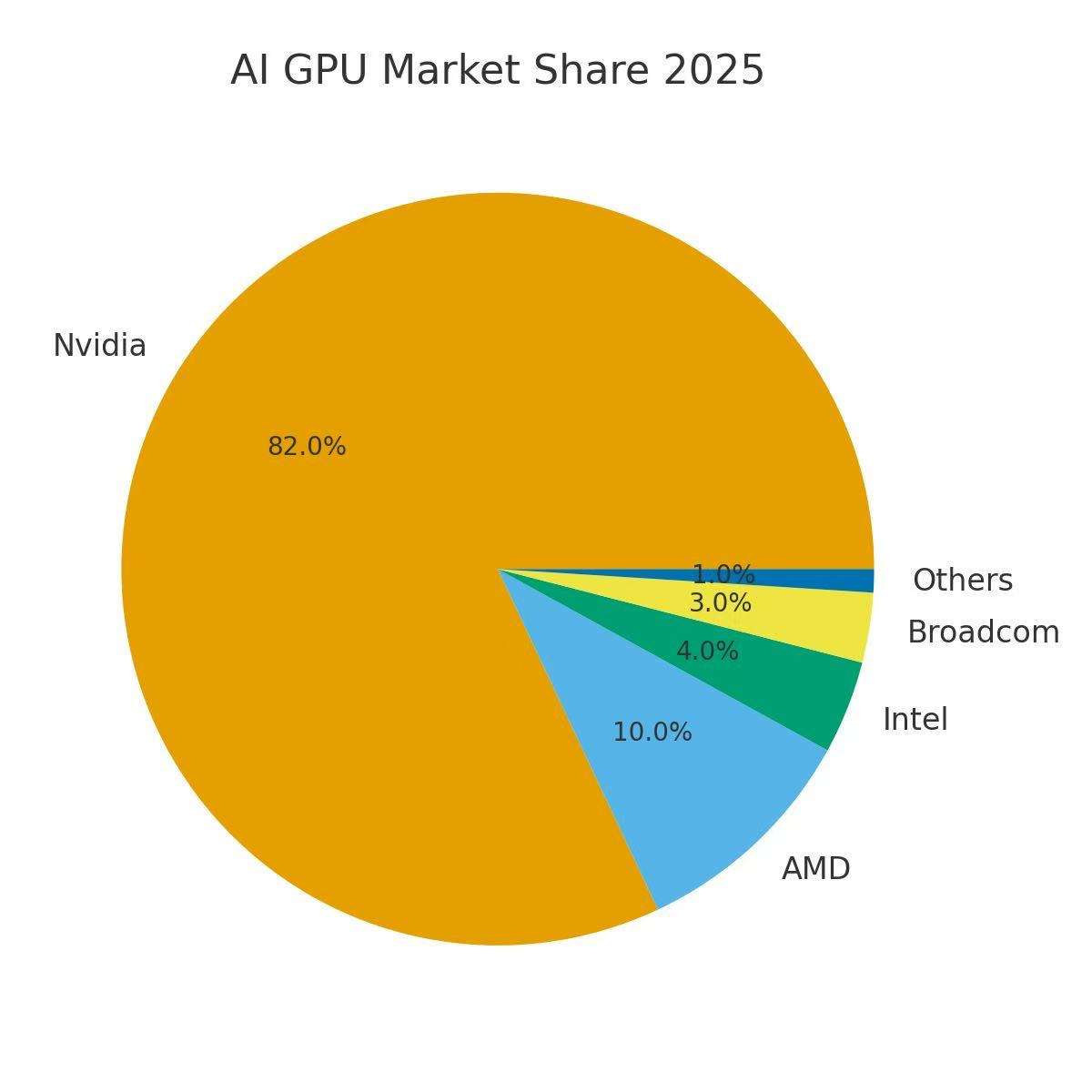

Nvidia vs. Competitors: AMD, Intel, and Broadcom

| Company (Ticker) | AI GPU Market Share | Data Center Growth (YoY) | Key Strength |

|---|---|---|---|

| Nvidia (NVDA) | 82% | +150% | Dominant AI infrastructure & CUDA ecosystem |

| AMD (AMD) | 10% | +65% | Cost-efficient GPU alternatives |

| Intel (INTC) | 4% | +30% | CPU-accelerator hybrid design |

| Broadcom (AVGO) | 3% | +40% | Custom ASIC & networking solutions |

| Metric | NVDA | AMD | INTC | AVGO |

|---|---|---|---|---|

| P/E Ratio (Forward) | 53x | 41x | 18x | 28x |

| PEG Ratio | 1.2 | 1.5 | 2.3 | 1.6 |

| Market Cap | $3.2T | $450B | $170B | $600B |

Interpretation:

Technical Analysis: NVDA Stock Trend 2025

Moving Averages

AI Infrastructure and Sovereign AI Projects: The Next Growth Wave

Governments are now building domestic AI clouds (Sovereign AI), boosting Nvidia’s export pipeline.

Risk Factors to Watch (2025–2028)

| Risk Category | Description | Potential Impact |

|---|---|---|

| Geopolitical / Export Controls | U.S.–China export bans on advanced GPUs | Could reduce 15–20% of total data center sales |

| Valuation Risk | Current P/E at 53x could compress if growth slows | 20–25% downside correction possible |

| Competition | AMD MI325X and Intel Gaudi 3 could pressure margins | Lower pricing power in AI accelerator market |

| Supply Chain | Reliance on TSMC for advanced node production | Disruption risk if geopolitical tension escalates |

Expert Opinions: Institutional and Analyst Insights

Nvidia (NVDA) Stock Forecast Summary (2025–2028)

| Year | Forecasted Price Range | Key Catalysts |

|---|---|---|

| 2025 (Current) | $180 – $225 | AI data center demand, Blackwell GPU ramp |

| 2026 | $245 – $260 | Sovereign AI initiatives, next-gen data center orders |

| 2027 | $280 – $300 | AI model expansion, AI PC ecosystem growth |

| 2028 | $320 – $350 | Rubin architecture rollout, autonomous computing adoption |

Long-Term Investment Outlook

Investment Summary:

Conclusion

For more detailed market analysis, strategies, and educational resources, visit BTCC Academy and stay ahead of the curve in the rapidly evolving crypto space.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1