Recommended

Silver Price Predictions for Next 5 Years: Is Silver a Good Investment in 2024?

2024/04/11By:

If you’re looking for the silver price predictions for next 5 years and want to know what the price of silver will be in 2024, 2025 and 2030, you’re in the right place. In this article, we will dive into the silver price history, technical analysis and summarize what experts’ opinions on the silver price forecast.

Despite a strong start in the first quarter of 2022, last year proved to be a disappointing year for silver, as its prices averaged $21.73 per ounce, down from its 2021 level at $22.73, according to the latest report from the London Bullion Market Association (LBMA). Silver has underperformed gold throughout 2022 as investment interest in the commodity has waned.

Meanwhile, recession concerns tilted silver prices to go down, as traders worried about low demand for the metal as an industrial input for goods with high electricity conduction needs, which was reflected by its sharp underperformance to gold in January this year. Still, projections of weak supply limited the fall, as COMEX inventories remained under pressure and LBMA stockpiles plunged amid outflows to India.

What are the factors weighing on the silver market and where should investors expect the market to move next? In this article, we look at some of the latest silver price predictions from analysts.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

Silver Price History

The silver markets have climbed from the $12 per ounce lows reached at the start of the Covid-19 pandemic, as investors have bought physical precious metals and financial instruments as safe-haven assets during ongoing economic uncertainty.

The silver price reached a $28 high in August 2020 and ended the year around the $22 dollar mark. The price then jumped to an eight-year high in February 2021, briefly touching the $30 per ounce psychological level, as the market attracted the attention of retail investors.

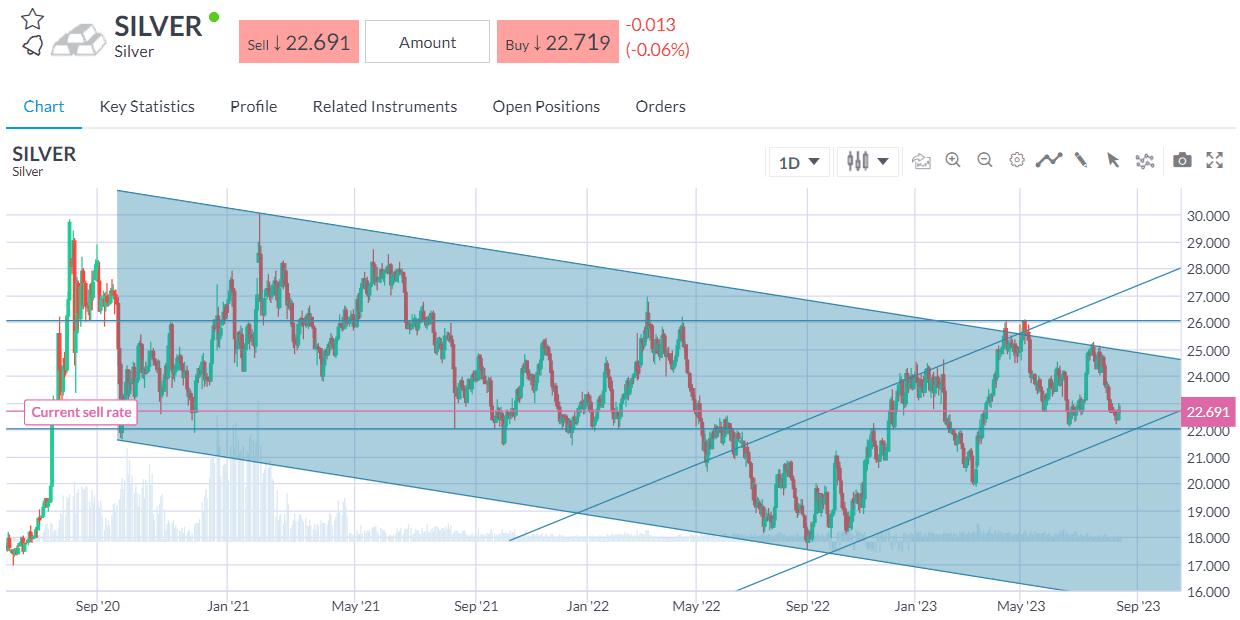

Silver 5-Year Price Chart

In addition to investor sentiment, the silver price trend has found support from its growing use in industrial settings, which account for roughly half the metal’s annual demand.

Physical silver demand climbed to a record high in 2021, led by an all-time high in industrial applications – silver is the best conductor of electricity, so is often used in high-end applications. Consumption rose by 9% to 508.2 million ounces, according to the Silver Institute.

There were several trends driving up silver demand, including strong consumer electronics demand amid the transition to remote working, investment in 5G infrastructure and rising silver use in the green economy – especially in solar photovoltaic (PV) panels. Physical demand is expected to continue to rise.

Sales of silver coins and bars for investment jumped by 36% to 278.7 million ounces, the highest level since 2015, “as retail investors in North America and Europe, motivated by safe-haven and inflationary concerns, took advantage of periodically lower silver prices to purchase coins and bars,” said the Silver Institute. The market saw its first deficit since 2015, with a shortage of 51.8 million ounces – the biggest shortage since 2010.

In 2022, silver traded up from $22.30 per ounce in late January to $26.90 per ounce in early March, a peak in 2022, as the market responded to the Russian invasion of Ukraine. But while the market traded between $24 to $26 until mid-April, it began to sell off sharply later in the month as the dollar strengthened.

The DXY reached 105.52 on 14 June – its highest level since December 2002 – which saw the silver trading price drop to $20.936 per ounce. In general, silver averaged $21.77 in 2022.

The silver price has rise above $23 per ounce since the start of 2024 from the previous lows at around $18 in late 2022. So, can the precious metal hang on to its recent gains? What is the potential for the price of silver in the future? Below, we look at some of the analysts’ latest projections.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

| Download App for Android | Download App for iOS |

Silver Price Prediction – Technical Outlook

Silver is getting close to a significant support level, a pivotal crossroads that may determine the direction of the market for the coming weeks or months.

Majority of the time, the trend is going down (the descending channel), but there are also up (the rising channel) periods. The crossroads is at the $22 mark. A drop below this level could open the door to testing the March low of 19.75 and the lower band of the declining channel. Most importantly, it would confirm the negative trend that has been in place since 2021 by establishing a lower-high-lower-low sequence.

If the $22 support holds, it might suggest the start of a long-term rally and a break over the $25 barrier. The silver price is expected to rise to $30 by 2020 under this scenario.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

Silver Price Predictions for Next 5 Years: What’s Next for Silver?

Analysts remain cautious on the silver outlook, with the price having broken the key $22 per ounce level and interest rates rising.

German-based firm Heraeus forecast that market tightness will ease this year, stating that silver demand is likely to increase following an uptick in polysilicon production – a key component of photovoltaic cells used for harvesting solar energy – which could support the metal’s price.

The rise in silver demand from the solar PV sector could receive a boost over the coming years that could support the silver value in the future.

Silver demand in photovoltaics accounts for around 10% of global silver demand and was 114 million ounces in 2021 (source: The Silver Institute). This is forecast to grow in 2024 as renewable energy sources retain government support. Demand for silver in the manufacture of electric vehicles is also set to rise to 70 million ounces in 2030, up from roughly 45 million ounces in 2017, according to the Silver Institute.

Besides, the Fed’s slowing jumbo rate hikes are a negative factor for the dollar and US yields, providing relief to precious metals. China government’s economic reopening also benefits the price of growth-sensitive and industrial-linked commodities like silver.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

| Download App for Android | Download App for iOS |

Silver Price Predictions for Next 5 years | Experts Say

Three months ago, a Reuters poll predicted silver prices would average $23 per ounce in 2024 and $24 in 2024, sharply higher than the $20 for 2024 predicted in the last poll.

Silver should begin to outperform gold as China’s economy reopens and global manufacturing activity recovers, said Bradley Saunders at Capital Economics.

“The main risk, though, is that high interest rates in developed markets take a significant toll on demand for interest-sensitive consumer goods, such as electronics, which silver is used in,” he said.

“Geopolitical and economic issues, including the Russian invasion of Ukraine, multi-decade-high inflation, lower global growth projections, and increasing interest rates, present challenges to forecasting precious metals this year,” the Silver Institute noted.

The World Bank’s silver price forecast for 2024 saw the precious metal averaging $21 throughout the year, and staying constant at the same level throughout in 2024.

According to TradingEconomics’ global macro models and analysts’ expectations, silver is expected to trade at $19.79 in 12 months’ time, or by November 2024.

While analysts are typically cautious in issuing long-term forecasts for commodities, algorithm-based forecasting services regularly provide price outlooks for more extended periods.

WalletInvestor’s silver price forecast for 2024 was bullish as of 23 May 2024. The website saw the precious metal closing the year at the $24.60 mark. The platform’s silver price forecast for 2025 saw silver growing even further to an average price of $27.81 by the end of that year, while its silver price forecast for 2027 has the commodity breaching the $30 price point to trade at an average of $31.83 by mid-November.

Gov Capital, another algorithm-based forecasting service, issued a silver price prediction stating that the metal would close out 2024 at a potential average of $36.10, $52.18 by the end of 2024, and $74.75 by December 2025.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

Conclusion

Please note that analysts’ and algorithm-based silver price forecasts can be wrong and should not be used as a substitute for your own research. Commodity markets remain volatile and shaped by the constant changes in economic and geopolitical events.

It’s essential to always conduct your own due diligence before trading and to look at the latest news, a wide range of commentary, fundamental and technical analysis.

In closing, BTCC is a perfect choice for those who want to diversify their investments to include stocks, commodities and cryptocurrencies. Apart from large crypto selection, BTCC also supports tokenized futures, allowing users to trade commodities and stocks futures with USDT. You can check the links below to create an account on BTCC and start trading silver now.

If you are into cryptocurrencies & commodities and need our up-to-date analysis of these assets, you are welcome to join BTCC Academy.

| Download App for Android | Download App for iOS |

FAQs

Just how much do you think silver will be valued in 2020?

In the next five years, if market circumstances improve as predicted, the price of silver (XAG) might hit a record high of $50 per ounce, according to the most recent projections and forecasts issued by online AI-based forecasting companies.

Will silver price reach $100?

Despite widespread optimism about silver’s future prospects, many industry insiders don’t think the price will rise above $100 per ounce anytime soon, especially in light of the current macroeconomic climate.

Will silver’s price rise in the next few weeks?

A rally in expectation of a reduction in U.S. interest rates and real yields that would likely precede a predicted rollover in U.S. growth in Q4’23 or early 2024 is one factor that could cause silver prices to drop in the coming days and weeks. The currency should feel the pressure and silver prices should benefit.

What are the prospects for silver in 2024?

Analysts predict that silver will hover around $23 for the next few months before breaking towards $30 around the end of 2024/beginning of 2024.

Can we expect a price drop for silver in the next several weeks?

Silver prices may fall in the coming days and weeks due to factors like rising interest rates and international instability. Weak jewelry demand owing to a prospective recession is another contributing cause, as is the likelihood of a prolonged pause before interest rates go down in the US.

What are BTCC’s specs?

Sometimes, users feel more comfortable working with an exchange if they know that the exchange has a footprint in the industry. BTCC has over 1.6 million registered users, and it has a trade volume (24H) of $10.19 billion.

BTCC is one of the best known exchange with over 12 years of stable and secure operating history focused on Bitcoin and Ethereum, offering trading service in US, Canada, and many other countries in Europe. It is also a one-stop exchange platform for investors to trade commodities or stocks to manage their portfolio risks.

Trading on BTCC begins with registration and log in, which only takes 30 seconds. New customers can now sign up here to get a welcome bonus of 10 USDT, and complete the KYC verification process to access all BTCC’s features and BTCC bonus. Once verified, you can start trading SILVER now.

|

BTCC Starter Rewards |

Read More:

Gold Price Predictions for Next 5 Years

XRP Price Prediction $500: Can XRP Reach $500 Dollars?

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real or Fake?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Pepe Price Prediction 2024, 2025, 2030

Pulsechain Mainnet Goes Live – What Exactly is Pulsechain?

Pulsechain (PLS) Launch: Everything You Need to Know

Pulsechain (PLS) Price Prediction 2024, 2025, 2030

Bitcoin (BTC) Price Prediction 2024, 2024, 2025, 2030

Luna Classic Price Prediction: Will Luna Classic Reach $1?

Ethereum Price Prediction 2024, 2025, 2030

Milady Meme Coin (LADYS) Price Prediction 2024, 2025, 2030

Gala (GALA) Price Prediction 2024, 2025, 2030

Cardano (ADA) Price Prediction 2024, 2025, 2030

HBAR Price Prediction 2025, 2030

Arbitrum (ARB) Price Prediction 2024, 2025, 2030

Core DAO Airdrop is Now Available, How to Claim It?

Core DAO (CORE) Price Prediction 2024, 2025, 2030

Stellar Lumens (XLM) Price Prediction 2024, 2025, 2030

Polygon (MATIC) Price Prediction 2024, 2025, 2030

The Sandbox Price Prediction 2025, 2030

Can Solana Reach $1,000? Solana Price Prediction

Sui (SUI) Price Prediction 2024, 2025, 2030

JasmyCoin (JASMY) Price Prediction

Litecoin (LTC) Price Prediction 2024, 2025, 2030

Polkadot (DOT) Price Prediction 2024, 2025, 2030

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*