Apple Stock (AAPL) Price Forecast 2024,2025,2030 — Can AAPL Hit $1000?

Are you interested in buying Apple shares? Do you wish to determine whether the investment is profitable? Do you want to know if this is a solid long-term investment? So you must continue reading because our Apple (APPL) stock price forecast will supply you with all the information you need to make an informed decision.

Investing in some of the top stocks available is one of the most reliable methods for accumulating wealth in the future. Apple stock has existed for a very long time. The investments of some of the company’s original investors have grown dramatically over time. Yet, you should not rush to purchase the stock. Before investing, it is crucial that you comprehend its history and evaluate its price forecasts.

In accordance with custom, we will not rush you through some numbers. Rather, we will examine Apple stock forecast in detail to help you choose whether investing now or later will be advantageous for you. We will also provide answers to queries that will assist you in taking decisive action.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Apple Stock (AAPL) Overview

| Stock | Apple |

| Last Price | $ 267.44 |

| Rank | 3 |

| Market Cap | $ 3,951.8B |

| 24H Trading Volume | $ 40.8M |

| Exchange | NASDAQ |

| Open | $ 269.92 |

| Previous Close | $ 269.92 |

| High | $ 270.71 |

| Low | $ 265.32 |

| ATH | $ 276.60 / 2025-11-13 |

| Website | http://www.apple.com |

| CEO | Timothy Donald Cook |

| Total Employees | 137000 |

| Industry | Telecommunications Equipment |

| Address | One Apple Park Way |

| City | Cupertino |

| State | CA |

| Country | US |

| Zip | 95014-2083 |

| Phone | 1.408.996.1010 |

| Update Time | 2025-11-19 13:57:02 |

The American multinational technology firm Apple Inc. is a market leader in several areas, including personal computers, mobile devices, and software and online services. The company has its main office in Cupertino, California, although it has clients all over the world. Currently, Apple is the most valuable firm in the world. Together with Amazon, Google, Microsoft, and Meta, it is considered to be one of the “Big Five” US IT giants (formerly Facebook).

Apple is the world’s second-largest producer of mobile phones. Apple’s iPhones are the most sought-after mobile devices in the world. Moreover, they are the number four PC vendor in the world. The iPhone, iPod, iPad, HomePod, Apple TV, Apple Watch, AirPods, and Macintosh are just some of the company’s consumer electronics offerings. Apple also provides a number of other services that are specific to the corporation, including as the App Store, Applecare, Apple Music, Apple News+, Apple TV+, Apple Pay, Apple Card, and Apple Fitness.

Among the Big Five US tech corporations, Apple is the oldest. In 1976, Steve Jobs, Steve Wozniak, and Ronald Wayne started the company as Apple Computer Care. After working together for a year, Steve Jobs and Steve Wozniak finally formed Apple Computer Inc. Apple went public in 1980 and saw immediate financial success.

Apple has evolved and improved in numerous ways throughout the years. The company has created items that have received widespread recognition and executed remarkable marketing efforts. In order to reach its current status as a worldwide powerhouse, it has expanded through a number of strategic acquisitions. Steve Jobs, CEO and co-founder of Apple, resigned in 2011 due to health concerns and passed away a short time later. Tim Cook, the current CEO, took over from him.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Apple Stock (AAPL) Price Performance

| Price Change 1H Percent | -0.44% |

| Price Change 1D Percent | -0.01% |

| Price Change 7D Percent | -0.74% |

| Price Change 30D Percent | 6.01% |

| Price Change 90D Percent | 16.00% |

| Price Change 365D Percent | 18.87% |

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Apple (AAPL) Stock Price History

| Date | Open | High | Low | Close | Volume |

| 2018-11-19 | $ 47.50 | $ 47.68 | $ 46.25 | $ 46.47 | 167.7M |

| 2019-11-19 | $ 66.98 | $ 67.00 | $ 66.35 | $ 66.57 | 76.3M |

| 2020-11-19 | $ 117.59 | $ 119.06 | $ 116.81 | $ 118.64 | 74.1M |

| 2021-11-19 | $ 157.87 | $ 160.72 | $ 157.14 | $ 160.49 | 87.7M |

| 2024-11-19 | $ 227.61 | $ 230.11 | $ 227.41 | $ 228.21 | 23.3M |

Apple (AAPL) Stock Technical Analysis

All financial markets use moving averages (MA), a well-liked indicator that smoothes price movement over a predetermined period of time. Since they are a trailing indication, past price activity has an impact on them. The simple moving average (SMA) and exponential moving average (EMA) are the two forms of moving averages shown in the table below.

Daily Simple Moving Average (SMA) & Daily Exponential Moving Average (EMA)

Date Calculated:2025-11-19

| 3_SMA | $ 270.94 | 3_EMA | $ 267.46 |

| 5_SMA | $ 272.31 | 5_EMA | $ 270.06 |

| 10_SMA | $ 270.94 | 10_EMA | $ 270.70 |

| 20_SMA | $ 268.57 | 20_EMA | $ 268.11 |

| 21_SMA | $ 268.27 | 21_EMA | $ 267.78 |

| 50_SMA | $ 256.52 | 50_EMA | $ 257.57 |

| 100_SMA | $ 237.83 | 100_EMA | $ 244.58 |

| 200_SMA | $ 225.56 | 200_EMA | $ 233.14 |

Weekly Simple Moving Average (SMA) & Weekly Exponential Moving Average (EMA)

Date Calculated:2025-11-19

| 21_SMA_weekly | $ 235.00 | 21_EMA_weekly | $ 244.54 |

| 50_SMA_weekly | $ 228.53 | 50_EMA_weekly | $ 229.85 |

| 100_SMA_weekly | $ 214.61 | 100_EMA_weekly | $ 215.50 |

| 200_SMA_weekly | $ 188.46 | 200_EMA_weekly | $ 189.73 |

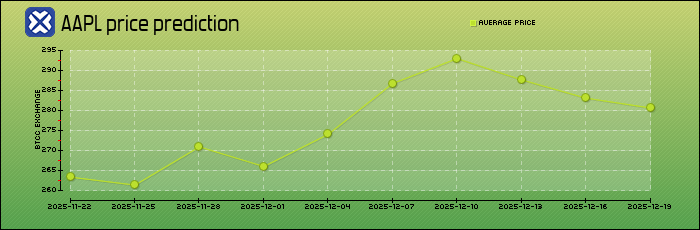

| Date | Price Prediction | Change |

| 2025-11-20 | $ 267.44 | 0.00% |

| 2025-11-22 | $ 263.33 | -1.54% |

| 2025-11-25 | $ 261.35 | -2.28% |

| 2025-11-28 | $ 270.90 | 1.29% |

| 2025-12-01 | $ 265.99 | -0.54% |

| 2025-12-04 | $ 274.04 | 2.47% |

| 2025-12-07 | $ 286.75 | 7.22% |

| 2025-12-10 | $ 292.98 | 9.55% |

| 2025-12-13 | $ 287.65 | 7.56% |

| 2025-12-16 | $ 283.08 | 5.85% |

| 2025-12-19 | $ 280.63 | 4.93% |

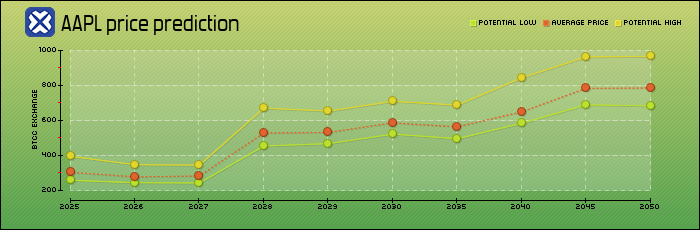

Apple Stock (AAPL) Price Forecast for 2025-2050

| Year | Yearly Low | Yearly Average | Yearly High |

| 2025 | $ 258.29 | $ 303.87 | $ 395.03 |

| 2026 | $ 244.53 | $ 277.88 | $ 347.35 |

| 2027 | $ 243.10 | $ 282.68 | $ 344.87 |

| 2028 | $ 454.06 | $ 527.98 | $ 670.53 |

| 2029 | $ 467.83 | $ 531.63 | $ 653.90 |

| 2030 | $ 521.88 | $ 586.38 | $ 709.52 |

| 2035 | $ 496.17 | $ 563.83 | $ 687.87 |

| 2040 | $ 584.13 | $ 649.03 | $ 843.74 |

| 2045 | $ 689.52 | $ 783.54 | $ 963.75 |

| 2050 | $ 683.59 | $ 785.74 | $ 966.46 |

Apple Stock (AAPL) Price Forecast 2024

After a very encouraging Q4 earnings report, Apple is expected to start 2024 in a strong financial position. Additional information regarding the strength of iPhone sales in 2024 can be found in the preliminary data that the firm should have regarding demand for the new iPhone 15.

But in 2024, Apple’s Vision Pro augmented reality goggles will be the centre of all the attention. Shipments of the headset, which could be Apple’s most significant product launch since the iPhone, are anticipated to begin early next year.

With demand for augmented reality headsets being so low for Apple’s rivals, it’s hard to predict how well this product launch will go. But Apple’s track record demonstrates that the company can carve out its own niche in the market with its groundbreaking products, and the headset is getting a lot of buzz from Apple fans all across the globe.

We think the headset has a lot of promise. Revenue from iPhone sales and services will justify Apple’s high stock price, regardless of how initially successful the product is. The Vision Pro isn’t having much of an impact on the stock price at the moment, although it is being considered by certain analysts for their estimates.

Having a head start in augmented reality technology could be crucial for Apple in the future. Despite sluggish acceptance, augmented reality (AR) might have a profound impact on the workplace, interpersonal relationships, and daily lives, comparable to the way the smartphone revolutionized communication. Apple has made its intentions clear with the Vision Pro that it intends to be at the forefront of this emerging technology.

Meanwhile, international sales of iPhones should keep going up. Apple ought to keep expanding its service revenue stream as well. The stock should keep to higher in 2024 thanks to growth in these areas, which are Apple’s main sources of revenue.

Maintaining or reducing interest rates will be good for Apple as well. The Federal Reserve is expected to start decreasing rates next year, according to firms like Goldman Sachs. The tech industry in particular will see an uptick in investment activity as a result of this.

Taking everything into account, we anticipate that Apple stock will reach $240 by the end of 2024, representing a 32.6% increase from its current price.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Apple Stock (AAPL) Price Forecast 2025

We anticipate that Apple stock will maintain its upward trajectory well into 2025. Our analysis of the Apple stock market for the year 2025 reveals two key tailwinds.

A decrease in interest rates is the initial measure. After holding at 5.6% today, the Federal Reserve has set a goal of a rate of 3.9% by the end of 2025. If interest rates were to drop by that much, many would likely start putting their money back into equities again, and especially into “risk-on” industries like tech.

Put another way, a more favourable macroeconomic climate in 2025 might lead to huge investment inflows in Apple stock, which could cause the stock price to rise even if the company’s business doesn’t change significantly.

Second, the overwhelming preference of today’s youth for the iPhone over Android handsets is a boon for Apple. The majority of teens (87%) would rather have an iPhone, according to a new poll.

These teens will predominantly favour iPhones when they become adults and start buying their own devices, just as today’s tweens will favour Apple products when they acquire their first phones. That secures the continued success of Apple’s iPhone and related accessories in the American market for the foreseeable future.

Plus, Apple can count on these youthful customers to stick around. After getting an iPhone, customers are likely to spend money on services like iCloud storage, apps from the App Store, and more.

Our 2025 Apple stock price forecast is $290, supported by these positive trends.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Apple Stock (AAPL) Price Forecast 2030

Although projecting a stock’s price more than seven years in the future is extremely difficult, we are optimistic about Apple’s 2030 price.

We anticipate the following favourable trends supporting Apple’s continued growth between now and 2030:

- Apple plans to keep expanding its presence in Asia’s developing nations, particularly in the rapidly expanding Indian market.

- Apple might gain more traction in Africa’s expanding marketplaces.

- Younger consumers will continue to be Apple’s primary market, guaranteeing a consistent flow of new subscribers for Apple’s subscription services.

- Future revisions of Apple’s Vision Pro headset will position the company as a key player in AR/VR services.

Additionally, Apple has additional chances that can enable it to hold onto its leadership in a world that is evolving. For instance, the business may collaborate with manufacturers of electric cars to incorporate Apple’s operating system or offer more inducements to buy an iPhone.

Our forecast for the price of Apple stock in 2030 is $510, or a $8 trillion market capitalization. In our opinion, Apple will remain, by far, the most valuable corporation in the world in 2030.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Apple Stock (AAPL) Earnings History

| Report Date | Forecasted EPS | Reported EPS | Last Year’s EPS | EPS YoY Change |

| 2025-10-30 | $ 1.78 | $ 1.85 | $ 1.64 | 12.80% |

| 2025-07-31 | $ 1.44 | $ 1.57 | $ 1.40 | 12.14% |

| 2025-05-01 | $ 1.63 | $ 1.65 | $ 1.53 | 7.84% |

| 2025-01-30 | $ 2.36 | $ 2.40 | $ 2.18 | 10.09% |

| 2024-10-31 | $ 1.60 | $ 1.64 | $ 1.46 | 12.33% |

| 2024-08-01 | $ 1.35 | $ 1.40 | $ 1.26 | 11.11% |

| 2024-05-02 | $ 1.50 | $ 1.53 | $ 1.52 | 0.66% |

| 2024-02-01 | $ 2.10 | $ 2.18 | $ 1.88 | 15.96% |

| 2023-11-02 | $ 1.39 | $ 1.46 | $ 1.29 | 13.18% |

| 2023-08-03 | $ 1.19 | $ 1.26 | $ 1.20 | 5.00% |

Apple Stock (AAPL) Dividend History

| Ex-Dividend Date | Payout Amount | Declare Date | Payment Date | Stock Price |

| 2025-11-10 | $ 0.26 | 2025-10-30 | 2025-11-13 | $ 269.43 |

| 2025-08-11 | $ 0.26 | 2025-07-31 | 2025-08-14 | $ 227.18 |

| 2025-05-12 | $ 0.26 | 2025-05-01 | 2025-05-15 | $ 210.13 |

| 2025-02-10 | $ 0.25 | 2025-01-30 | 2025-02-13 | $ 227.61 |

| 2024-11-08 | $ 0.25 | 2024-10-31 | 2024-11-14 | $ 227.05 |

| 2024-08-12 | $ 0.25 | 2024-08-01 | 2024-08-15 | $ 216.68 |

| 2024-05-10 | $ 0.25 | 2024-05-02 | 2024-05-16 | $ 183.08 |

| 2024-02-09 | $ 0.24 | 2024-02-01 | 2024-02-15 | $ 188.85 |

| 2023-11-10 | $ 0.24 | 2023-11-02 | 2023-11-16 | $ 186.40 |

| 2023-08-11 | $ 0.24 | 2023-08-03 | 2023-08-17 | $ 177.69 |

Can AAPL Hit $1000? Pros and Cons

Growth of the service segment – Apple’s little reliance on the advertising business in 2022 is one of the major reasons for the company’s outperformance of its share. Over the past few years, Apple Inc. has put a lot of emphasis on advertising its services. That’s why it’s the most profitable division of the corporation. Twenty percent of the recent quarter’s $90 billion in revenue came from the service sector, but it generated thirty percent of the quarter’s net profitability.

The service industry is expanding, and its profit margin is expanding along with it. The product division’s profit margin fell by 152 basis points in the most recent quarter, while the service division’s profit margin increased by 169 basis points. The service industry is unquestionably the one to watch in the next decade.

Disruption in iPhone production – At the moment, investors are most worried about Apple’s reliance on China to produce iPhones. Covid-19 instances are on the rise once more in the country, and in response to the government’s regulations, multiple lockdowns have been declared in the previous couple of months, halting iPhone production. Foxconn employees, who are responsible for manufacturing 70% of iPhones, have pushed back hard.

JP Morgan Chase predicts that by 2025, about 25% of Apple’s goods would be manufactured in India, and the company is actively seeking to diversify iPhone production in the country. However, Apple now predicts that it will sell at least 3 million fewer iPhone 14s this year than it had anticipated. Apple’s dependence on China could be detrimental to the company in the years to come.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Can Apple Stock Hit $1000? Analysis

The price per share right now for Apple Inc. is $147.81. (as of 2.12.2022). The current share price of $148 is based on the company’s P/E ratio of 24.30 and its EPS of 6.11.

Now the service segment is forecast to grow at a CAGR of 3% through 2030 from 2021, generating $388 billion, while the service segment is expected to increase at a CAGR of 18% to $304 billion. As a result, $692 billion in total income is projected by 2030, with services accounting for $440 billion and hardware for $560 billion.

In a similar vein, EPS projections go from $5.61 in 2022 to $7.96 in 2026, representing a CAGR of 7.24%. It is reasonable to expect a CAGR of 10% for the service sector over the next decade, given the industry’s promising future.

By 2031, analysts anticipate that earnings will amount to $14.55. The average P/E over the past five years is 24, and it is projected to increase further over the next several years as a result of the service sector. This implies a predicted share price of $363 in 2031 based on a relatively low P/E of 25. Therefore, even for a prosperous and expanding firm like Apple Inc., $1,000 is far too high.

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

Conclusion

Apple Inc. is not among the fastest-growing but rather one of the most stable firms in the world. It stands out from rivals thanks to its dominant market share in the service sector and healthy free cash flow. Could Apple sell for $1,000? It’s a long-term play, and the aim may be too optimistic for Apple shares. Think about Apple Inc.’s well-known share buyback and its ensuing benefits.

You can also trade AAPLUSDT Perpetual Futures on BTCC: https://www.btcc.com/en-US/trade/perpetual/AAPLUSDT

[TRADE_PLUGIN]AAPLUSDT,AAPLUSDT[/TRADE_PLUGIN]

FAQs

What will the price of Apple shares be in 2024?

We project that the price of Apple stock will be $240 in 2024, with a possible high of $250 and a possible low of $210.

Should I buy Apple stock?

Based on our forecast that the price of Apple stock would reach $240 by the end of 2024, we rank the stock as a strong buy. In late 2024, we think Apple will continue to thrive and profit from declining interest rates.

In five years, what is the expected price of Apple’s stock?

According to our predictions, Apple’s share price will reach approximately $240 in 2025 and $510 in 2030. Our five-year projection for AAPL is $400.

Where to Trade AAPL Futures?

You can trade tokenized futures on BTCC Now. Over 300 USDT-margined perpetual trading pairs are available for users to trade, including many popular altcoins and meme-coins.

You can deposit and receive up to 10,055 USDT now when you sign up and verify your account on BTCC Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

About BTCC

BTCC is a leading cryptocurrency trading platform that is distinguished by its ability to balance the simplicity of use with advanced features. It provides a comprehensive educational program through the BTCC Academy, 24/7 customer support, and robust security to both novices and experts. BTCC is a top choice for digital asset investors due to its emphasis on user contentment, which fosters a secure and informed trading environment across a variety of cryptocurrencies.

BTCC is one of the few exchanges in the market that offers high-leverage options for investors and concentrates extensively on futures trading. Users have access to more than 300 USDT-margined perpetual trading pairs, which encompass numerous prominent altcoins and meme-coins. Additionally, the platform has recently implemented spot trading to facilitate novice users who may not be acquainted with futures trading.

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?