Crypto & Tech Indices: The Rough Week That Reveals Everything

Crypto markets stumble as traditional tech follows suit—showing just how intertwined these sectors have become.

The Domino Effect

When crypto catches a cold, tech stocks start sneezing. This week proved the correlation isn't just theoretical—it's painfully real.

Market Mechanics Exposed

Institutional money flows both ways now. The same algorithms that pumped tech stocks for years are now playing in digital assets—and sometimes they trip over their own code.

Silver Linings in the Red

Every dip creates buying opportunities. Smart money knows volatility is the price of admission for generational returns—while Wall Street analysts suddenly remember they've been 'cautious about valuations' all along.

Across crypto sectors, everything finished in the red. Two areas held up relatively well: Gaming at -2.8% and the Revenue sector at -3.2%.

On the other side, Crypto Equities and Miners were the hardest hit, falling -10.3% and -13.2%, respectively. The monthly picture is even more painful, with HOOD at -17.6%, COIN at -27%, and GLXY at -38%. Miners remain weighed down by skepticism around the AI trade and whether the pivot to AI data centers will deliver returns.

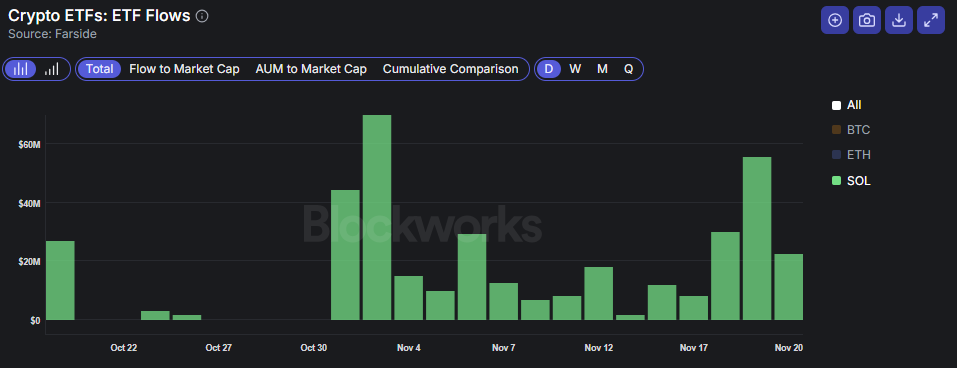

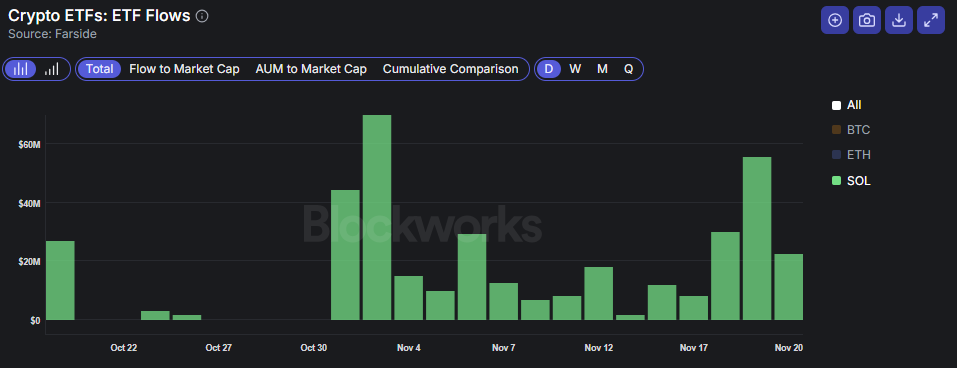

One bright spot remains solana ETF flows. While BTC and ETH ETFs have seen consistent outflows since Oct. 28, SOL ETFs just logged their 14th-straight day of inflows following the launch of BSOL. Roughly $500 million worth of SOL is now held across these ETFs, with more issuers having entered the staked SOL ETF race.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.