Crypto Carnage: Digital Assets and Tech Indices Get Hammered in Brutal Trading Week

Bloodbath on Blockchain Street as major cryptocurrencies and technology indices post devastating losses

The Digital Downturn

Bitcoin plunged below critical support levels while Ethereum got crushed alongside other major altcoins. Tech stocks mirrored the crypto collapse, creating a perfect storm of digital asset destruction.

Market Mayhem Unfolds

Trading desks reported massive liquidations as leveraged positions got wiped out. The fear and greed index hit extreme fear territory while volume spiked to panic-selling levels.

Institutional Exodus

Major funds rotated out of risk assets faster than you can say 'decentralized finance.' The correlation between crypto and tech stocks tightened dramatically - when one sneezes, the other gets pneumonia.

Another week where traditional finance bros get to smugly say 'I told you so' while checking their boring bond yields. The digital revolution continues - just heading south for now.

Across crypto sectors, everything finished in the red. Two areas held up relatively well: Gaming at -2.8% and the Revenue sector at -3.2%.

On the other side, Crypto Equities and Miners were the hardest hit, falling -10.3% and -13.2%, respectively. The monthly picture is even more painful, with HOOD at -17.6%, COIN at -27%, and GLXY at -38%. Miners remain weighed down by skepticism around the AI trade and whether the pivot to AI data centers will deliver returns.

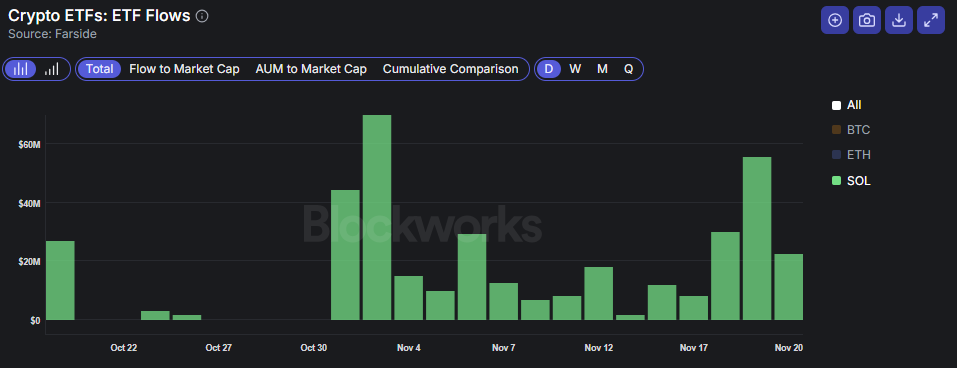

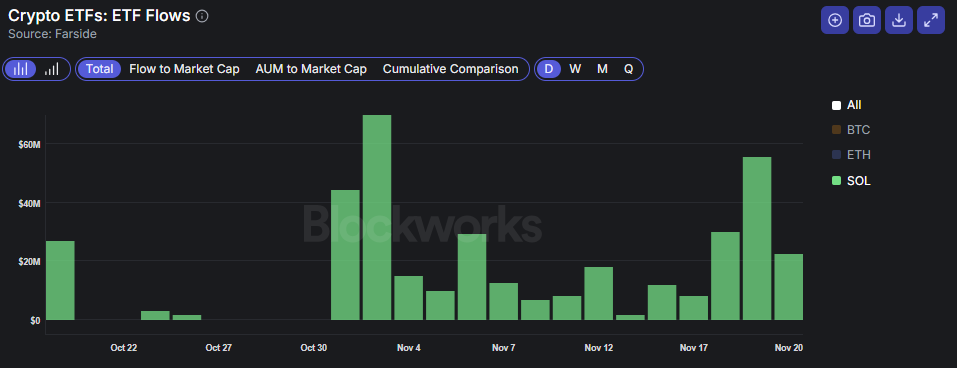

One bright spot remains solana ETF flows. While BTC and ETH ETFs have seen consistent outflows since Oct. 28, SOL ETFs just logged their 14th-straight day of inflows following the launch of BSOL. Roughly $500 million worth of SOL is now held across these ETFs, with more issuers having entered the staked SOL ETF race.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.