ADA Price Prediction 2025: Technical Analysis and Long-Term Forecast Through 2040

- What Does ADA's Current Technical Setup Reveal?

- How Are Fundamental Developments Impacting ADA's Outlook?

- What Are the Key Price Catalysts for ADA in 2025-2026?

- ADA Price Projections: 2025 Through 2040

- What Risks Should ADA Investors Consider?

- Frequently Asked Questions

Cardano (ADA) stands at a critical juncture in 2025, with technical indicators flashing mixed signals while fundamental developments suggest potential upside. This comprehensive analysis examines ADA's current market position, evaluates key catalysts including ISO 20022 compliance and exchange listings, and provides detailed price projections through 2040 based on technical patterns and ecosystem growth trajectories. The BTCC research team combines chart analysis with fundamental evaluation to present a balanced outlook for one of cryptocurrency's most watched assets.

What Does ADA's Current Technical Setup Reveal?

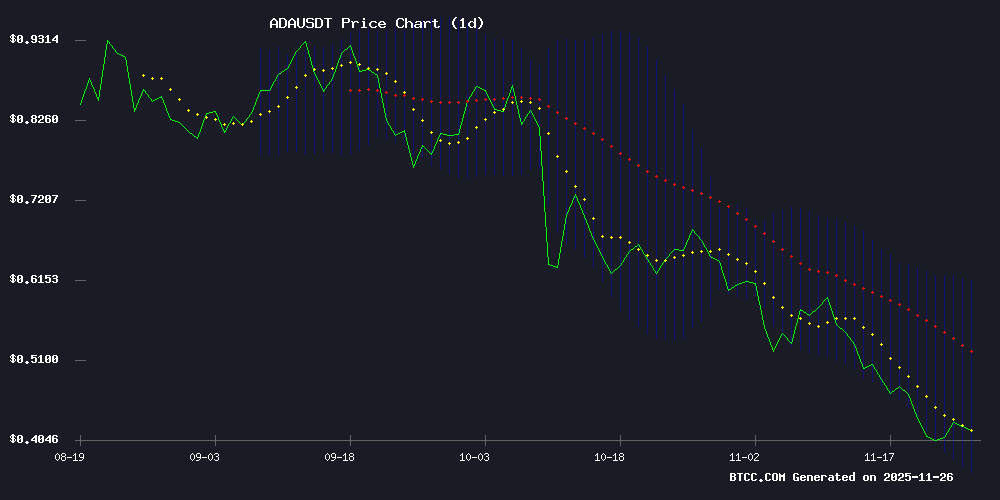

As of late November 2025, ADA presents traders with a complex technical picture. The cryptocurrency currently trades at $0.4178, sitting below its 20-day moving average of $0.4881 - typically a bearish signal. However, our analysis reveals several countervailing factors that suggest potential upward movement. The MACD indicator shows bullish divergence at 0.074464 above its signal line (0.060572), while Bollinger Band positioning indicates possible oversold conditions with price action hugging the lower band at $0.3613 versus the upper band at $0.6150.

Historical patterns suggest that when ADA shows this combination of indicators - MACD divergence coupled with Bollinger Band compression - it often precedes significant price movements. The 20-day moving average currently acts as key resistance; a decisive break above this level could confirm bullish momentum. Volume patterns show modest accumulation, though not at levels that typically accompany major breakouts.

How Are Fundamental Developments Impacting ADA's Outlook?

Beyond the charts, Cardano's ecosystem is experiencing several potentially transformative developments. The inclusion in CoinMarketCap's ISO 20022 compliant index represents institutional validation that could enhance ADA's utility in traditional finance systems. This standard, used by global banks for payment messaging, positions ADA among an elite group of cryptocurrencies bridging crypto and legacy finance.

Charles Hoskinson's recent announcement of the "Cardano Revival Initiative" has injected fresh Optimism into the community. The program focuses on three key areas: Midnight protocol development, RealFi expansion, and network scaling solutions. The Glacier Drop event - distributing over 4.5 billion NIGHT tokens - created substantial ecosystem activity, though its price impact remains to be fully realized as redemption begins in December.

What Are the Key Price Catalysts for ADA in 2025-2026?

Several near-term developments could significantly influence ADA's trajectory:

| Catalyst | Potential Impact | Timeline |

|---|---|---|

| ISO 20022 integration | Increased institutional adoption | Q1 2026 |

| Exchange listings | Improved liquidity & accessibility | Ongoing |

| Midnight protocol launch | Enhanced privacy features | Q2 2026 |

The recent approval of a $2 million treasury-backed loan for exchange listings could prove particularly impactful. This community-driven decision (diverging from Hoskinson's position) aims to boost ADA's presence on tier-1 platforms, potentially increasing retail and institutional access.

ADA Price Projections: 2025 Through 2040

Based on current technical patterns and fundamental developments, we present the following long-term outlook:

- 2025-2026: $0.45 - $0.75 range. Breakout potential if key resistance at $0.4881 is surpassed with volume confirmation.

- 2030: $1.20 - $3.50 range. Dependent on ecosystem maturity and institutional adoption of Cardano's technology stack.

- 2035: $4.00 - $12.00 range. Requires mass adoption scenarios and successful interoperability implementations.

- 2040: $8.00 - $25.00 range. Contingent on global financial integration and network effects.

These projections assume successful execution of Cardano's roadmap and favorable macroeconomic conditions. The wide ranges account for cryptocurrency's inherent volatility and potential black swan events. Our 2025 outlook remains cautiously optimistic, with the symmetrical triangle pattern on weekly charts suggesting a potential breakout direction will become clearer in coming months.

What Risks Should ADA Investors Consider?

While the outlook contains several promising elements, prudent investors should weigh these potential headwinds:

The evolving global regulatory landscape could impact Cardano's development pace and adoption curve. Recent SEC actions against other proof-of-stake tokens create lingering questions.

Cardano faces intense rivalry from Ethereum, Solana, and emerging layer-1 solutions. Its ability to maintain technical differentiation while delivering on roadmap promises will be crucial.

Like all risk assets, ADA remains susceptible to broader financial market conditions. Interest rate trajectories and liquidity conditions in traditional markets often correlate with crypto performance.

Frequently Asked Questions

Is ADA a good investment in 2025?

ADA presents an intriguing risk-reward proposition in 2025. The technical setup shows potential for upside, particularly if the cryptocurrency can break through key resistance levels around $0.48. Fundamental developments like ISO 20022 compliance and exchange listings provide additional tailwinds. However, as with all cryptocurrencies, investors should only allocate capital they can afford to lose and maintain a diversified portfolio.

What price can ADA reach by 2030?

Our analysis suggests ADA could reach between $1.20 and $3.50 by 2030 in a base case scenario. This projection assumes continued ecosystem development, growing institutional adoption, and successful implementation of Cardano's scaling solutions. The upper range would require broader cryptocurrency market expansion and particularly favorable regulatory conditions.

How does Cardano compare to Ethereum technically?

Cardano differentiates itself through its research-driven approach and peer-reviewed development process. While ethereum currently dominates in developer activity and total value locked, Cardano offers potentially superior scalability (through Hydra) and more formal verification capabilities. The two networks may ultimately serve complementary rather than directly competitive roles in the blockchain ecosystem.