What Is Free Margin in Forex

According to a 2019 survey for the FX and OTC derivatives markets, the foreign exchange market, otherwise known as the Forex market ranks as the largest market in the world with a $6.6 trillion dollar daily volume, making it attractive to retail traders/ and institutional investors such as commercial/Investments banks, central banks, investment managers/hedge funds, multinational corporations.

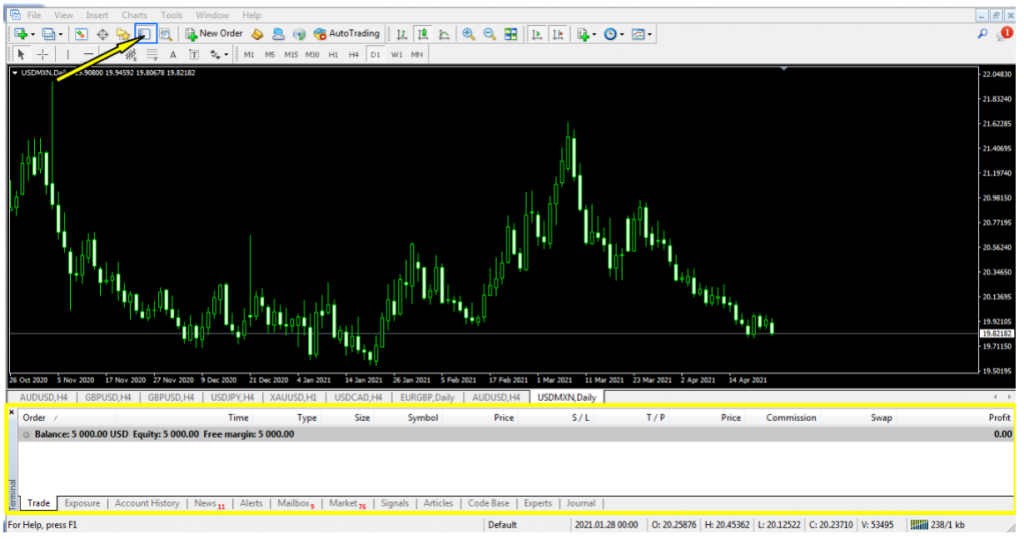

We’ll be following the retail trader’s perspective in this post, and the most popular Forex trading platform by retail traders is the MetaTrader4 trading platform.

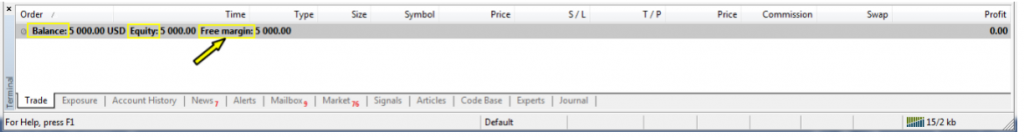

By clicking on the Terminal icon on the MT4 standard menu or hitting the (Ctrl+T) keys, you get to view your open orders, account balance, Margin, and Free margin.

We cannot explain the ideas behind free margin in isolation without looking at other parts such as account balance, account equity, margin used and margin level.

| YOU MAY LIKE: Use CFDs to trade bitcoin & crypto which are more volatile than forex pairs to make heavy profits quickly. |

Account Balance

The trader’s account balance is the amount of money available in his/her trading account, often denominated in USD without considering opened positions (live buy or sell orders).

Account Equity

As a trader, your account equity involves an increase or decrease to your account balance, which depends on if your cumulative open trades are in profit or loss.

With that said, your account equity can be greater than your account balance or less than your account balance.

Let’s take an example:

Let’s say your account balance is $5000, and you have an open trade on the EURUSD with a $450 profit, USDJPY trade with a loss of -$50 and USDMXN trade with a profit of $800. Your account equity would now be $6200 ($5000 + $450 – $50 + $800).

So your account balance would be $5000, while your account equity is at $6200. If you close your open positions, then your account balance would update to $6200, and your account equity would also be at $6200 with no fluctuations since all your orders are now closed.

Margin

Margin is the amount of money that’s required for you to place a trade. Margin on your account becomes visible after placing your first trade, so you can start by placing the minimum allowed lot size for your trading account.

When trading on the MetaTrader4 platform it’s recommended that you understand your account type, which can be any of Nano, Micro, Mini, or Standard accounts? Doing this will allow you understand the minimum lot size, which can consequently influence your risk exposure (on your available Margin).

Margin Level (%)

The Margin level is output in percentage, where a value greater than 100% shows a relatively healthy account, and a level that’s less than or equal to 100% shows that you’ve taken too much positions and you stand a higher risk of hitting a margin call, consequently leading to liquidation of some or all of your open trades.

Here’s how it’s done:

Let’s assume your Account Equity = $5000, and Margin used = $1000.

We calculate Margin Level as shown below.

Margin Level = (Account Equity / Margin) X 100

Margin Level = 500%

From our example, a 500% Margin level shows that your trading account will probably not hit margin call, and lower risk of account liquidation.

Free Margin

Finally, we get to free margin, which is the primary subject of this post.

Here, we illustrate the free margin on a trading account via a simple equation shown below.

Free margin = Equity – Margin

So, to keep things simple, pay attention to your account equity and margin. If your account equity is equal to your margin, it then means that your margin level is 100% and the free margin on your account is zero, which means you cannot place more positions on the account unless you make a new deposit to your trading account.

NOTE: If you often get into a scenario where the free margin on your trading account quickly gets to zero, it’s clear that you’re taking up way more risk. In that case your margin level (%) will also be at 100%, meaning you can’t place new trades on the current account balance and account equity levels.

Conclusion

Having a clear understanding of the free margin on your Forex trading account will serve you well in money management and risk management

Last, keeping track of your account free margin will help you size your position in such a way that it optimizes your trading strategy.

| YOU MAY LIKE: Use CFDs to trade bitcoin & crypto which are more volatile than forex pairs to make heavy profits quickly. |