How to Trade Forex in India

What is Forex-FX Trading?

Foreign exchange trading otherwise known as FOREX or FX trading involves the simultaneous buying and selling of foreign currencies in pairs to hedge, arbitrage, or for speculation on the rise and fall in exchange rates.

The Forex market involves global participants, which include central (eg India’s RBI) /commercial banks, corporations, hedge funds, Investment management firms, retail FX brokers, and retail investors/traders.

A common example is, say you’re at the airport travelling from the United States to France.

To keep things simple, let’s also assume you want to convert a hundred USD out of your travelling allowance into Euro at an exchange rate of 1 EURO to 2 USD (for simplicity ), since you can easily spend Euro in France.

So, $100 at 1 EURO to $2 will give you 50 EUR.

Now, let’s assume your flight got cancelled and you won’t be travelling again that day, and you want to convert your 5EUR back to USD.

If the new exchange rate of the EUR to USD is now 1EUR to 3USD, then your new balance in US dollar would be 150 USD (3 X 50), making you a $50 profit.

A scenario where you realize a loss would be if the exchange rate dipped by 1 EUR to 1.5 USD brings your new balance to $55 and a $45 loss.

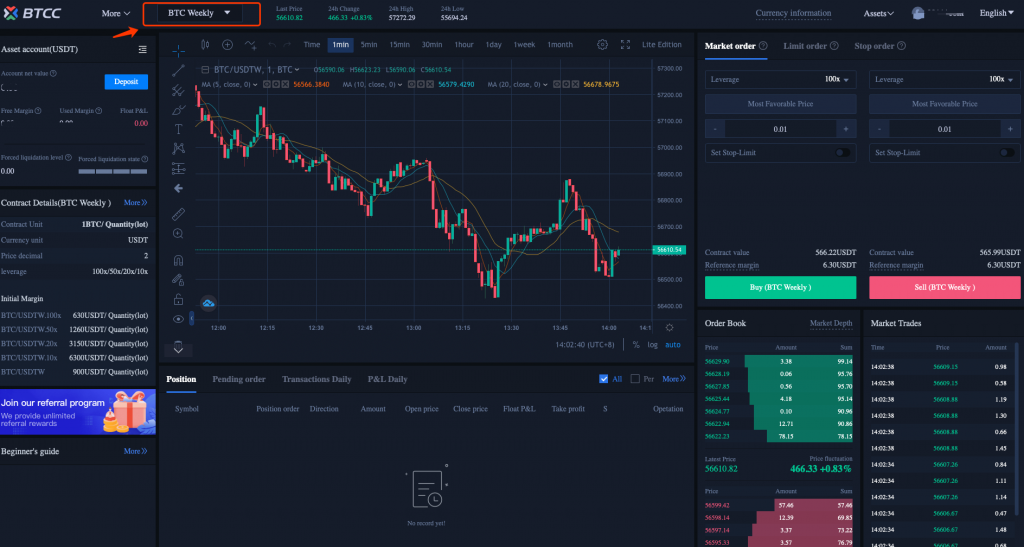

| YOU MAY LIKE: Register A Free Account At BTCC Crypto Derivative Trading Platform And Use CFDs To Trade Bitcoin & Crypto Which Are More Volatile Than Forex Pairs To Make Heavy Profits Quickly. |

Understanding the Basics of Forex-FX Trading & How currency markets work

There are different concepts and ideas you need to understand about currency trading. They include:

Currency Pairs

As mentioned in our hypothetical example, we traded currencies in pairs. You want to trade a weak currency for a stronger one.

Bid and Ask Prices

Since currencies are traded in pairs, as a buyer of one currency for another, you will be buying at the ASK price. Conversely, as a seller of currency, you will be selling at the BID price.

Spread

The difference between the BID and ASK price is the spread. It is the what the broker charge for providing the service on their trad terminal.

Lots

Currencies on popular FX terminals like the MetaTrader4 are traded in lots, with the highest being one standard lot i.e. 1pip to $10, and the minimum being 1pip to 1cent on a cent/Nano account.

Pips

A pip in Forex otherwise known as percentage in point is 0.0001. Therefore, for a standard lot size that’s 100 000 units, a pip would be 0.0001 X 100 000, wich equals $10.

Leverage

It is a common practice to trade currency pairs with leverage, which helps boost your starting balance for bigger positions for a smaller collateral (margin ).

It’s worth mentioning that you should exercise leverage according to your risk appetite as the more leverage you take exposes your capital to more risk, as well as offers potential to maximise your gains.

it’s advisable to start with low leverages of about 1:25 if you’re just starting out with FX trading. Only experienced traders should look into taking high leverage (1:50, 1:100, 1:200) as there are different ways it can hedge your positions.

How to start Forex-FX trading in India?

Trading foreign currency contracts in India is cash settled, meaning it does not require physical delivery of the currencies.

To get started with forex trading in India, we’ll recommend that you follow the steps below.

– Get a high speed Internet Connection.

– Shop for a regulated Forex broker.

– Sign up for an account and setup a demo and live account.

– Log on to your brokers’ FX trading terminal/platform.

– Place your first Long or Short trade.

Who can trade in the Forex-FX Market?

We use the forex market for hedging against risk, speculations, and arbitrage. With that said, retail traders/investors would want to speculate on foreign currencies, while hedge funds, institutions and banks may want to use it for hedging speculation, arbitrage, or to settle transactions across borders.

Although there are different trading strategies out there, we’ll only be looking at two trading strategies for simplicity, which are Trend following strategies and Mean reversion strategies.

Different Forex-FX Trading Strategies

Trend Following Strategy

A trend following approach involves identifying the trend direction, followed by placing positions in the identified trend direction.

Mean Reversion Strategy

Mean reverting strategies often involve placing trades against an identified volatile trend to capture some gains as the currency pair trades towards the mean price.

Note:

We can apply these trading strategies from different time horizons such as Scalping, Day Trading, Swing Trading, and Position trading.

Scalping: Scalpers would look to capture small moves in a currency pair to lock in profits within a brief time.

Day Traders: As a day traders you will want to open and close your trades within a day, regardless of the trading strategy.

Swing traders: Following this approach as a trader means you look into a longer holding time on your trades that can be more than a day.

Position Trading: Position traders follow a longer time frame approach with longer holding time starting from a week to months.

Why trade Forex-FX as an Indian Resident?

If you’re looking at the possibilities of making extra income, then Forex trading allows you the possibility to do that.

By taking leverage, you can add a second layer of buffer to your account balance, making you more profits from your starting capital.

With more experience, and following the principles of compound interest, you can gradually scale up your account balance.

Conclusion

The presence of off-shore regulated online forex brokers and regulated Indian brokers now broaden the scope and participation of resident Indian traders and investor community.

Hopefully, we’ve been able to cover the major points required for you to get started with forex trading in India and start earning.

| YOU MAY LIKE: Register A Free Account At BTCC And Use CFDs To Trade Bitcoin & Crypto Which Are More Volatile Than Forex Pairs To Make Heavy Profits Quickly. |