How to buy and sell EOS futures on BTCC

EOS is a blockchain protocol developed by BM (Daniel Larimer). The main goal is to support business by enabling high-performance and high-security blockchain-based application to be build on the open source smart contract platform. EOS has raised 4 billion US dollars in one year and is currently the largest ICO project. In 2018, EOS was once regarded as Blockchain 3.0, and has set off a wave of TPS boom due to its vision of achieving one million TPS.

However, a series of problems emerged such as the high threshold to use EOS, and complicated technology. BM later developed other new projects, and project parties have been criticized for raising funds to buy treasury bonds. The current views toward the project is very polarized. EOS is currently quoted at a price of US$3.02. In 2020, the price of EOS increases 9.60%.

You can buy EOS at a low price and sell at a high price to invest in EOS. However, this method is only effective when the EOS price rises.

BTCC cryptocurrency derivatives margin trading platform can solve these shortcomings. EOS futures allow you to benefit from EOS fluctuations. In addition, these derivative have built-in leverage, you can use small capital to trade large transactions.

7 Steps to Complete Buying and Selling EOS Futures at BTCC

STEP 1: Open the BTCC margin trading buying and selling interface

STEP 2: Choose the type of EOS margin to buy

STEP 3: Select the type of EOS order

STEP 4: Choose the leverage level to add

STEP 5: Choose the lot size to buy

STEP 6. Set the take profit and stop loss price

STEP 7. Choose direction: bullish “buy”, bearish “sell”

STEP 1: Open the BTCC margin trading buying and selling interface

Log in to the official website of BTCC.com and click Margin Trading on the main menu.

If you have not opened an account with BTCC, click here to quickly register a free account and top up the initial amount. You can deposit at least 2 USDT for an attempt. If the deposit amount is greater than 500 USDT, you can receive up to 2,000 USDT bonus.

STEP 2: Choose the type of EOS margin trading to buy

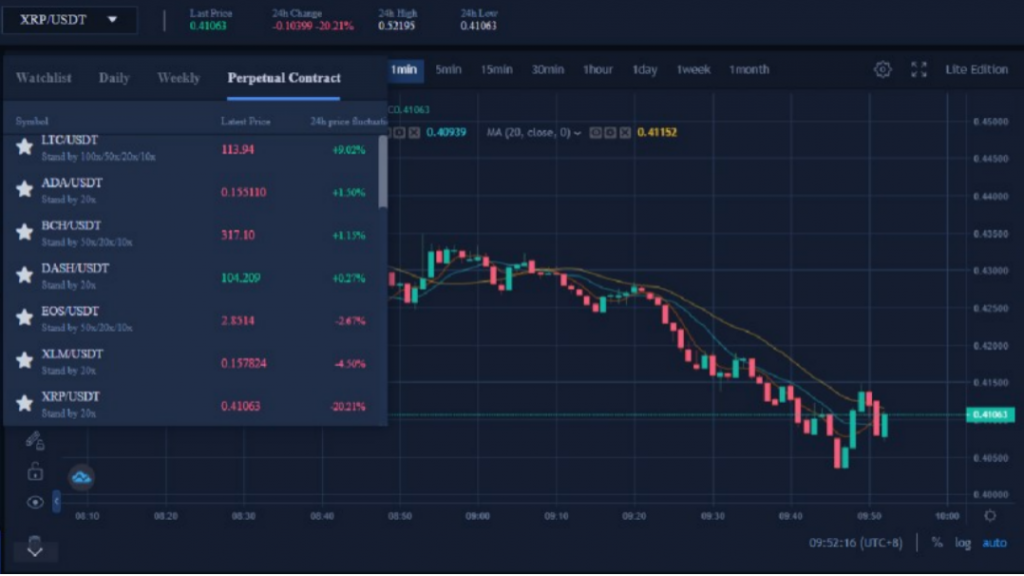

Select the weekly contract or perpetual contract of EOS at the top of the page.

STEP 3: Select the type of EOS order

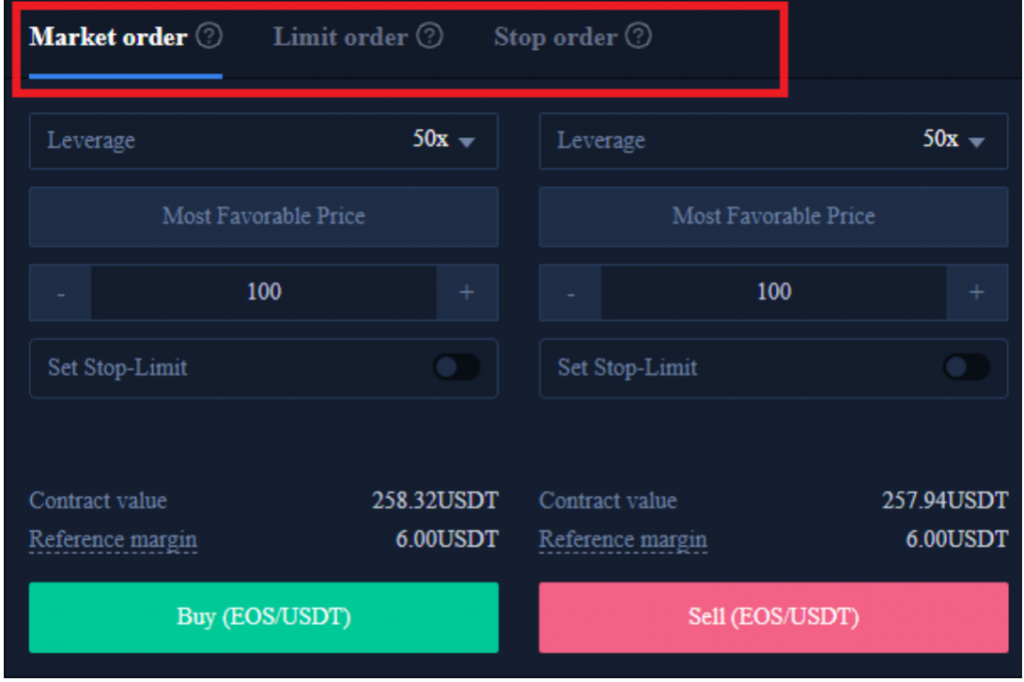

Select the BTCC margin trading order type at the top right of the page. BTCC margin trading orders are divided into market orders, limit orders and stop loss orders.

·Market orders: Users place orders at the best current price in the market to achieve fast trading.

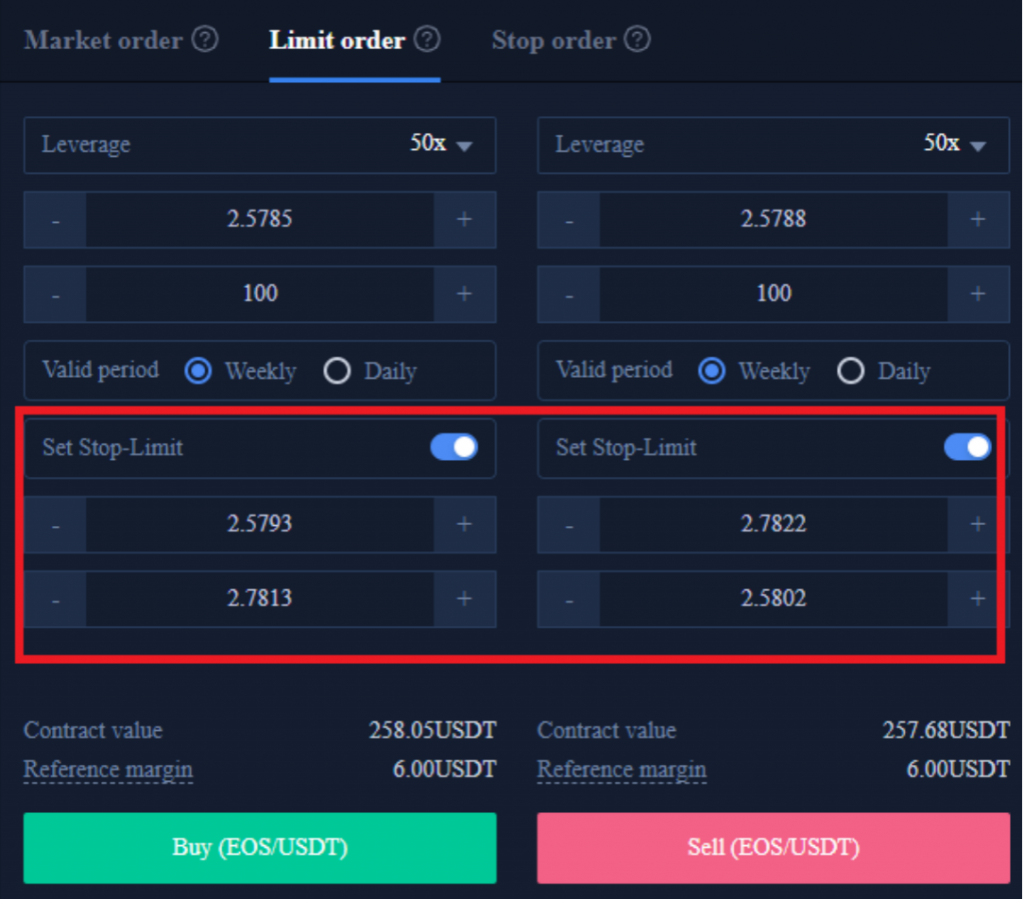

·Limit order: A limit order is used to copy the top/bottom, and refers to a buy/sell price set by the user. After the market reaches the limit price, the margin trading can be executed.

·Stop Order: A stop order is an advanced limit order, and users can customize a buy/sell price. After the market reaches the limit price, the margin trading can be executed.

STEP 4: Choose the leverage level to add

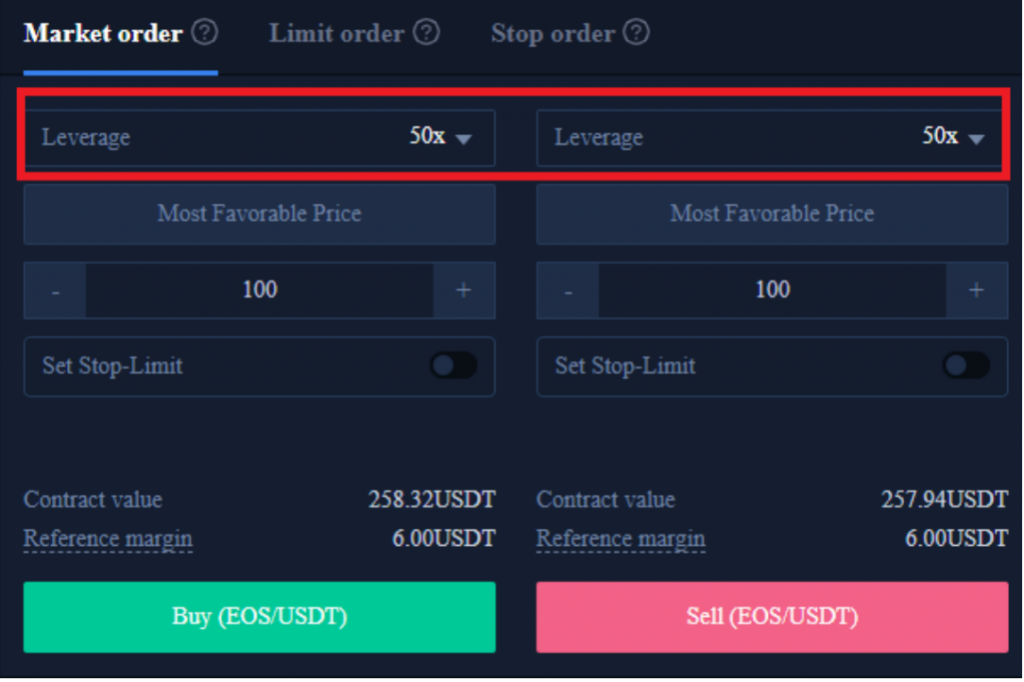

Leverage multiples can be adjusted by themselves. For example, EOS’s weekly contract and perpetual contract provides 10x, 20x and 50x leverages.

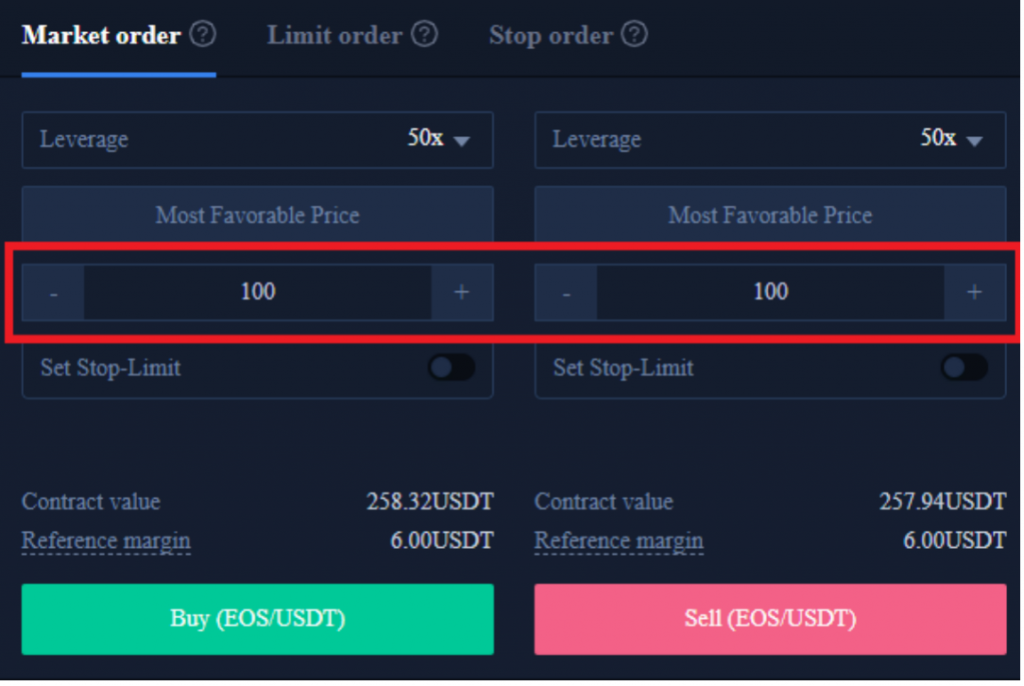

STEP 5: Choose the lot size to buy

The EOS trading unit can choose the number of lots according to the user’s investment situation, and the range can be selected from 1 to 10000 lots. There are real-time contract values and reference margins below.

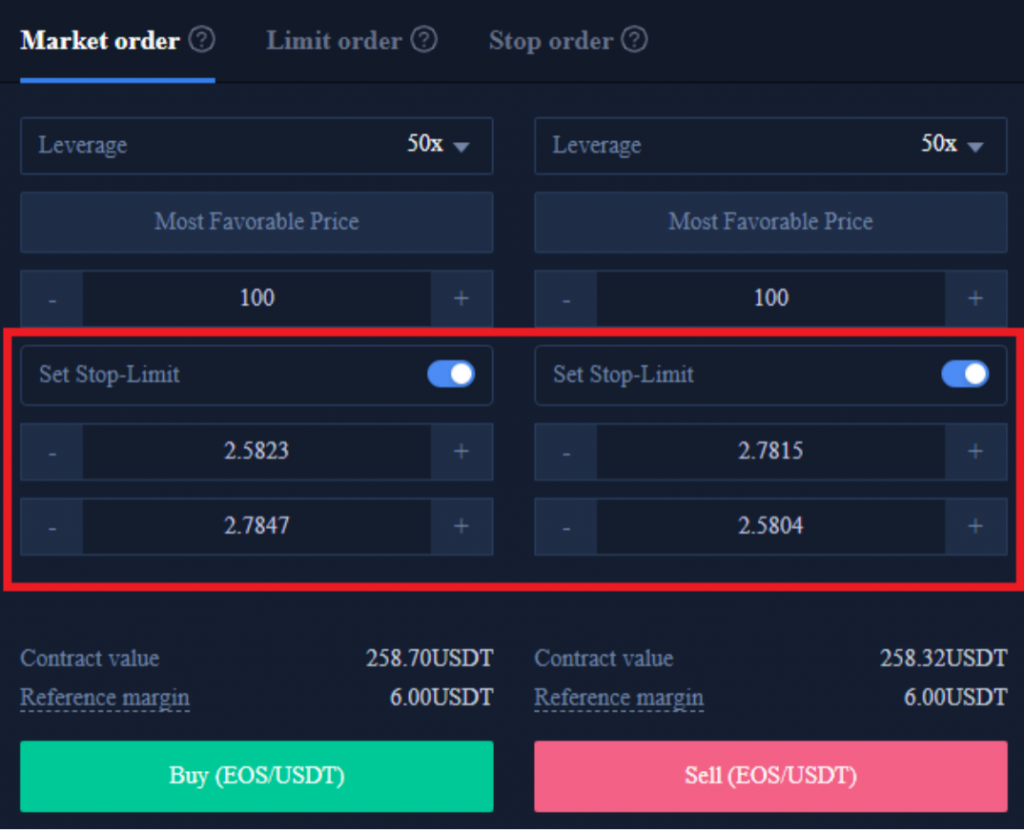

STEP 6. Set the take profit and stop loss price

Market orders, limit orders and stop orders all need to set a take-profit and stop-loss price. The difference is that market orders are executed immediately at the best current price, while limit orders and stop orders need to be set for the same day or a week.

STEP 7. Choose direction: bullish “buy”, bearish “sell”

After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Note that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform. Click the buy or sell button, and the EOS order is completed.

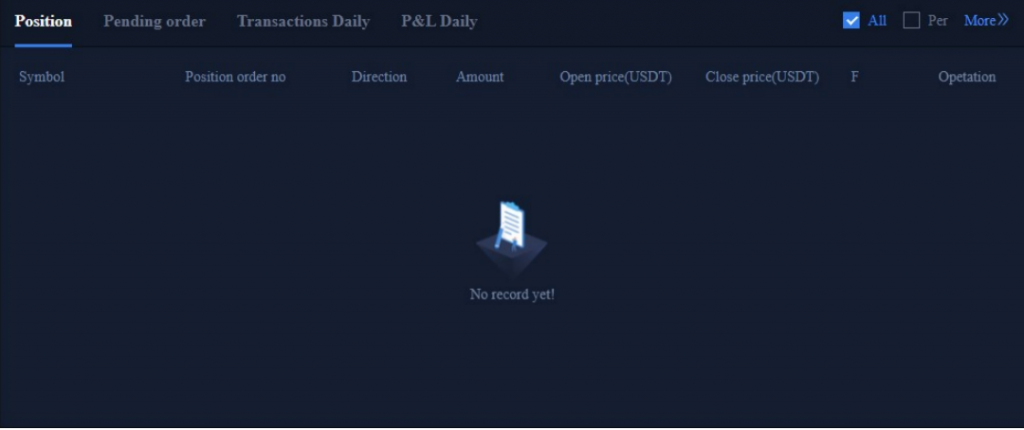

Finally, after the margin trading is completed, it will be displayed at the bottom of the position page; if there is no trading to be executed, it will be displayed at the bottom of the pending order page.

For more orders information, you can click on the margin trading report at the top right of the page to view.

At this point, you have completed the EOS margin trading. If you have further inquiries, please contact the online customer service.