How to Trade Futures Options

What is an Option?

An Option is a right leaving out the obligation to buy or sell the underlying futures contract at a decided price, on or before a given future date.

So, we make decisions every day, such as what food to eat or what color of clothes to wear.

Let’s take an example.

Say you work for a company, and the company is considering moving to a new city, meaning you may have to move.

You may also consider buying a house in the new city, which may not be the best use of your capital, in the event the company decides not to move.

Wait, what if you can buy an option on a house in the new city?

You would need to pay the owner for this right, and the cost of this right is termed a premium.

If the company relocates, you will exercise your option to purchase the house at the decided price.

In a scenario where the company does not move, then you will not exercise your right or option to buy the house, and the premium paid now belongs to the house owner.

| BTCC offers cryptocurrency futures trading (bitcoin futures, ethereum futures, litecoin futures, and more), enabling you to leverage crypto’s strong volatility to make a quick, heavy profit. |

Options on Futures Contract

Options on Futures operate the same way as options on other assets like the house example or stocks. However, more standardized terms are used, and they are often settled in cash that is not exercised early.

They can also be imagined as a second derivative, with significant details being the contract specification for the options contract and futures contract, which is the underlying asset.

Futures contracts are often paired with options. An example is a Gold option based on the price of gold futures (being the underlying asset) and cleared through the CME Chicago Mercantile Exchange.

Like futures, options allow you to lock in a price with an added layer of flexibility.

Let’s consider another example where you buy an option on gold futures. You pay a premium upfront, agreeing to buy that particular futures contract at a specified price, $2.50, and will cost $250 ($2.50 X 100 ounces), i.e., premium and commission.

You can exercise the option and receive the futures contract at that price without obligation.

In a scenario where the price moves against you, you can decide not to exercise the contract.

All option transactions must have a buyer, and a seller, where the buyers pay a premium to the seller and the seller is saddled with the risk of price movement.

Summary

Buying an Option means someone else had written that option. Writers of an Option generally own the underlying futures contract taking a premium from the buyer, and saddled with the liability of covering the option buyer’s profits.

Writing Options is “Covered Call Writing,” a strategy deployed by a trader to gain income by applying options on futures already owned in their portfolio.

For access to trade options on futures, you need a brokerage account that gives margin on options and futures, such as the Chicago Mercantile Exchange CME or Chicago Board Options Exchange CBOE, and other brokerages that offer options trading.

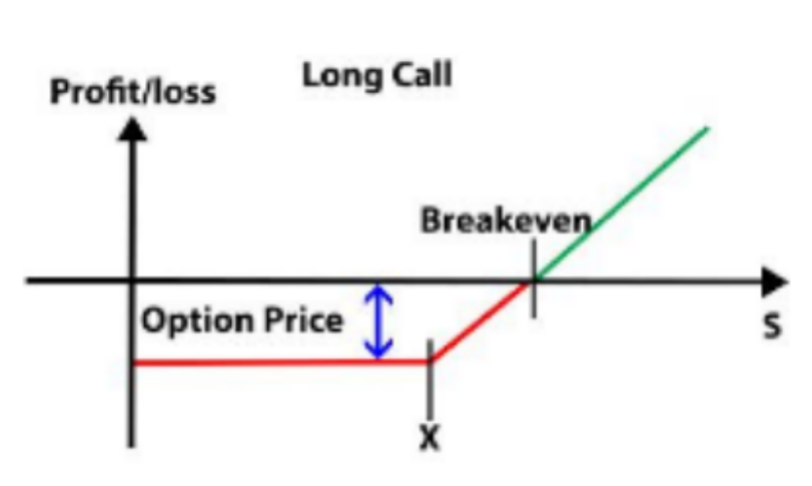

Buying a Call Option

If you’re confident that the price of an underlying asset will grow, then you can buy a Call Option.

Your call option’s value will increase if the price of the underlying increases.

Conversely, you lose the premium if the underlying does not increase.

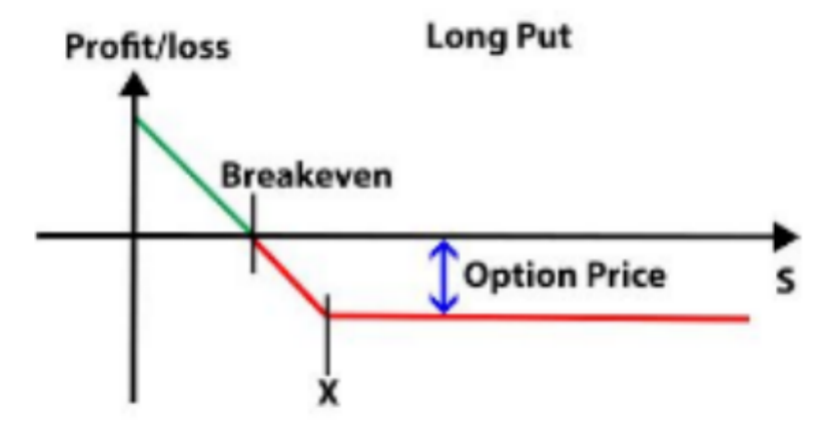

Buying a Put Option

You can purchase a put Option if you think the underlying asset’s value will plummet before the set expiration period.

Your option will rise if the underlying does slump in value before the expiration date/time. The premium is lost if the underlying doesn’t depreciate.

Benefits of Options on Futures

As an Insurance Policy

Options can be used similarly as an insurance policy to limit losses on a futures contract.

Another benefit is for speculative purposes on price movement, whether you’re selling options to obtain income on premium or using options to establish a position in a commodity, index, or interest rate.

Hedge Price Risk

Options are also used to hedge, where they generate profits in the face of adverse price changes in the cash market.

Lastly, with options, you can efficiently deploy capital, meaning you can take part in the underlying asset’s price movement out rightly without owning it.

Conclusion

So, following this guide, you can profit by include buying options on futures contracts or write covered calls in your investment portfolio as new investment tools.

| BTCC offers cryptocurrency futures trading (bitcoin futures, ethereum futures, litecoin futures, and more), enabling you to leverage crypto’s strong volatility to make a quick, heavy profit. |