What Is Bitcoin & Cryptocurrency Margin Trading and How Does It Work?

Following the launch of the first successful crypto-asset Bitcoin BTC in 2009, crypto early adopters, enthusiasts, and traders saw an opportunity to buy into an increase in the asset’s value.

What traders were doing then and still popular now is spot trading, which involves the buying or selling Bitcoin BTC for instant delivery.

Spot trading Bitcoin and other cryptocurrencies (Altcoins) is made possible on different crypto exchanges. These exchanges complete one spot trade with one single order, allowing for normal buying and selling of cryptocurrencies.

However, let’s say you want to bet on a fall in the value of Bitcoin. Well, that is not possible on spot trading. Enter margin trading.

- Explanation of the crypto margin trading.

- Why trade crypto on margin?

- The difference between the Spot trading and Crypto margin trading on Leverage.

- Where to margin trade crypto?

Explanation of the crypto margin trading.

Now that we understand how it all started, and what spot trading is, let’s explain what margin trading is.

Margin trading is standard in traditional financial markets like Forex, where a broker allows a trader to use borrowed money to trade such financial assets.

Trading cryptocurrencies on margin is simply making a bet on the direction of the crypto asset, which can move in the up or down trend, and the percentage increase or decline in value.

Why trade crypto on margin?

Trading cryptos on a margined account allows traders to time opportunities on shorter time frames and consequently take advantage of short term market fluctuations. Traders could also take advantage of crypto perpetual futures contracts or its variants offered by some crypto exchanges for longer market projections.

- Margin trading allows traders to take either a long or short position on a crypto asset. Taking a long position implies a forecast that the Bitcoin/cryptocurrency will be worth more at a later date/time. Conversely, shorting means a prediction of loss in value of the cryptocurrency. It allows traders to short sell a crypto asset, which is betting on a collapse in the value of the asset. This is possible with the introduction of CFDs, regular and perpetual futures contracts.

- Trading cryptos on margin allows traders access to more funds than they have earlier through Leverage, and potentially scale-up the trading account and earn more profits within a liquidation/margin call window. Leverage on margined accounts on some crypto exchanges fall within 5X to 100X and may vary depending on the cryptocurrency.

The difference between the Spot Crypto trading and Crypto margin trading on leverage.

Let’s first explain what margin is.

Margin is the money available in your trading account, which you can later use as collateral if you intend to advance into leveraged trading, i.e., taking on positions higher than your initial capital.

Spot trading is the first way traders could buy cryptocurrencies, speculating on potential growth in the value of the crypto asset by buying and storing their private keys. By trading crypto following the spot trading approach, you buy Bitcoin or other cryptos with only the money in your trading account, and you do not borrow any money from your broker.

Crypto margin trading on Leverage, on the other hand, involves using your available margin/funds in your trading account as collateral, allowing you more control of positions more significant than the value of assets (Bitcoin or other cryptocurrencies) in your possession.

Let’s take an example:

Say you want to buy (take a long position of) 5bitcoins, and you have 1bitcoin in your trading exchange account to serve as margin. To make this trade, you will need a 5X leverage (1:5 Leverage).

Leverage = Position Size divided by Available Margin.

Trading on leverage is a high risk and high reward trading approach.

Where to margin trade crypto

Today, there are many crypto exchanges and traditional retail broker platforms that allow traders and investors to margin trade cryptocurrencies. Such crypto exchanges include Binance Exchange, Btcc.com Exchange, Coinbase, Bitfinex, Buybit, Bittrex, Huobi, KuCoin, to mention a few.

In this section, we’ll walk you step by step to margin trade cryptocurrencies on the BTCC.com crypto futures and perpetual contracts exchange.

Starting by first heading to the https://www.btcc.com, we sign up for a trading account and advance to make a deposit.

PROMOTION: Trade with Up to 2000 USDT Deposit Bonus on BTCC

There are two options for executing trades on the BTCC exchange. We can analyze and execute trades either on the BTCC exchange web-based Tradingview platform or download and install the BTCC trading APP from the Google Appstore.

In this post, we’ll be carrying out our trade operations on the BTCC exchange mobile APP following five easy steps.

- BTCC Exchange Mobile Trading Application

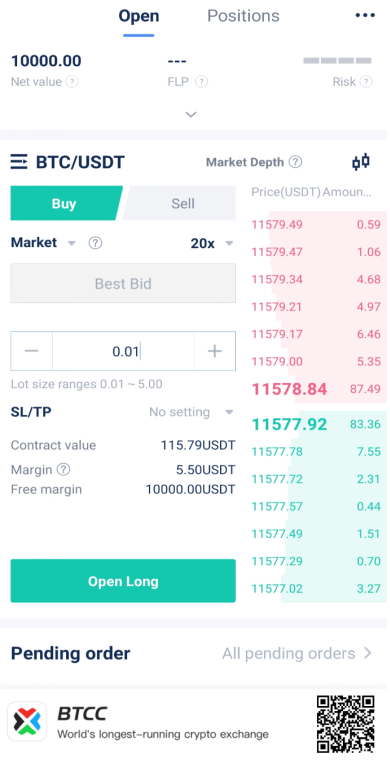

On the above trading terminal, we can analyze the available cryptocurrencies offered by BTCC Futures exchange, which are classified under Regular and Perpetual contracts.

By selecting the hamburger button that has the BTCWeekly Futures set by default, we can expose the option to also choose the perpetual contracts, as shown in the image below.

- Regular and Perpetual Futures Contracts on BTCC exchange

From the above option, we go on to select the regular BTC weekly futures contract, followed by clicking on the green open long button on the terminal window.

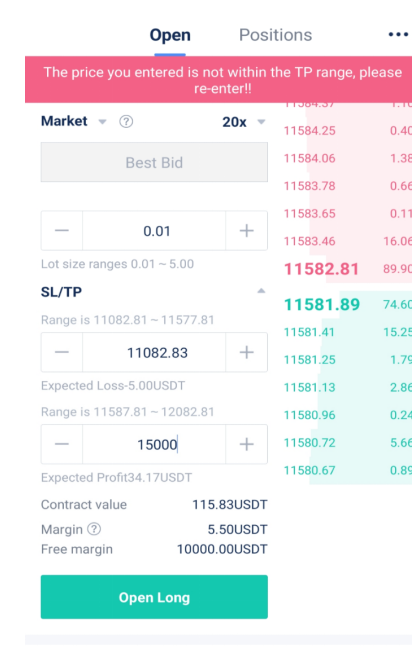

The window below is then loaded and ready to select our desired lot size, which must be confined within the range of 0.01 to 5.00, following a sound risk management methodology.

From the window below, we must also chose the desired Leverage for the trade.

The stop loss (SL) and take profit (TP) levels can be left blank to be modified later. However, it is best practice for newbie traders to set the stop loss and take profit within the desired range set by the broker.

In this example, the stop loss should be set between a range of 10609.13 and 11604.13, while the take profit should be set within a range of 11614.13 and 12609.13.

- BTCC Order Window for BTC/USDT Perpetual Contract

The above screenshot reveals what it looks like if we select the BTCC perpetual contracts, from which we can enter a pending stop or limit order, setting the Leverage, lot size, stop loss and take profit levels just like the earlier example.

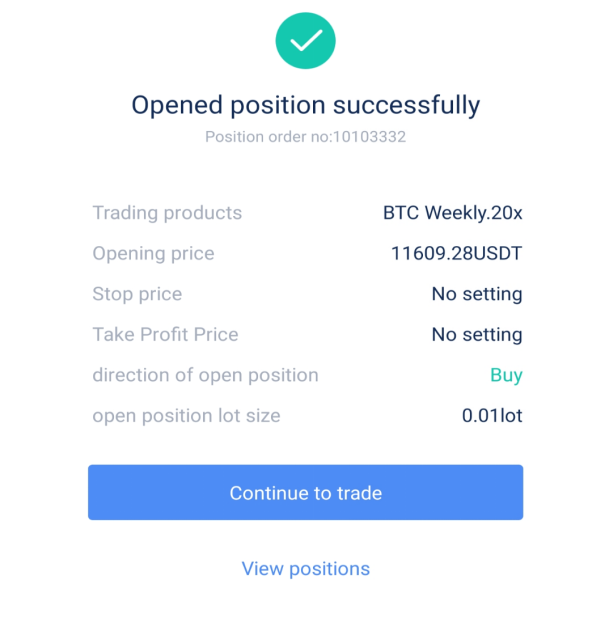

- Long/Buy position successfully Opened

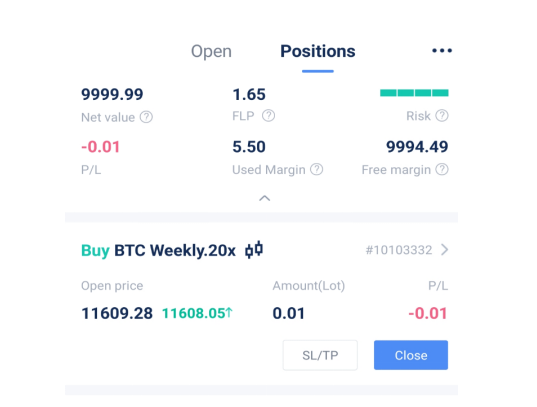

After a successfully executed buy order, we can go on to click on the view positions button on the above window, or click on “continue to trade” button to place more trades. Here, we click on the “view position” button, which then displays the opened trade, as shown below.

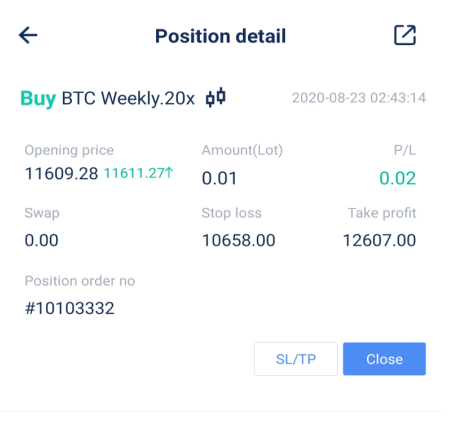

Next, clicking on the right-pointing arrow beside the order id #10103332, we can get more information on the position detail, as shown below.

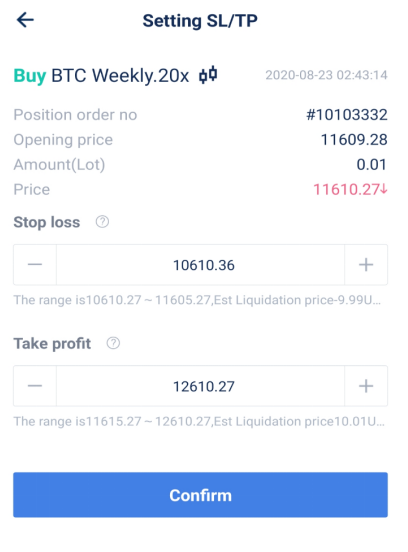

- Modify Stop Loss/ Take Profit

Establish the stop loss (SL) and take profit (TP) within the required ranges of 10610.27 to 11605.27 for stop loss and 11615.27 to 12610.27 for profit we can easily update the stop loss and take profit price levels.

Error Setting Stop Loss and Take Profit Levels

Placing your stop loss and take profit at a level that exceeds the BTCC price range will lead to an error, where you won’t be able to update your stop loss and take profit parameters.

Bonus: Bitcoin Miners’ Reward and how to gauge market sentiment when trading on Leverage

An understanding of Bitcoin miners’ reward as a fundamental driver of Bitcoin price will prove useful when trading the number one cryptocurrency Bitcoin BTC following a long term perspective.

The BCHAIN/MIREV chart viewed from a monthly time frame reveals a similar price formation to that of 01 October 2016.

A slump in the miners’ reward following the last Bitcoin BTC halving signaled a bearish inside bar candlestick pattern without dragging the Bitcoin BTC market price along with it.

Also, notice how the BCHAIN/MIREV monthly price chart enters and exits the oversold area on 01 October ’16. A similar formation is building up this month, as the MIREV enters the oversold territory and prepares to exit the zone, from which we target the overbought area as the first exit for profit taking.

Bitcoin BTC Miners’ Reward Weekly TF

Considering the miners’ reward from a weekly overview, we notice a breakout of bearish inside bar resistance similar to the monthly time frame.

If the MIREV can extend beyond the MA-50, we’ll be confident of a prolonged bullish trend for Bitcoin BTC and perhaps other cryptocurrencies.

Summary

Although margin trading Bitcoin and other cryptocurrencies may attract some level of risk, however, with proper market analysis, timing, and risk management, traders can take advantage of the Leverage offered by BTCC.com and other crypto exchanges, therefore boosting potential profits.