Research Report | Particle Network Project Analysis & PARTI Market Valuation

I. Project Introduction

Particle Network is a Web3 chain abstraction infrastructure provider focused on addressing the fragmentation of multi-chain assets and accounts. Through , it enables a seamless user experience with The launch of its mainnet marks the transition of chain abstraction from theory to real-world application.

Particle Network’s architecture is built around three CORE modules: , all running on a high-performance, . This framework allows users to interact, make payments, and trade across multiple blockchains using any token—without the need to create multiple wallets or hold native tokens. Cross-chain transactions are executed via a , while the platform supports , including .

Currently, Particle Network is integrated with major ecosystems such as. Its native token, , functions as both the settlement and governance asset on the network. The team, consisting of , has secured from top-tier investors, including . As chain abstraction gains real-world adoption, Particle Network is positioning itself as the in this emerging sector.

II. Project Highlights

1. Universal Accounts: A Unified Entry Point for Users and Assets

The system is Particle Network’s . Built on and Particle’s proprietary , it enables users to . With just one login, users can access all their assets across various dApps .

2. Pay Gas with Any Token, Removing Native Token Barriers

The module allows users to , eliminating the need to just for transaction fees. The system automatically processes these payments through , enhancing accessibility and convenience.

3. Modular Architecture for Scalability and Security

Particle L1 is built with the , featuring a . It integrates with , and other DA solutions to , bolster network stability, and . Additionally, it employs a to further .

4. Strong Backing from Top Investors & Rapid Ecosystem Growth

Particle Network has raised from leading venture firms, including . It has also , driving strong in the chain abstraction sector.

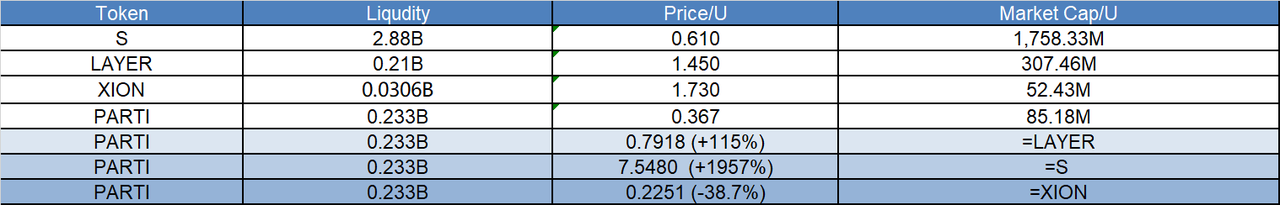

III. Market Valuation

PARTI is the . As the , it plays a vital role in , reducing barriers to . The project is currently in an , with . As the gains momentum, .

- Current PARTI price: $0.3670

- Circulating supply: 0.233 billion tokens

- Circulating market cap: ~$85.18M

If the and attracts , PARTI’s market valuation has significant .

IV. Tokenomics

PARTI Total Supply: 1 billion tokens

Initial Circulating Supply:

- 233 million PARTI (23.3% of total supply)

Token Allocation:

- Community Growth (40%) – 400,000,000 tokens, with 9% distributed via an initial airdrop, and the remainder released gradually.

- Private Sale (24.39%) – 243,900,000 tokens, initially locked and released over multiple years.

- Team & Advisors (12.11%) – 121,100,000 tokens, subject to long-term linear vesting to align with project incentives.

- IDO (5%) – 50,000,000 tokens, launched via Binance Wallet.

- Liquidity (5%) – 50,000,000 tokens, allocated at TGE for market-making and stability.

- Binance HODLer Airdrop (6%) – 60,000,000 tokens, distributed in two rounds to long-term BNB holders.

- Binance Wallet Airdrop (1%) – 10,000,000 tokens, distributed at TGE to attract wallet users.

- KOL Round (1.5%) – 15,000,000 tokens, partially unlocked at TGE, with the remainder vesting over time.

- Reserve (5%) – 50,000,000 tokens, allocated for future ecosystem expansion and strategic use.

Token Utility:

- Gas Settlement: Transactions through Universal Accounts are settled in PARTI, ensuring ongoing demand regardless of which token is used for gas payments.

- Universal Gas Payments: Users can pay gas fees on any chain with any token, which is then automatically converted to PARTI for settlement, eliminating gas token fragmentation and improving user experience.

- Cross-Chain Functionality: As the settlement layer for chain abstraction, PARTI enables Universal Accounts to maintain unified balances across multiple chains.

- Auto-Conversion Mechanism: A portion of transaction gas fees is automatically converted into PARTI, allowing users to interact with the network without needing to hold PARTI directly.

- Ecosystem Incentives & Governance: As the network’s native asset, PARTI will be used for governance, staking, and incentive mechanisms, with potential future utilities including governance rights, priority access to ecosystem programs, and premium features.

V. Team & Fundraising

Team Information:

Particle Network’s consists of four key members:

- Pengyu Wang – Founder & CEO

- Tao Pan – Co-Founder & CTO

- Ethan Francis – Head of Developer Relations

- Lydia Wu – Researcher

The team is dedicated to , accelerating the adoption of a .

Fundraising History:

Particle Network has successfully raised in multiple funding rounds:

- Series A: $15 million, expected to conclude on June 20, 2024. Investors include Spartan Group, gumi Cryptos Capital, SevenX Ventures, Morningstar Ventures, HashKey Capital, UOB Venture, MH Ventures, SNZ Holding, Flow Traders, Alibaba, FOMO Ventures, and notable individuals such as dingaling, Alex Krüger, Zeneca, OxSun, Altcoin Sherpa, SalsaTekila, and SpiderCrypto.

- Strategic Round (April 14, 2023): Led by Cobo Ventures.

- Pre-Seed Round (May 5, 2022): Raised $30 million, backed by LongHash Ventures, Mask Network, Cyber, Insignia Ventures Partners, and Monad.

VI. Potential Risks

VII. Official Links

- Website: https://particle.network/

- Twitter: https://x.com/ParticleNtwrk

- Discord: https://discord.com/invite/particlenetwork