The Best Alternative to Bybit for Crypto Futures Trading

Updated in Mar 2021

In 2021, Cryptocurrency derivatives are one of the fastest growing markets, and the volume of futures trading greatly exceeds the volume of spot trading.

If you used to trade Crypto futures on Bybit, you may want to try BTCC Crypto futures trading platform which is a 10-year-old Crypto exchange and provides more stable and secure trading environment and more bonuses and promotions.

Trading Features Comparison of BTCC and Bybit

| BTCC | Bybit | |

| Leverage | 10x、20x、50x、100x、150x (Only for BTC daily and ETH daily) | 10x、25x、50x、75x、100x |

| Pairs Trading | Daily margin trading: BTC/USDT、ETH/USDT Weekly margin trading: BTC/USDT、ETH/USDT、LTC/USDT、BCH/USDT、EOS/USDT Perpetual margin trading: BTC/USDT、ETH/USDT、LTC/USDT、ADA/USDT、BCH/USDT、DASH/USDT、EOS/USDT、XLM/USDT、XRP/USDT | USDT Perpetual : BTC/USDT、ETH/USDT、LINK/USDT、LTC/USDT、XTZ/USDT Reverse perpetual: BTC/USD、ETH/ USD、EOS/ USD、XRP/USD |

| Trading Fees | Trading fee: 0 fees for opening a position, 0.06%—0.10% for the weekly margin trading when the position is closed; 0.06% for the daily margin trading. Perpetual margin trading charges a rollover rate every 24 hours. For the daily margin trading and weekly margin trading charges a 0 rollover rate. | Perpetual Contract Charged opening fee and closing fee: Maker -0.025%, Taker 0.075% Funding fee charged every 8 hours:Funding Fee = Position Value x Funding Rate Futures Contract: Charged opening fee and closing fee: Maker -0.025%, Taker 0.075% Settlement fee: 0.05% |

| Ex. | (Take BTC/USDT market order as an example) Opening fee: 0 Closing fee: 0.06% Rollover: Daily margin trading, weekly margin trading charges a 0 rollover rate. Perpetual margin trading charges a rollover rate every 24 hours; | (Take BTC/USDT market order as an example) Opening fee: 0.075% Closing fee: 0.075%; Funding rate: fees will be charged every 8 hours |

| Market Depth | Best price is about 500 BTC | Best price is about 50 BTC |

| Types | Limit order, market order, stop loss order | Limit order, market order, conditional Order |

| Deposit Currency | USDT-ERC, USDT-ERC20, Bitcoin and Ethereum | BTC, ETH, XRP, EOS and USDT |

| Minimum Amount for Deposit | Fiat money: 100USDT USDT deposit: 2 USDT | No minimum deposit amount |

| Safety related functions | Market warning (set the price of the cryptocurrency to fall or increase, and push the warning in time to achieve fast trading) | Mutual Insurance (Risk management tools, compensation for losses in perpetual margin trading) |

| Customer service | 24-hour online customer service with telephone service | 24-hour online customer service, email and no phone service |

| New customer activity | First deposit 500USDT to receive 100USDT, 1000USDT to receive 200USDT, 2000USDT to receive 400USDT, 5000USDT to receive 1000USDT, 10000USDT to receive 2000USDT; | There is only one chance to receive the “First Deposit bonus”. The first deposit BTC≥0.05 / ETH≥2 / EOS≥260 / XRP≥2700 / USDT≥500 can receive $5; the first deposit BTC≥0.5 / ETH≥20 / EOS≥2600 / XRP≥27000 / USDT≥5000 can receive $50. |

| Minimum trading unit | 0.01 lot (BTC) | 1 US dollar 1 margin contract (BTC) |

| Maximum number of positions | 200 lots of BTC | 1,000,000 margin contracts, the maximum holding positions value 150 BTC |

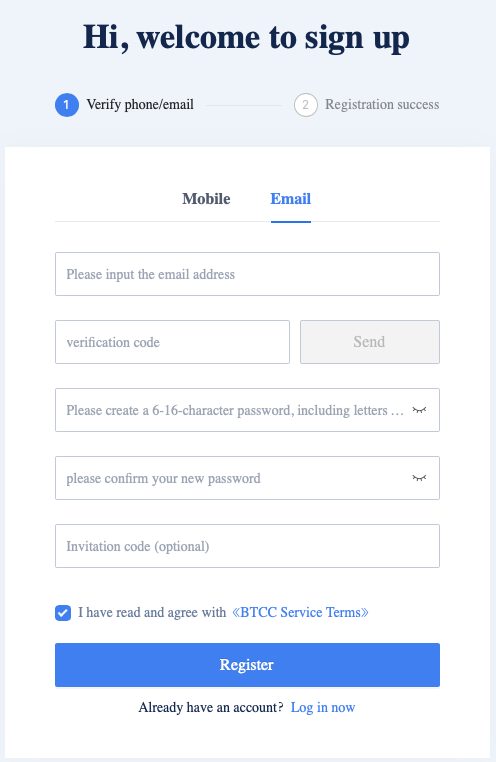

Go For A Free Account On BTCC In Seconds And Have A Try. New User Will Receive Up To 2,000 USDT Bonus!

It can be seen from the above comparison table that both BTCC and Bybit contracts support most of the mainstream cryptocurrencies, and BTCC’s margin trading is relatively richer. The reverse contract launched by Bybit is also called a currency-based contract. This means that users must hold BTC to buy BTC for margin trading, and to hold ETH for ETH margin trading. This is a high risk for most users and presented greater volatility; BTCC supports 10x, 20x, 50, 100x and up to 150x for BTC and ETH leverage. Users can adjust the leverage based on their trading need and risk appetite. While Bybit supports 10x, 25x, 50x, 75x, and up to 100x leverage.

In terms of processing fees, Bybit pending orders are -0.025%, and buy orders are 0.075%. In addition, the buyer and the seller regularly pay or receive funding fees every 8 hours. The formula is: funding fee = (number of contracts/marked price) * funding rate; Bybit will charge trading fees for opening and closing positions, to complete a transaction, the processing fee will be charged twice.

There is no fee for BTCC when opening a position, BTCC charged 0.06%—0.10% for weekly contract when the position is closed; and 0.06% closing fee for daily contract. There is no fund cost for BTCC daily contract, and weekly contract. Perpetual contract charges an overnight fee every 24 hours.

Take the market order of BTC/USDT as an example, the opening fee on Bybit: 0.075%, the closing fee: 0.075%, an additional funding fee is required every 8 hours; the opening fee at BTCC is 0, and the closing fee is 0.06 %, if it is a Daily Contract or Weekly Contract, no rollover rate is required.

On the whole, the trading cost of margin trading in BTCC is lower. In BTCC, as long as users hold USDT, they can trade daily, weekly, and perpetual contract at the same time.

In terms of safety, both exchanges provide a way to set profit and stop loss. When trading on margin, users are most worried about the large changes in the market leading to liquidation. Therefore, set profit and stop loss is the first choice for every user. In addition, BTCC has recently launched a market warning function. Users can independently set the price of the cryptocurrencies. When the market fluctuates to the set price, BTCC will promptly send reminders to help users avoid liquidation. It can be served as dual security setting. It is worth mentioning that the various margin contracts of BTCC have been launched and still maintain zero apportionments. Bybit’s mutual insurance is more like an “insurance” financial product.

The two exchanges are also very beneficial to customers in terms of benefits for users: new users of Bybit will have a chance to receive bonus after the first deposit. The first deposit of BTC≥0.05 / ETH≥2 / EOS≥260 / XRP≥2700 / USDT≥500 can receive $5; the first deposit of BTC≥0.5 / ETH≥20 / EOS≥2600 / XRP≥27000 / USDT≥5000 can receive $50, Although the event looks like a lot of bonuses, only more than a dozen USDT were actually received; The new user activity of BTCC is first deposit of 500USDT can receive 100USDT, 1000USDT to receive 200USDT, 2000USDT to receive 400USDT, 5000USDT to receive 1000USDT, 10000USDT to receive 2000USDT, the more you deposit, the more bonuses will be received.

For new users, online customer service is particularly important. The customer service response speed and professional attitude of the two exchanges are very good, and they also support 24 hours online. The difference is that in addition to online communication, Bybit can only reply via email, which takes time to come and go. And BTCC can communicate by telephone which is undoubtedly the fastest and most direct and clear way.

BTCC has been operating for more than 9 years and has achieved a relatively high market share. In the setting of the risk mechanism, BTCC has made a good balance between boldness, conservativeness and has strict controls on user positions, leverage multiples, and margin coefficients. In general, we believe that BTCC’s advantages are low processing fees, large trading volume, and good trading depth. It is not only the first stop for the new users but also the arena for the senior traders. As a 9-year-old exchange in the cryptocurrency industry, BTCC has accumulated many loyal users over the years and has become the first stop for many traders.