How will futures affect Bitcoin

Bitcoin futures trading became popular with the introduction of the CME and CBOE back on December 10, 2017. Today there are more players in the space of crypto/Bitcoin futures trading.

Though this article’s primary focus is on how futures trading will affect Bitcoin BTC, we’ll start by going over how futures trading works.

A deal between two entitiies to determine a fixed price and date to buy or sell an asset is a known as a futures contract. So a futures contract defines what kind of asset is traded at an agreed price and date.

Let’s take an example where Ben agrees to buy ABC stock from Jo at $1000 per share and pay upon the settlement date in a month.

If the stock price increases to $1200 per share on the settlement date, Ben must pay the agreed $1000, which means he made a profit based on the difference of $200.

There is a second type of futures contract known as the perpetual futures contract in crypto trading, where there’s no expiration date on the deal, and Ben can hold it for as long as possible.

On the other hand, Ben can even decide to sell the asset before the expiration date.

Why is the Bitcoin futures contract such a big deal, and how will it affect the underlying Bitcoin crypto asset?

It all comes down to three primary reasons.

1 – Liquidity

Institutional investors, otherwise known as smart money, could not buy Bitcoin with ease in the early days.

With an increase in crypto exchanges offering futures contracts, Bitcoin is becoming increasingly available to the massive players, driving enormous money into the Bitcoin market.

Considering that the current asset under management in traditional assets dwarfs that of crypto funds, an increase in demand by hedge funds may drive the prices higher in a bull market and lower in a bear market.

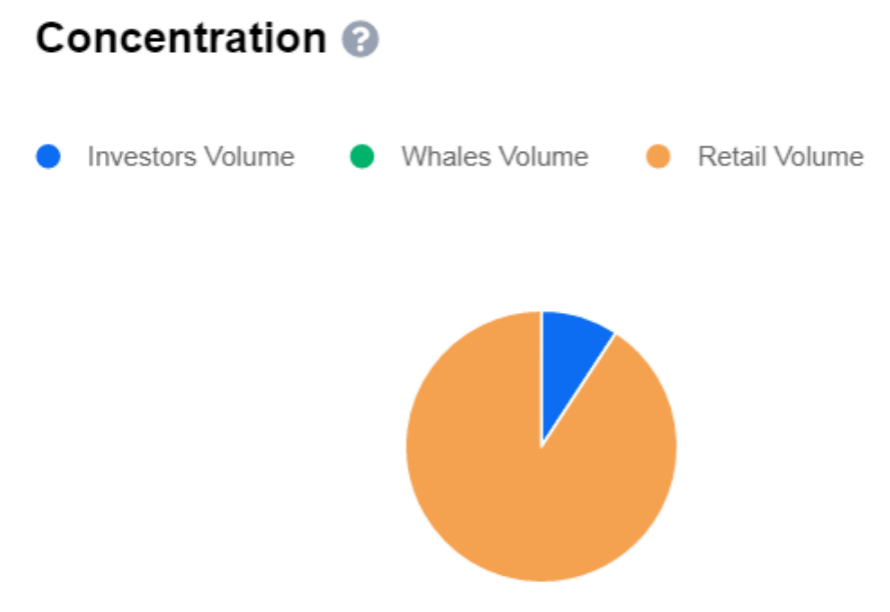

Chart Showing Concentration of Bitcoin by Investors, Retail, and Whale Volume

Retail volume (90.75%), Investor and Whale volumes (9.25%)

Whale: An address that owns more than 1% of the circulating supply.

Investor: This is an address that owns 0.1% to 1% of the circulating supply.

Retail: An address that holds less than 0.1% circulating supply.

The introduction of futures trading and the fact that traders do not have to own Bitcoin wallets and addresses will increase the volume across the retail and investor volumes.

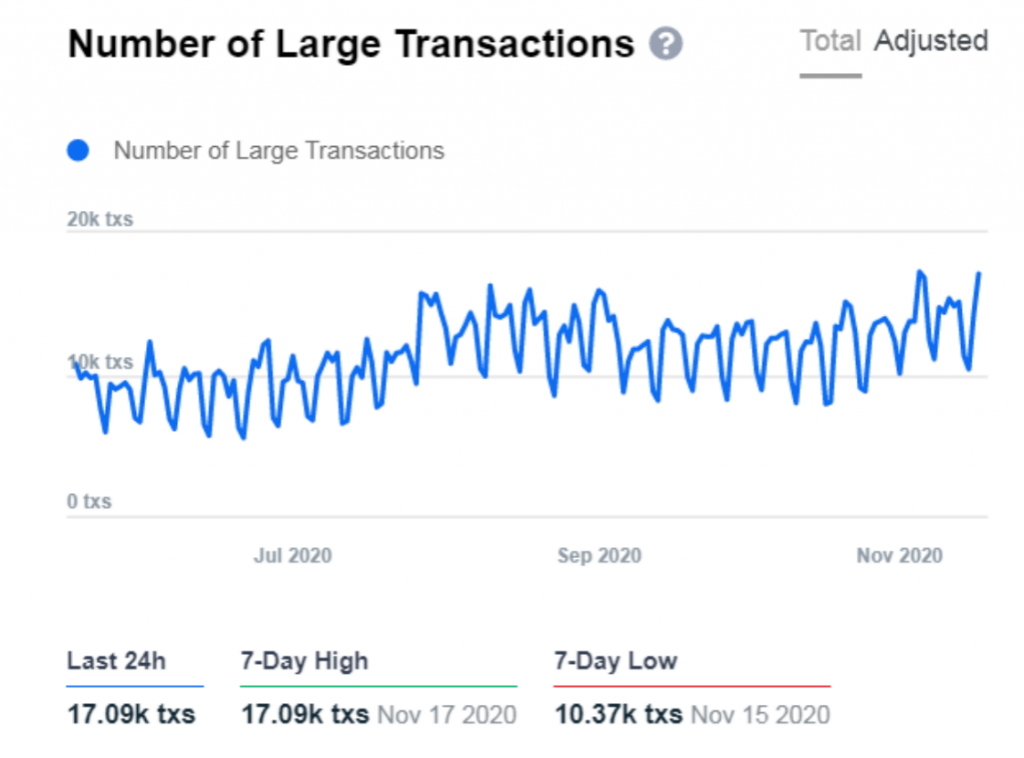

Number of Large Transactions (Bitcoin BTC)

Above is a chart that shows an increase in the number of large transactions, which can be attributed to increased adoption via futures trading and main stream adoption.

2– Hedging

There are many reasons why many would want to use futures contracts, and one of the reasons is hedging.

When you buy a futures contract, you know what risk you’re taking because you know what you would receive from selling and what you would have to pay, the main reason companies involved with manufacturing are involved in the futures market.

Let’s take Soybean, for example. The Soybean farmer wants to know how much he’s going to make at the end of each month. So while the Soybean is still growing out on the field, he sells some futures on Soybean.

This way, he knows how much he’s getting paid and when. Sure, the Soybean price might go up this time, but missing out on profit is not as bad as not making ends meet.

In Bitcoin’s case, you can be sure that many miners would sell futures to make their income more predictable.

BTC Miners’ Reward

Miners have to pay huge electricity bills every month, so having a predictable cash flow is very important. Cash is king, but predictable cash flow, they say, is queen.

3 – Shorting

Here’s where things get more interesting. Shorting bitcoin prices, which is, speculating or betting on the downward decline in the Bitcoin price, hasn’t been in the early days.

A lot of people watch the futures market to measure the sentiment. If many people are short Bitcoin, this could be a negative sign and lead to massive selling.

An increase in miners’ reward alongside institutional money coming into the Bitcoin BTC market often increase demand for Bitcoin BTC.

Shorting an asset, however, also comes with significant risk. Say I buy a stock, for example; I can never lose more than 100%. The probability of it going beneath zero is close to impossible. If I short the asset, the price could double, meaning I could lose more in the Bull Run.

Conclusion

In conclusion, Bitcoin futures should introduce huge price movements in the long term, but futures markets tend to stabilize the market and make them more effective in the long term.

A billion-dollar investor probably won’t buy today and sell tomorrow; hence institutional money is stickier.

Trade bitcoin futures on BTCC

Trade Bitcoin futures on BTCC which has 9 years of stable and secure operating historyand the total trading reached 98 billion USDT contracts in the last 30 days. Up to 2,000 USDT deposit bonus is available for new users now!