How To Buy And Sell Stellar (XLM) Futures On BTCC

XLM (Stellar) is a new payment system, which is similar to Ripple, launched by McCaleb, the original founder of Mt-Gox and Ripple.

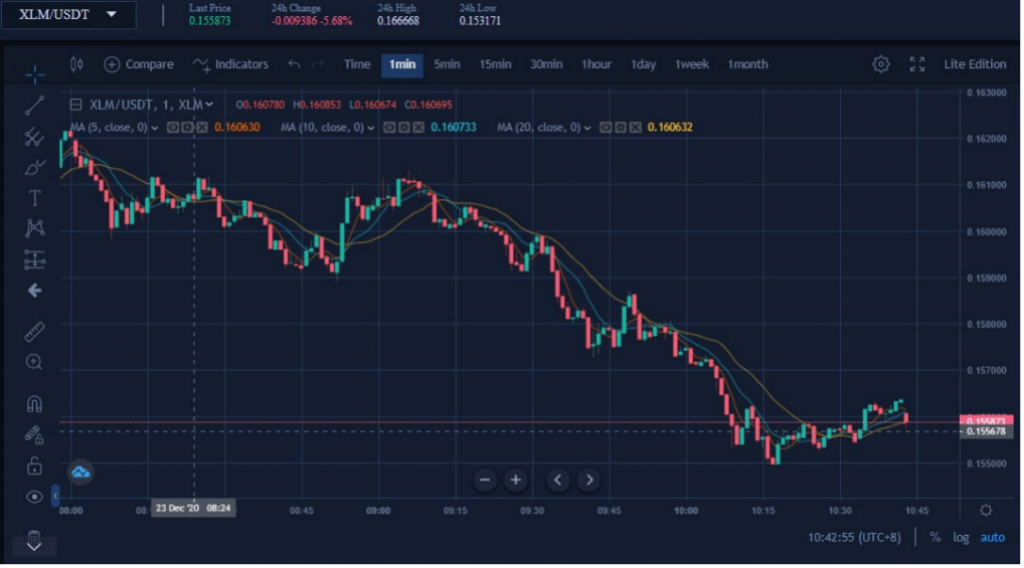

The network created by Stellar has the same functions as the Ripple payment network. It is able to transfer any currency through it, including U.S. dollar, euro, RMB, yen and bitcoin. It is easy and fast to process. It relies on Bitcoin blockchain technology. It can connect to 180 currencies in the world within 2-5 seconds, including banks, payment systems and the general public, reducing transaction fees and time delays caused by cross-border payments. The circulating market value of XLM is 3.339 billion, and the current price of XLM is $0.16. XLM will increase by 203.86% in 2020.

If you want to invest in XLM , in addition to spot trading, you can also buy and sell XLM margin trading to earn. Compared with spot trading, the advantage of margin trading is that it allows you to earn, it doesn’t matter the price of XLM rises or falls. Besides, margin trading allows you to add leverage and trade with little amount of asset.

7 steps to buy and sell XLM perpetual contract on BTCC

STEP 1: Log in btcc.com and click upper right to register/ log in.

STEP 2: Choose XLM/USDT perpetual contract

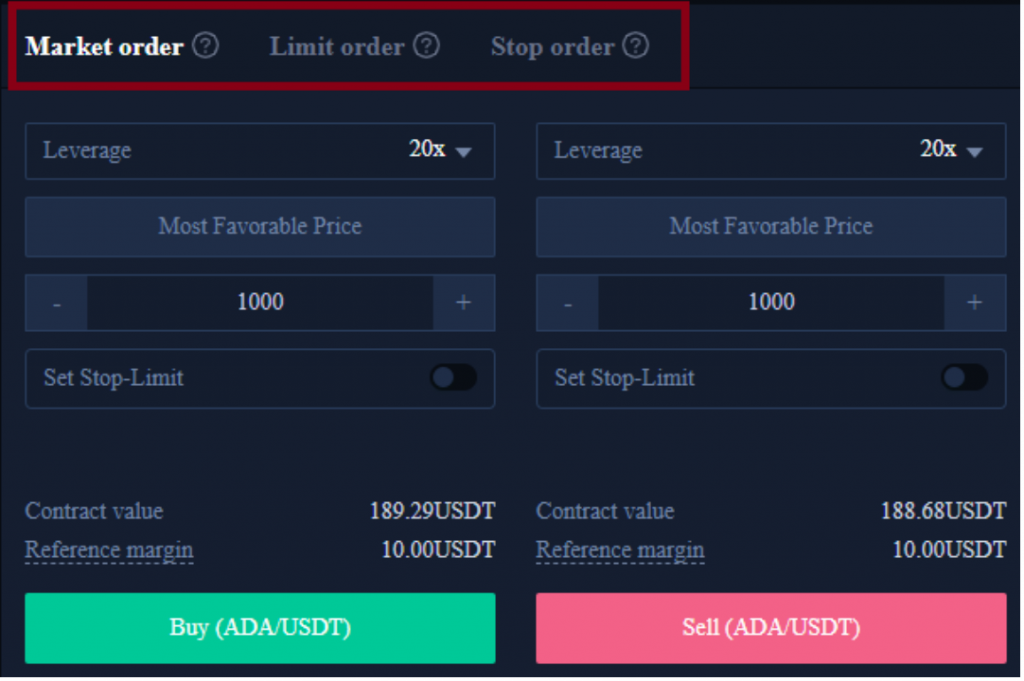

STEP 3: Select the BTCC margin trading order type at the top right of the page. BTCC margin trading orders are divided into market orders, limit orders and stop loss orders.

·Market orders: Users place orders at the best price in the current market to achieve fast trading.

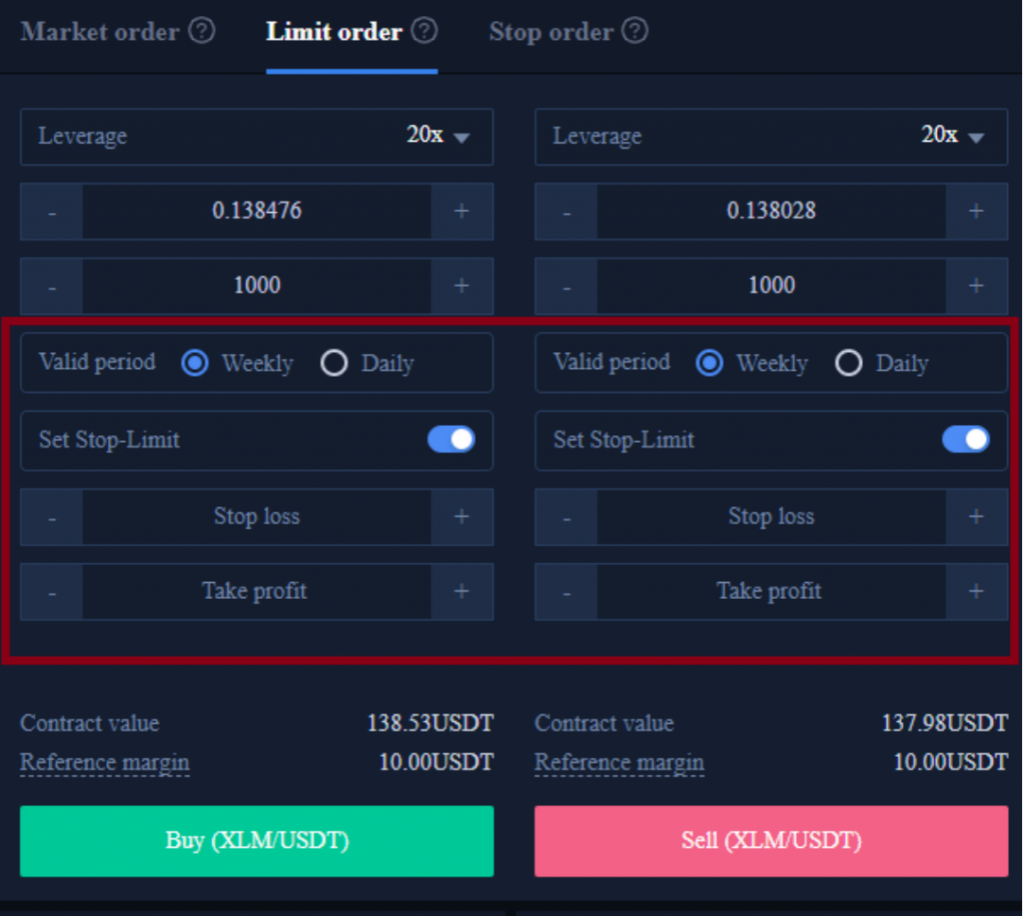

·Limit order: A limit order is used to copy the top/bottom, and refers to a buy/sell price set by the user. After the market reaches the limit price, the margin trading can be executed.

·Stop Order: A stop order is an advanced limit order, and users can customize a buy/sell price. After the market reaches the limit price, the margin trading can be executed.

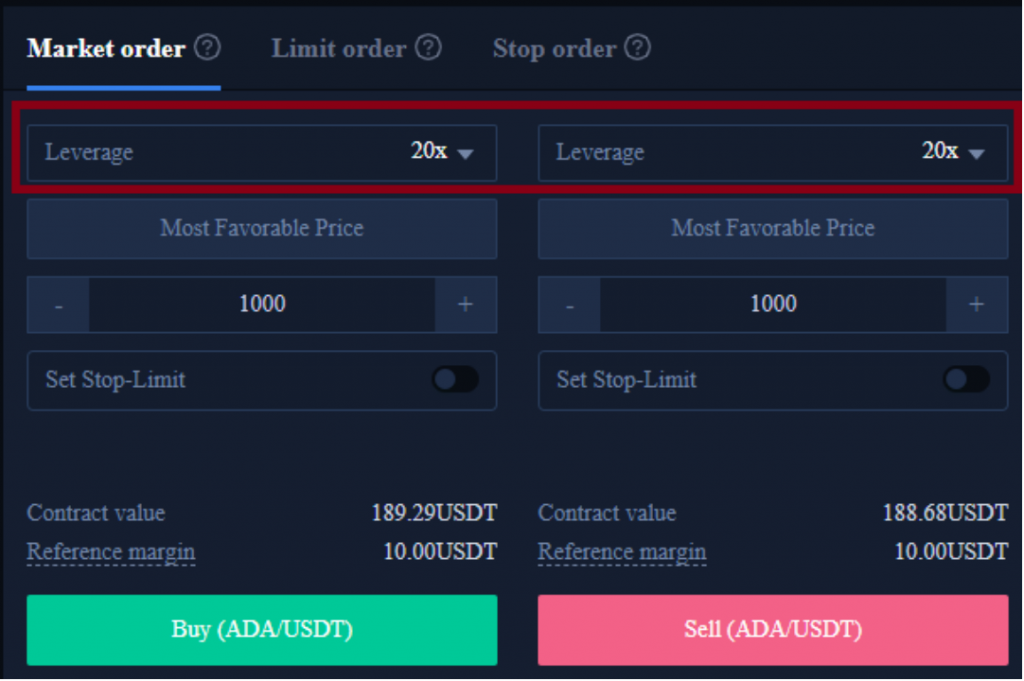

STEP 4: BTCC provies 20x XLM/USDT perpetual contract.

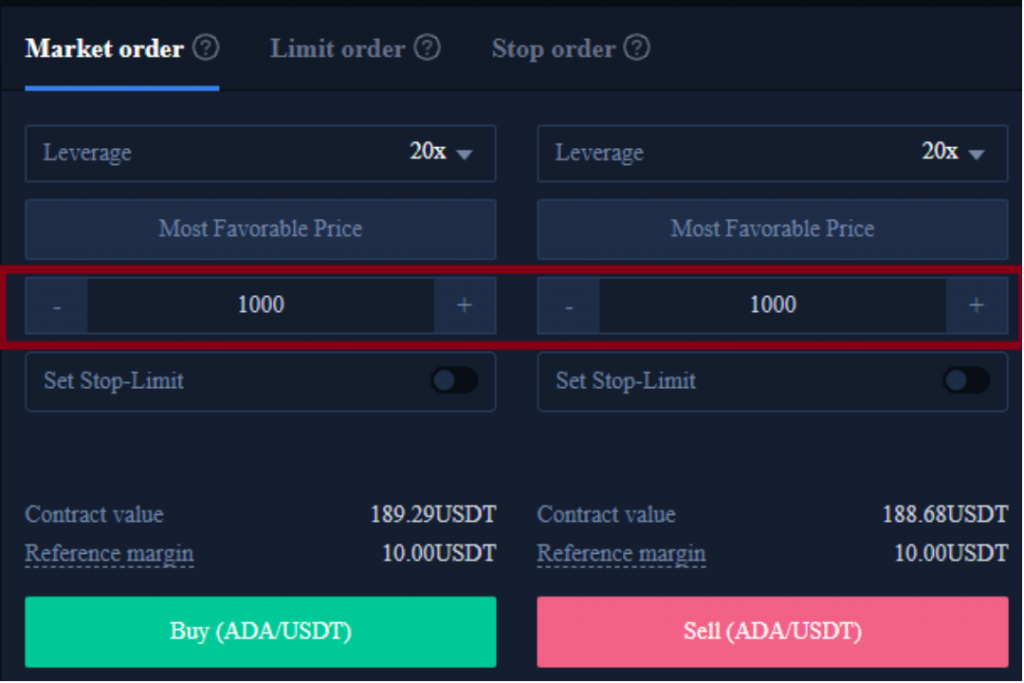

STEP 5: Choose the lot size to buy

The XLM trading unit at BTCC allow user to choose the number of lots based on their investment situation, and the range can be selected from 1000 to 150000 lots. There are real-time contract values and reference margins below.

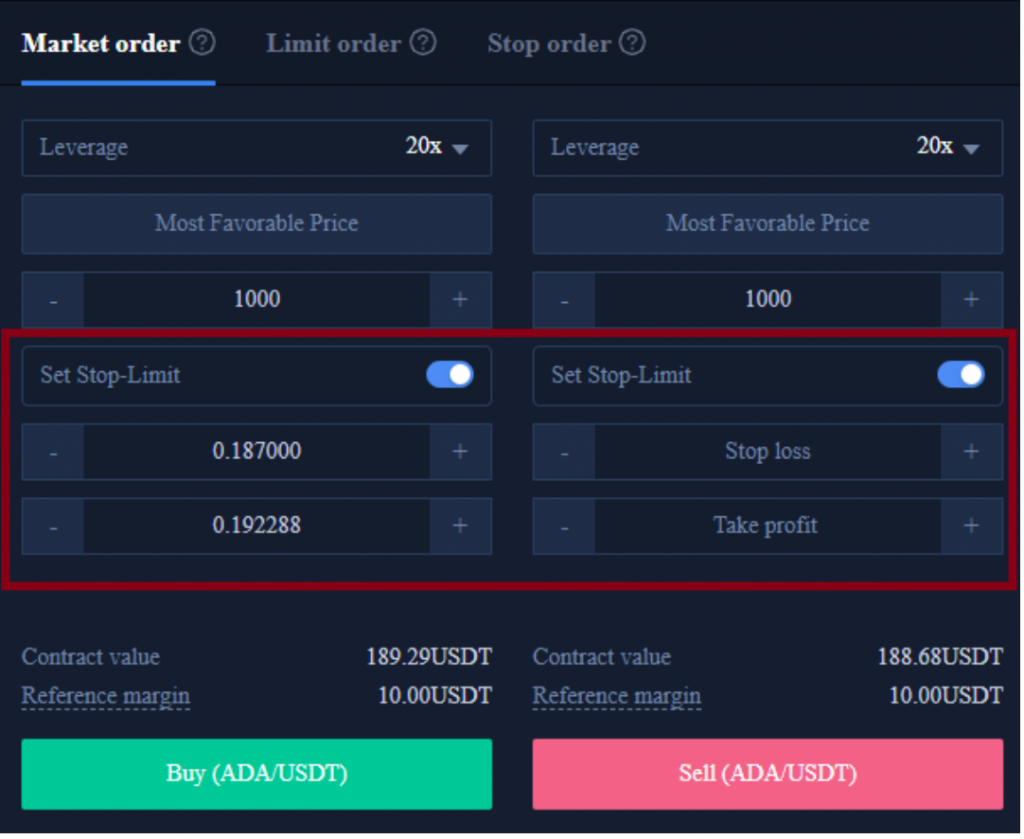

STEP 6. Set the take profit and stop loss price

Market orders, limit orders and stop orders all need to set a take-profit and stop-loss price. The difference is that market orders are executed immediately at the best price, while limit orders and stop orders need to be set for the same day or a week.

STEP 7. Choose direction: bullish “buy”, bearish “sell”

After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Note that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform. Click the buy or sell button, and the XLM order is completed.

Finally, after the margin trading is completed, it will be displayed at the bottom of the position page; if there is no trading to be executed, it will be displayed at the bottom of the pending order page.

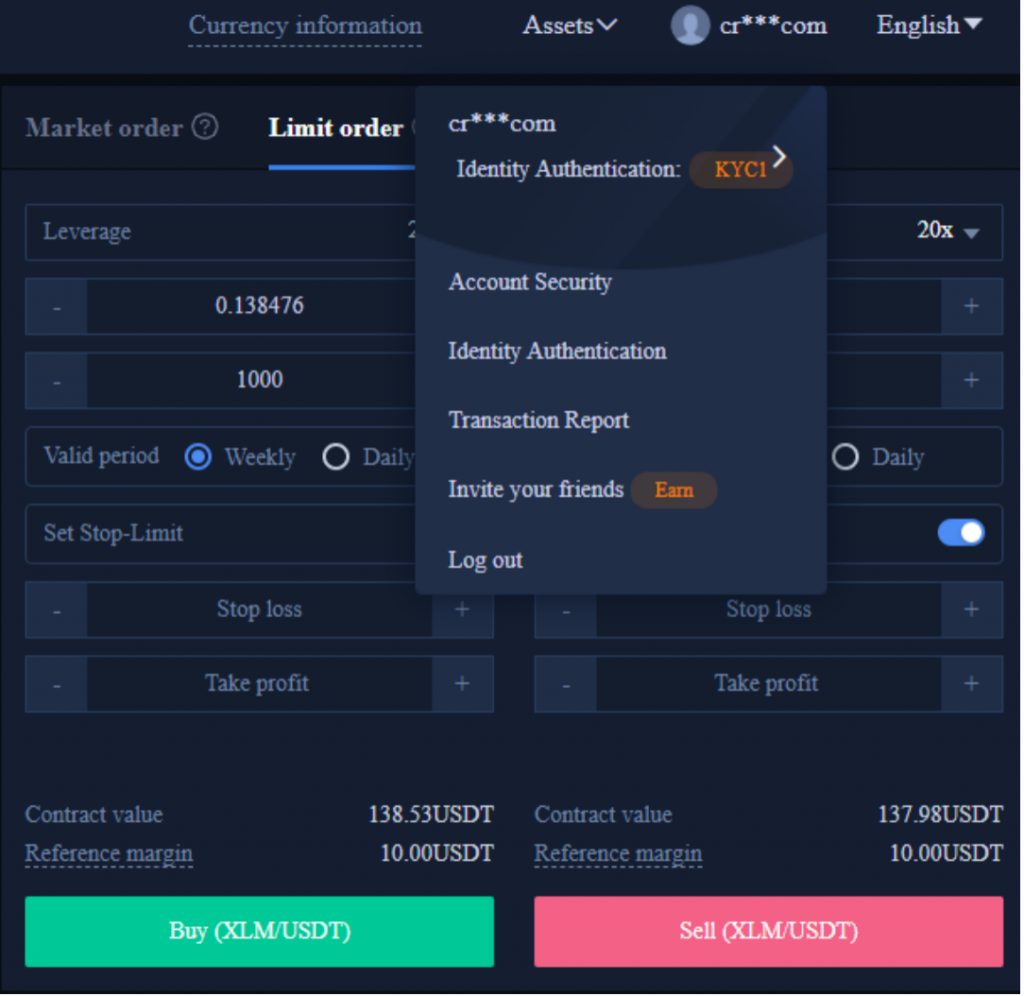

For more orders information, you can click on the margin trading report at the top right of the page to view.

At this point, you have completed the XLM margin trading. If you have further inquiries, please contact the online customer service.