How to Buy and Sell Ethereum (ETH) Futures on BTCC

On October 12, 2020, the digital asset management firm Grayscale Investment was approved by the U.S. Securities and Exchange Commission (SEC) to becomes SEC reporting company. Grayscale Ethereum Trust (ETHE) become the second crypto trust to obtain the status of a declared company in the SEC following Grayscale Bitcoin Trust (GBTC).

As of the latest public data on October 21, 2020, Grayscale announced the firm has added 7 billion US dollars in assets under management (AUM), of which Bitcoin Trust (GBTC) and Ethereum Trust (ETHE) are respectively 5.8 billion US dollars and 9 Billion US dollars, accounting for more than 95% of the share.

A Reddit’s user named “Joe-M-4” has done an investment experiment for three consecutive years, using a principal of $1,000 to invest in the top ten cryptocurrencies on the first day of the year. At the end of the first year, the value of the invested cryptocurrencies has shrunk by nearly 85%; In the second year, the rate of return exceeded 66%; this year he continued to repeat the experiment, and data from October showed that he earned 60% this year. According to his investment results, the cryptocurrencies that brought him the greatest return are ETH (210%) and BTC (90%).

From the perspective of the overall blockchain development trend, ETH 2.0 turned out to be the most anticipated event in the industry, and the recent price spike of ETH has confirmed this view.

7 steps to quickly complete buying and selling ETH (Ethereum) futures on BTCC

STEP 1: Open the webpage of BTCC futures trading for buying and selling

STEP 2: Choose the type of ETH futures contract to buy

STEP 3: Select the order types for ETH

STEP 4: Choose the level of leverage to add

STEP 5: Choose the lot size to buy

STEP 6. Set take profit and stop loss targets

STEP 7. Choose the price direction: Buy if you are bullish, Sell if you are bearish

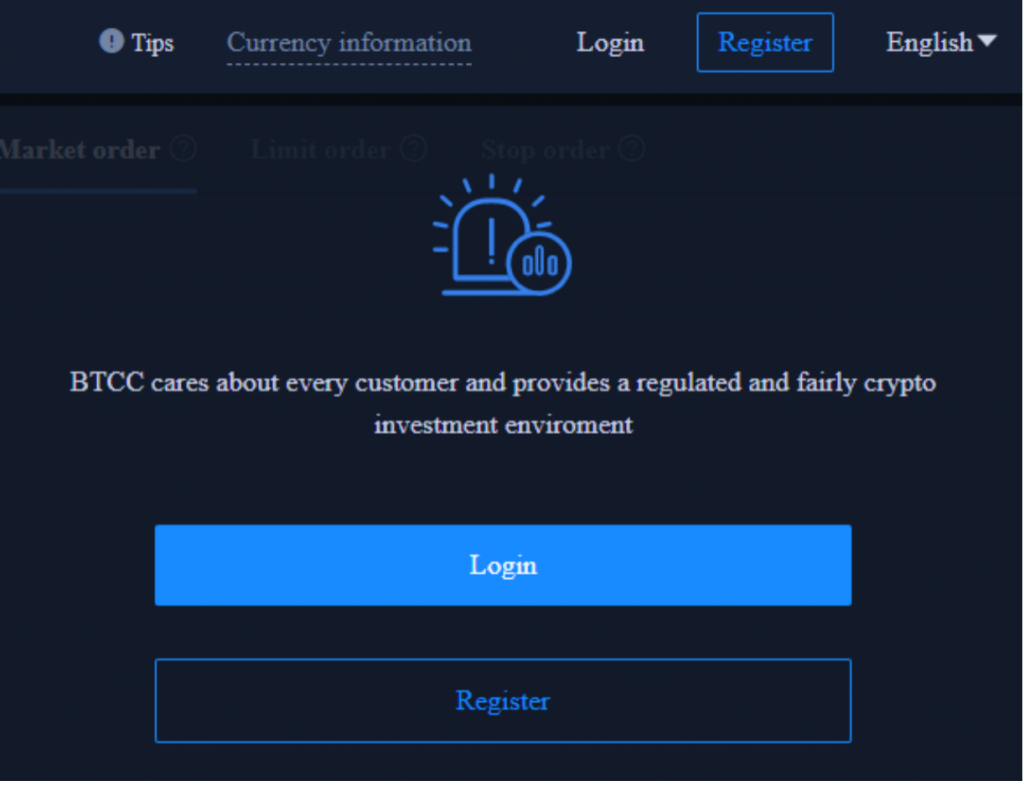

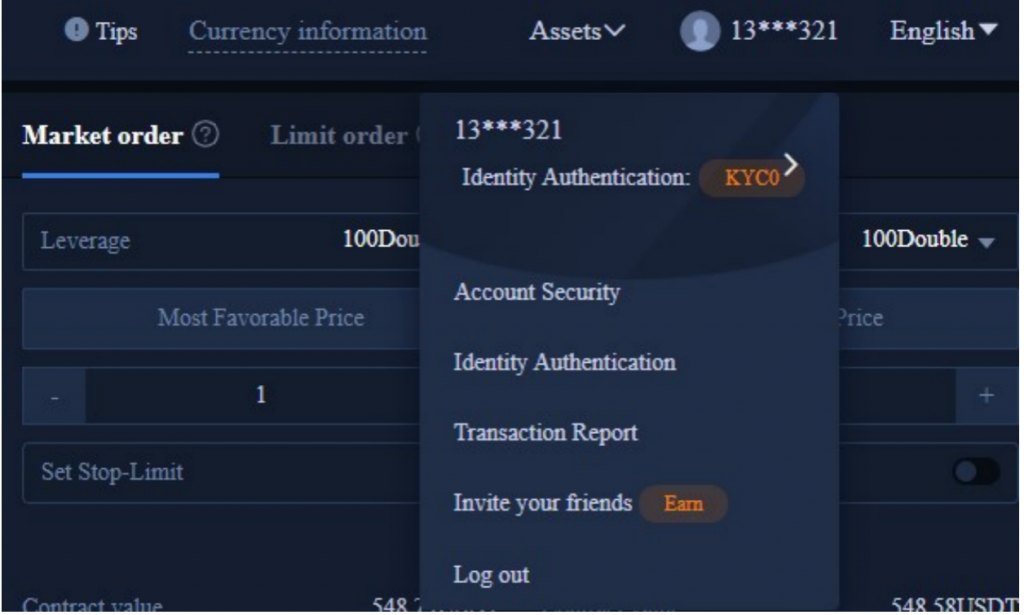

STEP 1: Open the webpage of BTCC futures trading for buying and selling

Register a free account at BTCC in seconds, and make your initial deposit. You can start to trade with the minimum deposit of 2 USDT. If your deposit amount is greater than 500 USDT, you can receive up to 2,000 USDT bonus.

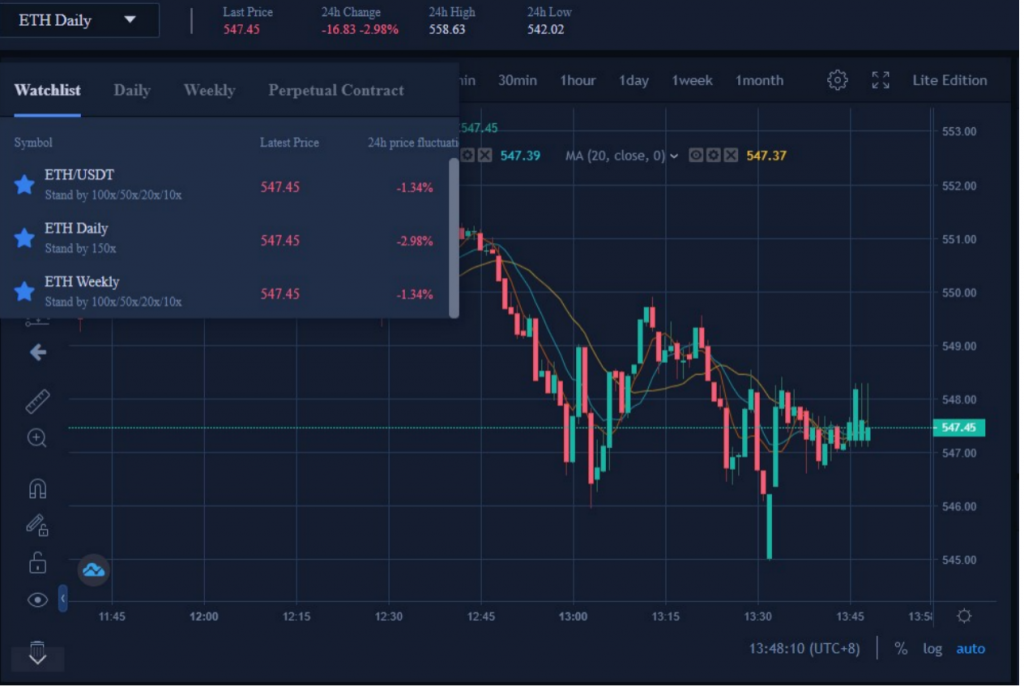

STEP 2: Choose the type of ETH futures contract to buy

Select the daily, weekly or perpetual contract of ETH at the top of the page.

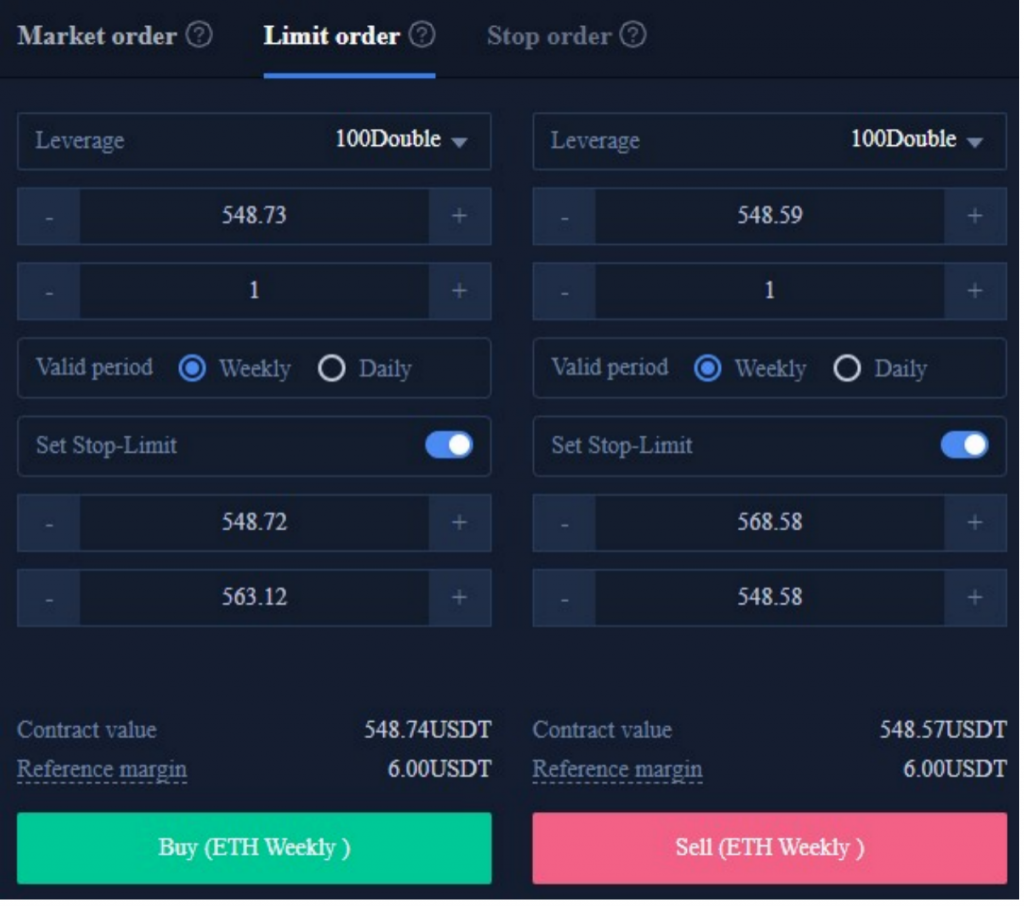

STEP 3: Select the order types for ETH

Select the order types for ETH at the top right of the page. The order types at BTCC included market orders, limit orders and stop loss orders.

- Market orders: Users place orders at the best current price to execute buy or sell order instantly.

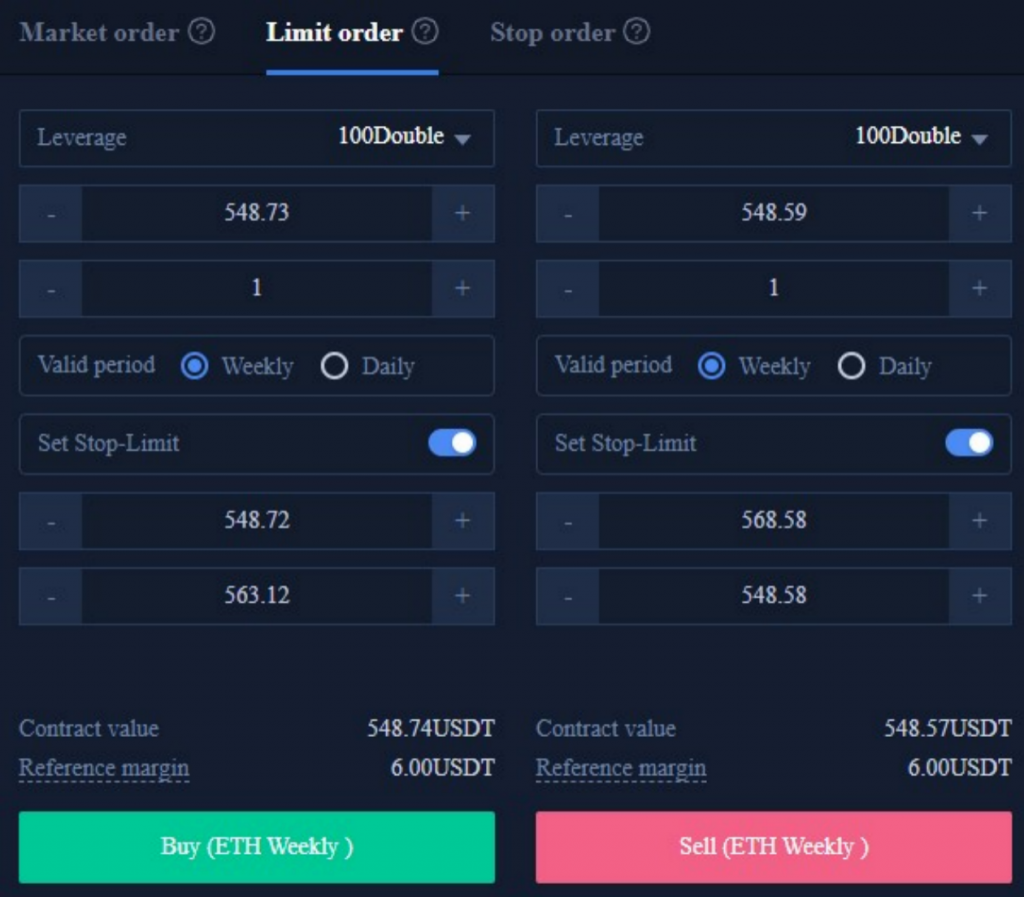

- Limit order: A limit order is a type of order set by the trader to buy or sell at a specified price level or better. The buy order will be executed at the limit price or a lower one, while the sell limit order will be executed at the limit price or a higher one. The limit order can be seen by the market, which has given the opportunity for market participants to fill the buy or sell order.

- Stop order: A stop order, also known as the stop-loss order is a type of order set by the trader to buy or sell at a specified price level. The order will be executed automatically after a certain price level has been reached.

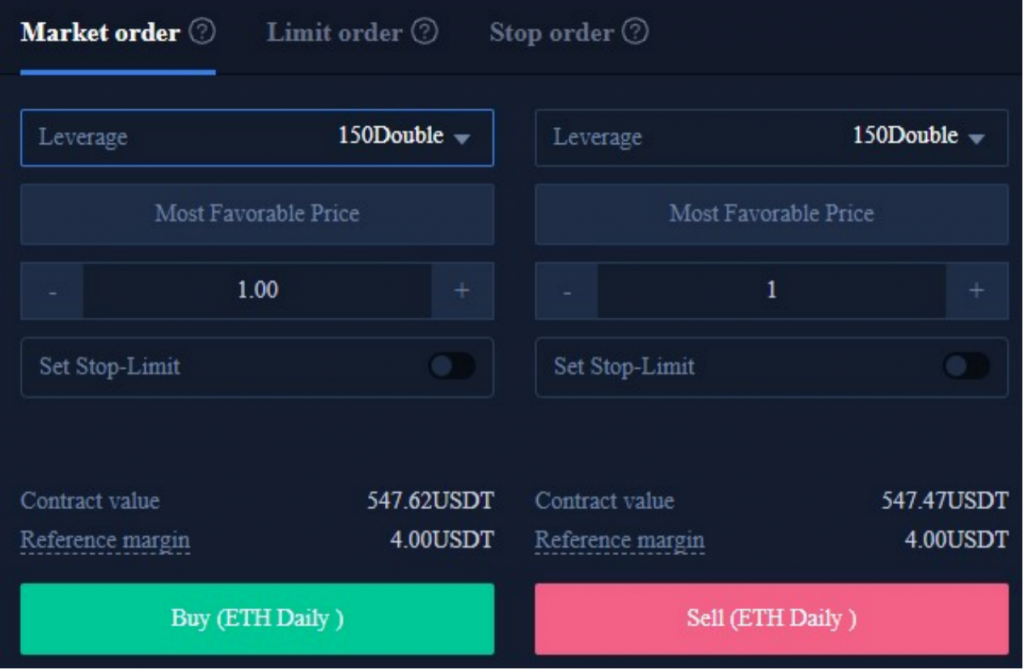

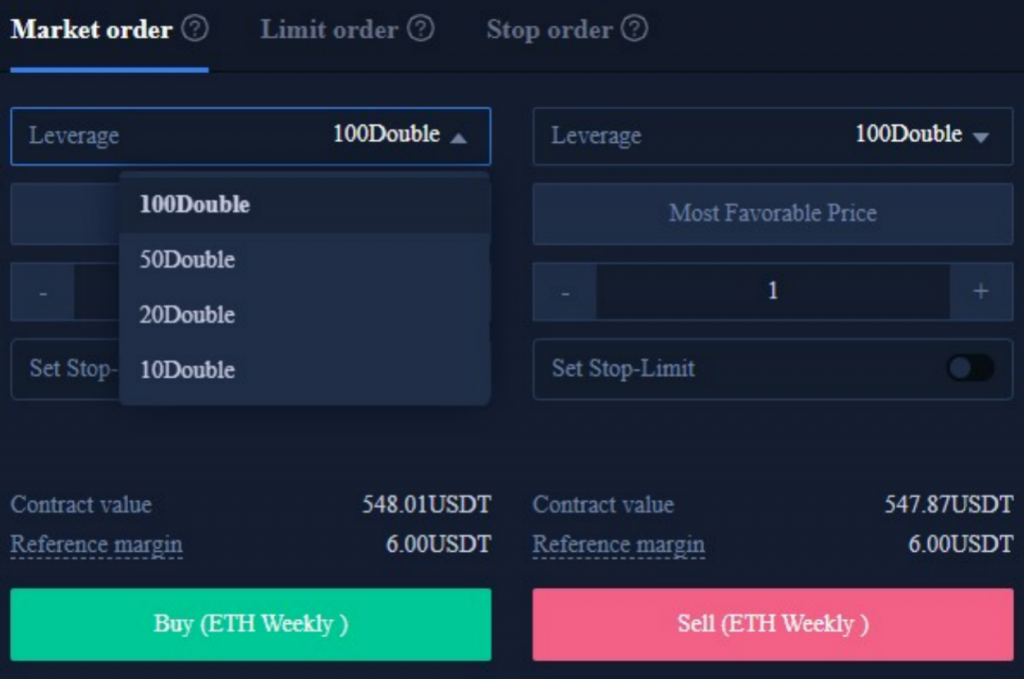

STEP 4: Choose the level of leverage to add

You can adjust the level of leverage based on your need. For example, the leverage of ETH’s weekly contract included 10x, 20x, 50x, and up to 100x leverage.

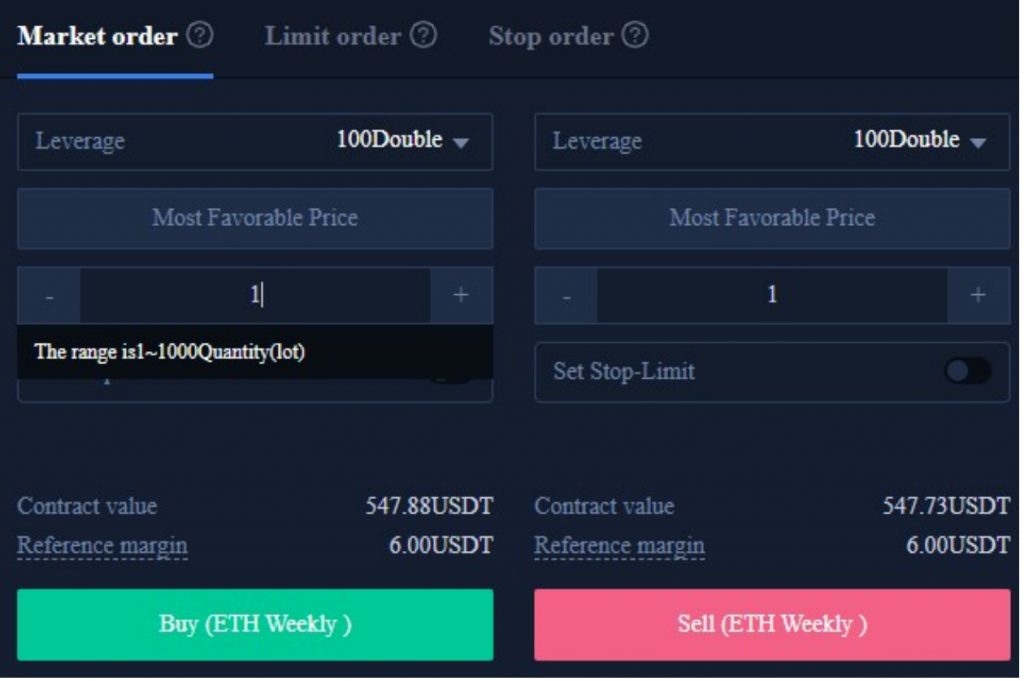

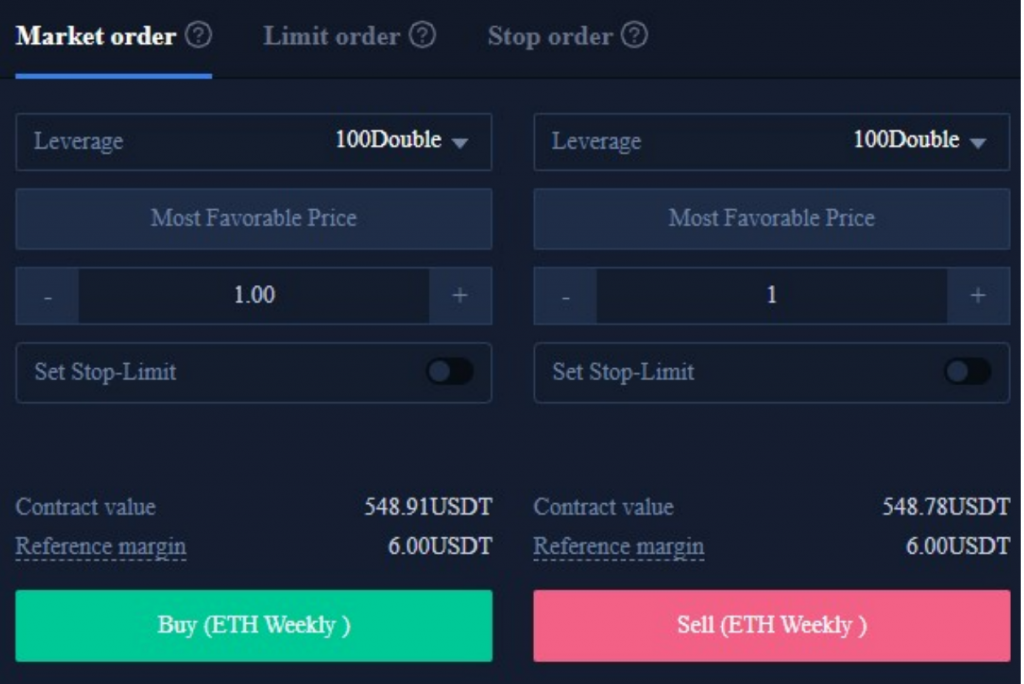

STEP 5: Choose the lot size to buy

Trader can select the lot size based on his need, and the lot size of ETH futures ranged from 1 to 3000 lots. Below are contract values from real-time data and insurance fund for reference.

STEP 6. Set take profit and stop loss targets

Market orders, limit orders and stop orders can used to set stop-profit and stop-loss price targets. The difference is that market orders can be executed immediately at the best current price, while limit orders and stop orders can only be executed at the price within a day or during the week.

STEP 7. Choose the price direction: Buy if you are bullish, Sell if you are bearish

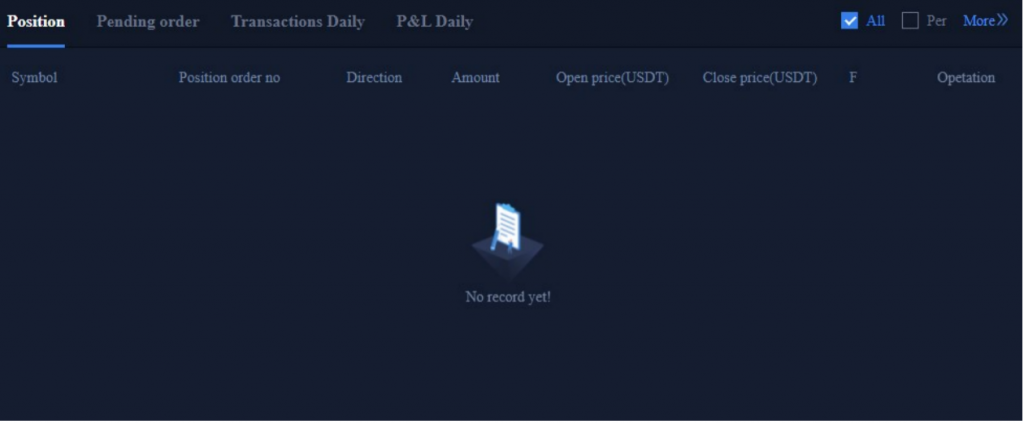

After setting up the basic data information, users can choose to buy (open long) or sell (sell short) after entering their desired price. Note that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform. Click the buy or sell button, and the ETH order is completed.

After the contract order is completed successfully, you will be notified at the bottom of the position page; if there is no contract order to be executed, it will be displayed at the bottom of the pending order page.

For more orders information, you can click on the futures trading report at the top right of the page to view.

At this point, you have completed the ETH (Ethereum) futures trading. If you have further inquiries, please contact the online customer service.

Go For A Free Account On BTCC Today And Try Your First Ethereum Futures Trading!