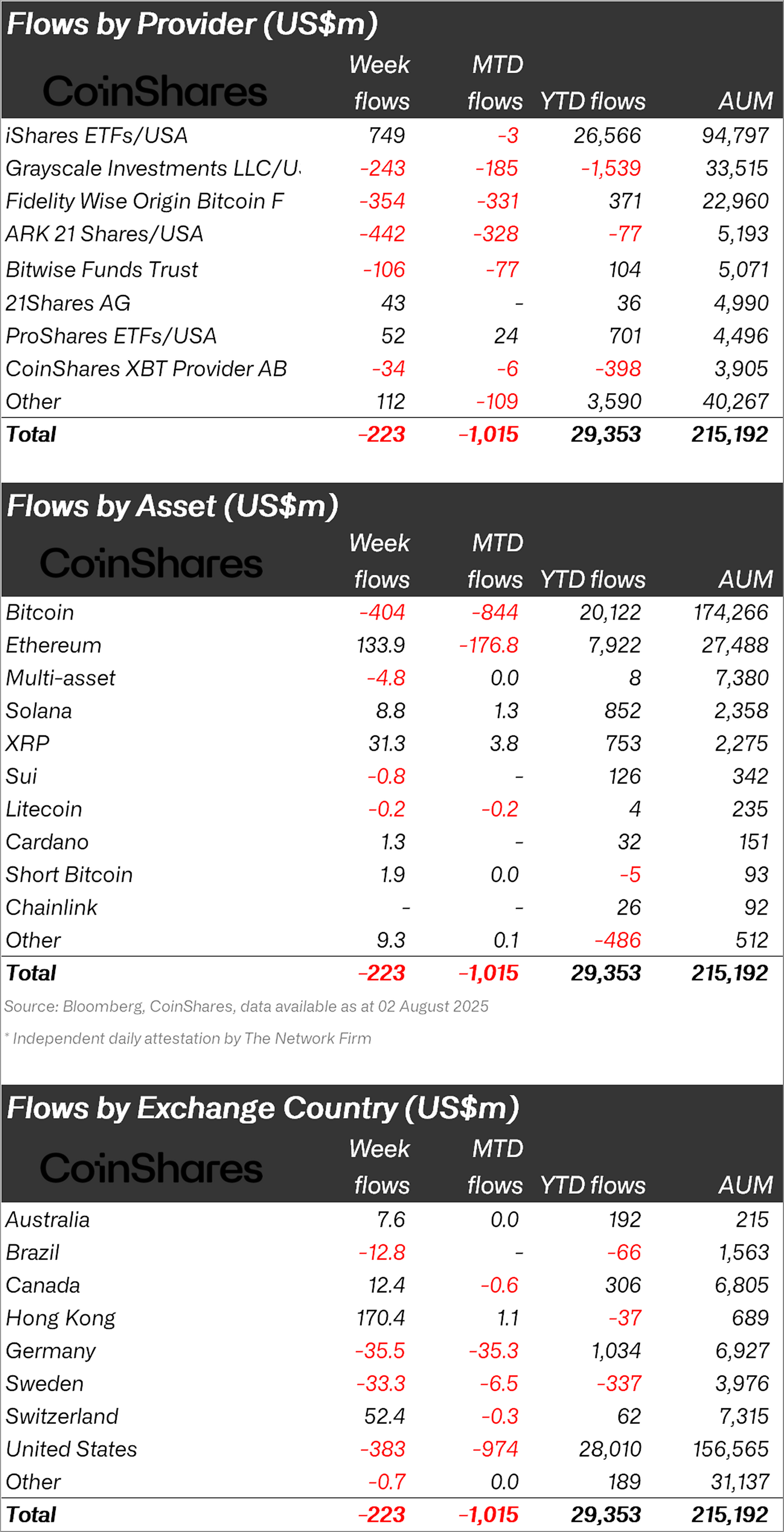

Fed Shock Triggers $223M Crypto Fund Exodus—Here’s Why It’s a Buying Opportunity

Crypto funds just bled $223M in a week. The Fed's latest move spooked traditional investors—but the smart money's already sniffing a rebound.

Short-term panic meets long-term conviction

When Powell speaks, weak hands fold. This week's outflows scream institutional knee-jerk reaction, not a fundamental crypto crisis. Remember: the same funds that panic-sold BTC at $30K in 2021 missed the ride to $69K.

The silver lining no one's talking about

Liquidations create liquidity. That $223M? It's not vanishing—it's shifting to cold wallets and DeFi pools where real hodlers park assets. Meanwhile, Bitcoin's hash rate just hit an ATH. Network health > spreadsheet jockeys.

Wall Street's playing checkers while crypto plays 4D chess

Funny how these 'sophisticated' funds still treat digital gold like a speculative tech stock. Newsflash: the blockchain doesn't care about Fed balance sheets. One cynical observation? These outflows conveniently preceded next week's options expiry—almost like someone wanted cheaper BTC calls.

Overall, despite last week’s outflows, the broader trend remains positive. With YTD inflows totaling over $29 billion, the market may simply be experiencing a short-term cooldown after a period of rapid accumulation.

Overall, despite last week’s outflows, the broader trend remains positive. With YTD inflows totaling over $29 billion, the market may simply be experiencing a short-term cooldown after a period of rapid accumulation.