BTC Price Prediction 2025: Will Bitcoin Hit $100,000 Before Year-End?

- Current BTC Price Position and Technical Outlook

- Institutional Adoption vs. Regulatory Challenges

- Key Factors Influencing BTC's Price Trajectory

- The $100,000 Question: Technical Perspective

- Market Sentiment and Expert Opinions

- Conclusion: Path to $100,000

- BTC Price Prediction: Frequently Asked Questions

Current BTC Price Position and Technical Outlook

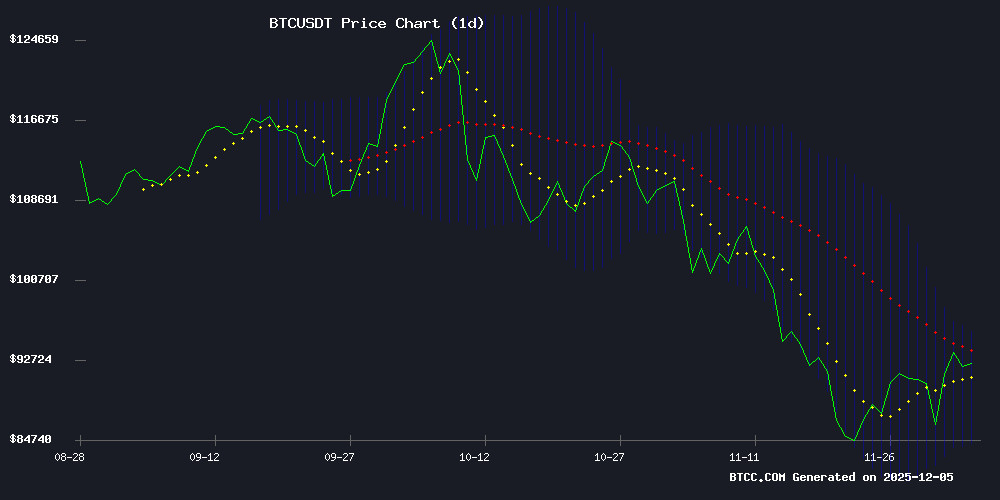

As of December 5, 2025, Bitcoin trades at $92,500 on BTCC, presenting a fascinating technical setup. The cryptocurrency sits comfortably above its 20-day moving average ($89,972) but shows signs of potential consolidation. The MACD indicator reveals waning momentum with a signal line at 4,136 and histogram at -3,651, suggesting we might see some resistance near the upper Bollinger Band at $95,596 before any decisive move higher.

Institutional Adoption vs. Regulatory Challenges

The market narrative presents a fascinating dichotomy. On one hand, we have BlackRock CEO Larry Fink revealing sovereign wealth funds accumulating BTC at various price points ($80K, $100K, even $120K), treating it as strategic long-term holdings. Meanwhile, regulatory actions like Washington's crackdown on Coinme create headwinds. It's like watching a tug-of-war between Wall Street's growing acceptance and government oversight.

Key Factors Influencing BTC's Price Trajectory

1. Derivatives Market Activity

CryptoQuant analyst Darkfost notes speculative derivatives trading has hit record levels in 2025, with Binance and BTCC seeing particularly thick order books. The Coinbase Premium Gap shows sustained institutional demand, creating a self-reinforcing cycle where price momentum attracts more capital.

2. MicroStrategy's Bitcoin Bet

MicroStrategy's $60B bitcoin treasury now exceeds its $55B market cap - the most severe NAV inversion since 2020. While CEO Phong Le established a $1.44B emergency dividend reserve, Wall Street remains skeptical about corporate crypto strategies. JPMorgan estimates potential $8.8B in outflows if MSCI delists the firm.

3. Political and Celebrity Endorsements

Eric Trump's American Bitcoin Corp (ABTC) is accumulating BTC rather than selling for operational costs, calling it "the decade's pivotal financial opportunity." Meanwhile, Rep. Marjorie Taylor Greene's disciplined ETF accumulation strategy has yielded 10% returns in just two weeks.

The $100,000 Question: Technical Perspective

From current levels, Bitcoin needs approximately 8.1% upside to reach $100,000. The technical roadmap suggests:

| Level | Price (USDT) | Significance |

|---|---|---|

| Current Price | 92,500 | Base |

| Upper Bollinger Band | ~95,600 | Immediate Resistance |

| Target | 100,000 | Psychological & Technical Target |

Market Sentiment and Expert Opinions

The crypto Fear and Greed Index sits at 27 (as of December 4), showing reduced tension compared to November's lows. Notable debates include:

- Peter Schiff vs. CZ on Bitcoin vs. tokenized gold at Binance Blockchain Week

- SEBI-regulated Hedge Equities endorsing Bitcoin allocations via US ETFs

- Quantum computing fears being dismissed as premature by experts like Blockstream's Adam Back

Conclusion: Path to $100,000

The confluence of bullish technical structure and strengthening institutional fundamentals makes $100,000 achievable, but not guaranteed. Key watchpoints:

- A decisive breakout above $95,600

- Maintaining support above the 20-day MA (~$89,970)

- Continued institutional inflows offsetting regulatory headwinds

As the BTCC research team notes, "While regulatory news may cause short-term volatility, the overarching trend of institutional integration appears to be the dominant force." The next few weeks could determine whether Bitcoin enters 2026 above or below this psychological milestone.

BTC Price Prediction: Frequently Asked Questions

What is Bitcoin's current price and technical position?

As of December 5, 2025, Bitcoin trades at $92,500 on BTCC, above its 20-day MA ($89,972) but showing potential consolidation signals in the MACD indicator.

What are the key resistance levels for BTC?

The immediate resistance sits at the upper Bollinger Band (~$95,600), with the psychological $100,000 level being the next major target.

How are institutions affecting Bitcoin's price?

Institutional adoption through ETFs and direct accumulation (like sovereign wealth funds) provides strong support, though regulatory actions create volatility.

What percentage gain is needed to reach $100,000?

From current levels, Bitcoin needs approximately 8.1% upside to reach the $100,000 milestone.

What should investors watch in coming weeks?

Key factors include: 1) Break above $95,600, 2) Maintaining $89,970 support, and 3) Institutional Flow trends versus regulatory developments.