Bitcoin’s 2026 Frontier: Navigating the Uncharted Digital Landscape

Bitcoin's next chapter is being written in real-time—and the script is anything but predictable.

The Halving Horizon

All eyes are on the clock. The next supply-cutting event looms, a programmed scarcity that historically rewrites the asset's playbook. Miners are already recalibrating their spreadsheets, while speculators place bets on the resulting supply shock. Will history rhyme, or will this cycle break the mold?

Regulatory Crossroads

Global watchdogs are drawing lines in the digital sand. From the SEC's lingering gaze to evolving frameworks in Asia and Europe, the rulebook is a moving target. Every regulatory nod or rejection sends shockwaves—creating arbitrage opportunities for the nimble and compliance headaches for the entrenched. It's the ultimate game of jurisdictional chess.

Institutional On-Ramps (and Off-Ramps)

Wall Street's flirtation is turning into a full-blown relationship. Spot ETFs are now old news; the conversation has shifted to complex derivatives, treasury management, and balance sheet allocations. But with big money comes big volatility—the very whales once prayed for can now capsize the ship with a single, massive trade.

The Macro Maelstrom

Bitcoin doesn't trade in a vacuum. Central bank pivots, geopolitical tremors, and the relentless search for a non-sovereign store of value keep the asset on its toes. It's become the hedge of choice for some, the high-beta risk asset for others—a dual identity that fuels both its rallies and its ruthless corrections.

So, where does that leave us? At the intersection of hardened code and human emotion. Bitcoin's path forward isn't a straight line—it's a series of volatile zigs and zags, dictated by algorithms, adoption, and the occasional old-fashioned panic sell. One thing's certain: the traditional finance playbook is obsolete here. Navigating this terrain requires a stomach for uncertainty and a willingness to ignore the very analysts who, just last quarter, were confidently predicting its demise. After all, in crypto, the only consistent forecast is being wrong.

Institutional Optimism: Are New Highs on the Horizon?

In the bull camp, prominent names like VanEck, Bitwise, Grayscale, Bernstein, and Coinbase stand firm. They suggest that Bitcoin might witness a strong recovery in 2026, potentially soaring to new all-time highs around $150,000. Despite Bitcoin concluding 2025 in red, Bitwise and VanEck emphasize the possibility that the four-year cycle theory may no longer hold relevance.

This perspective suggests that Bitcoin may now MOVE more in sync with the US stock markets. Particularly, a positive trend in tech stocks could elevate BTC prices. In such a scenario, a traditional severe bear market may not occur, or its impact could be limited. Matthew Sigel, Head of Digital Asset Research at VanEck, argues that the Relative Unrealized Profit (RUP) indicator is not yet at dangerous levels and the market cycle hasn’t peaked.

The Bear Camp and On-Chain Alerts

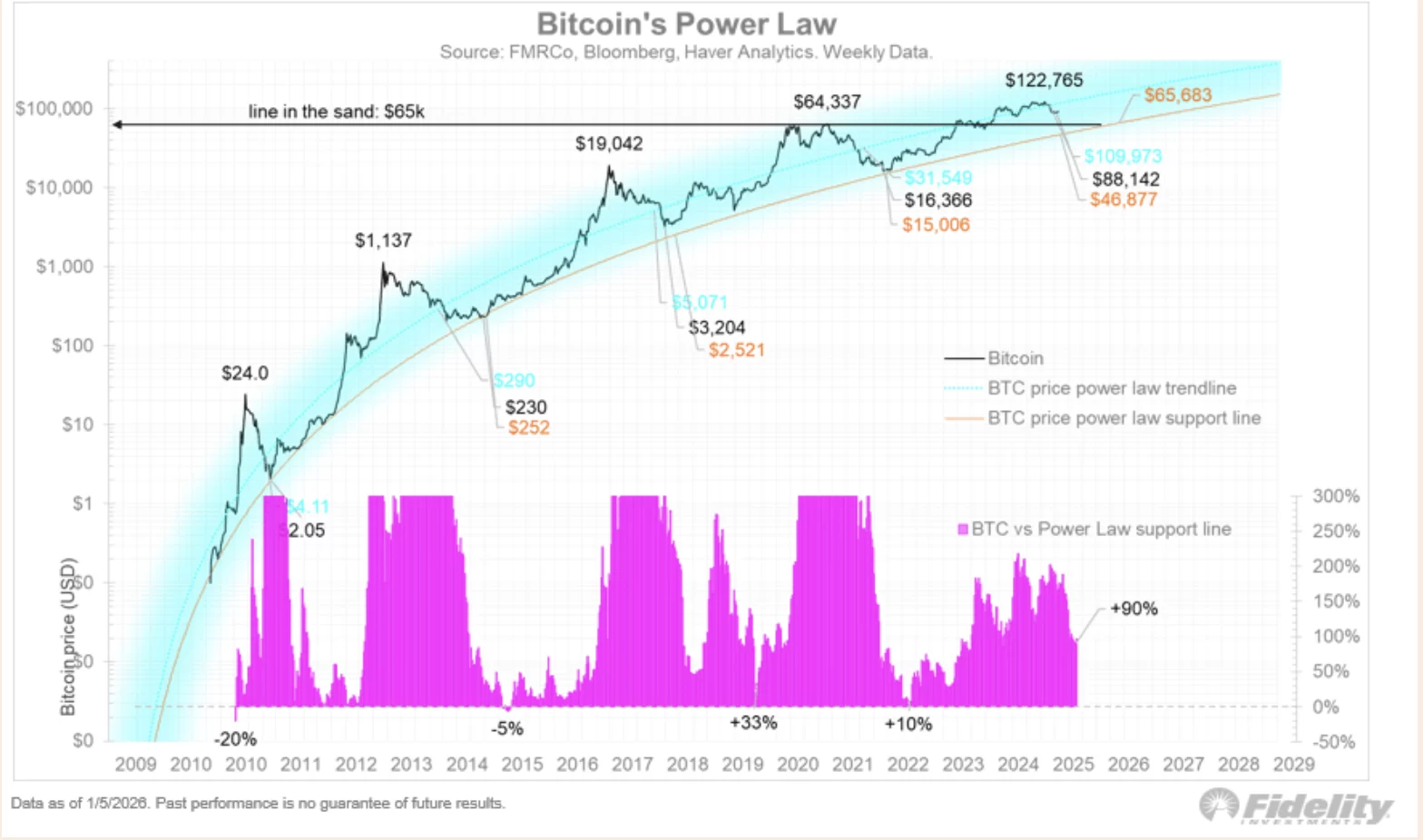

However, not everyone shares this optimism. Jurrien Timmer, Director of Global Macro at Fidelity, is cautious about the idea that bear markets have ended. According to Timmer, a critical threshold for Bitcoin is the $65,000 level, with a risk of retreating to $45,000 if this level is breached. He suggests Bitcoin might trade sideways for a year, gaining strength for another upward attempt.

On-chain data also supports this cautious stance. According to CryptoQuant data, Bitcoin dipped below its one-year moving average in November 2025, entering a bear market. Ki Young Ju, the firm’s founder, highlights that the slowdown in the Realized Market Value (Realized Cap) indicator is reminiscent of past bear periods. This is seen as a potential risk that could weaken optimistic predictions for 2026.

Additionally, the slowing inflow into spot Bitcoin ETFs in the US further complicates market uncertainty. The recent decrease in net inflows in ETFs suggests that institutional demand remains cautious in the short term, which can pressure prices.

In conclusion, Bitcoin’s journey into 2026 seems more dependent on macroeconomic conditions and institutional behaviors than classic cycles. On one side are strong players believing in new highs, while on-chain data warns of caution. This setup indicates that high volatility may be inevitable in the coming period, and investors shouldn’t rely on a single scenario.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.