Cryptocurrency Exchanges Combat Inactivity: Altcoin Delistings Surge as Market Matures

Exchanges are wielding the delisting hammer—and altcoins are feeling the squeeze.

It's spring cleaning season in crypto, only with less dust and more disappearing trading pairs. Major platforms are aggressively culling low-volume tokens, signaling a shift from the 'list everything' frenzy of previous cycles.

The Great Filter Begins

Forget the speculative mania of 2021. Today's playbook prioritizes liquidity and regulatory compliance over sheer quantity. Inactive projects—those with dwindling trading volumes or teams that have gone radio silent—are getting the boot. It's a brutal but necessary Darwinian process for an industry stepping into the institutional spotlight.

Investors, consider this your wake-up call. That obscure token you bought 'for the tech' three years ago? It might be on borrowed time. Exchanges aren't charities; they're businesses optimizing for revenue and risk management. Maintaining hundreds of dead-weight pairs costs money and invites regulatory scrutiny.

One cynical finance jab? This purge is the market's version of a performance review—and many projects are getting fired for failing to show up to work.

The message is clear: build utility, foster community, and maintain momentum, or face digital oblivion. The era of easy listings is over. Welcome to crypto's leaner, meaner, and arguably more professional, second act.

Summarize the content using AI

ChatGPT

Grok

The recent trend in the cryptocurrency exchange sector highlights a pressing need to reevaluate altcoin listings due to fluctuating trade volumes and diminishing interest in certain digital assets. Exchanges seeking to boost their revenue are turning their focus towards eliminating cryptocurrencies that fail to contribute significantly to their income. The logical step for exchanges under these circumstances is to remove altcoins that impose maintenance costs without any corresponding financial benefit.

ContentsAltcoin Delisting: A Sudden AnnouncementStrategies for Investors in a Volatile MarketAltcoin Delisting: A Sudden Announcement

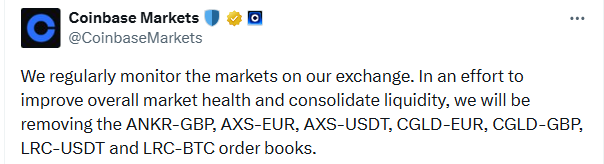

Though altcoins will continue trading in other pairs, the removal of specific trading pairs reflects a concerning decline in liquidity and interest. Notably, Coinbase’s decision to fully delist the ANK altcoin has sent ripples through the market. The complete list of pairs set for removal includes ANKR-GBP, AXS-EUR, AXS-USDT, CGLD-EUR, CGLD-GBP, LRC-USDT, and LRC-BTC.

For LRC Coin, the remaining USD pair indicates potential complete delisting if its trading volume doesn’t recover. Similarly, Axie Infinity (AXS), traditionally a strong performer, is now teetering on the edge with its USD pair being its sole trading option.

Strategies for Investors in a Volatile Market

Cryptocurrency exchanges often remove altcoins that become a burden, as evidenced by recent delistings. Altcoins face increasing challenges, and with 2021’s popular P2E project AXS also at risk, it underscores the difficult climate for many digital currencies. Investors should avoid getting too attached to any one altcoin and must carefully select those with genuine long-term potential.

Many holders find themselves clinging to altcoins over extended periods, watching their investments dwindle to zero, which speaks volumes about the cryptocurrency market‘s unpredictable nature. It’s advisable not to over-diversify into numerous altcoins that can’t be regularly evaluated. Regular re-evaluation and updating of investment portfolios, much like exchanges that reassess altcoin viability, is prudent for managing investment risks effectively.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.