Bitcoin’s Pain Threshold: Critical Concerns Emerge as Market Tests Resilience

Bitcoin's pain threshold is flashing red—and the market is watching every tick.

The Breaking Point

Every asset has its limit. For Bitcoin, that line isn't just a technical level—it's psychological bedrock. When support cracks, the domino effect ripples through portfolios, exchanges, and investor psyches. The current stress test reveals more than chart patterns; it exposes structural vulnerabilities in crypto's flagship asset.

Liquidity's Vanishing Act

Thin order books magnify every sell order. Market makers pull back during volatility, creating air pockets where prices free-fall before finding footing. This isn't 2017's retail frenzy—it's 2025's institutional reckoning, where algorithmic traders and hedge funds amplify moves traditional finance would dampen.

The Regulatory Shadow

While regulators debate frameworks, markets move faster. Each dip triggers whispers about intervention, leverage unwinds, and counterparty risk—the kind of concerns that keep traditional finance executives awake, but apparently not enough to stop them from launching another crypto ETF.

Network Stress, Real-World Tests

Miners face margin calls. Developers watch adoption metrics. Everyday holders check prices more often. Bitcoin's decentralized nature distributes pain differently than traditional assets—there's no central bank put option, no government backstop. Just code, consensus, and collective nerve.

The Silver Lining Playbook

Volatility isn't a bug; it's a feature. Each test of Bitcoin's pain threshold separates speculative noise from fundamental signal. Infrastructure that survives becomes stronger. Use cases that persist gain legitimacy. And investors who understand cycles—rather than chasing them—position for the next phase.

Bitcoin's current discomfort isn't an endpoint—it's a diagnostic. The market isn't asking if digital gold can shine; it's testing whether the foundation can withstand earthquakes. The answer will define crypto's next decade, not just its next quarterly report.

Summarize the content using AI

ChatGPT

Grok

Bitcoin’s price might still appear high to those who discovered cryptocurrencies after 2022. Although recent price drops seem severe for those who entered the market during Trump’s elections, many investors believe that the current price, lingering above previous all-time high levels, hasn’t suffered a fatal blow. However, on-chain data suggests that Bitcoin $87,412 has reached its peak pain threshold.

$87,412 has reached its peak pain threshold.

Cryptocurrencies Hit Rock Bottom

If predicting the market’s bottom based on a single metric were possible, The Graph below would suggest that we have indeed hit rock bottom. Investors have been experiencing losses between 20% to 25% over the past two weeks, reflecting clear capitulation behavior. Such rapid and significant loss series traditionally indicate the formation of a bottom, signaling the beginning of a recovery.

CryptoQuant analyst Darkfost reported that on-chain trader groups experienced the largest percentage loss of this cycle with a realized price of $113,692. This analysis focuses on a niche group of investors speculating in the short term, particularly those holding BTC for 1 to 3 months. These investors have seen losses of 20% to 25% over the past fortnight, highlighting capitulation behavior. Historically, such phases are often associated with bottom formation, providing an opportunity for accumulation when many in this group surrender, but only if the long-term upward trend remains intact. Currently, despite the uncertainty, the situation still appears to be stable, yet caution and vigilance are crucial.

Even with the prevailing uncertainty, the warning of maximum pain is significant in halting noteworthy short-term gains or losses.

The graph above illustrates that such an event hadn’t occurred since the start of 2023.

Worst Since March

BTC experienced its worst day since March and its return to March levels after the all-time high was more painful. Monday’s decline exceeded 6%, a rarity. Losses since the October peak have surpassed 30%.

Patrick Horsman, BNB Plus’s investment director, warned that growing pessimism about the market and economy has reversed risk sentiment. Additionally, he mentioned that Bitcoin reaching $60,000 does not imply the nightmare is over, indicating that opinions about the bottom vary.

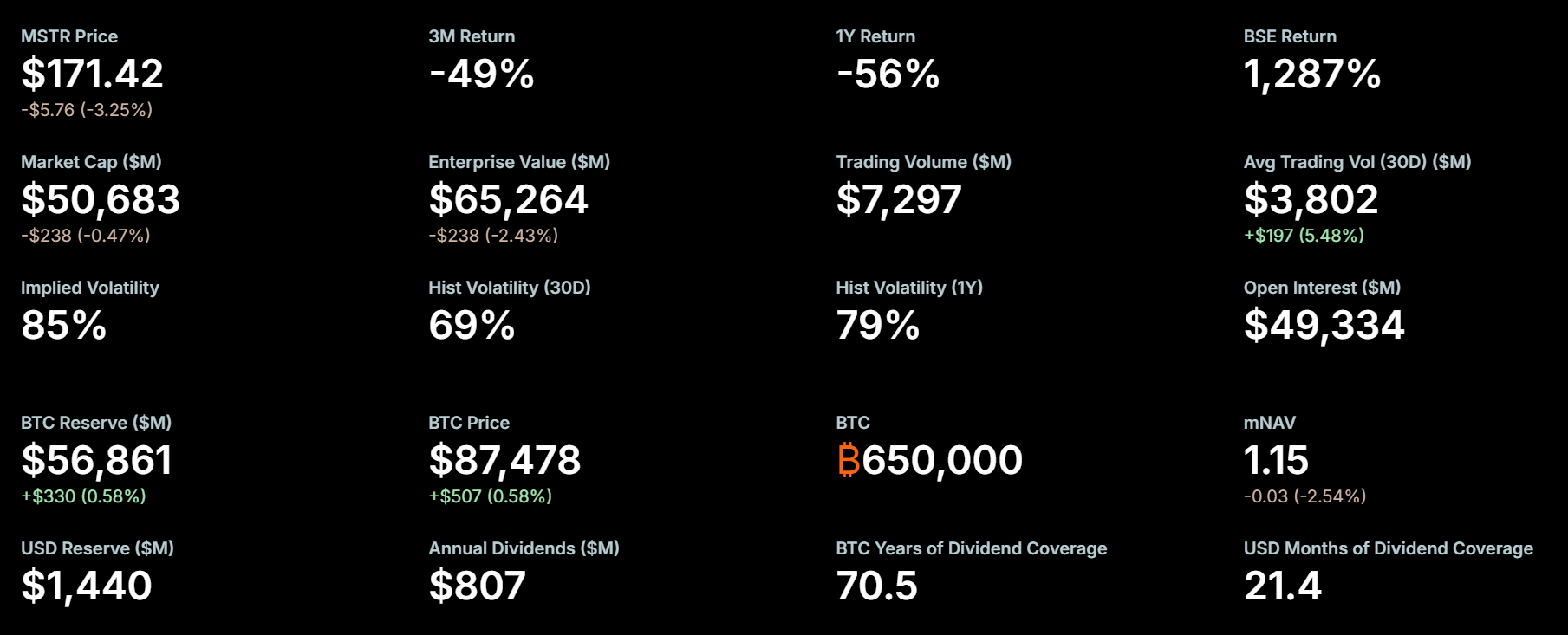

Michael Saylor’s recent video presentation added to the fear, potentially reassuring shareholders but drawing criticism from the crypto community.

“If mNAV falls below 1, we might sell some bitcoin and related securities. We will act in the shareholders’ best interests.”

Strategy CEO Phong Le indicated last week:

“Currently, as we experience the crypto winter, our mNAV is declining. I hope it doesn’t fall below one. However, if it does and we lack alternative capital, we will sell Bitcoin.”

You might be tempted to say, “Fatih told me mNAV hasn’t fallen below 1,” but despite a 7% drop yesterday, it’s at 1.15 today, suggesting some loss recovery is positive.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.