ADA Price Prediction 2025: Will Cardano Stage a Comeback Before Year-End?

- What Does ADA's Technical Setup Reveal About Its Recovery Potential?

- How Does Market Sentiment Impact ADA's Price Trajectory?

- Can the "Pentad Blueprint" Overcome Institutional Skepticism?

- Key ADA Price Levels to Watch Before 2026

- Is ADA Worth Buying Before 2026?

- ADA Price Prediction 2025: FAQ

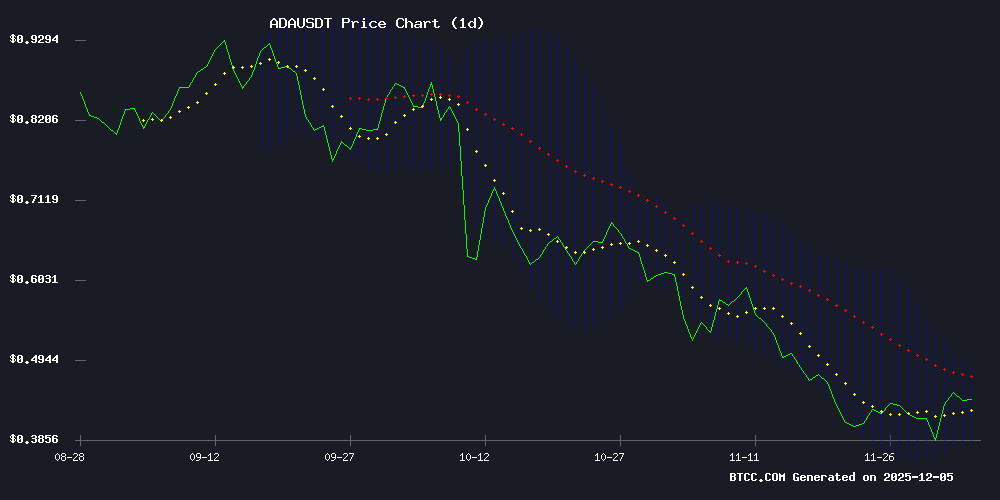

Cardano (ADA) finds itself at a critical juncture as we approach the end of 2025. The cryptocurrency, currently trading at $0.44, shows tentative signs of recovery but faces conflicting signals from institutional investors and technical indicators. While founder Charles Hoskinson's ambitious "Pentad Blueprint" for 2026 promises long-term growth, recent on-chain data reveals troubling capital flight from long-term holders. This analysis examines whether ADA can break free from its current consolidation pattern between $0.384 and $0.482 before the new year.

What Does ADA's Technical Setup Reveal About Its Recovery Potential?

As of December 2025, ADA presents a mixed technical picture that hints at both promise and peril. The price currently hovers just above the 20-day moving average ($0.433), which traditionally serves as a support level during uptrends. The MACD indicator tells an interesting story - while still in negative territory at 0.020832, the bearish momentum appears to be weakening, with the histogram reading -0.024108. This suggests the selling pressure might be exhausting itself.

Bollinger Bands paint a clear picture of ADA's current trading range, with the upper band at $0.482 and the lower at $0.384. In my experience, when an asset consolidates within these bands after a downtrend, it often precedes a significant move. The question is: which direction? A decisive break above the middle band could signal the start of a recovery phase, while failure to hold the 20-day MA might see ADA retest lower supports.

How Does Market Sentiment Impact ADA's Price Trajectory?

The sentiment surrounding cardano feels like watching two different movies simultaneously. On one hand, Hoskinson's vision for 2026 through the Pentad initiative (connecting five key Cardano entities) provides a compelling growth narrative. The focus on infrastructure deals and institutional outreach could significantly boost ADA's utility and demand.

However, the blockchain doesn't care about narratives when coins start moving. Recent data from CoinMarketCap shows an alarming trend: 114.66 million ADA (about $50 million) moved by long-term holders this week alone - a 23% spike in aged token circulation. When whales exit quietly like this, retail investors often hear the crash too late, as analyst Ali Martinez pointed out.

Can the "Pentad Blueprint" Overcome Institutional Skepticism?

Hoskinson's 2026 strategy represents Cardano's most ambitious governance framework yet. By linking the Cardano Foundation, Emurgo, Input Output, Midnight Foundation, and Intersect, it aims to create a unified growth engine. The immediate focus on securing critical integrations (bridges, stablecoins, oracles) makes strategic sense - these are the plumbing that makes DeFi ecosystems thrive.

Yet the market's reaction has been... underwhelming. The Spent Coins Age Band metric (a reliable smart money indicator) shows accelerating divestment from ADA's most experienced holders. This creates a fascinating tension between long-term vision and short-term reality. In crypto, we often see this pattern before major trend reversals - institutions sell while retail remains distracted by newer shiny objects.

Key ADA Price Levels to Watch Before 2026

| Level | Price | Significance |

|---|---|---|

| Upper Bollinger Band | $0.482 | Breakout confirmation |

| 20-Day Moving Average | $0.433 | Trend indicator |

| Lower Bollinger Band | $0.384 | Critical support |

Is ADA Worth Buying Before 2026?

This is the million-dollar question (sometimes literally). Based on TradingView data and on-chain metrics, ADA presents a classic high-risk, high-reward scenario. The technical setup suggests we might be seeing the early stages of accumulation, but the institutional exodus can't be ignored.

For traders: The $0.433 level is key - holding above it suggests potential upside to $0.482. Breaking below might see a test of $0.384. For long-term investors: The 2026 roadmap is compelling, but execution risk remains. Dollar-cost averaging might be wiser than going all-in at current levels.

Remember what we saw with ethereum in 2020 before its massive 2021 run - smart money often moves contrary to retail sentiment. Could ADA be setting up for a similar surprise? Only time will tell, but the ingredients are there for either a spectacular comeback or continued frustration.

ADA Price Prediction 2025: FAQ

What is ADA's current price and key technical levels?

As of December 2025, ADA trades at $0.44. Key levels to watch include resistance at $0.482 (upper Bollinger Band), support at $0.433 (20-day MA), and critical support at $0.384 (lower Bollinger Band).

Why are institutions selling ADA despite the positive 2026 roadmap?

Institutional investors often take profits or rebalance portfolios year-end. Some may be rotating into newer LAYER 1 projects, while others might be waiting for clearer signs of the Pentad initiative's execution.

How reliable is the TD Sequential buy signal for ADA?

While the TD Sequential has flashed accurate signals historically, it's more reliable when confirmed by other indicators like volume and on-chain data. The current MACD configuration suggests caution is warranted.

Could ADA drop below $0.38 before year-end?

It's possible if bitcoin experiences volatility or if the institutional selling continues. However, the 20-day MA has held so far, suggesting some underlying strength.

What would confirm an ADA recovery is underway?

A sustained break above $0.482 with strong volume, coupled with a reduction in aged coin movements and positive developments in the Pentad initiative WOULD suggest a genuine recovery.