Litecoin’s Fakeout: Why Its Breakout Failed as Remittix Takes Aim at the PayFi Market

Litecoin just pulled a classic crypto fakeout—flashing bullish signals before slamming back into its range. Meanwhile, a new player is sharpening its knives for the lucrative cross-border payments pie.

The Phantom Rally

LTC's recent price surge turned out to be a head-fake for traders. The move lacked the volume and follow-through needed for a genuine breakout, leaving chart watchers with another lesson in crypto volatility. It's a reminder that in this market, not every green candle tells the truth.

Remittix Eyes the Prize

While Litecoin churns, Remittix is making a direct play for the PayFi sector's market share. The platform isn't just tweaking existing models—it's building infrastructure designed to bypass traditional gatekeepers and their hefty fees. Think streamlined settlements, lower costs, and a user experience that doesn't require a finance degree to navigate.

The Real Competition

The target is clear: the multi-trillion-dollar cross-border payments industry, a sector still bogged down by legacy systems and what some might call 'profitable inefficiencies.' Remittix's approach leverages blockchain's core strengths—transparency and speed—to cut out middlemen. It's a move that could pressure established giants to innovate or lose ground.

So, while one veteran coin struggles for momentum, the real battle is shifting to utility. In the race for real-world use, flashy breakouts matter less than actually moving money—something the old-guard banks have made an art form of overcharging for. The future of finance won't be won by fakeouts, but by who actually delivers the goods.

Litecoin price prediction threads have exploded after LTC ripped through $80 in a fast squeeze that punished short sellers and lit up trading desks. Certainly the MOVE above that key level felt like the start of something big, and headlines quickly framed it as the next leg of a new bull phase for digital silver. For anyone watching the charts only, it looks exciting on the surface.

Under the hood, the story is very different. Litecoin is now drifting around the mid $80 region, and traders are already arguing about whether this was a fake move or the start of a new base. At the same time, serious capital is eyeing PayFi projects that push crypto into real bank accounts, with Remittix quietly taking attention from Litecoin price prediction noise.

Litecoin price prediction: fake breakout or new base?

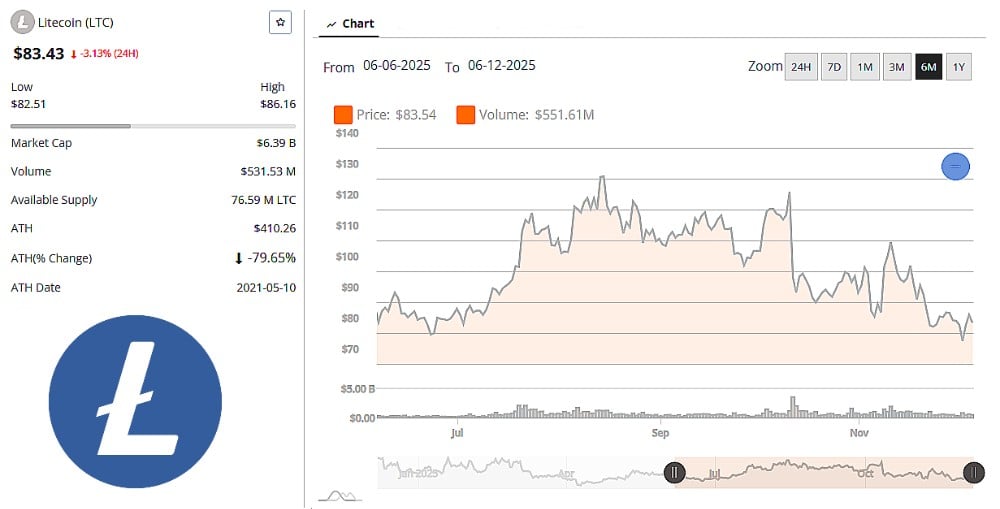

On paper, the bulls still have something to point at. Litecoin trades near $85 with small intraday losses, sitting just above the $80 area that triggered this week’s breakout move. Pattern watchers see a bullish triangle structure that could carry the price back toward $100 if that support holds. In the short term, every new litecoin price prediction depends on whether that zone survives the next Bitcoin wobble.

The wider lense tells a cooler story. Resistance bands near $105 and $130 have not been breached since July – with many desks still flagging $134 as the line that would actually reset medium-term Litecoin price prediction models. Sentiment also took a hit when plans for a new Coinshares Litecoin ETF were pulled, raising questions about long-term demand.

Nonetheless, price action remains constructive as Litecoin holds above its long-standing $80 support level. Intraday charts show the asset repeatedly defending $83, with traders watching $91.50 and $96 as interim resistance zones.

As of December 5, 2025, Litecoin trades around $83.43, down 3.13% on the day, while market watchers note that its correlation with Bitcoin continues to shape short-term sentiment. Some analysts also highlight multi-year triangle formations on Litecoin charts, referencing setups discussed on TradingView, which could support a larger move if liquidity improves. For now, Litecoin’s trajectory hinges on whether it can maintain strength above key EMAs and build enough momentum to challenge the $98–$100 resistance area, a zone many traders continue to monitor closely.

Remittix and the PayFi answer to lack of Momentum in Litecoin price prediction trades

Remittix sits right at the centre of the shift in Litcoin sentiment. It is a PayFi and DeFi project designed to move money from crypto wallets into bank accounts in more than 30 countries, with a single app that handles multi-chain support, real-time FX quotes, and low fees that challenge classic remittance firms.

While traders scrutinize each new Litecoin Price prediction, Remittix is quietly locking in real-world payment flows and user signups. The numbers already look like an early-stage crypto investment window that will not stay quiet for long. The RTX price is currently $0.119, with more than 692.8 million tokens already taken up and over $28.4 million raised from a base of more than 40,000 buyers.

The team has passed a full CertiK security review and is ranked at the top of CertiK’s table for pre-launch tokens, which gives Remittix a stamp of quality that many rivals lack. Live beta testing of the wallet is underway, with community users already sending funds through the system.

Key reasons Remittix keeps appearing on analyst shortlists include:

- The PayFi wallet lets everyday users move crypto into local bank accounts in more than thirty countries without relying on centralized exchanges.

- The current wallet beta gives investors a live view of payment flows instead of a simple white paper promise with no product.

- Cross-chain support that includes major layer one networks and RTX positions Remittix as a single hub rather than another isolated token.

- Confirmed listings on platforms such as BitMart and LBank create a clear path for future liquidity when new investors decide to buy RTX tokens.

Add the fact that the team has a strong security stamp from CertiK and an engaged community already testing the wallet, and the setup becomes very hard to ignore. Traders who focus only on the next Litecoin price prediction may be watching the wrong race while Remittix quietly builds the PayFi rails that could dominate the next cycle.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQs

Is Litecoin still a good investment after the recent breakout?

Litecoin still has an active trader base and clear support and resistance zones around $80, $100, and higher levels NEAR $130. However, its most recent price spike lost momentum quickly, and many Litecoin price prediction models now assume a wide-range rather than a clean trend change.

What is the latest Litecoin price prediction for 2025?

Most realistic Litecoin price predictions for 2025 now cluster between $75 and $110, unless there is a very strong new wave of demand. Upside targets above $130 usually assume better regulatory news or stronger flows into older large-cap coins.

Why is the market watching Remittix in the PayFi sector?

Investors are eyeing Remittix because it focuses on moving crypto into real bank accounts across more than 30 countries instead of living only inside trading charts. The project already has a live wallet beta, strong CertiK security validation, confirmed exchange listings, and clear payment use cases.

How can investors compare Litecoin and Remittix today?

Litecoin offers a long history, DEEP liquidity, and a familiar chart that suits short-term trading strategies. Remittix focuses on PayFi utility, with under $1 pricing, growing user numbers, and a product that aims to capture real remittance and payroll volume.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.