Trillion-Dollar Tech Valuations: The Incredible, Possibly Impossible Frontier

Tech Titans Hit Trillion-Dollar Club—And Nobody Knows How They Got There.

The New Math of Valuation

Forget price-to-earnings ratios. Today's tech valuations run on a different calculus—user growth times hype, divided by skepticism, with a dash of 'network effects' that somehow justify numbers larger than some national economies. Analysts scramble for new metrics while traditional finance veterans mutter about tulip bulbs over expensive scotch.

When 'Potential' Outweighs Profit

Companies burn cash for a decade, pivot three times, and still command valuations that make industrial giants weep. The market now rewards audacious vision over quarterly dividends—investors bet on ecosystems, not earnings statements. It's a faith-based economy where the roadmap matters more than the current location.

The Gravity-Defying Act

These valuations create their own reality distortion fields. Talent flocks in, competitors fade out, and capital flows toward the already-massive—creating feedback loops that justify the unjustifiable. The trillion-dollar mark isn't just a number; it's a force field that repels doubt and attracts more oxygen.

Finance's cynical take? 'We've replaced intrinsic value with inspirational PowerPoints—and the market's buying every slide.'

So here we stand: marveling at technological marvels priced like celestial objects, wondering when physics—or economics—finally kicks in. The trillion-dollar question isn't whether they're worth it, but what 'worth' even means anymore.

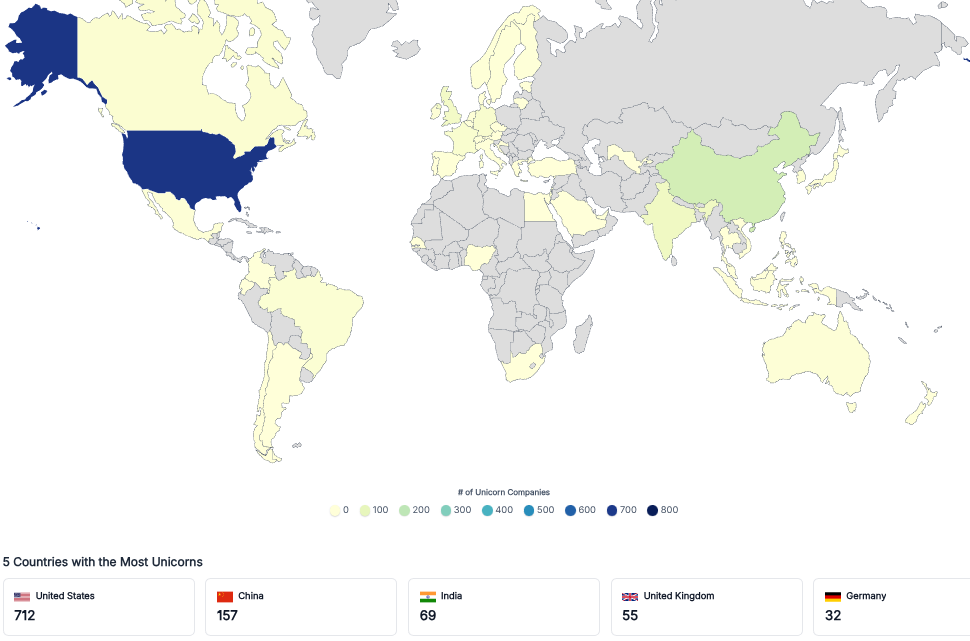

The US has 712 unicorns, worth a collective $2.9 trillion, vs. just 157 for second-place China. 80 of those were founded in 2025 alone.

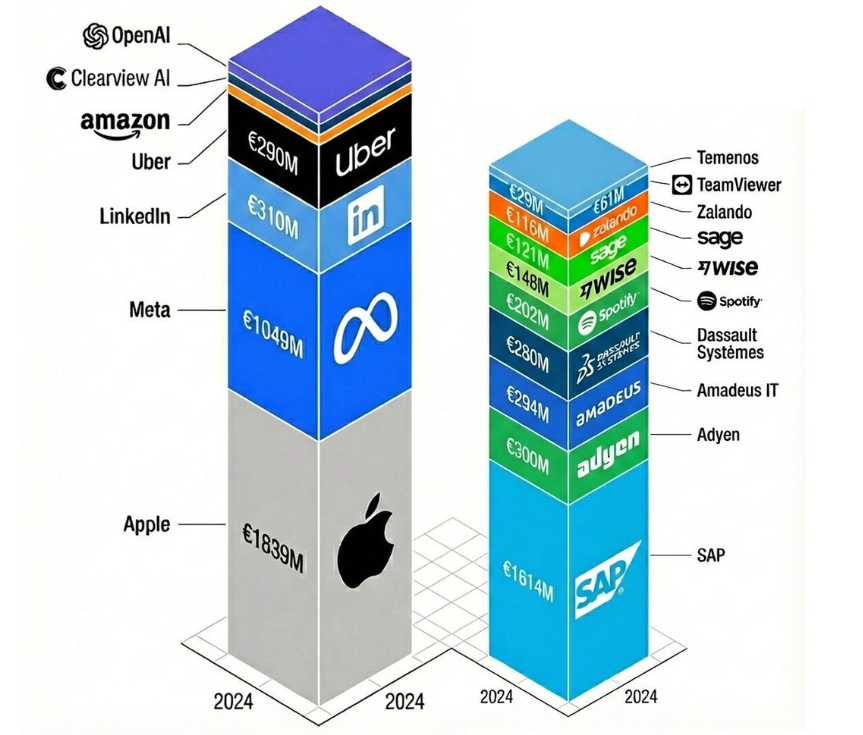

Big companies are good to have:

An unofficial tally finds that, in 2024, the EU made more from fining US tech companies than it collected from all public European internet companies. A related stat (attributed to Goldman Sachs): In the past 50 years, just 14 companies with a market cap greater than $10 billion were founded in Europe vs. 241 in the US.

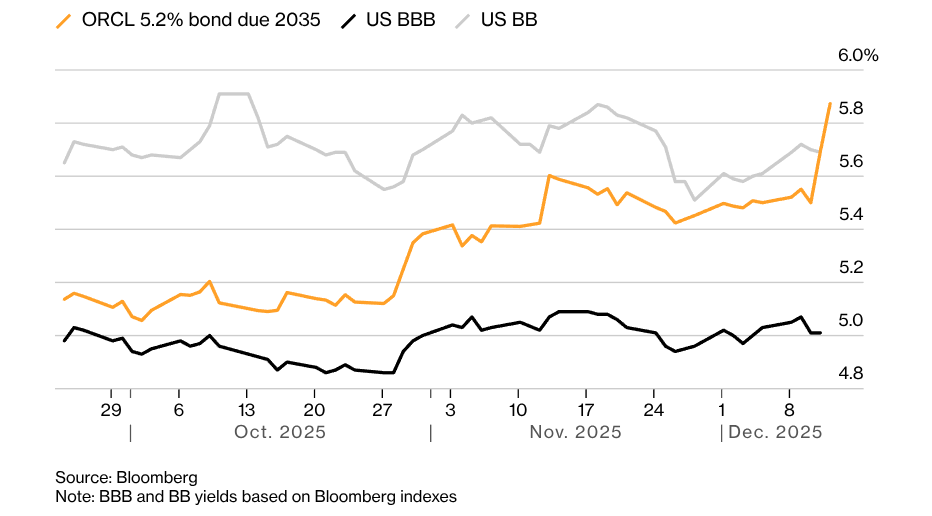

AI credit worries:

Bloomberg reports that Oracle debt now trades at junk-bond levels.

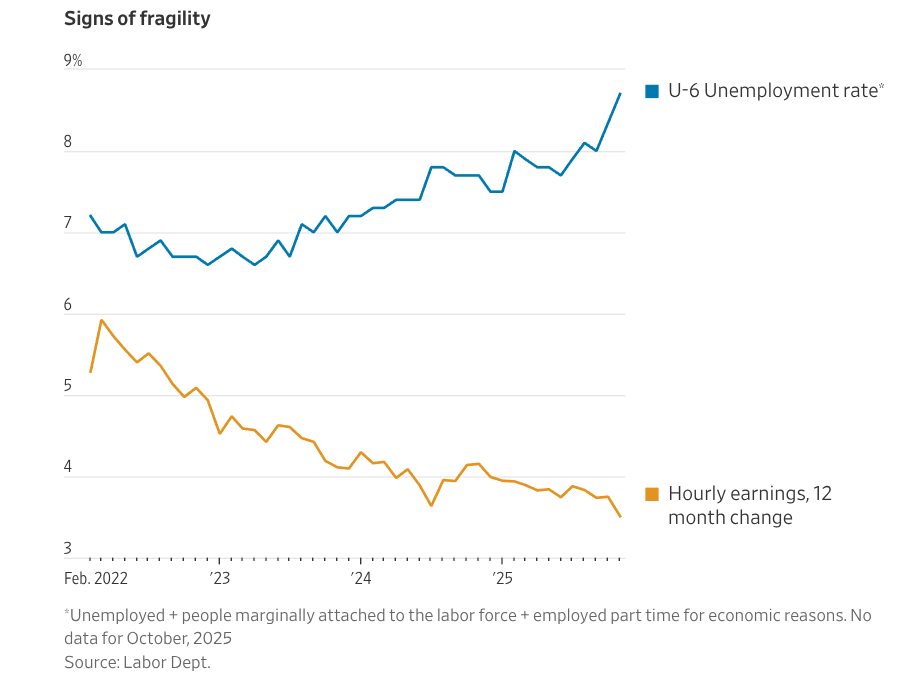

Jobs are the new prices:

Greg IP writes that with US unemployment up and wage growth down, jobs will soon replace prices as the focus of our economic anxiety.

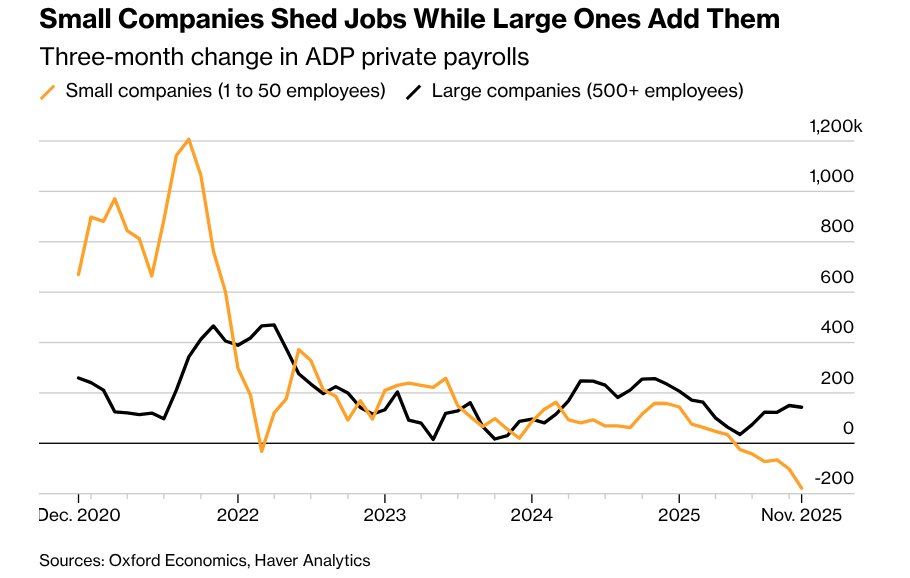

Where the jobs are being lost:

Bloomberg reports that tariffs have hit small firms the hardest, causing them to shed jobs.

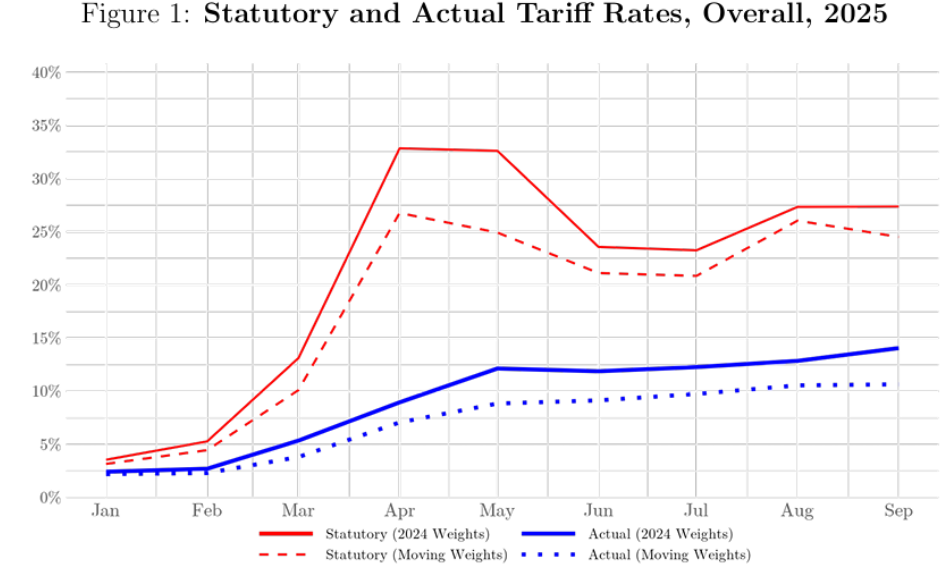

The good and bad news on tariffs:

A new study reports good news: Effective US tariff rates have so far been about half the headline number due to time lags, exceptions and enforcement gaps. The bad news, however, is that “nearly 100%” of tariffs are being passed through to consumers via higher prices.

Just getting started?

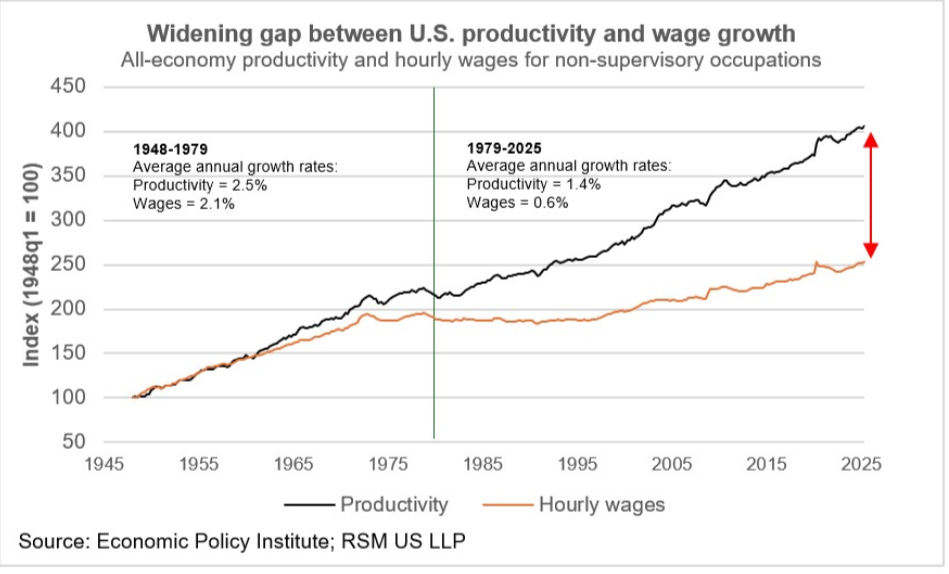

Joe Brusuelas reports that “The gap between US productivity and the hourly wage paid to non-supervisory employees continues to widen. If anything, the gap is accelerating as the American economy continues to be transformed by the global supply chain and technological advances.”

Read on:

The FT reported earlier this year on the decline of reading: The percentage of Americans reading for personal interest is down 10 percentage points since 2005, although the percentage reading to children remains steady. Do newsletters count as personal interest? If so, please consider reading this one to a child.

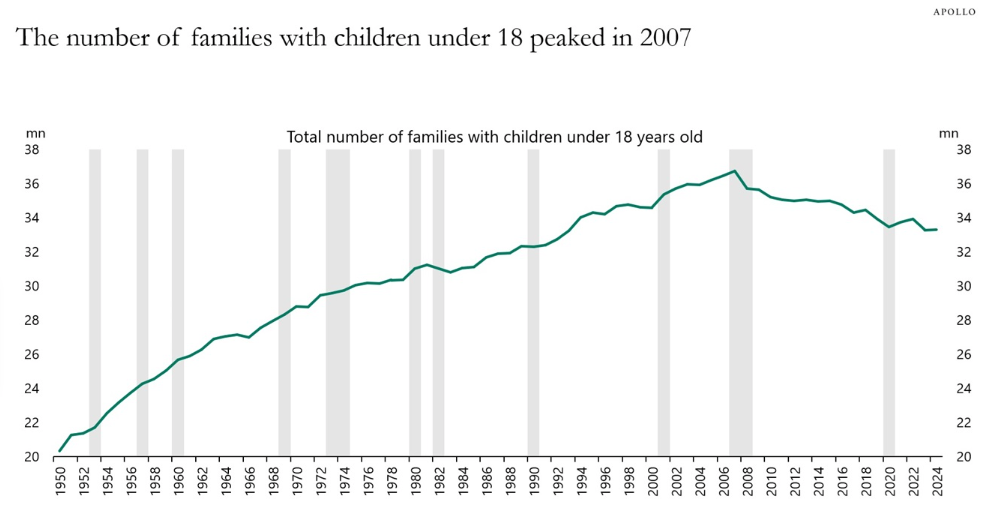

Fewer kids to read to:

Torsten Slok notes that the percentage of US families with children has been falling.

The YouTube generation:

Nearly 50% of US teens say they “hardly ever” read in their spare time, up from 20% in 1990. Seems worrying, but you really can learn a lot on YouTube.

Land of the rising yield:

The yield on 10-year Japanese government bonds is about 2% for the first time since 1999. Higher yields typically mean Japanese savers will sell US investments to reinvest at home, but the opposite seems to be happening, likely because of the appeal of US AI stocks.

Prices by weight:

Measuring everything in price per pound, Andrew McCalip finds that a Tesla Model 3 costs less than Camembert. “We pull sand, oil, and ore from the earth and transmute them into machines cheaper than aged milk.”

Perhaps that is the kind of thinking we need to make sense of trillion-dollar valuations.

Have a great weekend, trillionaire readers.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.