I. Project Introduction

Roam is a DePIN project built on the

Solana blockchain, aiming to revolutionize traditional telecommunications. It enables users to share their home WiFi, creating a global decentralized wireless network while earning ROAM token rewards through a token-based incentive system. Roam utilizes Solana’s

decentralized identity (DID)

and

verifiable credential (VC) technology

to enhance user data security and provide seamless WiFi connectivity. Once set up, devices can automatically connect and roam globally, eliminating the need for repeated logins and authentication, making connectivity more convenient.

Roam has seen rapid growth, expanding to

over 190 countries

with

1.21 million deployed devices

, making it one of the

largest DePIN networks

worldwide. In the second half of 2024 alone, the number of devices jumped from

400

,000 to 1.2 million

, with registered users surpassing

2.08 million

. Roam currently has a strong presence in

South Korea, China, Southeast Asia, and Europe

, while gradually expanding into the

U.S. and Latin America

. Users can also connect to

3.5 million OpenRoaming hotspots

via the Roam App. Additionally, Roam has introduced an

eSIM international roaming service

, allowing users to access low-cost global data services without needing a physical SIM card.

Beyond WiFi sharing, Roam is developing a

decentralized telecom data layer

to support the DePIN ecosystem. Its vision extends beyond WiFi connectivity, aiming to integrate

decentralized storage, CDN networks, and IoT data

, positioning Roam as a

comprehensive data infrastructure platform

. The project has raised

$7 million in funding

from prominent investors, including

Volt Capital, Anagram, and Samsung Next

.

II. Project Highlights

According to DePINscan data, Roam operates the

largest DePIN network

, leveraging its decentralized WiFi roaming protocol. It spans

190+ countries and regions

, with

over 1.21 million WiFi nodes

and access to

3.5 million OpenRoaming hotspots

, enabling seamless and automatic connectivity.

Roam utilizes

DID (Decentralized Identity) + VC (Verifiable Credential)

authentication to

protect user identity and data privacy

when connecting to WiFi. Once a device is connected, it can roam

globally without requiring repeated

password

entries or account registrations

, reducing security risks associated with centralized data storage.

Roam’s

dual-layer incentive system

attracts users through:

-

Allowing users to

connect their home routers to the Roam network and earn points by

sharing WiFi.

-

Offering

official mining-grade routers:

MAX30 ($199) and MAX60 ($499). Owners of these routers enjoy

higher mining rewards and receive

exclusive NFT airdrops, making Roam one of the

fastest-growing projects in the DePIN sector.

Beyond WiFi sharing, Roam has introduced an

eSIM international data service

, covering

160+ countries and regions

. Users can

switch between global networks at lower costs without needing a physical SIM card

. Compared to traditional telecom providers’

high international roaming fees

, Roam offers

affordable, on-demand data plans at $1.19–$1.99 per GB

, providing Web3 users with a

cost-effective and flexible

mobile internet solution. This also strengthens Roam’s

commercial revenue model

.

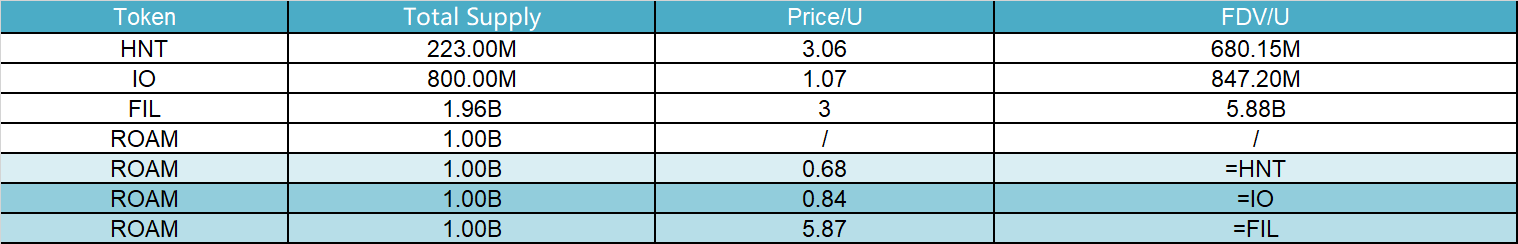

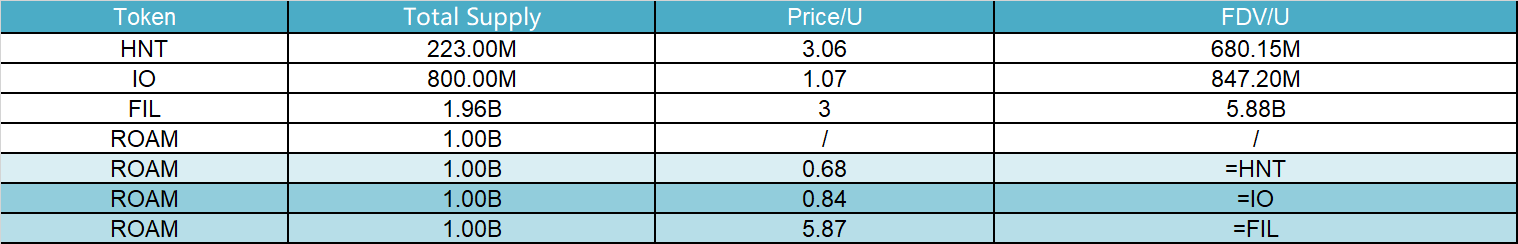

III. Market Valuation Projection

As a

key infrastructure provider for decentralized wireless networks (DePIN)

, $ROAM operates within the

decentralized telecom, network sharing, and AI data economy

sectors. To estimate its potential

market valuation, we compare it with:

-

Helium ($HNT) – A decentralized wireless hotspot network

-

Filecoin ($FIL) – A decentralized storage network

-

io.net

($IO) – A decentralized computing network

These projects provide essential Web3 infrastructure and serve as

valuable market benchmarks

for assessing $ROAM’s future valuation.

IV. Tokenomics

$ROAM Total Supply: 1,000,000,000 (1 Billion)

Token

Allocation & Release:

-

Mining Incentives (60%) – Earned through WiFi sharing, mining operations, CDN nodes, and more.

-

Early Investors & Airdrops (28%) – Distributed to early investors, TGE participants, and community airdrop campaigns.

-

Team Allocation (12%) – Reserved for the core team, vested gradually over

6 years to ensure long-term stability.

Token Utility:

Mining Rewards

Users can earn

$ROAM tokens by contributing

WiFi, running mining nodes, and providing storage services.

Mining nodes generate

long-term passive income within Roam’s ecosystem.

Points Conversion

Roam operates a

dual-layer economic system:

Roam Points + $ROAM Tokens.

Users can

burn points to exchange for $ROAM, with market-driven conversion rates ensuring token stability.

Transaction Fees

eSIM data purchases, CDN usage, NFT transactions, and other services require

$ROAM payments.

A portion of on-chain transactions is

burned, introducing a

deflationary mechanism.

Staking Mechanism

Mining node operators can

stake $ROAM to increase mining rewards, with

staking amounts influencing mining power.

Staking also unlocks

discounted data rates, priority network access, and ad revenue sharing.

Governance

$ROAM functions as a

governance token, allowing holders to

vote on ecosystem policies, economic adjustments, and token burn mechanisms.

A

DAO (Decentralized Autonomous Organization) ensures the

fair and sustainable development of Roam’s economy.

Burn & Deflation Mechanism

-

Dynamic Burning: $ROAM tokens are

burned through points conversion, eSIM data purchases, and node usage fees, reducing overall supply.

-

Post-TGE Reverse Burn Mechanism: Tokens can be

converted back into points, encouraging token utilization and mitigating sell pressure.

V. Team & Funding

Team Information:

-

YZ (Co-Founder) – Developed Roam’s

User Flywheel, Node Flywheel, and AI Data Flywheel models. Led Roam’s transformation from MetaBlox into the

largest DePIN WiFi roaming network.

-

Jason Zhao (CTO) – Holds an

M.S. in Computer Science from Stanford University. Formerly at

Google DeepMind, specializing in

AI, blockchain, and decentralized networks. He leads Roam’s

core tech architecture and global

WiFi OpenRoaming expansion.

-

Roam’s core team members have extensive experience in

telecom, blockchain, data analytics, and hardware development, spanning

investment, ecosystem growth, and technical innovation.

Funding Rounds:

-

Strategic Round (March 2024) – Raised

$5 million, led by

Anagram and Volt Capital, with participation from

Comma3 Ventures, IoTeX, Awesome People Ventures, Stratified Capital, JDI Global, ZC Capital, Future3 Campus, ECMC Group, and DePIN Labs.

-

Seed Round (March 2022) – Raised

$2 million, led by

Collab+Currency and Synergis Capital, with contributions from

SNZ Holding, Crowdcreate, Future Life, and Slope.

-

Strategic Investment (April 2024) – Received funding from

Samsung Next (undisclosed amount), supporting Roam’s

global expansion in the DePIN sector.

VI. Potential Risks

User Growth Dependent on

Token

Incentives – If token rewards primarily attract speculative users, activity may decline over time. Additionally, if the

points-to-token conversion mechanism lacks a

sufficient burn ratio, inflation could impact long-term token value.

Revenue Model Still Developing – Roam’s revenue streams include

mining hardware sales, eSIM services, ad monetization, and CDN services, but these have yet to achieve

full profitability. Expanding

eSIM services may also face regulatory challenges in different countries.

VII. Official Links

-

Website:

https://weroam.xyz/

-

Twitter:

https://x.com/weRoamxyz

-

Telegram:

https://t.me/WeRoamXYZ