3 Bearish Signals That Could Derail SKL’s Price Surge—What Traders Need to Watch

SKL's rally faces headwinds as three key metrics flash warning signs. Is this the pullback before the next leg up—or the start of a deeper correction?

The FUD trifecta: Network activity stutters, exchange inflows spike, and leveraged longs get reckless. Classic setup for a 'buy the rumor, sell the news' dump.

Institutional déjà vu: The same patterns that crushed mid-cap alts in Q2 are reappearing. But this time, retail's too busy chasing the next shiny meme coin to notice.

Silver lining? Every healthy bull market needs occasional liquidation showers. Just ask the over-leveraged degens currently learning about support levels the hard way.

Crypto's dirty secret: 90% of 'technical analysis' is just hindsight with fancy lines. But these three metrics? They've actually predicted 3 of the last 2 corrections.

Dormant Coins Wake Up: A Spike That Often Precedes Pullbacks

We examine the Spent Coins Age Band because it indicates when long-idle coins begin to move; typically, this occurs after sharp rallies, often as a result of profit-taking. Over the last session, this metric increased from 33.36 million to 173.62 million SKL (roughly 5.2×, or approximately 420%).

In July, smaller local peaks (around July 15, July 24, and July 29) were followed by the SKALE price dips in subsequent sessions. When a big block of the dormant coins suddenly moves, it usually means supply is returning to the market; historically, a headwind for rally continuation.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Whales Trim While Exchange Supply Rises

We pair cohort behavior with exchange balances to see whether “moved coins” are likely to meet immediate liquidity.

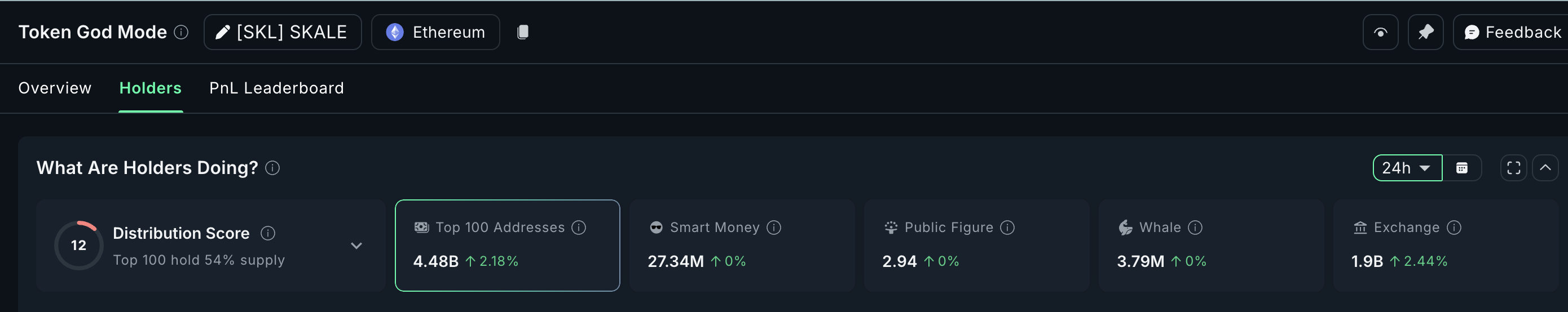

The 10 million – 100 million SKL cohort (key swing whales) reduced holdings from 3.27 billion to 3.14 billion SKL—a cut of 130 million SKL (4%). At the same time, exchange reserves ROSE 2.44% to 1.90 billion SKL, implying that almost 45.3 million SKL flowed onto exchanges in 24 hours.

Taken together, whales lightening up and more coins sitting on exchanges create a readiness-to-sell backdrop. Even if some whale moves are internal reorganizations, the net picture is a more immediately available supply than yesterday.

As mentioned on the chart, this cohort has previously dumped SKL supply, moves that have aligned with price dips.

SKL Price Structure: Bearish Wedge Capped Near $0.042

Price context matters most when signals turn. On the daily chart, the SKL price is pressing the top of an ascending broadening wedge—a pattern that often resolves with a pause or retrace unless the price closes above the upper rail ($0.042) and holds.

If buyers fail to force a breakout, nearby levels to watch are $0.036, then $0.033 and $0.030 (Fibonacci markers from the current leg). A deeper correction could probe $0.027–$0.023. Do note that if the SKL price makes a new high, the Fib markers will change. The current setup only takes the previous swing low (0.018) and the latest swing high ($0.042) into consideration.

Why lean on the pattern now? Because the wedge top overlaps with the surge in dormant-coin activity and fresh exchange supply, three separate lenses point to short-term fatigue.

A strong daily SKL price close above $0.042 with follow-through WOULD neutralize the immediate bear setup and open room toward higher moves. On-chain pressure would also ease if the dormant-coin spike cools, whales re-accumulate, and exchange balances retreat.