XRP Price Prediction 2025: ETF Launch and Bullish Technicals Signal Potential Breakout

- What Do the Technical Indicators Say About XRP's Price Movement?

- How Is the XRP ETF Launch Impacting Market Sentiment?

- What's Behind the Massive XRP Exchange Withdrawals?

- How Are Institutional Flows Affecting XRP's Price Stability?

- What Are the Key Factors Driving XRP's Potential Upside?

- What Are Analysts Saying About XRP's Future Price Trajectory?

- Frequently Asked Questions

XRP is showing strong bullish signals as we approach the end of 2025, with the recent launch of the first U.S. spot XRP ETF and positive technical indicators suggesting potential upside. The cryptocurrency currently trades at $2.2646, displaying bullish momentum on the MACD while hovering near Bollinger Band support. With $26 million in ETF volume within just 30 minutes of launch and significant exchange withdrawals reducing sell pressure, market conditions appear ripe for a potential breakout. This analysis examines the key factors driving XRP's price action and what investors might expect in the coming weeks.

What Do the Technical Indicators Say About XRP's Price Movement?

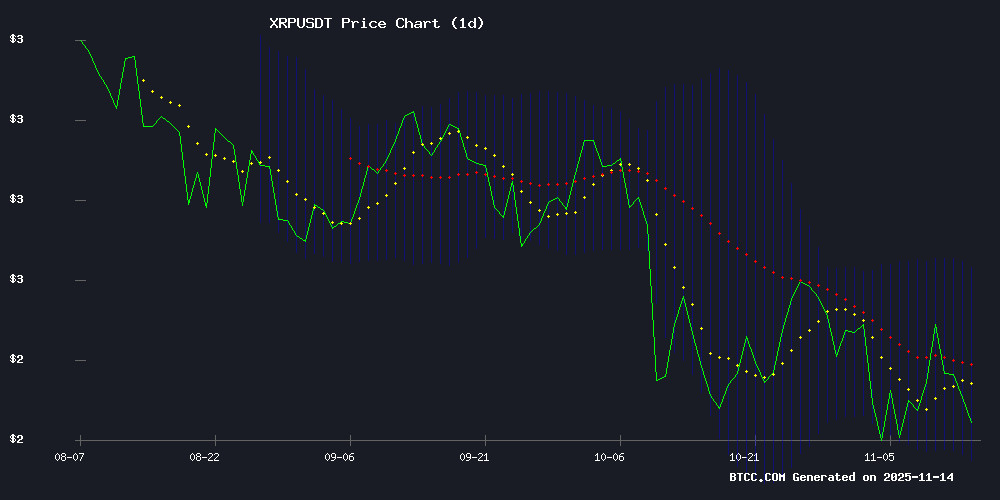

The BTCC technical analysis team notes that XRP is currently trading slightly below its 20-day moving average of $2.4173, which could serve as immediate resistance. The MACD histogram shows bullish momentum with a positive reading of 0.0342, while Bollinger Bands indicate the price is testing the lower band at $2.1490 - traditionally a potential buying opportunity when combined with other bullish signals.

Source: BTCC TradingView Chart

How Is the XRP ETF Launch Impacting Market Sentiment?

The November 13 debut of Canary Capital's spot XRP ETF (ticker: XRPC) on Nasdaq marked a watershed moment for institutional crypto adoption. Trading $26 million in volume within its first 30 minutes, the ETF's strong start suggests robust institutional interest. Bloomberg analyst Eric Balchunas noted this debut could surpass BSOL's $57 million Day One volume, while Bitwise CIO Matt Hougan called it a "watershed moment for crypto ETFs."

What's Behind the Massive XRP Exchange Withdrawals?

Data from CryptoQuant reveals an unusual movement of 149 million XRP (worth approximately $336 million) leaving centralized exchanges within 24 hours. This represents about 2% of available supply and suggests investors are moving to private storage rather than preparing for liquidation. Such large withdrawals typically reduce immediate sell pressure and often precede price rallies.

How Are Institutional Flows Affecting XRP's Price Stability?

REX-Osprey's hybrid XRP ETF has already attracted $131 million in assets, demonstrating Wall Street's growing appetite for regulated XRP exposure. The cryptocurrency has shown relative stability at $2.10 despite broader market volatility, with analysts attributing this to the combination of institutional inflows and reduced government regulatory uncertainty.

What Are the Key Factors Driving XRP's Potential Upside?

| Factor | Impact |

|---|---|

| ETF Approval | Increased institutional access |

| Exchange Withdrawals | Reduced immediate sell pressure |

| Technical Indicators | Bullish MACD, Bollinger Band support |

| Institutional Inflows | $10B market cap increase |

What Are Analysts Saying About XRP's Future Price Trajectory?

While some analysts remain skeptical about XRP reaching $3 in the NEAR term, the combination of technical factors and fundamental developments creates a compelling case for upside potential. The BTCC research team notes that a break above the 200-day EMA could propel the token toward $3, with institutional inflows potentially fueling longer-term targets of $5 or beyond.

Frequently Asked Questions

Is XRP a good investment in 2025?

Based on current technical and fundamental factors, XRP presents an interesting opportunity. The combination of ETF approval, institutional interest, and positive technical indicators suggests potential upside, though cryptocurrency investments always carry significant risk.

What price can XRP reach by end of 2025?

While predictions vary, technical analysis suggests that if XRP can break through resistance at $2.4173 (the 20-day moving average), it could test the $3 level. More ambitious targets around $5 WOULD require sustained institutional inflows and broader market support.

How does the XRP ETF affect retail investors?

The ETF provides easier access to XRP exposure without the complexities of direct cryptocurrency ownership, potentially bringing more institutional money into the ecosystem. However, ETF prices may not perfectly track spot prices due to premium/discount mechanisms.

Why did 149 million XRP leave exchanges?

Large withdrawals typically indicate accumulation by whales or institutions moving to cold storage. This reduces immediate sell pressure and often precedes price rallies, though the exact motivations behind specific movements are rarely known with certainty.

What are the risks of investing in XRP now?

Key risks include regulatory uncertainty (despite recent progress), cryptocurrency market volatility, potential ETF underperformance, and macroeconomic factors that could impact risk assets broadly.