SOL Price Prediction 2025: Key Factors Driving Solana’s Market Outlook

- SOL Technical Analysis: Is the Current Dip a Buying Opportunity?

- Corporate Confidence: Upexi's $50M Vote for Solana

- Solana's Roadmap: The Tech Behind the Token

- Market Psychology: Navigating the Fear and Greed

- Is SOL a Good Investment for 2026?

- SOL Price Prediction FAQs

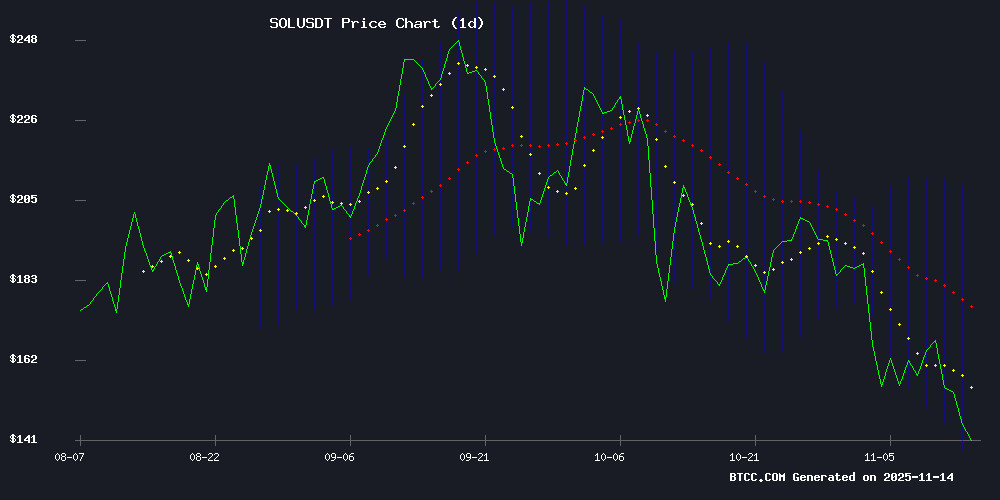

Solana (SOL) finds itself at a critical juncture as we approach the end of 2025. Currently trading at $142.54, the cryptocurrency shows signs of being oversold while simultaneously benefiting from strong corporate backing and network upgrades. This comprehensive analysis examines SOL's technical indicators, market sentiment drivers, and fundamental developments that could shape its price trajectory in the coming months. From Upexi's $50 million buyback program to Solana's ambitious roadmap upgrades, we break down the key factors every investor should consider before making trading decisions.

SOL Technical Analysis: Is the Current Dip a Buying Opportunity?

According to TradingView data, SOL presents an intriguing technical picture as of November 2025. The price sits below its 20-day moving average of $170.92, typically indicating bearish pressure, but the MACD histogram remains positive at 5.5763. What's particularly interesting is SOL's position NEAR the lower Bollinger Band at $134.53 - historically, this level has acted as strong support.

The BTCC research team notes that while the signal line (14.8155) remains below the MACD line (20.3918), suggesting some momentum weakness, the overall technical setup hints at potential for a reversal. "We're watching the $170 level closely," mentions a BTCC market strategist. "A decisive break above this middle Bollinger Band could trigger significant upside."

Corporate Confidence: Upexi's $50M Vote for Solana

Institutional interest in solana received a substantial boost when Nasdaq-listed Upexi announced a $50 million share buyback program. CEO Allan Marshall framed this move as a strategic concentration of SOL exposure, telling investors: "We're effectively doubling down on our conviction in Solana's ecosystem at what we believe are attractive valuations."

This corporate endorsement carries weight for several reasons:

- Upexi maintains one of the largest SOL treasuries among public companies

- The buyback represents nearly 20% of Upexi's market cap

- Execution will occur opportunistically during market dips

Market analysts interpret this as a bullish signal, suggesting sophisticated investors see long-term value in Solana despite recent volatility.

Solana's Roadmap: The Tech Behind the Token

Beyond price action, Solana's fundamental upgrades paint an optimistic picture for 2025-2026. The network's development team has rolled out two critical improvements:

| Upgrade | Impact | Timeline |

|---|---|---|

| Firedancer | Increases transactions per second by 5x | Q3 2025 |

| Alpenglow | Reduces consensus time to near-instant | Q1 2026 |

These technical enhancements address Solana's historical growing pains while positioning it as a leader in Web3 infrastructure. The network already hosts the most lucrative dApp ecosystem, generating more protocol revenue than ethereum layer-2 solutions combined.

Market Psychology: Navigating the Fear and Greed

Crypto markets in late 2025 reflect a curious dichotomy - while retail investors remain cautious, corporate treasuries are quietly accumulating. Upexi's MOVE follows a broader trend of crypto-native companies using buybacks to signal confidence during downturns.

"It's the institutional equivalent of buying the dip," explains a decentralized finance researcher. "When public companies with skin in the game put their money where their mouth is, smart traders pay attention."

However, risks remain. Solana's past network outages and validator issues, though less frequent in 2025, still linger in investor memory. The BTCC team advises: "Diversification remains crucial - never allocate more to SOL than you can afford to lose."

Is SOL a Good Investment for 2026?

Based on current metrics and developments, Solana presents a compelling risk-reward proposition:

- Upside potential: Technical bounce from oversold conditions + corporate backing + network upgrades

- Downside risks: Macro crypto volatility + potential network issues + competitive pressures

The BTCC research team summarizes their outlook: "SOL at current levels offers an attractive entry for long-term holders, but traders should maintain strict risk management given crypto's inherent volatility."

SOL Price Prediction FAQs

What is SOL's price prediction for end of 2025?

Technical analysis suggests SOL could rebound to $180-$220 range if it holds above $134 support, though market conditions remain volatile.

Why did Upexi announce a $50M buyback?

The company views current SOL prices as undervalued and aims to concentrate its crypto exposure per share during market weakness.

How will Solana's upgrades affect SOL price?

Firedancer and Alpenglow improvements should enhance network reliability and throughput, potentially increasing adoption and demand for SOL tokens.

Is now a good time to buy SOL?

While technicals suggest SOL is oversold, investors should assess their risk tolerance and consider dollar-cost averaging given crypto volatility.

What are the main risks to SOL's price?

Key risks include broader crypto market downturns, network outages, and competition from other layer-1 blockchains.