Best Ethereum ETFs In Canada For 2025

With a market capitalization of about $607 Billion CAD, Ethereum is the second-largest cryptocurrency and is poised to introduce several network upgrades this year, meaning investors are salivating at the prospect that Ethereum might surpass Bitcoin as the world’s most popular cryptocurrency.

Ethereum ETFs were consequently been among the top performers in the Canadian market and Canadian investors looking to access the trend have a variety of ETFs that track the price of Ethereum to choose from. This article will introduce the best-performing Ethereum ETFs in 2025, thus helping Canadians make the best choice.

BTCC, one of the longest-running crypto exchanges in the world, supports crypto demo trading, crypto copy trading, crypto spot trading for 240+ crypto pairs, as well as crypto futures trading for 360+ crypto pairs with a leverage of up to 500Χ. If you want to start trading cryptocurrencies, you can start by signing up for BTCC.

\Trade On BTCC With 10 FREE USDT!/

Table of Contents

- What is an Ethereum ETF?

- Best Ethereum ETFs In Canada 2025

- Evolve Ether ETF (ETHR)

- CI Galaxy Ethereum ETF (ETHX)

- Purpose Ether ETF (ETHH)

- Purpose Ether Staking Corp. ETF (ETHC.B)

- How to Buy Ethereum ETFs in Canada?

- Final Words

- Where & How To Buy Ethereum (ETH) in Canada?

\Trade On BTCC With 10 FREE USDT!/

What is an Ethereum ETF?

[TRADE_PLUGIN]ETHUSDT,ETHUSDT[/TRADE_PLUGIN]

Best Ethereum ETFs In Canada 2025

The following section lists the best Ethereum ETFs available to trade on Canadian exchanges. These ETFs may be spot funds that invest in ETH directly, or they may provide indirect exposure to ETH by tracking its price movements.

Evolve Ether ETF (ETHR)

Launched by Evolve Funds Group Inc. In Aprile 2021, Evolve Ether ETF is world’s first Ether ETF. ETHR provides investors with exposure to the daily price movements of the U.S. dollar price of Ether by utilizing the benefits of the creation and redemption processes offered by the exchange traded fund structure. The benefits of ETHR include:

- Access to Ether directly in portfolios.

- Easy to trade: accessible through brokerage accounts.

- TFSA and RRSP eligible: this ETF is eligible for registered accounts.

[TRADE_PLUGIN]ETHUSDT,ETHUSDT[/TRADE_PLUGIN]

CI Galaxy Ethereum ETF (ETHX)

The CI Galaxy Ethereum ETF (ETHX) is an Ethereum exchange-traded fund (ETF) jointly launched by CI Global Asset Management and cryptocurrency company Galaxy Digital. Since ETHX directly tracks the price performance of Ethereum, its price movement is highly correlated with the price of Ethereum. Investors can indirectly participate in the Ethereum market by purchasing CI Galaxy Ethereum ETF.

As an exchange-traded fund, the CI Galaxy Ethereum ETF is strictly regulated by regulators, providing investors with a compliant investment channel. Since its launch, the CI Galaxy Ethereum ETF has attracted a lot of investor attention and its trading volume has remained at a high level.

Purpose Ether ETF (ETHH)

The price performance of Purpose Ether ETF (ETHH) is highly correlated with Ethereum’s price. Due to the volatility of the Ethereum market, the price of ETHH will also be affected accordingly. This ETF provides physical exposure, by owning its shares investors earn the return of the securities composing the index (as the ETF holds them directly).

Purpose Ether Staking Corp. ETF (ETHC.B)

Launched by Cboe Canada, Purpose Ether Staking Corp. ETF (ETHC.B) is a unique investment vehicle that offers exposure to Ethereum and its staking rewards. Purpose Ether Staking Corp. ETF is also managed by Purpose Investment. This fund not only offers investment opportunities in Ethereum but also generates additional income through the staking of Ether. The held Ether is also stored using a cold wallet to ensure the security of the assets.

Its launch represents a significant development in the world of crypto ETFs and could have implications for the broader market as it continues to evolve and integrate cryptocurrencies into traditional financial systems. By participating in Ethereum staking, this ETF aims to capture the rewards distributed to validators on the Ethereum network. These rewards are in addition to any potential capital appreciation in the value of Ethereum.

[TRADE_PLUGIN]ETHUSDT,ETHUSDT[/TRADE_PLUGIN]

How to Buy Ethereum ETFs in Canada?

Investing in Ethereum Exchange-Traded Funds (ETFs) in Canada is a straightforward process that can be completed in just a few steps. Here’s how to get started:

1. Choose a Trusted Platform and Open an Account

Begin by selecting a reputable brokerage or trading platform that offers access to Canadian-listed ETFs. For beginners, it’s best to choose a user-friendly and regulated provider such as Wealthsimple, Questrade, or TD Direct Investing.

Create an account by providing your personal details, including your full name, date of birth, address, and Social Insurance Number (SIN) for tax purposes. You’ll also need to verify your identity using a government-issued ID such as a passport or driver’s license.

2. Fund Your Account

Once your account is set up, you’ll need to deposit funds. Most Canadian platforms support payment methods like:

-

Bank transfers

-

Interac e-Transfer

-

Wire transfers

Choose the method that’s most convenient for you and fund your account with the amount you wish to invest.

3. Research and Select an Ethereum ETF

Use the platform’s search function to find Ethereum ETFs by their ticker symbols. Popular Ethereum ETFs in Canada include:

-

ETHH (Purpose Ether ETF)

-

ETHX (CI Galaxy Ethereum ETF)

-

QETH (3iQ Ether Fund)

Take time to review each ETF’s performance, management fees, holdings, and risk profile. Most platforms provide real-time data and in-depth fund details to help you make informed decisions.

4. Place Your Order

Once you’ve chosen an ETF, you can place an order to buy shares. You typically have two options:

-

Market Order: Executes immediately at the current market price.

-

Limit Order: Executes only when the ETF reaches your specified price.

Enter the number of shares you’d like to purchase and confirm the order. The process is quick and user-friendly.

5. Track and Manage Your Investment

After your purchase, the ETF will appear in your account portfolio. You can monitor its performance over time, set alerts, or schedule future purchases based on your investment strategy.

What You’ll Need to Get Started:

-

A smartphone or computer with internet access

-

A government-issued ID (e.g., passport or driver’s license)

-

A Canadian bank account or payment method

-

Approximately 15 minutes to complete the setup and first purchase

Final Tip: ETFs are a regulated and accessible way to gain exposure to Ethereum without directly owning or managing cryptocurrency. As with any investment, be sure to evaluate your risk tolerance and consult a financial advisor if needed.

\Trade On BTCC With 10 FREE USDT!/

Final Words

Since the approval of the first SPOT Ethereum ETF by the SEC, Ethereum ETFs have seen many ups and downs. For Canadian investors who are bullish on the long-term development of Ethereum, long-term holding of Ethereum ETFs may be a good choice.

However, as any investment carries with both opportunities and risks, investors need to fully understand their investment strategy, fee structure and potential risks, then develop an appropriate investment strategy based on their risk tolerance and investment objectives.

\Trade On BTCC With 10 FREE USDT!/

Where & How To Buy Ethereum (ETH) in Canada?

ETH USDT-margined perpetual futures contract with a leverage of up to 500x is available on BTCC, you can trade Ethereum (ETH) Perpetual Futures Contract on BTCC at the most competitive price and highest security.

The following sets forth the guidance for trading Ethereum (ETH) Perpetual Futures Contract on cryptocurrency exchange BTCC:

Step 1: Create a BTCC account

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method.

Step 4: Place your crypto futures order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find the ETH/USDT trading pair.

You can also click the button below to directly enter the Ethereum (ETH) trading page⇓

[TRADE_PLUGIN]ETHUSDT,ETHUSDT[/TRADE_PLUGIN]

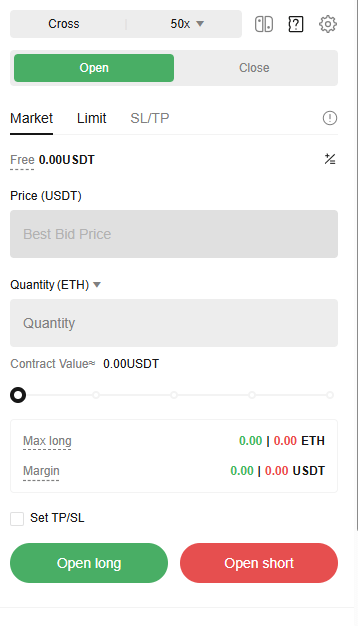

Then, choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

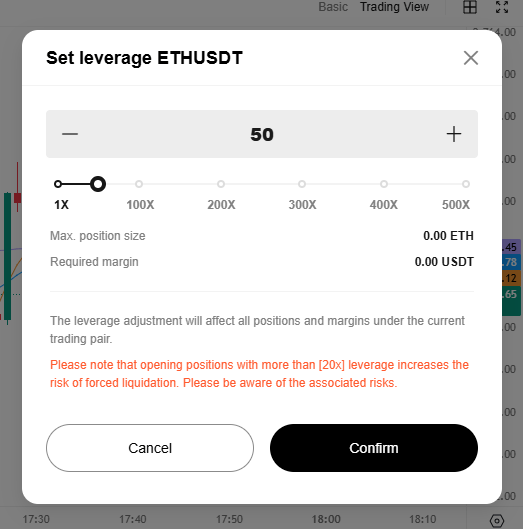

Next, adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Then, choose the lot size and set the SL/TP price. After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Finally, click the buy or sell button, and the Ethereum (ETH) futures contract order is completed.

\Trade On BTCC With 10 FREE USDT!/

Why Choose BTCC?

Fully licensed and regulated in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms for crypto trading. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High liquidity & volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Trade On BTCC With 10 FREE USDT!/

Recommended for you:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Top Free Crypto Sign-Up Bonuses In Canada For June 2025

Buy Bitcoin Canada: A Complete 2025 Guide

A Beginner’s Guide: How To Buy Meme Coins In Canada In 2025

A Beginner’s Guide: How to Trading Crypto in Canada in 2025

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

How To Buy Pi Network (PI) In Canada: A Comprehensive Guide In 2025

Pi Network Mainnet Launch Now Goes Live: Pi Network Price Prediction Post Mainnet Launch

How To Use Pi Network’s Mainnet In Canada: An Ultimate Guide In 2025

Pi Network (PI) Price Prediction: Will Pi Coin Reach $10 Amid Binance Listing Rumors?

Pi’s Open Network Launches February 20: Everything You Need To Know About It

Bybit Hack: Everything You Need To Know About It

Best Ethereum ETFs In Canada For 2025

Top Gold Stocks To Buy In Canada 2025

How to Buy Ripple (XRP) In Canada: A Complete Guide For Beginners

How to Buy Binance Coin (BNB) In Canada: A Comprehensive Guidance For Beginners

Best Crypto Wallets Canada 2025: Top & Secure Picks!

Top Canadian Crypto Stocks to Buy in 2025

Hottest Cryptocurrencies To Buy In Canada For February 2025

Best Bitcoin ETFs To Buy In Canada For 2025

Best Crypto Trading Bots in Canada For 2025

BTCC vs. Bybit vs. eToro:which is the best choice for you?

Compare BTCC vs. Binance: Which is a Better Choice for Canadian Traders in 2025?

BTCC vs. NDAX: which is a better choice for crypto trading in Canada?

How to Choose Best Crypo Exchanges in Canada

Canada Cryptocurrency Market Analysis and Outlook 2025

Best Crypto Exchanges Canada 2025

Trump Wins 2024 Presidential Election, Boosting Bullish Sentiment Within Crypto Community