What Are Stochastic Oscillator and Relative Strength Index?

What Are Momentum Indicators

Momentum indicators are commonly used by trader to make forecast on market trends and changes. However, not all indicators are useful in all type of market condition. This time, we will discuss two most commonly used indicators, Stochastic Indicator and Relative Strength Index, and evaluate their reliability in different market condition.

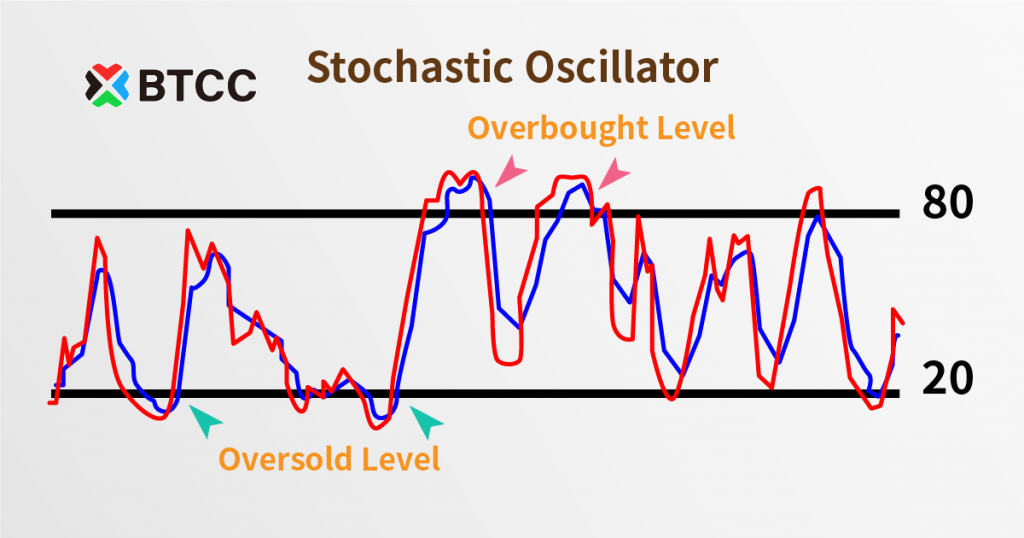

Stochastic Indicator

Stochastic indicator uses a scale of 0 to 100 to represent the momentum and trend strength for the market. This indicator can help trader to find an entry point for the market trend at the beginning.

When the stochastic lines are above 80, it indicates the market is overbought, and there is a high possibility that a downtrend will follow. While, the reading below 20 mean that the market is oversold, which is likely that uptrend will follow.

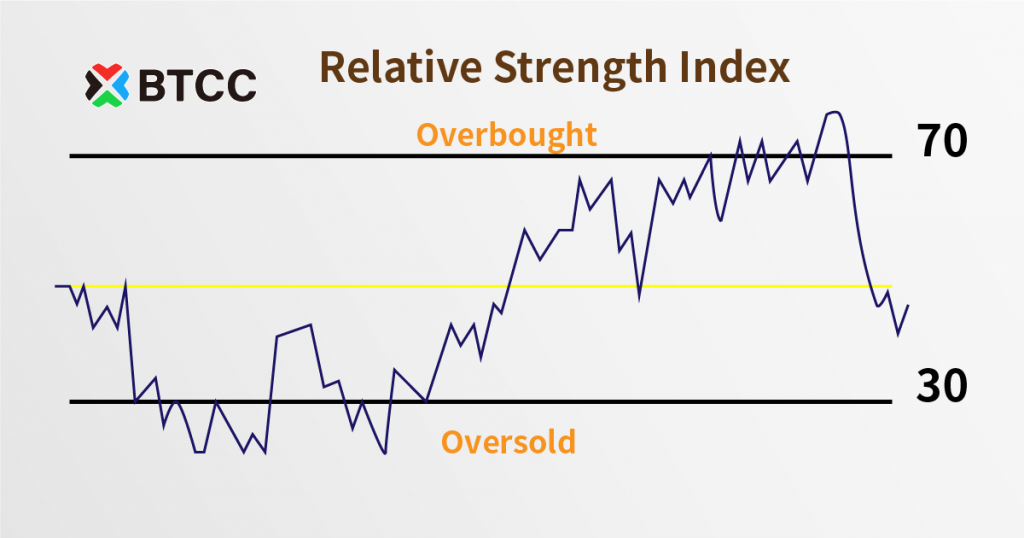

Relative Strength Index (RSI)

Similar to Stochastic Indicator, the RSI also use a scale of 0 to 100. The RSI measure the speed of price movement in which the slope of the RSI is directly promotional to the velocity of the price movement.

When RSI value reach above 75, it means a possible overbought market, while RSI value below 25 mean a possible oversold situation.

Difference between Stochastic Indicator and RSI

The goal of both indicators are different, the RSI is design to help measure whether the price has move too far or too fast, and RSI is work best in a trending market. While, Stochastic indicator help trader to identify whether the price has moved to the top or bottom of a trading range, and it implicate a non-trending market.

Trade Now: https://bit.ly/32vH17P

Disclaimer: Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

Follow us on social media!