How to Make Money Trading Forex

Forex Trading is the exchange of one pair of currency for another. Every nation has a designated currency, and with advances in global trading volumes, payments in non-resident currencies are ever-increasing. Therefore, forex trading bridges the gap by facilitating the exchange and settlements of payments dues and requested currencies.

With the rise in access to the internet and technology, many individuals and institutions can trade on forex. And one question every trader should have a resounding reply to is: How to make money on forex trades.

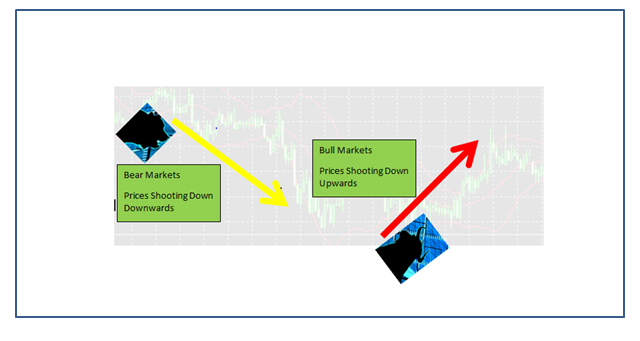

Bull markets are when prices trend upwards, while bear markets are when prices trend downwards.

My inception into forex trading had the blessings of a great mentor, and I’m happy to help you explore the tiny bits you must not overlook so that you can make good returns when you do forex.

Now, over to you:

Master Risk Analysis

Let no one ever lie to you; forex trading is a very risky business, in case you are unaware of how best to do it. Where exactly is the risk?

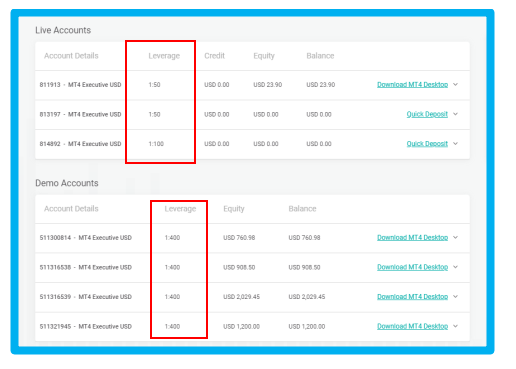

The most significant risk comes in leveraging, where brokers allow you to borrow capital to open and hold positions latently.

| You May Like: Use CFDs to trade bitcoin & crypto which are more volatile than forex pairs to make heavy profits quickly. |

Most brokers offer varying terms for leverage, some up to 1000 times your commitment.

What’s the catch? You can commit a dollar and win upwards of 1000 times that dollar. Else if you can lose the same dollar, but up 1000 times for the adverse side.

Firstly, managing risks in forex point to managing trader’s stakes to find a winning nexus between greed and leveraging.

Secondly, traders require more than ever mastering risk within the entire forex industry. Things happen within forex markets, and it’s no joke when traders lose all capital within a fraction of a minute. I’ve seen it happen in front of my eyes.

To help wannabe forex traders gain a solid foundation, here is a list of things one must internalize once and always for them to win in forex trading.

Pro-Tip: Even professional traders lose some trades. However, they make it a sure bet that their profits outdo their losses, always.

Fundamental Analysis

In forex trading, the fundamental analysis attempts to get the correct intrinsic value of a currency. If it’s undervalued, traders but it at low prices and also sell it if the opposite is the case (Overvalued)

Initially, it may be very challenging to get to the bottom of this, but novice traders become pros at it over time.

Technical Analysis

Technical analysis involves traders looking at charts: forex brokers allow bar charts, line graphs, and the candlesticks. It’s from the behavior of the graphs that traders gain inference of predictions.

I recommend using candlesticks, and I consider myself lucky to have come across Ryner Teo’s eBook for reading the candlestick patterns.

Sentimental Analysis

When it comes to sentiment, here traders narrow down to grasp the general feeling of trades behavioral patterns within the domain of price in the light of demand and supply.

Here are two tips that derive from sentiments.

One: Gold prices dived down 4000+ pips. Reason: This is from 27 to 28 October 2020, and the US election fever is high, with the election date being 3rd November 2020.

Two: Prices of Gold against the US Dollar (XAUUSD) always go in opposite directions with the USDJPY at any one time.

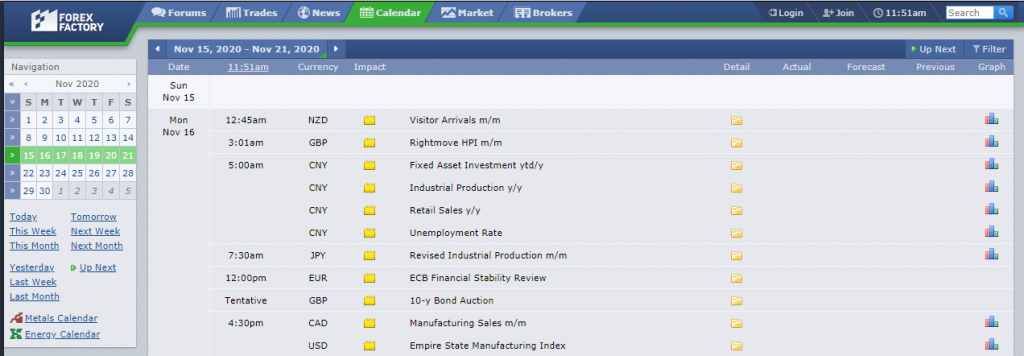

Three: Smart and winning traders keep tabs on what is happening around them, both locally and internationally. My mentor hooked me into this portal: forexfactory, where industry experts look at actual and upcoming events that affect forex prices.

Image source: forexfactory.com

Pro-Tip: Forexfactory marks news as low, medium, and high impact on the specific currency. Their portal is interactive enough to show you the countdown to each.

Stakeholders keep tabs, and at varying durations, you notice the reactions with forex prices via the charts.

Pro-Tip 2: Some traders thrive by mastering trading on high impacts of news.

Trend Analysis

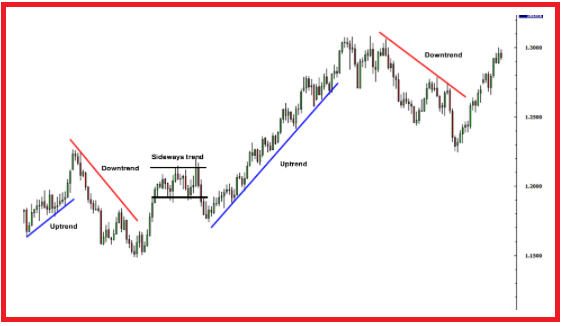

Winning traders mostly trade with the trend. Therefore, it’s a significant step if one can draw out the trend lines.

Once a trader can know the trend-lines direction, they can open and close profitable positions along with it.

Principally, go short for downtrends. Go long for uptrends.

Sideways or choppy trends are very risky, and most traders can choose to stay out of such markets. But, some confident traders also make money by opening positions within the support and resistance lines.

Image source: babypips.com

Portfolio Diversification

One other smart way to survive and make smart returns on forex is to diversify a portfolio. One good instance is trading on the five best pairs of currencies as opposed to one.

In financial circles, diversifying is spreading risks. Also, ordinarily, guys will tell you, do not place all your eggs in one basket.

| You May Like: Use CFDs to trade bitcoin & crypto which are more volatile than forex pairs to make heavy profits quickly. |

Work with a Tested, Verified Strategy

After initial indoctrination, master the basics but advance efforts towards crafting several winning strategies. Take a reasonable time to run tests with each. Which one gives your least losses and best returns? Pick that as your winning strategy.

Get Professional Training or Mentors

Professionals in the picture will help you come to speed with grasping and deploying strategies. Best if you can engage a credible mentor. Mastering forex trading is lucrative but has many pitfalls for novices.

On the same, the value a mentor imparts to a novice is an invaluable pack of benefits.

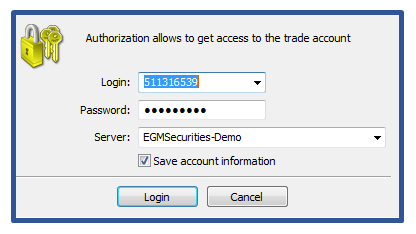

Use Demo Trading Accounts

Starting on a demo is wonderful. You get a feel of a pilot’s deck, less the injuries in actual circumstances.

If used optimally, demo accounts allow one to simulate actual trading as you master the trends and indicators. Good brokers allow you demo accounts for free.

Checklists Before Funding Live Accounts

To make money on forex, arm yourself with a winning, tried, and tested strategy. Benchmark adequately: have you been able to double the amounts in your demo account with ease? If yes, you are good to go with funding and trading on live accounts.

Timing of Trades and Markets

Winner traders in forex do not just press to open trades.

- Ask yourself, where does your pair find the best price movements? Is it within Tokyo, Sydney, London, or New York sessions?

- How best do you open and close positions? Is it every interval of 15 minutes or hourly or daily? Some may rally up to months.

With a precise timing of trade entry and right session, you stand chances to win best.

Select a Good Broker -With Best Spreads and Discounts For Starters

Onboarding with brokers matters towards you, making money trading on forex. Most significantly is the spread they offer you. Shop around and go for the broker with the lowest spreads – they allow you to hit profit much easier.

Also, good brokers may help you with some capital to fund your account when you meet set conditions while onboarding with them.

Overall, a good broker helps you learn and grasp up concepts towards upscaling your trading engagements. They go for a win-win scenario, where trader-warfare and profiting is part of their core business.

Final Thoughts

Forex trading is very risky but equally very rewarding if you do it with the right strategy.

There are many ways to beat riskiness. You can master trading as an individual or have in place a plan to pool capital and pay a master trader to trade on your behalf – you share profits or losses after a stipulated period. Either way, you can win in forex trading.

Also, never stop learning and employing whatever you learn along.

| You May Like: Use CFDs to trade bitcoin & crypto which are more volatile than forex pairs to make heavy profits quickly. |