How to Buy and Sell DASH Futures on BTCC

DASH is one of the main cryptocurrencies for anonymous payment. It is the first cryptocurrency, the goal of Dash is to protect investors’ privacy. The total issuance of Dash is 18.9 million, and the current circulating market value is approximately US$1.006 billion.

You can buy and sell DASH coins, buy at a low price and sell at a high price to invest in DASH. However, this method is only effective when the DASH price rises. In addition, leveraged trading is not allowed.

BTCC cryptocurrency derivatives margin trading platform can solve these shortcomings. DASH allows you to benefit from DASH fluctuations. In addition, these derivative have built-in leverage, you can use small asset to trade large transactions.

7 steps to quickly complete buying and selling DASH futures on BTCC

STEP 1: Open the BTCC margin trading buying and selling interface

STEP 2: Choose the type of DASH margin to buy

STEP 3: Select the type of DASH order

STEP 4: Choose the leverage to add

STEP 5: Choose the lot size to buy

STEP 6. Set the stop profit and stop loss price

STEP 7. Choose direction: bullish “buy”, bearish “sell”

STEP 1: Open the BTCC margin trading buying and selling interface

Log in to the official website of BTCC.com and click Margin Trading on the main menu. Or directly enter the web version link: https://trade.btcc.com/, and log in at the upper right corner of the page;

If you have not opened an account with BTCC, click here to quickly register a free account and top up the initial amount. You can deposit at least 2 USDT for an attempt. If the deposit amount is greater than 500 USDT, you can receive up to 2,000 USDT bonus.

STEP 2: Choose the type of DASH margin trading to buy

Choose DASH perpetual contract

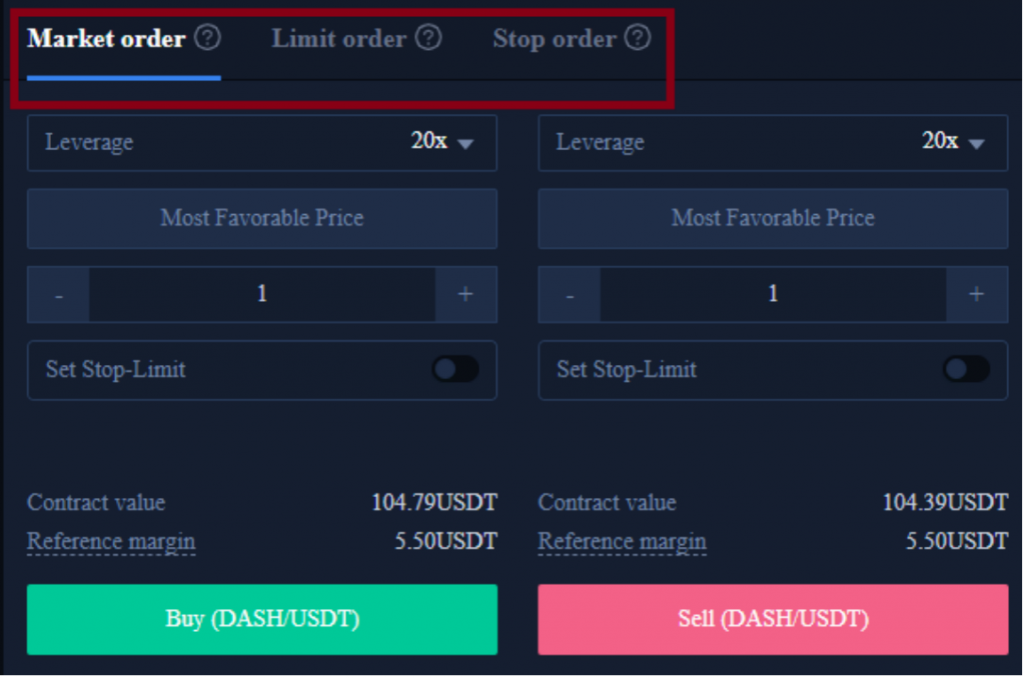

STEP 3: Select the type of DASH margin trading order

Select the BTCC margin trading order type at the top right of the page. BTCC margin trading orders are divided into market orders, limit orders and stop loss orders.

·Market orders: Users place orders at the best price in the current market to achieve fast trading.

·Limit order: A limit order is used to copy the top/bottom, and refers to a buy/sell price set by the user. After the market reaches the limit price, the margin trading can be executed.

·Stop Order: A stop order can be understood as a “”breakthrough order””, which is an advanced limit order, and users can customize a buy/sell price. After the market reaches the limit price, the margin trading can be executed.

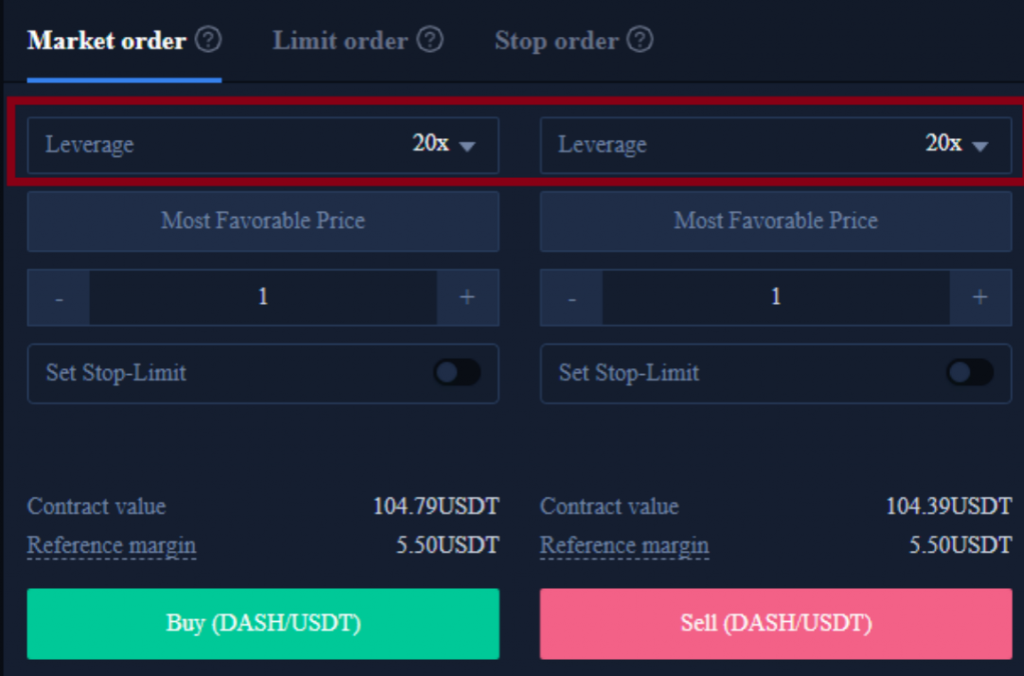

STEP 4: Choose the leverage to add

BTCC provies 20x DASH/USDT perpetual swap.

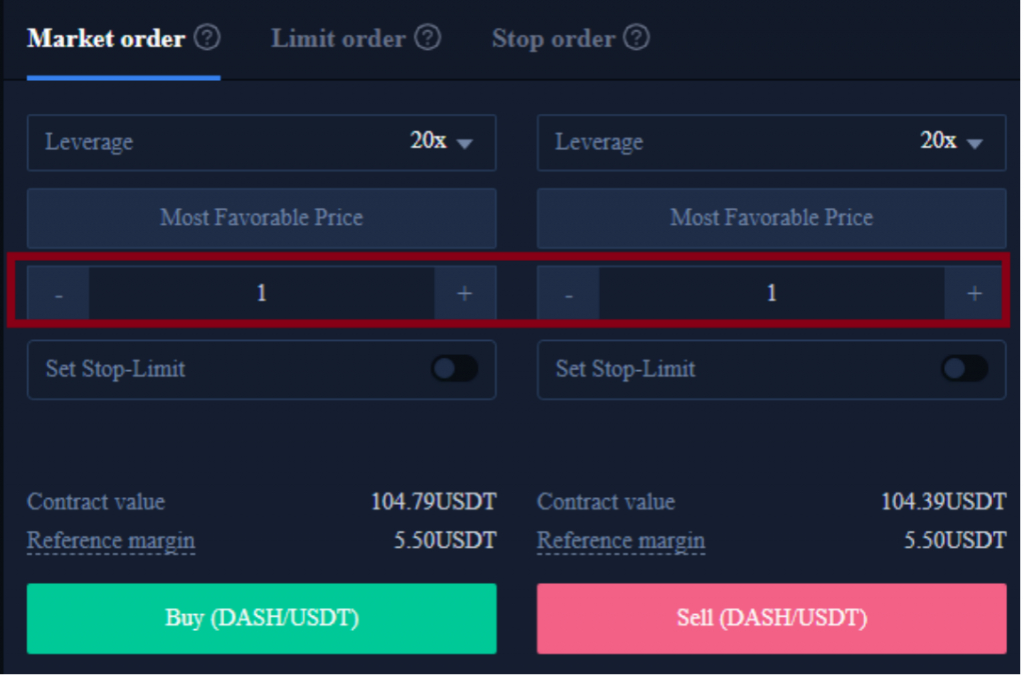

STEP 5: Choose the lot size to buy

The DASH trading unit at BTCC allow users to choose the number of lots based on their investment situation, and the range can be selected from 1 to 300 lots. There are real-time contract values and reference margins below.

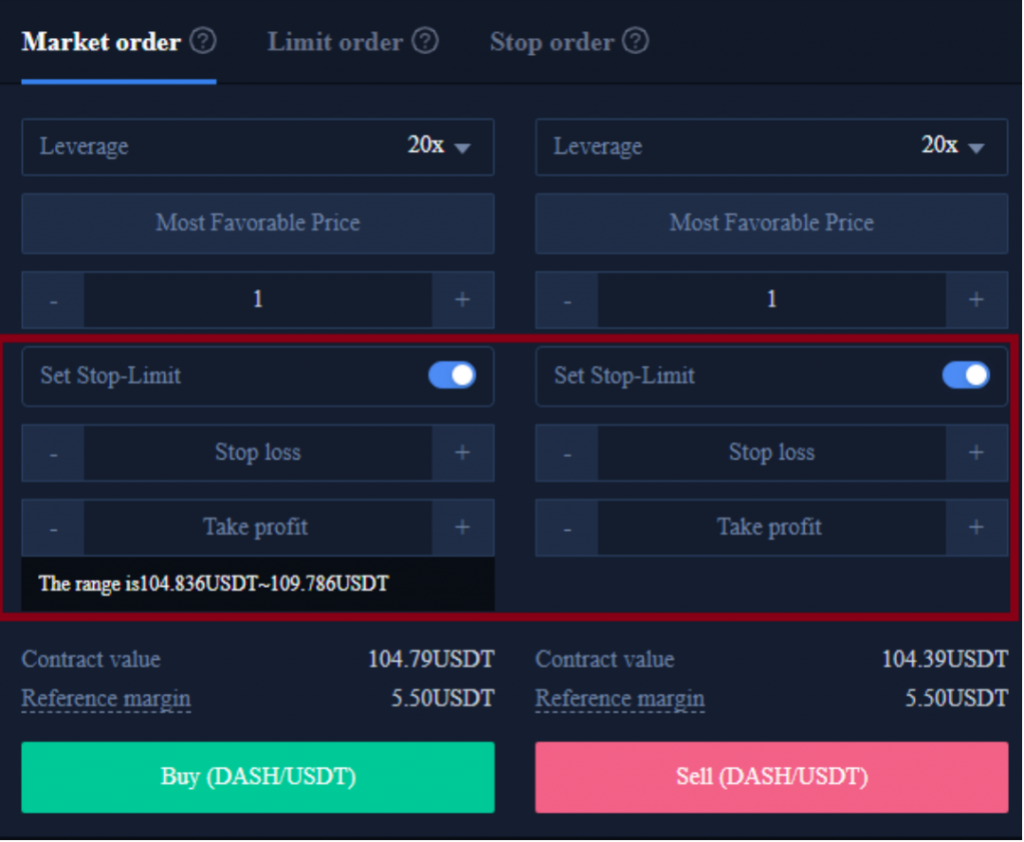

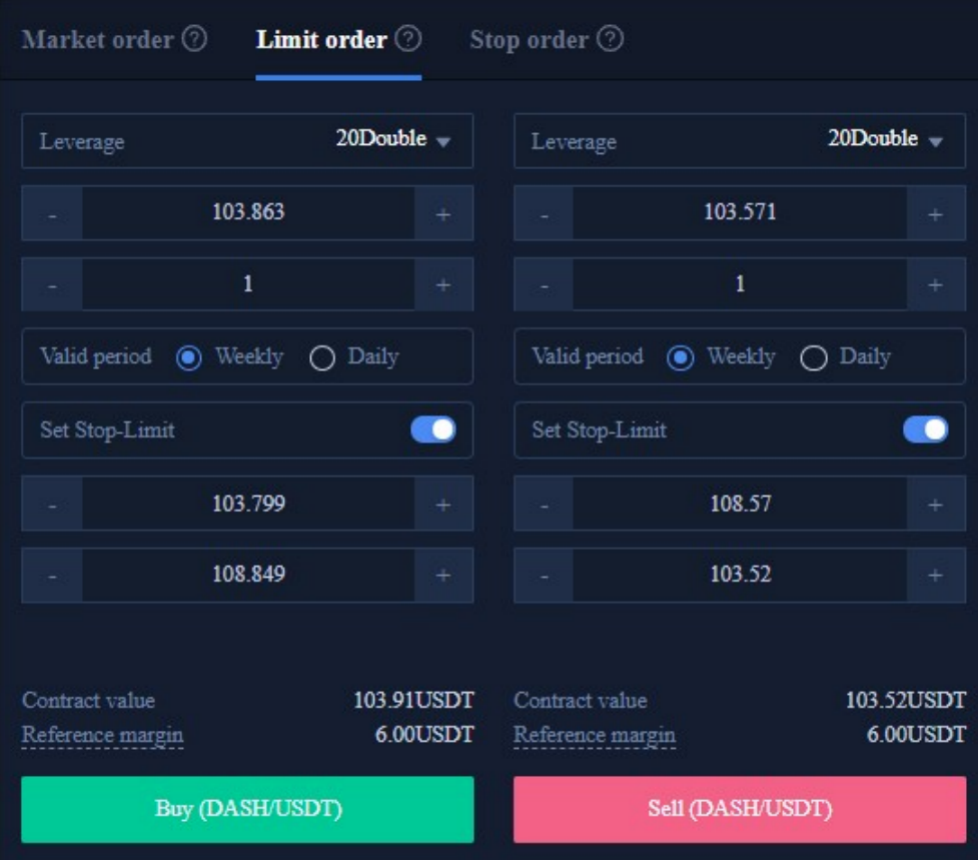

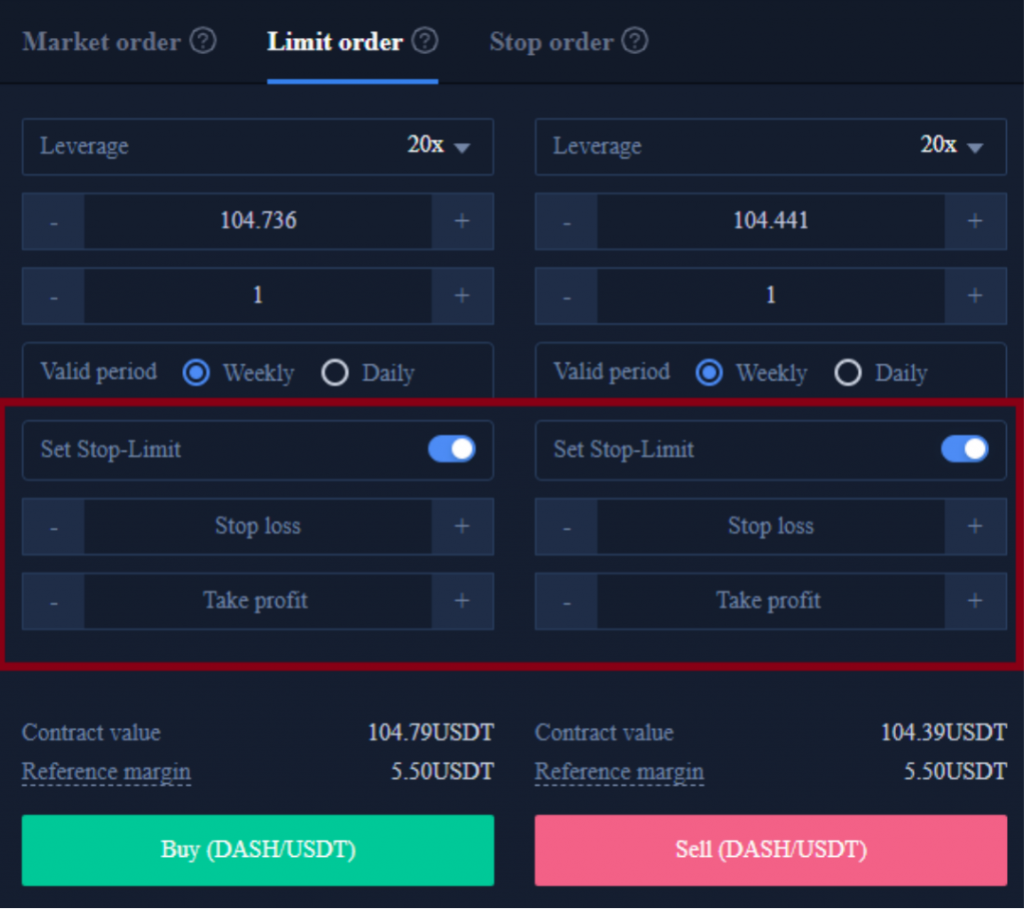

STEP 6. Set the take profit and stop loss price

Market orders, limit orders and stop orders all need to set a take-profit and stop-loss price. The difference is that market orders are executed immediately at the best price, while limit orders and stop orders need to be set for the same day or a week.

STEP 7. Choose direction: bullish “buy”, bearish “sell”

After setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Note that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform. Click the buy or sell button, and the DASH order is completed.

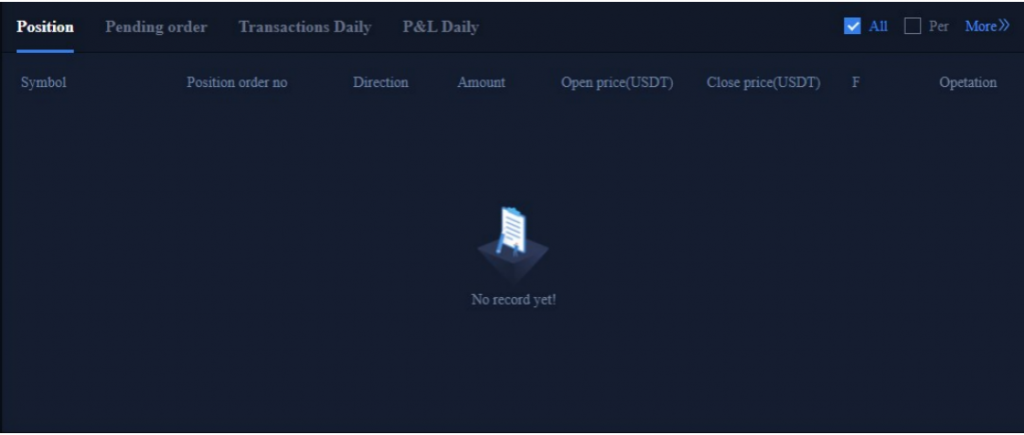

Finally, after the margin trading is completed, it will be displayed at the bottom of the position page; if there is no trading to be executed, it will be displayed at the bottom of the pending order page.

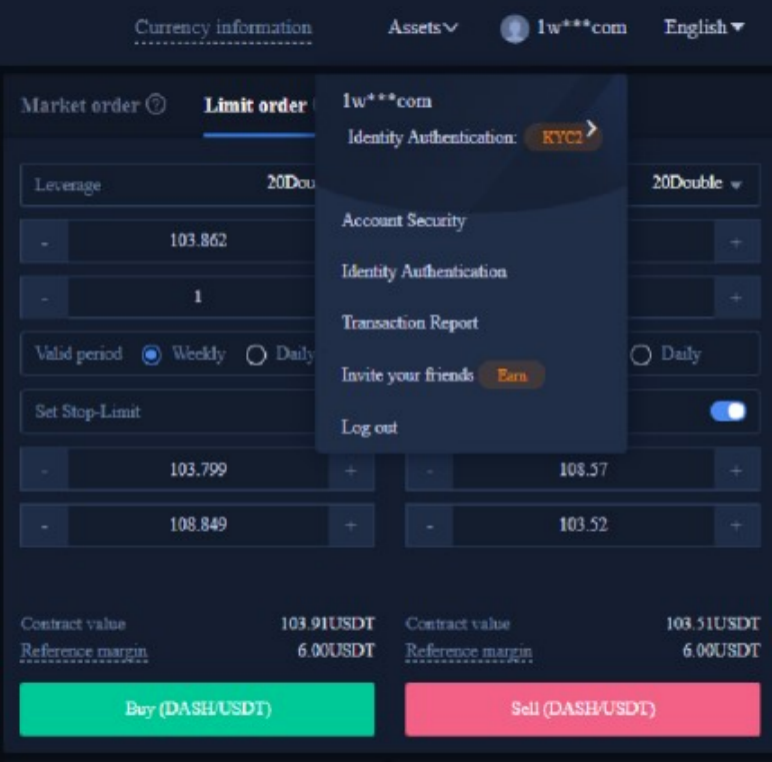

For more orders information, you can click on the margin trading report at the top right of the page to view.

At this point, you have completed the DASH margin trading. If you have further inquiries, please contact the online customer service.