The 2026 Recession Playbook: How to Build Wealth When Markets Crash

Economic storm clouds gather for 2026. Traditional portfolios brace for impact. But a new breed of investor isn't just preparing to survive—they're positioning to thrive.

Forget Safe Havens, Find Asymmetric Bets

Recessions don't just destroy value; they redistribute it. While legacy finance scrambles for cover, digital asset markets have historically demonstrated a decoupling effect. Liquidity doesn't vanish—it migrates. The playbook isn't about hiding in cash; it's about identifying where the capital will flow when the old system seizes up.

The Infrastructure That Thrives on Chaos

Look past the price charts. Real opportunity lies in the protocols and platforms that solve real problems when credit dries up. Decentralized lending, non-custodial exchanges, and verifiable reserve assets aren't just crypto buzzwords—they're the operational rails for a parallel financial system. When banks tighten lending, DeFi pools remain open 24/7. When traditional markets freeze, blockchain settlements finalize in minutes.

Timing the Tide, Not the Waves

Macro-economic shifts are tides, not waves. Positioning for 2026 means building exposure now, during the calm. It means accumulating stakes in resilient networks with proven utility, not just speculative tokens. It's a boring strategy of disciplined accumulation, fueled by the cynical understanding that central banks will inevitably print their way out—flooding the system with liquidity that seeks the hardest, most transparent assets available.

The coming recession isn't a threat to the informed; it's a clearance sale on the future of finance—courtesy of short-sighted monetary policy and institutional myopia.

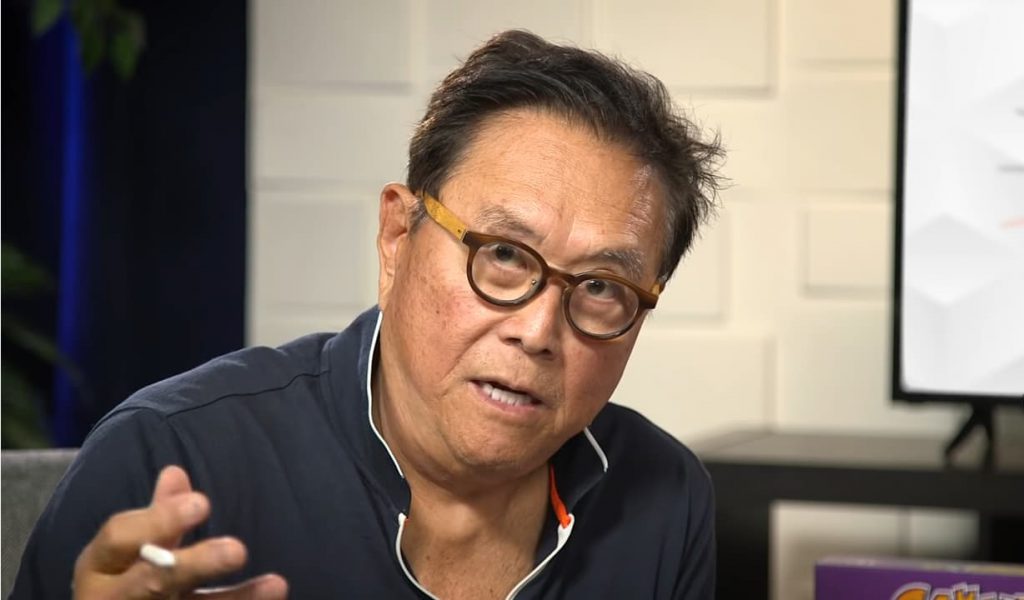

Kiyosaki Warns: Recession Is Nigh; Do This or Be Left Behind

In his latest X post, Robert Kiyosaki, the author of Rich Dad Poor Dad, has once again sounded a cautious alarm, adding how 2026 might be the year when recession hits the world. Sharing the data insights to back his claim, Kiyosaki said that ADP has announced 32,000 layoffs, with small businesses laying off nearly 320,000 workers. These signs are signalling global recession fears brewing over, with Kiyosaki suggesting ways to secure one’s wealth in such a scenario.

The Rich Dad Poor Dad author shared how to join Uber or Lyft service to begin to learn more about their “system,” all while suggesting starting a business that can survive the pangs of recessions by delivering value in those times.

Additional Tips and Predictions By Kiyosaki

The tweet further comprises two more methods of surviving and combating the looming recession. Kiyosaki suggested that structuring the real estate services by purchasing dilapidated properties and selling them before the crisis hits might be a good idea to survive the looming recession crisis.

. W

Lastly, Kitosaki advised his audience to go to school and learn a trade, as well as accumulate assets like gold, silver, and BTC to outsmart a recession.

..

Lesson #4: How to get richer when the economy crashes:

ADP just announced 32,000 jobs were lost in November.

Those job losses are from big businesses.

The frightening news is small businesses laid off 120,000 workers.

The bigger lay offs will begin in 2026 when the world…