21Shares Launches SUI ETF: Is a Massive Price Surge Imminent?

Another crypto ETF hits the market—this time, it's SUI's turn. 21Shares just flipped the switch on its SUI-focused exchange-traded fund, sending a fresh wave of institutional capital toward the Layer 1 contender. Forget waiting for direct spot approval; this is the backdoor play for big money to get exposure.

The Institutional On-Ramp Opens

This isn't just another product listing. An ETF acts as a regulated bridge, letting traditional finance giants dip their toes into crypto assets without the operational headache of custody. It signals a vote of confidence from a major issuer and opens the liquidity floodgates from pension funds, hedge funds, and your average brokeraged account—all with a single ticker.

Supply, Demand, and the Price Catalyst

Here's the simple math the market is pricing in: a new, massive pool of buyers enters the scene, while the circulating supply of SUI remains fixed. Basic economics suggests upward pressure on price. It's the same demand-shock narrative that propelled other assets post-ETF launch, just wrapped in a newer, shinier package.

A Reality Check for the Bulls

Let's not pop the champagne just yet. An ETF launch is a catalyst, not a guarantee. It brings liquidity but also scrutiny. Every price move will now be dissected by ETF flows data—a new kind of volatility. And remember, Wall Street's embrace often comes with strings attached, turning a decentralized asset into just another line item in a quarterly report. Sometimes, adoption looks a lot like assimilation.

The bottom line? A major barrier to entry just crumbled. Whether this translates into a sustained rally or a 'buy the rumor, sell the news' event depends on whether real demand meets the newfound access. One thing's for sure: SUI just got put on a much bigger map.

21Shares SUI ETF Launch Marks a New Chapter for Sui

According to ETF analyst Eric Balchunas, this development is rare because the coin’s very first ETF is leveraged—something that previously happened with XRP. This new product also becomes the 74th crypto Exchange Traded Funds launched this year and the 128th overall, reflecting how quickly regulated digital asset ETFs are expanding. Analysts expect another 80 ETFs to hit the market within the next 12 months.

The 21Shares ETFs team explained that $TXXS allows investors to double their exposure to it without navigating traditional leverage hurdles like margin calls or account minimums. Instead, $TXXS offers simple entry and exit through a normal brokerage account, making it “simply amplified.”

The launch highlights Sui’s strengths—easy onboarding via Google or Face ID, sponsored transactions that remove network-fee friction, and a growing user base. As it steps into traditional markets through Nasdaq, many investors see this as an important turning point.

How the Market Reacted: Coin Price Under Pressure

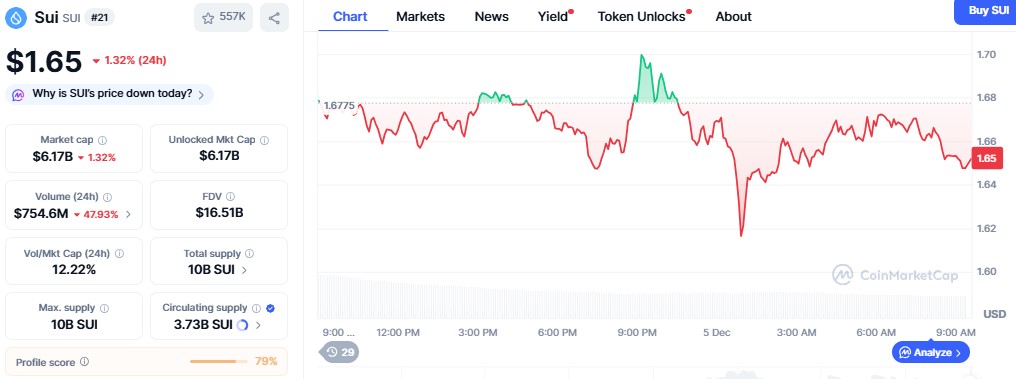

Even with the approval and launch, the SUI coin price did not deliver an instant jump. Instead, it dropped 1.32% in 24 hours, trading around $1.65 with a market cap of $6.17B and a strong 24-hour volume of $754.8M.

However, it registered a 7% upward spike on the weekly chart, indicating that broader sentiment remains cautiously positive.

From a technical viewpoint, it recently bounced back from a low level close to $1.20, with the RSI at 46.9, signalling neutral momentum, neither overly bullish nor weak enough to trigger panic.

What’s Next? Price Prediction After the SUI ETF News

Short-Term Outlook: Range-Bound Momentum

It is likely that, over the coming weeks, the coin will trade between a range of $1.40–$1.80. Should it succeed in a breakout above the level of $1.85, it could be pushed up toward $2.00, but if momentum weakens, it may retest $1.35.

Medium-Term View: Testing Bigger Levels

Between Q1–Q2 2026, reclaiming $2.50 becomes the key objective. If it crosses this level with rising volume, the next resistance lies between $2.80–$3.20, followed by a major hurdle at $3.50.

Long-Term Projection: Can It Revisit Highs?

By late 2026, if the ecosystem keeps expanding and market conditions recover, it could revisit the $4.00–$5.00 zone, matching earlier highs NEAR $4.30. A bearish macro trend, however, may cap gains at $3.00.

Conclusion

The launch of the 21Shares SUI ETF marks a major MOVE for the coin entering regulated markets. Until now, the price of the coin hasn't shown a sharp reaction. The long-term outlook depends on ecosystem growth, trading demand, and broader market recovery. For now, it continues to build momentum as Exchange Traded Funds adoption opens a new path for investors.

This is purely for educational purposes. Always do your own research before any crypto investment.