Crypto Markets Crash Due To Trump’s Proposed Tariff On China: Everything You Need To Know

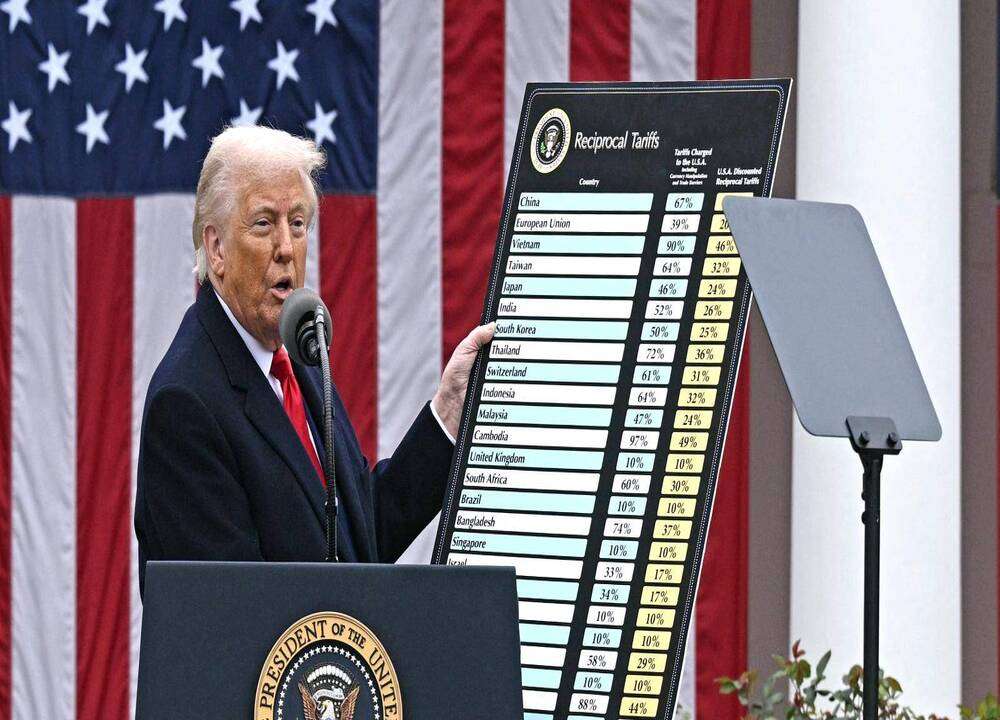

Global financial markets are shaking as U.S. President Donald Trump announced plans to impose a 100% tariff on Chinese imports, marking one of the most aggressive trade policy proposals in recent years.

Reigniting fears of a renewed U.S.–China trade war, the announcement triggered a swift and widespread sell-off of risk assets — from equities to cryptocurrencies. Within hours, Bitcoin, Ethereum and other major cryptocurrencies had plummeted, while investors sought the relative safety of gold and U.S. Treasuries.

This article analyzes how Trump’s proposed tariffs on China sent shockwaves through global markets, particularly the cryptocurrency sector, and explores what investors can expect next.

Trump Announces To Impose Additional 100% Tariff on China

On 10 October 2025, President Donald Trump publicly declared that the United States would impose an additional tariff of 100% on Chinese imports, effective from 1 November (or possibly sooner, depending on China’s response), alongside new export controls on ‘critical software.’

This additional tariff is intended to be added to existing duties, representing a significant escalation in US–China trade tensions.

Trump also announced the cancellation of a scheduled meeting with Chinese President Xi Jinping, citing a breakdown in trust and accusing China of ‘hostility’.

Earlier this week, China introduced export restrictions on rare earth minerals, which are critical to the manufacturing, AI, defence and technology industries, triggering concern that supply chain disruptions would have a global impact.

Trump accused China of becoming “very hostile,” pointing to curbs it took this week on exports of rare earth minerals. As part of the trade dispute, China also slapped new port fees on US ships and launched an antitrust investigation into US-based Qualcomm (QCOM).

The announcement spooked markets globally: investors viewed it as a possible return to trade war escalation, with unknown retaliation, broader sanctions, and geopolitical risk. The timing—amid a fragile U.S. fiscal environment and slow global growth—magnified the negative sentiment.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Bitcoin and Other Cryptos Plummet Amid Trump Tariff

Almost immediately following U.S. President Donald Trump’s announcement regarding potential tariffs on Chinese goods, the cryptocurrency markets experienced significant turmoil. Bitcoin plummeted by more than 8%, descending from above $120,000 to the range of $108,000–$110,000.

As of writing the article, Bitcoin (BTC) is traded at $ 117905.0000, witnessing a hefty 24-hour trading volume of $ 36.7B. Bitcoin (BTC) saw a 24-hour change of 0.24%, with minor fluctuations of -0.14% in the past hour.

Ethereum, Solana, and many altcoins followed suit, with declines ranging from 3% to 10%, reflecting widespread risk-off sentiment.

According to aggregated data, the total market capitalization of cryptocurrencies fell by over $200 billion as margin liquidations accelerated and overall sentiment deteriorated.

The Block reported that more than $125 billion worth of crypto assets were erased in the immediate aftermath of the tariff threat.

Liquidation cascades exacerbated the downward spiral, with long positions being forcibly closed and contributing to increased selling pressure and heightened volatility.

Crypto-related equities also suffered losses—companies such as Coinbase, MicroStrategy, and Robinhood experienced declines of between 3% and 10%.

This sell-off highlights the susceptibility of cryptocurrencies to macroeconomic and geopolitical risks. When investors move their capital out of risky assets, cryptocurrencies often become an immediate outlet, even before equities or bonds have had time to adjust.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Gold Price Surge Above $4,000 After Trump’s Tariff Warning on China

As crypto and equities plunged, gold rallied strongly. As U.S. President Donald Trump’s warning of possible fresh tariffs on China accelerated a flight to safe-haven assets, gold pared some gains after briefly rallying above the $4,000 an ounce milestone for a second time on October.

Spot gold was up 0.4% at $3,989.49 per ounce as of 1:40 p.m. ET (1740 GMT).

This move was bolstered by diminishing 10-year Treasury yields, which dropped as bond yields were bid up (prices rising) in the scramble for safety.

Geopolitical risks, alongside strong central bank gold-buying, exchange-traded funds inflows, U.S. rate cut expectations and economic uncertainties stemming from tariffs, have all contributed to gold’s rally.

Gold acted as a stabilizer in a world of increasingly volatile risk assets—and its rally acts as confirmation of capital rotation away from speculative assets like crypto.

[TRADE_PLUGIN]GOLDUSDT,GOLDUSDT[/TRADE_PLUGIN]

What’s Next: Will Crypto Market Recover?

Short-Term Outlook: Volatility and Reassessment

In the short term, the cryptocurrency market is expected to remain highly volatile. Traders and institutions will evaluate whether Trump’s tariff threats are merely rhetorical or carry substantive implications—and whether China will respond with further retaliatory measures. Any new escalation or confirmation (such as enforcement actions or legal filings) could potentially reignite panic in the markets.

Currently, market participants are either discounting potential outcomes or awaiting clarifications. Should Trump choose to back off or delay implementation of tariffs, a relief rally in both cryptocurrencies and equities may ensue. Conversely, if China responds with its own tariffs or restrictions, risk assets could experience more significant drawdowns.

The risks associated with margin trading and leverage continue to be unpredictable factors. Given that cryptocurrencies are frequently traded using high levels of leverage, even minor catalysts can lead to substantial price movements. Liquidations may further exacerbate trends in either direction.

Medium-Term Prospects: Structural Resilience Tests

For a sustainable recovery, the cryptocurrency sector must demonstrate resilience beyond mere speculation. This entails sustained institutional inflows, robust network activity, expanded use cases (including DeFi, staking, and NFTs), as well as regulatory clarity.

Macro-level risks will remain pivotal during this period. The crypto market must navigate expectations surrounding interest rates, inflation data releases, central bank policies, global trade developments—alongside geopolitical volatility.

If Bitcoin (and leading altcoins) can establish a solid base by regaining support levels and exhibiting strength in on-chain metrics (such as active addresses, transaction volume, and staking flows), then overall sentiment may gradually shift towards a more constructive outlook once again.

Longer-Term Scenario: Divergence Possible

Market participants remain divided on the long-term implications. While tariffs have caused immediate volatility, some experts argue that they could accelerate the adoption of Bitcoin as a hedge against a fragmented financial system. Over a multi-year horizon, the trajectory of cryptocurrency may become somewhat decoupled from trade policy surprises, so long as its adoption for use cases such as payments, financial infrastructure and tokenisation continues. In this optimistic scenario, significant setbacks such as tariff shocks may be viewed as opportunities to buy.

However, repeated policy shocks could make long-term capital allocators cautious, slowing institutional commitment. If trade tensions remain a recurring issue, crypto’s sensitivity to macro risks may become more pronounced and long-lasting.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

At a time when markets were already jittery, Trump’s proposal to impose a 100% tariff on Chinese imports rekindled fears of a full-blown trade war. The announcement swiftly rippled through the crypto markets, triggering a sharp sell-off and cascading liquidations, as well as a broader flight towards safe havens. The sharp drop in Bitcoin and the decline in altcoins reflects how sensitive risk assets are to geopolitical escalations.

Gold’s surge past $4,000 highlights how capital is reallocated in times of stress, and the appeal of more stable, time-tested stores of value. In this tumultuous environment, adaptability and informed decision-making will be crucial: those who navigate the situation wisely may emerge resilient, while others could find themselves caught up in this economic storm.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

About BTCC

Fully licensed and regulated in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

Why Choose BTCC Futures: A Comprehensive Guide For All Traders

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

BTCC Referral Code 2025: Inviting Friends To Sign Up On BTCC

Crypto Investing Guide:

Best Gold Stocks To Buy In Australia For 2025

Best Gold ETFs To Buy In Australia For 2025

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

How To Buy Pi Network (PI) in Canada: A Comprehensive Guide In 2025

How to Sell Pi Coin in Canada: A Complete Guide for 2025

Best Binance Alternatives In 2025

Best AI Agent Coins To Buy In 2025

8 Types of Crypto Scams to Avoid in 2025

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Crypto Tax In Australia: A Complete Guide For 2025

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

VWA Crypto Price Prediction 2025, 2026 And 2030: Is It A Good Investment In 2025?

Monad Airdrop Guide: How To Claim Your MON Token?

Aster Airdrop Guide & Tips: How to Claim The AST Token?

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

Best Free Bitcoin Accelerators 2025

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

What Is SUV Bitcoin Miner APK: Everything You Need To Know About It

Coinbase vs. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

eToro vs. CoinJar: Which Is A Better Crypto Trading Platform For Australian Traders In 2025

Coinspot vs. Swyftx: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

Arctic Pablo Coin (APC) Review & Analysis: Next 100x Token?

What Is Crundle (CRND) Crypto: Everything You Need To Know About It

Toshi (TOSHI) Price Prediction 2025, 2026 And 2030: Can TOSHI Hit $1?

How To Stake XYO For Earning $XL1: A Useful Guide For All Users

Zexpire (ZX) Coin Review & Analysis: Next 100× Big Token?

BullZilla ($BZIL) Meme Coin Review & Analysis: Everything You Need To Know About It

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Klarna Stock Price Prediction: How High Will It Go Post IPO?

Figure (FIGR) IPO Price Prediction: Will It Explode After IPO?

Gemini Stock Price Prediction: Will It Skyrocket Post IPO?

Bullish Stock Price Prediction & Forecast 2025 To 2030: Is BLSH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

American Bitcoin (ABTC) Stock Price Prediction 2025, 2026 And 2030: Is ABTC Stock A Buy Now?

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?