Recommended

Ethereum Gained $5.1M Million Last Week, While Bitcoin Lost $10.9 Million

2023/02/14By:

The crypto markets have been headed in a downward trajectory for the last couple of days. The current plummet may be attributed to various reasons, such as regulatory fears, action against certain firms, and new inflation data to be released today. Bitcoin and Ethereum have fallen from highs not reached since November 2022.

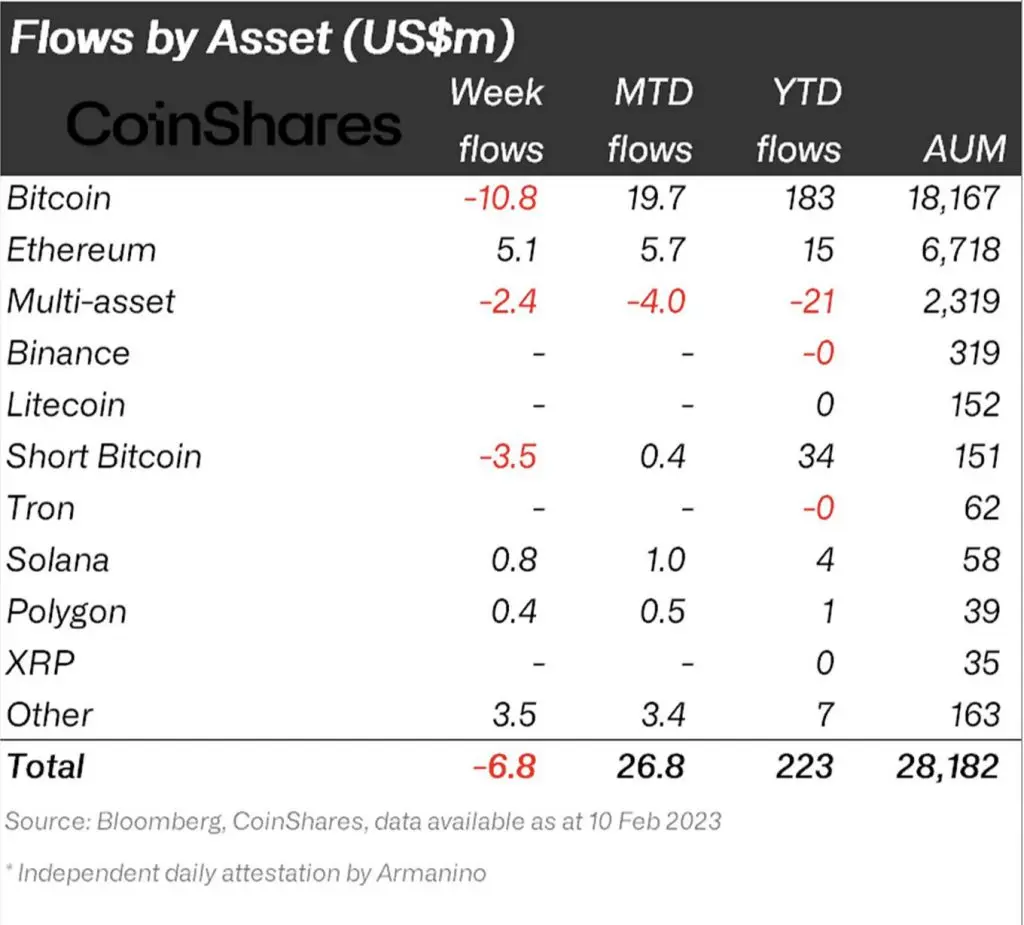

According to CoinShares’ “Digital Asset Fund Flows Weekly” report, digital asset investment products saw a total outflow of $6.8 million. As per the report, Bitcoin (BTC) saw outflows of $10.9 million, while Ethereum (ETH) saw inflows of $5.1 million. Additionally, there were outflows of $3.5 million from short-Bitcoin investment products.

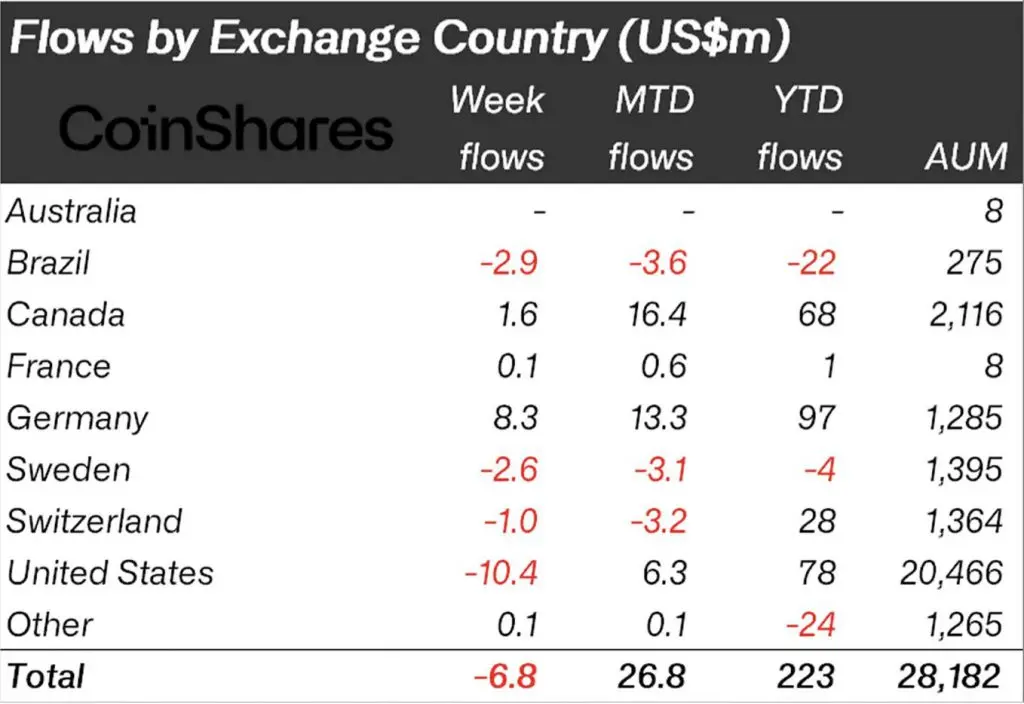

The country with the highest outflows is the United States, with $10.4 million. Meanwhile, Germany had the highest inflows, with $8.3 million. Europe as a whole saw inflows of $4.7 million. On the other hand, the Americas saw outflows of $11.7 million.

Last week, multi-asset investment products had withdrawals of US$2.4m, marking the 11th straight week of outflows. Blockchain shares are still popular, with inflows of US$6.7m in the previous week, increasing the year-to-date inflows to US$11m.

Will Bitcoin (BTC) and Ethereum (ETH) gain momentum soon?

Bitcoin and Ethereum are the two largest cryptocurrencies by market cap. Both currencies reached their all-time highs (ATH) in November 2021. However, it has all been downhill from there. Bitcoin has fallen 68.52% from its ATH, while Ethereum has fallen by 69.24%. Although the market did enter the greens when entering the new year, the rally seems short-lived.

With the US inflation data for January set to be released later today, there is a possibility that the FED could take a hawkish stance with its next interest rate. This is because the unemployment data for the US showed the lowest recorded number since 1969. This could add additional headaches for the FED.

Moreover, US consumers’ one-year inflation is expected to remain at 5%. Inflation is still higher than the FED’s target of 2%, hence interest rates are probably not going away anytime soon. Experts claim that the economic slump can be dealt with by 2024. Hence the next bull run for the cryptocurrency markets will probably happen sometime then. Bitcoin (BTC) and Ethereum (ETH) are also expected to enter a bull run in 2024.

At the time of writing, BTC was trading at $21,724.15, down by 0.5% in the past 24 hours. On the other hand, ETH price stood at $1,501.90, down by 1.5% in 24 hours.

Read More:

Bitcoin Futures Trading for Beginners

Polygon MATIC Price Prediction 2023, 2025, 2030

Luna Classic Price Prediction: Will Luna Classic Reach $1?

HBAR Price Prediction 2025, 2030

Hooked Protocol Price Prediction: How High Can HOOK Coin Go?

Pi Network Launch Date: When Will Pi Coin Enter The Market?

Is Pi Network Legit Or Scam: Pi Cryptocurrency Real Or Fake?

Will Pi Network Ever Launch? What Stage is Pi Network Now?

Core DAO Launch Date: What is Core DAO Mainnet?

Moon Bitcoin Review – Your Best Chance to Get Free Bitcoins

Will Shibarium Burn Remove 111 Trillion SHIB Annually?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Wild Cash App by Hooked Protocol: Answer Quiz to Earn $HOOK

Ethereum Price Prediction 2025-2030

ADA Cardano Price Prediction 2025, 2030

Amazon Stock Price Prediction: Is Amazon Expected to Go Up?

Metamask Airdrop – To Get $MASK Token For Free?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved