Recommended

Tesla Stock Price Prediction 2023, 2025, 2030 — Is Tesla Stock a Good Investment?

2023/10/11By:

The price of Tesla stock (NASDAQ:TSLA) has been soaring for a very long time. In 2020, its stock price increased by 695%, making Elon Musk the world’s richest person; in 2021, it increased by another 50%. Major US indices, including the NASDAQ and the S&P 500, track the price of Tesla Motors stock. Over the past year, the business brought in $281 billion in revenue and $28.2 billion in profit. There hasn’t been much of a challenge to Tesla’s dominance in the market, but that’s beginning to change rapidly.

Still, Tesla has established itself as the market leader among EVs. In a market where many other brands are strongly producing their own EVs, it remains to be seen whether this will still be the case in the coming years. The trajectory of Tesla’s stock shows that electric vehicles represent both the wave of the future and a rapidly expanding market segment for automobiles.

Tesla Stock Price Analysis

A potential economic downturn has emerged as a result of the recent banking crisis. Those trying to hedge their bets have mostly abandoned the stock market in favour of the perceived security of gold.

The cost of a Tesla Model S or Model X was reduced not too long ago. Investors aren’t happy about it, despite the fact that it would help Tesla attract more customers. Although EVs are the wave of the future, their popularity has waned as of late. Stocks in electric vehicle manufacturers will be a better bet once demand increases. Recently, electric vehicle stocks have been performing as follows:

Tesla shares have gained about 2.5% in the last 5 days. XPENG, a Chinese automaker, has had its stock price rise by 17% in the last 5 days. Comparatively, NIO is up 13.6% and Rivina is up 4.6%.

As the first quarter of 2023 came to an end, Tesla stock had risen above $200. The first quarter of 2022 ended with Tesla’s stock ranking third on the S&P, behind Nvidia and Meta Platforms. In the first quarter, Tesla saw gains of almost 68%.

Tesla stock gained almost 6.24 percent by market closing on Friday. The revelation of possible plans for a new battery facility and the anticipation of positive delivery numbers in the first quarter of 2023 caused the stock price to soar.

Tesla delivered 405,000 electric vehicles in the fourth quarter of 2022. The financial market anticipates that Tesla will post 432,000 deliveries for the first quarter. Again, this is greater than Q4 of 2022 predictions from Bloomberg’s consensus.

Tesla’s stock price is projected to rise on Monday after the company reveals its delivery numbers on the second day of the new quarter, which is on Sunday.

| Download App for Android | Download App for iOS |

Tesla Stock Latest Updates

- Moody’s Investors Service raised Tesla’s credit rating from Ba1 to Baa3. Ba1 signifies garbage or the debt rating, whilst Baa3 indicates stability.

- Two antitrust class action lawsuits have been filed against Tesla, saying that the firm prohibited consumers from obtaining outside servicing, causing them to wait longer and spend more for repairs.

Tesla Stock Price Prediction

Tesla Stock Forecast 2023, 2024, 2025, 2030, 2040, 2050 – Tesla is at the vanguard of the electric vehicle and renewable energy technology revolutions, which makes investing in the company’s shares an exciting proposition. Tesla’s stock price has been erratic over the past few years, but long-term investors have experienced good returns as the firm expands its product line and enters new markets.

Given the company’s competitive advantages and development prospects, analysts are largely bullish on Tesla’s stock. However, potential investors should keep in mind that Tesla is a high-risk, high-reward investment and that its stock price is expected to continue to be volatile.

| Download App for Android | Download App for iOS |

Tesla Stock Price Prediction 2023, 2024

The price of a Tesla is anticipated to reach $120 by the end of 2023, indicating a 42% increase over the previous year. This would imply a +53 percent increase over the current price. It is anticipated that the share price of Tesla would reach $105 by the middle of 2023. In the first half of 2024, it is anticipated that the price will rise to $148, and by the end of the year, it will reach $149, representing a +97% increase from the current price.

Tesla Stock Price Prediction 2025, 2030

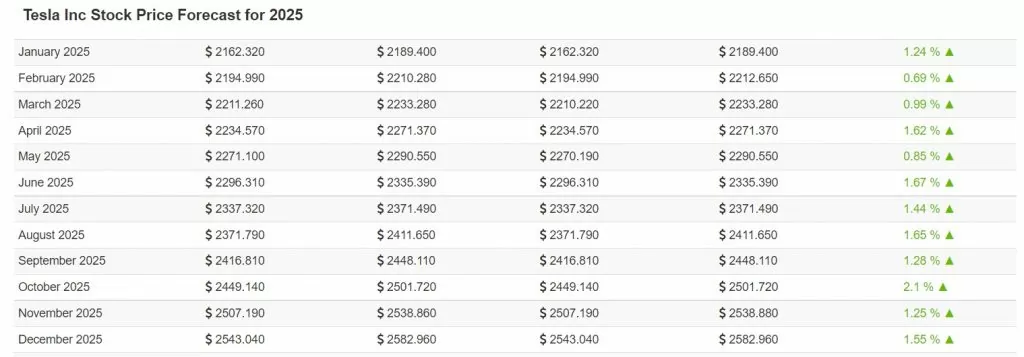

By the time we reach 2025 or 2030, I think TSLA stock will have skyrocketed from its current price. As the world transitions to electric cars, the company will be very successful at that time. Wallet Investor’s experts believe the stock will be worth more than $2,500 by 2025, as depicted in the table below. Cathie Wood forecasts that the stock price will rise to more than $3,000 by 2030.

| Download App for Android | Download App for iOS |

Is Tesla Stock a Good Investment?

Yeah, Tesla is a solid investment. Here are the factors working in Tesla’s favour:

- Excellent R&D and Execution capabilities. The corporation has introduced various technologies and has effectively overcome chip shortages through production. Tesla dealt with Chip shortages by substituting alternative chips and updating its firmware. This allowed Tesla to handle manufacturing significantly more efficiently than the majority of manufacturers.

- Twitter Inc. is merely a legal matter and will not consume Musk’s time: Despite reasonable concerns regarding the amount of time Musk would devote to Twitter, his focus will not be diverted from Tesla and SpaceX now that he has withdrawn from the transaction.

- With the stock split, TSLA is now significantly more liquid and available at a reduced price (if not value). It also has solid institutional support. EV as a sector will continue to expand, and Tesla will benefit immensely.

Will Tesla Stock Surged in 2023?

The stock price of Tesla has increased by more than 80% so far in 2023, indicating the company’s rapid expansion. The stock price of Tesla has risen for a number of reasons. Many of these are:

- China Price Drops

- The United States Government’s Tax Cuts

- Tesla’s earnings report is better than predicted.

But, macro forces may once again prevent a rise in Tesla’s stock price, as they did in 2022. In light of recent developments around the world, the macro outlook is still cloudy, and a recession may be around the corner.

Tesla’s stock price fell more than 50 percent in the first three months of 2022, but it rose more than 50 percent the following year. Despite this, Tesla’s current price of roughly $385 is still down by around 50% from its 52-week high.

| Download App for Android | Download App for iOS |

Why Did Tesla Stock Collapse Recently ?

- The Fed’s interest rate hikes over the past few months have sucked liquidity out of the markets. High-growth equities like Tesla’s have been hit harder by this than more conventional businesses.

- Tesla’s Shanghai factory was shut down despite the company’s predictions of 50% annual growth through 2022. However, the company was unable to produce at the desired rate. Rising Covid cases necessitated the temporary closure of the Shanghai factory, responsible for nearly 40% of overall production. Tesla is also having trouble ramping up production because to problems at its recently opened factories in Germany and Texas. In October, electric vehicle manufacturers decreased their projections for the year.

- Elon Musk, CEO, Exhibits Irregular Behaviour Companies often saw worse financial outcomes in 2022. Nonetheless, Elon Musk’s unconventional leadership style is seen as a major factor in Tesla’s poor performance relative to the market as a whole. Several skeptics cast doubt on his dedication to Twitter Inc. Many people find Musk’s frequent use of Twitter to be a nuisance, despite his obvious enthusiasm for the platform. More crucially, by constantly selling Tesla shares to acquire Twitter for $44 billion, he has degraded the stock’s reputation.

Will Tesla Stock Recover?

When it comes to electric vehicles, Tesla is the largest and one of the most profitable manufacturers in the world. In the first nine months of 2022, its net profit of $8.9 billion was more than GM’s. Yet, for the aforementioned explanations, the stock has underperformed. Today, the most discussed actions to restore the share price in the future months are as follows.

- Musk made $40 billion from the sale of Tesla stock in 2017. Adopting the 10b5-1 plan formally will give investors assurance that there would be no substantial sales of shares in the near future.

- Create a modest growth plan for 2023, say 35%, and then exceed it. In 2023, a difficult macro environment will prevent growth of 50%.

- Elon Musk needs to delegate Twitter’s leadership to someone else so he can focus on Tesla.

- Being a cash cow, the corporation should initiate a share buyback program to increase investor trust.

| Download App for Android | Download App for iOS |

Tesla Stock Price Prediction :FAQs

1.What will Tesla’s value be in ten years?

Within the next decade, the price of a Tesla could reach over $4,600 by the end of 2031. Tesla’s price could begin 2032 at $4,428, increase to $4,536 in the first half of the year, and end the year at $4,648.

2.How high is Tesla’s stock anticipated to rise?

The average 12-month price forecast based on the opinions of 20 analysts is $970.55, while the highest projection is $1,580.00 and the lowest is $250.00.

3.In 2030, how much will Tesla be worth?

By 2030, according to billionaire investor Ron Baron, Tesla could be worth $1.5 trillion (the company).

Where to Trade Tesla Futures?

BTCC have also launched tokenized stock and commodity USDT-margined futures. Now you can trade gold, silver and stock on BTCC. These tokenized futures contracts are innovative products invented by BTCC, and users can trade stocks and commodities with USDT on our platform. Below are the details of the newly-added trading pairs.

BTCC offers exclusive bonus for new users. Sign up and deposit on BTCC to get up to 3,500 USDT in bonuses. Meet the deposit targets within 30 days after successful registration at BTCC, and you can enjoy the bonus of the corresponding target levels. Find out what campaigns are available now: https://www.btcc.com/en-US/promotions

iOS QR Code Android QR Code

| Download App for Android | Download App for iOS |

Why Trade TSLAUSDT Perpetual Futures on BTCC

To trade TeslaUSDT Perpetual futures, you can choose BTCC crypto exchange.BTCC, a cryptocurrency exchange , was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. Over 11 years of providing crypto futures trading services. 0 security incidents. Market-leading liquidity.

Traders may opt to trade on BTCC for a variety of reasons

- Secure:safe and secure operating history of 11 years. Safeguarding users’ assets with multi-risk management through the ups and downs of many market cycles

- Top Liquidity:With BTCC’s market-leading liquidity, users can place orders of any amount—whSHIBer it’s as small as 0.01 BTC or as large as 50 BTC—instantly on our platform.

- Innovative:Trade a wide variety of derivative products including perpetual futures and tokenized USDT-margined stocks and commodities futures, which are innovative products invented by BTCC.

- Flexible:Select your desired leverage from 1x to 150x. Go long or short on your favourite products with the leverage you want.

BTCC FAQs

1.Is BTCC safe?

Since its inception in 2011, BTCC has made it a priority to create a secure space for all of its visitors. Measures consist of things like a robust verification process, two-factor authentication, etc. It is considered one of the most secure markets to buy and sell cryptocurrencies and other digital assets.

2.Is it possible for me to invest in BTCC?

Users are encouraged to check if the exchange delivers to their area. Investors in BTCC must be able to deal in US dollars.

3.Can I Trade BTCC in the U.S?

Yes, US-based investors can begin trading on BTCC and access the thriving crypto asset secondary market to buy, sell, and trade cryptocurrencies.

ADA Cardano Price Prediction 2025, 2030

Algorand Price Prediction 2030

MANA Coin Price Prediction 2030

HBAR Price Prediction 2022, 2025, 2030

Stellar Lumens (Yearn.Finance (YFI)) Price Prediction 2030

Algorand (ALGO) Price Prediction 2022, 2025, 2030

Apecoin Price Prediction 2022, 2025, 2030

CRO Crypto Price Prediction 2025

Yearn.Finance (YFI)lon Mars Price Prediction

Yearn.Finance (YFI) Price Prediction 2022, 2025, 2030

Solana (SOL) Price Prediction 2022,2050, 2030

Ethereum Price Prediction 2022, 2025, 2030

Aave (AAVE) Price Prediction 2023,2025, 2030: Will AAVE Recover from Crypto Crash?

ETC Price Prediction 2025-2030: Will Ethereum Classic Go Up?

MATIC Price Prediction 2030: Is Polygon Crypto a Good Investment?

Terra Classic (LUNC) Price Prediction 2022,2025,2030: Will LUNC Reach $1?

AMP Price Prediction 2023, 2025, 2030- Will AMP Hit $1?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Yearn.Finance (YFI) (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (TRX) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

ConstitutionDAO (PEOPLE) Coin Price Prediction 2023, 2025, 2030

Galxe (Previously Project Galaxy) Price Prediction 2023, 2025, 2030: Is GAL Coin a Good Investment?

Mina Protocol (MINA) Price Prediction 2023, 2025, 2030: Is MINA a Good Investment?

Toncoin (TON) Coin Price Prediction 2023, 2025, 2030

Internet Computer (ICP) Price Prediction 2023, 2025, 2030: Is ICP a Good Investment?

Internet Computer (ICP) Price Prediction 2023, 2025, 2030 — Is ICP a Good Investment?

Neo (NEO) Price Prediction 2023, 2025, 2030: Is Neo a Good Investment?

Alchemy Pay (ACH) Price Prediction 2023, 2025, 2030 – Is ACH a Good Investment?

Neo (NEO) Price Prediction 2023, 2025, 2030: Is Neo a Good Investment?

Conflux (CFX) Price Prediction 2023, 2025, 2030 — Is CFX a Good Investment?

Core DAO (CORE) Price Prediction 2023, 2025, 2030

Arweave (AR) Price Prediction 2023, 2025, 2030 — Is AR a Good Investment?

Synthetix (SNX) Price Prediction 2023, 2025, 2030 — Is SNX a Good Investment?

Measurable Data Token (MDT) Price Prediction 2023, 2025, 2030

Adventure Gold (AGLD) Price Prediction 2023, 2025, 2030 – Is AGLD a Good Investment?

Arbitrum (ARB) Price Prediction 2023, 2025, 2030

BitTorrent (BTT) Price Prediction 2023, 2025, 2030

Measurable Data Token (MDT) Price Prediction 2023, 2025, 2030

SafeMoon (SFM) Price Prediction 2023, 2025, 2030

OMG Coin Price Prediction 2023, 2025, 2030

Alien Worlds (TLM) Price Prediction 2023, 2025, 2030

Reserve Rights (RSR) Price Prediction 2023, 2025, 2030

Bitgert Price Prediction for 2022-2030: Can Brise Reach 1 Cent in 2030?

JasmyCoin (JASMY) Price Prediction 2023, 2025, 2030: Is JASMY a Good Investment?

Pi Coin Price Prediction: Will Pi Ever Be Worth Money?

Loopring Price Prediction: What Will LRC Coin Be Worth 2030?

Tamadoge Crypto Price Prediction 2022-2023-2025

Quant (QNT) Price Prediction 2023, 2025, 2030 — Will QNT Hit $10,000?

Tectonic (TONIC) Price Prediction 2023, 2025, 2030 — Will TONIC Hit $1?

Baby Doge Coin Price Prediction 2023, 2025, 2030: Can Baby Doge Coin Reach 1$?

Loopring Price Prediction: What Will LRC Coin Be Worth 2030?

Helium (HNT) Price Prediction 2023, 2025, 2030 — How high can HNT go?

LCX Price Prediction 2023, 2025, 2030 | Is LCX a Good Investment?

Shping Price Prediction: Can Shping Coin Reach $1?

LCX Price Prediction 2023, 2025, 2030 | Is LCX a Good Investment?

Floki Inu (FLOKI) Price Prediction 2023, 2025, 2030 — Is FLOKI a Good Investment?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*