What Is Plasma (XPL) Crypto: Everything You Need To Know About It

Plasma is a Layer 1 EVM-compatible blockchain purpose-built for high-volume, low-cost global stablecoin payments. On 24 September, Binance showed support for the Plasma (XPL) project, adding it to its HODLer Airdrops programme as the 44th project.

Following this announcement, Plasma (XPL) has attracted significant attention from crypto enthusiasts. But what exactly is Plasma (XPL)? Could it be a smart investment choice for 2025? This article provides a comprehensive overview of the Plasma (XPL) project, including its key features, XPL tokenomics, airdrop, Plasma (XPL) price prediction, as well as its growth potential in the crypto market.

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Plasma?

The stablecoin market is currently valued at $255.9 billion, and is experiencing rapid growth due to the high demand for low-volatility digital assets. Plasma is a blockchain platform designed specifically for stablecoins. It combines the security of Bitcoin with the smart contract functionality of Ethereum, enabling fast, zero-fee stablecoin transfers and global scalability. As stablecoins gain traction, Plasma’s innovative features and strategic approach are establishing it as a key player in the market’s evolution.

Plasma aims to address the inefficiencies of stablecoin transactions, such as high fees, slow speeds and fragmented infrastructure. The project focuses on enabling zero-fee USD transfers and supporting confidential payments, with the aim of targeting remittances, cross-border commerce, and institutional adoption. By prioritising stablecoins (a market worth over $250 billion), Plasma is positioning itself as foundational infrastructure for the movement of money around the world.

Notably, Plasma has formed strategic partnerships to increase its reach and improve the utility of stablecoins. Notable collaborations include:

- Yellow Card: Africa’s leading stablecoin on/off-ramp, enabling seamless regional adoption;

- BiLira: A Turkish lira-pegged stablecoin that facilitates cross-border transactions in Turkey;

- DeFi integrations: Partnerships with platforms such as Curve and Ethena enhance the utility of Plasma-native stablecoins within decentralised finance ecosystems.

These strategic alliances establish Plasma as a major player in the global stablecoin market, driving adoption across diverse regions and use cases.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Key Features of Plasma

As an EVM-compatible Bitcoin sidechain designed for free USDT transactions, Plasma combines high throughput, stablecoin-native features, and full EVM compatibility, giving developers the foundational infrastructure to build next-generation payment and financial applications. Its key feakures mainly include:

Zero-Fee USD₮ Transfers

One of Plasma’s central design goals is to allow fee-free USD₮ transfers, meaning users can send USDT on the network without transaction costs. This is intended to make digital dollar transactions frictionless and scalable.

This feature distinguishes it from many chains where gas costs or “layer-2” fees are a barrier for micropayments or frequent transfers.

High Throughput & Low Latency

Plasma promises robust performance with <1 second block times and support for thousands of transactions per second. The architecture is built to scale as stablecoin usage grows, reducing bottlenecks especially for payments and settlement.

Custom Gas Tokens & Burn Mechanisms

Unlike standard blockchains, Plasma supports custom gas tokens, meaning that transaction fees may be paid in other tokens or structured in flexible ways. Also, Plasma follows an EIP-1559-style mechanism, where part of the base fees are burned. This burning may counterbalance token inflation and introduce deflationary pressure over time.

EVM Compatibility & Developer Ecosystem

Plasma is built with EVM compatibility via the Reth stack, making it easier for Ethereum developers to port or build dApps. The intent is to support not just payments but DeFi, lending, and other ecosystem modules built on top of stablecoin rails.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is the XPL Token?

XPL is the native token of the Plasma blockchain, functioning as the economic backbone of the network. It is used to facilitate transactions as well as to reward those who provide network support by validating transactions. XPL is similar in these ways to Bitcoin (BTC) on the Bitcoin blockchain or Ethereum (ETH) on the Ethereum blockchain.

The XPL token is integral to Plasma’s ecosystem, serving multiple roles:

- Governance: Token holders can participate in decision-making processes, shaping the future of the network.

- Staking: XPL tokens can be staked to secure the network and earn rewards.

- Ecosystem Utility: XPL powers Plasma’s consensus mechanism and supports its Bitcoin bridge, ensuring seamless operations.

These functionalities make XPL a cornerstone of Plasma’s blockchain infrastructure and user experience.

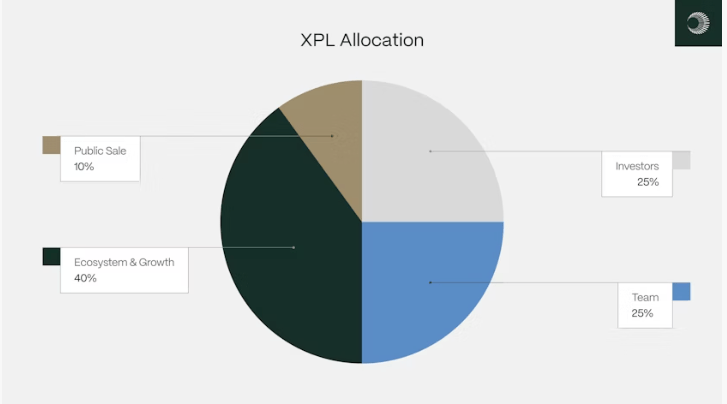

XPL Tokenomics

The total genesis supply of XPL is 10,000,000,000 (10 billion) tokens. At the time of Binance listing, the circulating supply is around 1.8 billion XPL (18% of the genesis supply).

- The XPL distribution is as follows:

- XPL Public Sale: 10% (1 billion XPL)

- Ecosystem & Growth: 40% (4 billion XPL)

- Team: 25% (2.5 billion XPL) (locked for 1–3 years)

- Investors: 25% (2.5 billion XPL) (locked for 1–3 years)

Unlock & Vesting Schedule

- Ecosystem & Growth allocation: 8% (800 million) is immediately unlocked at mainnet launch for incentives and liquidity. The remaining 3.2 billion unlocks monthly over three years.

- Team allocation: One-third is locked for one year (cliff), and the rest unlocks monthly over the next two years.

- Investors: They share the same unlock schedule as the team.

The XPL inflation schedule is designed to start at 5% annually and decrease by 0.5% per year until it reaches a floor of 3% annual inflation. This inflation is used to reward validators when staking / delegation becomes active. Meanwhile, the fees (base transaction fees) are burned (EIP-1559 style) to offset inflation and limit long-term dilution.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Plasma (XPL) Airdrop

The Plasma mainnet beta and XPL token launch are scheduled for September 25, 2025, at 8:00 AM ET. This marks the official release of Plasma’s native token and the beginning of its trading journey.

To encourage early adoption and incentivize community engagement, Plasma has set up a number of airdrop and reward programs. The Plasma (XPL) airdrop offers a unique opportunity to participate in a blockchain targeting the multi-trillion-dollar stablecoin market.

On September 24, Binance announced the addition of Plasma (XPL) as the 44th project on its HODLer Airdrops page. Users who subscribed their BNB to Simple Earn (Flexible and/or Locked) and/or On-Chain Yields products from 2025-09-10 00:00 (UTC) to 2025-09-13 23:59 (UTC) will get the airdrops distribution.

Binance will then list XPL at 2025-09-25 13:00 (UTC) and open trading against USDT, USDC, BNB, FDUSD, and TRY pairs. The seed tag will be applied to XPL. Binance will also support Tether (USDT) deposits and withdrawals on Plasma Network. Users can start depositing XPL and USDT from 2025-09-24 10:00 (UTC).

XPL HODLer Airdrops Details

Token Name: Plasma (XPL)

Genesis Total Token Supply (Genesis): 10,000,000,000 XPL

Max Token Supply: Infinite (5% of initial max supply in year 1 reducing by 0.5% per year with a floor at 3%)

HODLer Airdrops Token Rewards: 75,000,000 XPL (0.75% of genesis total token supply)

An additional 50,000,000 XPL will be allocated to marketing campaigns after the spot listing; and 150,000,000 XPL will be allocated into future marketing campaigns 6 months later. Details will be shown in separate announcements.

Circulating Supply upon Listing on Binance: 1,800,000,000 XPL (18% of genesis total token supply)

Smart Contract/Network Details:

- Plasma Explorer

- BNB Smart Chain (0x405FBc9004D857903bFD6b3357792D71a50726b0)

Listing Fee: 0

Notably, the move comes ahead of the token’s spot trading debut on September 25, 2025, giving eligible BNB holders early access to XPL rewards.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Plasma (XPL) Price Prediction

With the mainnet launch and increasing hype, XPL is likely to experience significant price volatility in late 2025. Assuming successful adoption, XPL could trade within the range of $0.90 to $1.50 by the end of that year.

In 2026, token unlocks may introduce selling pressure, potentially limiting growth. However, if adoption remains robust, XPL might consolidate between $0.75 and $1.20 before experiencing renewed acceleration in 2027.

By 2027, should Plasma gain traction within the DeFi and payments ecosystem, demand for XPL could propel prices toward a range of $2.00 to $2.50. Institutional interest in stablecoin infrastructure would serve as a crucial catalyst for this growth.

As adoption continues to scale—particularly if Plasma captures stablecoin volume from Tron or Ethereum Layer 2 solutions—XPL could rise to between $3.20 and $4.00.

With the maturation of the ecosystem, it is anticipated that XPL could trade within a range of $4.50 to $5.20, driven by both institutional use cases and broader retail adoption.

If Plasma successfully establishes itself as the preferred zero-fee stablecoin transfer network, there exists potential for XPL to reach values between $5.50 and $7.00 by 2030; however, failure to retain users following token unlocks may result in prices remaining below the threshold of $3.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Is Plasma (XPL) a Good Investment in 2025?

Plasma is entering a niche with high demand: stablecoin payments. Plasma (XPL) combines ambitious technology with strong adoption potential, particularly through its model of fee-free stablecoin transfers. If it successfully delivers zero-fee transfers, high throughput and seamless interoperability, it could attract significant usage. Its linkage to stablecoins provides real utility beyond pure speculation. The backing by notable investors (Founders Fund, Bitfinex, etc.) and a strong public sale / funding track record also lend credibility.

Furthermore, early airdrops and listing incentives create pathways for retail participation and liquidity momentum. However, the token does carry risk. The large unlock schedules for ecosystem and team allocations could lead to selling pressure. If demand growth does not match the release of supply, the price of the XPL token could struggle. The inflation schedule (5% → 3%) introduces dilution, which could dampen returns unless offset by burning or usage.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

How to Buy the XPL Token?

As of press time, the XPL token is not available on the open market. However, there are still several ways to obtain XPL tokens.

Participate in Airdrops / Rewards Programs

Make sure to fulfill eligibility conditions for Binance’s HODLer Airdrop or USDT locked product offers before the snapshot dates. These can allow you to receive XPL before trading commences.

Use Launchpool / Reward Campaigns

Exchanges like Bitget have Launchpool campaigns where users can lock other tokens (e.g. BGB) to earn XPL rewards.

Staking / Delegation (Once Live)

When the staking / delegation system becomes active, you may stake or delegate XPL to validators to garner rewards. Be sure to check lock periods, validator reliability, and reward structure.

Wallet & Network Setup

Use a wallet that supports Plasma network or connected chains (via EVM compatibility). Ensure you hold a small amount of gas or appropriate tokens for transactions once the network is live.

Trade on Exchanges After Listing

Once XPL is listed (e.g. on Binance, OKX, Bybit), you can trade it with pairs like XPL/USDT, XPL/BNB, etc. Deposits will open in advance of listing, and withdrawals shortly after.

Currently, XPLToken is not available on BTCC platform. However, it is worth mentioning that BTCC supports trading for large variety of popular coins, such as BTC, ETH, BNB, SHIB, BONK, etc. If you are interested in these popular coins, you can make a purchase on the BTCC exchange with the highest security level and a most competitive fee.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Conclusion

Plasma (XPL) is poised to redefine the stablecoin landscape with its zero-fee transfers, high transaction throughput, and robust security features. With a 10 billion token genesis supply, structured tokenomics, and early airdrop campaigns, the project is setting up strong incentives for uptake and community participation.

As the stablecoin market continues to grow, Plasma’s unique approach makes it a project to watch in the coming years. However, risks such as dilution, competitive pressure and regulatory challenges remain. If Plasma succeeds in making digital dollar transfers seamless, though, its utility could support sustained demand for XPL tokens. As is always the case in the world of cryptocurrency, it is timing, execution and adoption that will determine whether XPL is just short-term hype or a long-term infrastructure investment.

That’s all the information about Plasma (XPL). If you want to know more information about Plasma (XPL) coin and other cryptocurrencies, please visit BTCC Academy.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

About BTCC

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

Crypto Investing Guide:

What Is Hemi (HEMI) Crypto: Everything You Need To Know About It

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

Zebec Network (ZBCN) Price Prediction: Next Big Token To Explode?

Pendle (PENDLE) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can PENDLE Hit $10?

Aerodrome Finance (AERO) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can AERO Hit $2?

Api3 (API3) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can API3 Hit $10?

What Is Plume (PLUME) Crypto: A Complete Review & Analysis In 2025

Marlin (POND) Price Prediction 2025, 2026, 2030, 2040 And 2050: Can POND Hit $1?

Chainlink (LINK) Price Prediction 2025, 2026, 2030, 2040, and 2050: Next Big Token To Explode?

SKALE (SKL) Price Prediction 2025 To 2030: Can SKL Hit $1?

Pepe Heimer ($PEHEM) Review & Analysis: Next 100x Meme Coin on Ethereum?

Kanye West Launches YZY Crypto: Everything You Need To Know About It

Sapien (SAPIEN) Price Prediction: How High Can SAPIEN Go Post Binance Listing?

OKZOO (AIOT) Price Prediction 2025, 2026 And 2030: Can AIOT Hit $5?

Layer Brett ($LBRETT) Review & Analysis: Next 100x Meme Coin?

Bullish Stock Price Prediction: Will It Explode Post IPO?

What Is MAGACOIN FINANCE Crypto: Everything You Need To Know About This Trump-Inspired Crypto

What Is Rizenet ($RIZE) Crypto: Everything You Need To Know About It

UnitedHealth (UNH) Stock Price Target & Forecast 2025 To 2030: Is UNH Stock A Buy Now?

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Anoma Roadmap Explained: Is an Airdrop Coming?

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

UPTOP Goes Live on Binance Alpha: Everything You Need to Know About This Crypto and Its Airdrop

Yala (YALA) Debuts On Binance Alpha: Everything You Need To Know About This Crypto And Its Airdrop

Succinct (PROVE) Price Prediction: Next 100x Token?

Illuvium (ILV) Price Prediction 2025 To 2030: Can ILV Hit $1000?

Treasure (MAGIC) Price Prediction 2025 To 2030: Can MAGIC Hit $10?

Maxi Doge (MAXI) Price Prediction 2025 To 2030: Next 100x Gem?

Bitcoin Swift (BTC3) Review & Analysis: Next Big Gem To Explode?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

WeWake (WAKE) Review & Analysis: Next 100× Gem?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is Swapfone: Everything You Need To Know About This US-Based Crypto Exchange

Top Canadian Crypto Stocks to Buy in 2025

Best Crypto Trading Bots in Canada for September 2025

How to Sell Pi Coin in Canada: A Complete Guide for 2025

Top Crypto & Bitcoin Casinos Canada 2025

What Is Crypto30x.com ASX: Everything You Need To Know About It

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025