What is Margin Trading & How Does It Work?

What is margin trading? How does it work, and what are some of the benefits and risks of margin trading?

In this post, we’ll take away some of the mysteries in margin trading and some of the margin trading myths and help you decide whether it’s a strategy that can help you achieve your investment goals.

What is Margin Trading?

Margin trading is a form of borrowing, allowing trader leverage securities already own to purchase additional securities.

Margin trading may be suitable for any trader/investor that seeks additional leverage in their investment.

How does it Work?

Let’s move on to an example of how it works.

Although margin trading can be carried out on different asset classes from forex, stocks to cryptocurrencies, we’ll consider a hypothetical XYZ stock in the example below. We’ll later give an example from the BTCUSD chart.

Assume you want to buy 1000 shares of XYZ stock at $10 per share but only have $5000 in investment capital. With a margined account, you can use the $5000 in cash and borrow the other half on margin to complete your purchase. Without margin, otherwise known as a cash account, you would need the whole $10,000 in cash to make the stock purchase.

Now let’s see how a margin loan can affect your returns in the XYZ stock.

Assuming the XYZ stock increased from $10,000 to $11,000, and you exit the trade by selling it. You would pay back the $5000 margin loan and realize a profit of $1000, making a 20% return on your $5000 investment.

By merely putting only your money on the line, i.e., not using a margin loan, your $10,000 cash investment would have yielded you only 10% in profit.

Leverage is a powerful tool when the asset’s price moves in your favor. However, it is also essential to recognize the downside should the stock price fall.

| Use 150x leverage to trade cryptocurrencies which have crazy price fluctuations on BTCC bitcoin futures trading platform to make a quick profit. Up to 2,000 USDT deposit bonus is availble for new users now. Accept USDT deposit only! |

Let’s go over the same example once again; this time, we’ll consider the flip side.

Assuming the XYZ stock you purchased falls from $10000 to $9000, your equity ( Position value minus the loan balance of $5000) will fall to $4000. This makes a 20% loss from a 10% decrease in market value, not to mention transaction fees plus the spread.

It’s also worth mentioning that margin loans do not have a specific repayment period, as long as the equity in your trading account is within the required level.

Equity Requirement in Margin Trading

Let’s consider the crucial requirements for a margin account. To buy securities on margin, you must first deposit enough cash/fiat currency or eligible securities to meet your purchase’s initial margin requirements.

Though these requirements may differ based on the asset class you’re currently trading, you’re generally obliged to keep a particular level of equity in your margin account.

Margin Level

Most brokerage firms automatically calculate your margin level, indicating the health of a margin account.

Marked as a percentage, it is the ratio of equity to margin (Equity: Margin) used for your opened positions.

The account Equity here is the Account balance minus the loss, in the case of a loss, or plus profit, in the case of a profit.

So, the Margin level would be Equity/margin X 100.

What is a Margin Call?

A margin call occurs when the traders’ margin equity falls below the broker’s required amount due to either change in the underlying asset’s market value or because you purchased additional securities on margin.

To fix this, you’ll need to increase your account margin by making a deposit into your account, liquidating some open positions on securities, or via market growth.

Your broker can sell off or liquidate some of your securities to increase the equity in your account if your equity does not rise to the minimum amount by the margin call’s due date.

Let’s assume your broker sets the margin call percent to 40%, and your current margin level is at 120%.

As a trader, you should ensure your margin level does not go below the margin call percent to avoid account liquidation.

Margin Trading the BTCUSD 50% increase $10K to $15K (04 Dec 2017 to 18 Dec 2017)

Without margin, you can buy $100 worth of Bitcoin BTC from an exchange, and your account will only get liquidated if the price of Bitcoin goes to zero, which is almost impossible.

However, taking a 2X leverage on your trade implies that your account will hit margin call and, consequently, get liquidated if Bitcoin’s price drops by 50% from the initial price you placed your trade, e.g., from $10,000 per BTC to $5000 per BTC.

Conversly, if the price of Bitcoin BTC goes to $15000, you would have made a 100% profit on your initial deposit.

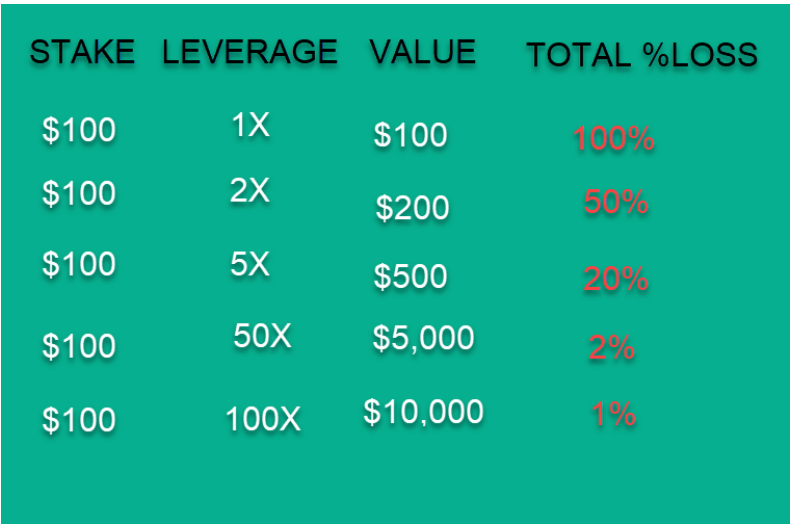

The image below illustrates the different leverage levels and liquidation percentage that an asset would move, should you use your entire capital in your trading account to buy the asset.

Stake, Leverage, Value in USD and Total %Loss (Liquidation %)

Now, don’t let the total loss% scare you. Understanding this means you’ll need to have more funds deposited in your trading account for your trades to stomach the deep oscillations that are more common in some asset classes, especially crypto assets.

With the above chart, you can adequately size your position per trade, applying sound risk and money management practices.

Conclusion

In summary, margin accounts enable you to leverage your investment, with the possibility of an increase in your return. Hopefully, the information covered so far will help you understand the benefits and risks involved.

| Use 150x leverage to trade cryptocurrencies which have crazy price fluctuations on BTCC bitcoin futures trading platform to make a quick profit. Up to 2,000 USDT deposit bonus is availble for new users now. Accept USDT deposit only! |