The BTCC Weekly Shot – Bringing you a weekly view!

From 03rd August, 2020 to 09th August, 2020

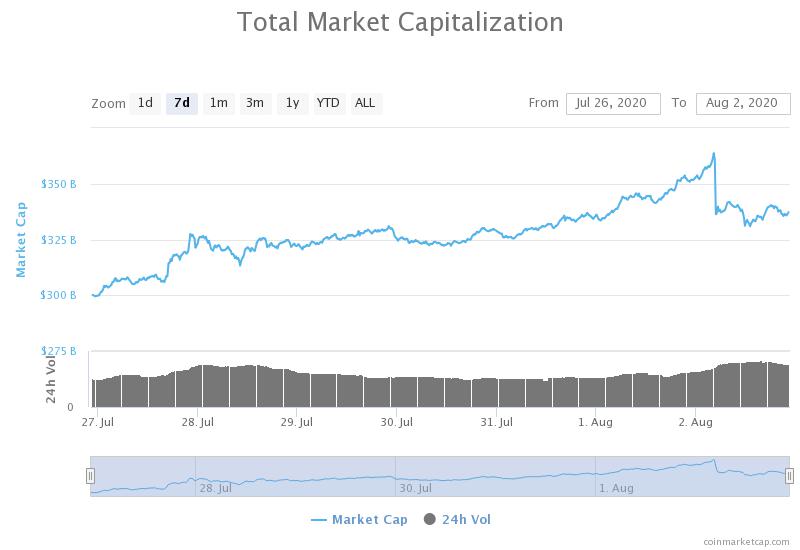

During the week ended August 02, 2020 we saw a great surge in the Crypto-World where the market capitalization rose from ~$300 billion to a high of nearly $364 billion and currently remains around $338 billion. Excluding Bitcoin, the market capitalization rose from $117 billion last week to $142 billion during the week.

Below is the snapshot of the Market Capitalization of the Crypto-world:

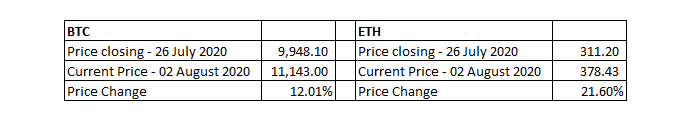

Following are the price changes for Bitcoin and Ethereum on Week-on-Week basis:

Looking at the current situation, during the week it is likely that Bitcoin and Ethereum are going to retrace their recent bullish move and consolidate before moving back for a newer and stronger move ahead.

Let’s speak of the Bitcoin’s possible move ahead:

Looking at the chart above (figure-3) it can be reasonably said that Bitcoin is likely to retrace its move into the previous breakout point which is between $9,900 to $10,300 where it will have a strong demand from the buyers. Similarly, the Bitcoin future will move pegged to the underlying Bitcoin prices and should move into 0.1% to 0.5% of the price differential.

Understanding the chart above, traders looking to take a trade may opt for taking a long position in the range of $9,900-$10,300 range with stop placed at $9,670 and target $12,400 as the next Bitcoin move and its futures.

The confidence level for this trade is 60% and according to me the risk to reward ratio for this trade remains ideal (with 1:4 ratio for risk: reward).

Similarly, an Ethereum price chart has been prepared:

Looking at the chart, it can be reasonably said that Ethereum just like the Bitcoin is likely to retrace its latest move in the range of $290-330 which would act as a strong demand zone for the coin. Similar to the price movement of the underlying asset, the Ethereum; the Ethereum future contracts are likely to stay in consolidation and retracement as well.

In my opinion, with stop of $278, the next move for Ethereum is going to be $540!

Upcoming events during the week:

| Date – From | Date – To | Event | Location |

| 3-Aug-20 | 6-Aug-20 | IEEE Dapps 2020 Facilitating the exchange between researchers and practitioners in the area of Decentralized Applications and Infrastructure | Oxford, UK |

| 7-Aug-20 | 9-Aug-20 | International Conference on Big Data & Blockchain 2020 ICBDB 2020 aims to bring together leading academic scientists, researchers and research scholars to exchange and share their experiences and research results in the field of Big Data and Blockchain. | New Castle, UK |

Hopefully this initiative of a weekly letter from the Btcc.com helps you with your knowledge and information. The analysis provided in the article are my personal views (Bilal Elahi) and by no means represent any view of people working at Btcc.com or managing it.

Disclaimer: This is my (Bilal Elahi’s) personal opinion and does not require you to trade. Consult your independent financial adviser/broker before getting into financial transaction/trade of any sort. Under no circumstances does Bilal Elahi (the author) or BTCC.com accepts any kind of claim or liability under whatsoever case of any financial damage. Following the analysis is your personal choice and risk and rewards belong to you.