Spot Trading vs. Margin Trading in Crypto – What’s the difference?

What is spot trading?

Spot trading is the most common type of trading method. It refers to the direct buying of cryptocurrencies at the current market price (known as the spot price) and holding it until the crypto value increases. Using a market order on an exchange allows you to buy or sell holdings at the best available spot price instantly or ‘on the spot’. The delivery is often immediate.

A spot market is an underlying market where cryptocurrencies are traded and settled instantly. It is also known as a cash market because traders make the payments upfront. Third parties, which are crypto exchanges, facilitate spot trading.

What is margin trading?

Margin trading is trading cryptocurrencies with funds borrowed from a third party (crypto exchange). This changes the way you trade because you can access larger amounts of crypto to increase your buying power. You can open positions of far greater value than your existing account balance and realise larger profits on successful trades.

In contrast to spot trading where traders use their capital to fund trades, margin trading allows traders to multiply (leverage) their trading capital.

Key terms you need to know in margin trading

Margin: the amount you need to enter a trade.

Free margin: the amount available for trading in your account and opening new positions. To calculate free margin, you can subtract the margin of your open position from your equity (your assets plus/minus your profit or loss).

For example, you enter a trade at $20 with leverage of 1:4 to borrow $80 to buy $100 worth of bitcoin. The requirement is that you have to pay back $80 plus transaction fees. To ensure the requirement is met, the exchange will make a margin call once your position hits a price where it starts losing the margin. A margin call demands the trader to deposit more funds into the position or place a stop limit to the position.

Maintenance Margin: It refers to the amount of equity you must hold to not fall below the maintenance margin requirement. The equity is the amount of crypto or USD you can withdraw if all your positions are closed.

Margin Call: A margin call occurs when the value of the trader’s account falls below the account’s maintenance margin requirement. You must add funds or your assets will be liquidated until you gain funds to meet the requirement.

What are the differences between spot trading and margin trading?

Spot trading is when traders fully purchase the asset immediately and take delivery. Conversely, margin trading allows traders to open larger positions so they can amplify their potential profits but it can amplify their potential losses too.

In spot markets, you can only profit when prices go up. You can’t profit when prices fall. On the other hand, margin trading allows you to profit in a bear market by going short (sell) on your position.

What is going short?

Going short means opening a short position. Traders typically go short when they expect the value of a crypto to drop, then go long (buy) on the crypto when it is expected to increase in value. This allows traders to profit from the difference between the cost of buying and selling.

How does margin trading work on BTCC?

At BTCC, we have 14 trading pairs for traders to choose from. We also offer flexible payment methods. The best benefit of trading on BTCC is that traders are not charged any fees for opening a position.

Now that you’re familiar with the basics, let’s look at how you can go short in margin trading on the BTCC app.

1. Once you’ve downloaded the BTCC app from Google Play or Apple Store, open an account and deposit funds to start trading.

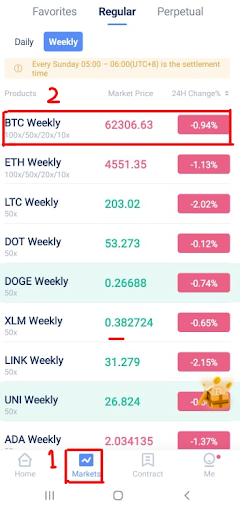

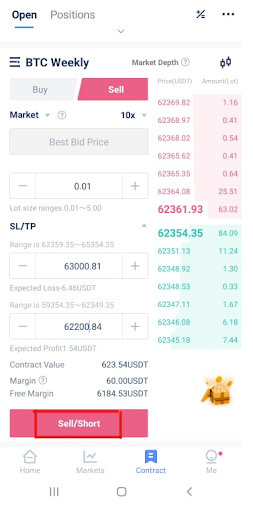

2. Go to ‘Markets’ and identify a cryptocurrency with a downward trend under the ‘Regular’ tab. We will use BTC Weekly as an example here. Tap ‘BTC Weekly’.

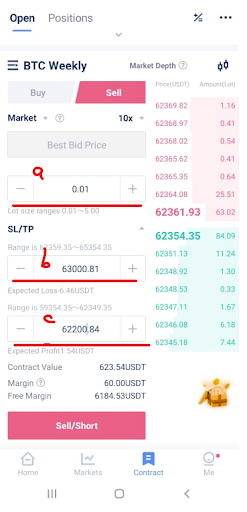

3. Tap ‘Sell/ Short’.

4. a. Select your leverage. For example: 10x

b. Select your lot size. For example: 0.01

c. Set your stop limit and/or take profit price for better control of risk management to prevent a margin call.

5. Tap ‘Sell/ Short’ to open the short position.

How can you minimise risks with margin trading?

Since margin trading can be riskier than spot trading, you have to manage the risks efficiently and effectively. You should invest only what you can afford to lose. Limit your leverage, set your stop-loss to cap the maximum loss you will incur if the market goes against you. The stop-loss is triggered when the price of a crypto falls beneath the price specified by you. Add take-profit to your trade according to the specific price at which you’re happy to close a position. Start exploring your favourite cryptocurrency today.

| Get a free account on BTCC and try your first Bitcoin leverage trading. New users will receive up to 2,000 USDT deposit bonus! |