3 Ways to Short Bitcoin (BTC) in 2021 – An Easy to Follow Guide

- Introduction: Let’s talk Bitcoin BTC

- How to Short Bitcoin BTC

- Shorting Weekly or Perpetual Bitcoin Futures Contract on Crypto Exchanges

- Short the BTCUSD on CFD/ Margin Trading Broker

– Instant Market Sell Order

– Pending Sell Limit and Sell Stop Order - Buying a Bitcoin BTC PUT option on Binary Options trading Broker platform.

Introduction: Let’s talk about Bitcoin

In the early days of Bitcoin, the only way to get the crypto asset (Bitcoin) was to either set up a node and become a miner, buy from someone who has Bitcoin locally, or buy from miners.

Miners were the only ones that could sell Bitcoin in large quantities considering that they were creating it.

After the creation and launch of Bitcoin BTC by the mysterious Satoshi Nakamoto, there was no way traders could short Bitcoin.

But wait, before we move on, we have to understand what it means to short an asset. Let’s first look into what it means when you buy an asset.

Well, buying an asset suggests that you have confidence in the short term, medium term, or long term potentials of the asset, and you believe the value will increase over time. Therefore, you buy it from the available sources placing a wager on the rise.

If you purchase Bitcoin at $10000 per Bitcoin and the price increased to $18000 at a future date, then you have made a profit from the difference between your purchase price and the current market price.

What if you do not have confidence in the asset’s short-term view or believe that the value may slump in the mid-term due to some macroeconomic event?

In this case, you can decide to sell the asset (AKA Short), which means you are betting that the asset’s value will collapse within a period. By doing this, you make a profit from the difference between the price you took the short sell order, for example, $19000, and the future price at $16,000.

How to Short Bitcoin

So, going back to our question, “How to short Bitcoin?”

Here are the different ways you can short Bitcoin in today’s’ crypto market.

– Shorting Weekly or Perpetual Bitcoin Futures Contract on Crypto Exchanges

– Short the BTCUSD on CFD/ Margin Trading Broker

– Buying a Bitcoin PUT option on Binary Options trading Broker platform.

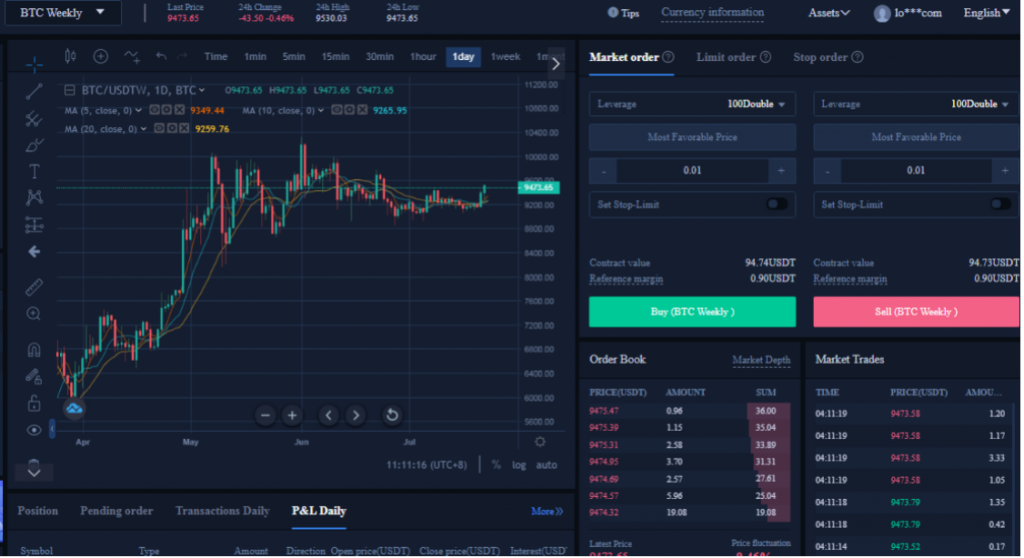

Shorting Weekly or Perpetual Bitcoin Futures Contract on Crypto Exchanges

As big investors got into the mining space and early mining equipment became obsolete, it became more difficult to mine Bitcoin as an individual due to the increase in mining difficulty; thus, you won’t cover the running cost.

Similarly, in December 2017, the CBOE and CME launched Bitcoin BTC futures trading, opening the door to institutional money, and allowing traders/investors to take a long or short position on the number cryptocurrency.

Notice how the Bitcoin BTC bullish trend ended after the exchanges commenced operation. Investors started betting on a possibly overvalued Bitcoin, and this was done by taking a short position on the BTC against the USD.

Apart from the CBOE and CME Bitcoin futures, other exchanges like Binance and BTCC also launched crypto futures trading.

Most brokers would allow you to short sell Bitcoin using regular (daily/weekly) futures contracts bound by an expiration date/time. You may also opt for perpetual future contracts where you can hold the trade for as long as your trading account stays liquid.

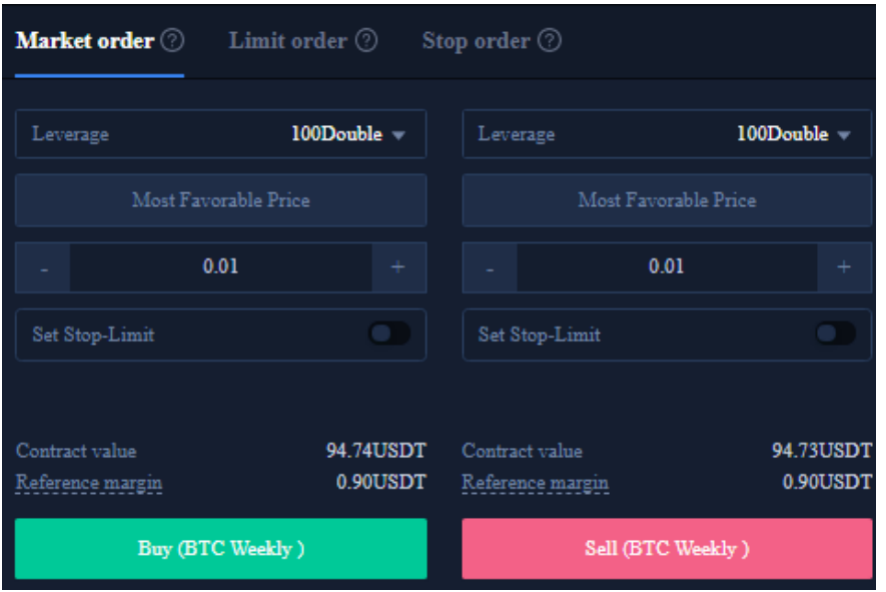

Short selling orders on a daily/weekly Futures contract, for instance, can be done using a market order, which gets executed instantly.

You can also short Bitcoin using pending (limit or stop) orders, which is only executed if the current bid price is equal to a set price level away from the bid price.

A short-sell limit order is set above the current bid price when you expect the Bitcoin exchange rate to decline after moving up to your set sell limit level. Conversely, a short-sell order is set below the current Bitcoin bid price, where you anticipate the bitcoin price to continue in a bearish trend after hitting the sell stop level.

Pending orders are initialized into live order as soon as they get triggered, and the fluctuation in the exchange rate will then be noticed on your account equity.

Short the BTCUSD on CFD/ Margin Trading Broker

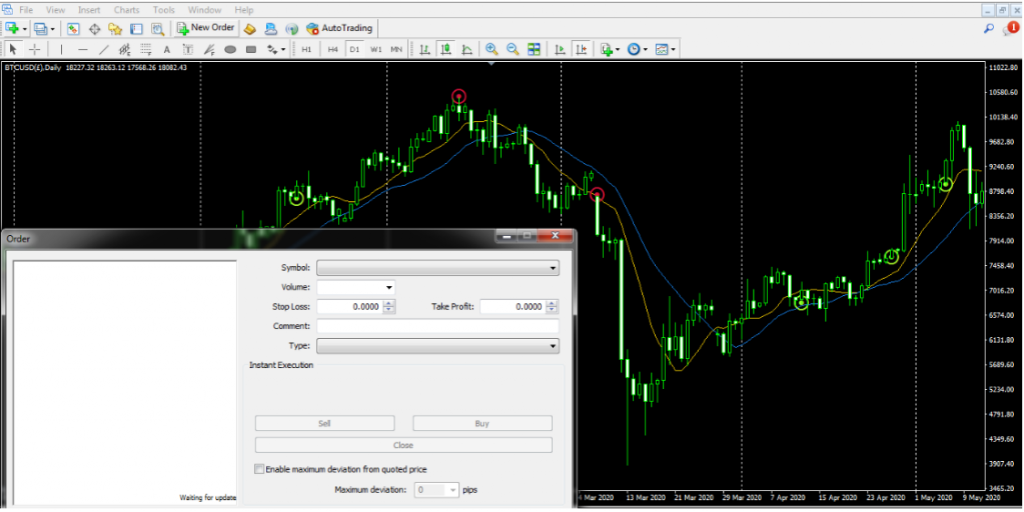

Shorting Bitcoin is very easy when using CFDs on a margined account. To do this, you have to first search for a broker that offers crypto trading. These days, popular brokers that offered traditional assets in the past now allow their clients to trade Bitcoin and other cryptos.

Most of these brokers now allow traders to be long or short Bitcoin BTC on the MetaTrader 4 trading platform, taking away the burden of storing Bitcoin private keys and speculating on a collapse in the BTCUSD exchange rate.

Other brokers/exchanges that offer web-based trading platforms also allow traders to short sell Bitcoin the same way as MetaTrader 4 brokers.

Let’s take an example where we analyzed a probable decline in the Bitcoin price. To profit from this potential price collapse, we should take a short sell order.

Short sell trades can be executed using an instant/market sell order or a pending (sell limit or sell stop order).

Instant/Market Sell Orders

As the name implies, an instant market sell order is executed at the available market bid price.

Once your trade is executed, you’ll see your open short sell trade running on the trade terminal window, where you can see how it affects your account equity and make a decision to exit your trade in a profit or loss.

There is no expiration date/time when you short Bitcoin on traditional broker platforms. You can hold your sell order for as long as you meet the required margin limit.

Pending Limit/Stop Order

As we explained under futures contracts, pending sell orders are activated into live orders when the market price goes to the pending price level.

A sell limit order is set above the market price and will only be live if the market price reaches the level. Conversely, a sell stop order is set below the market order, believing that the Bitcoin trend will continue in a downward slope once activated.

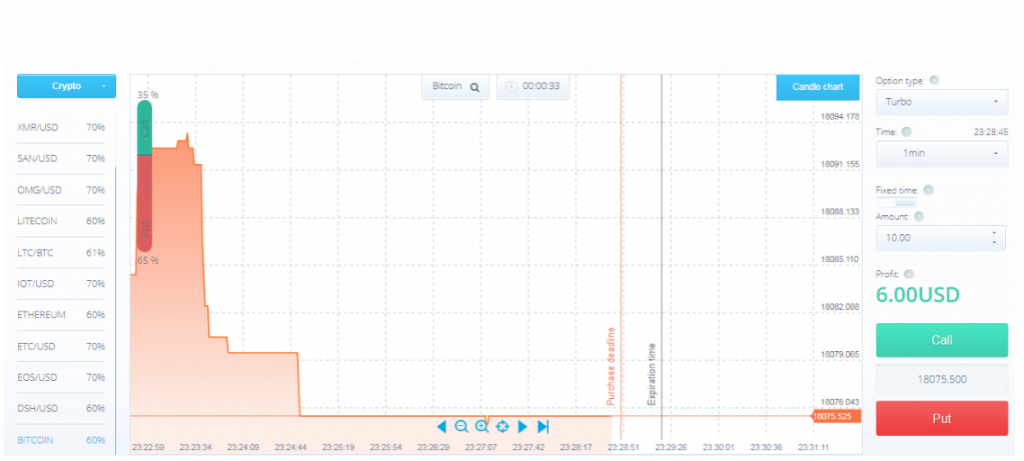

Buying a Bitcoin BTC PUT option on Binary Options trading Broker platform

Lastly, you can short sell Bitcoin on a Binary options broker platform, which is quite similar to buying a futures contract. The difference here is that you have to keep the short-sell trade open till expiration time, and the payout varies from 60% to 70%.

By buying a put option on a binary Options broker platform, you have entered a short sell trade, betting on a decline in Bitcoin price.

If the price stays below the strike price before the option expires, then you make a profit.

Summary

So, instead of swapping your Bitcoin for a Stablecoin like USDT or USDC where you do not make a profit, you may want to consider taking a short position on Bitcoin if you feel the price is overextended and make some profits on its way down.

Now you don’t only have to profit when the Bitcoin price goes higher, and you can also benefit from a projected collapse in the Bitcoin BTC price following some of the methods highlighted in this article.

Go For A Free Account In Seconds On BTCC And Try Bitcoin Shorting Today. New User Will Receive Up To 2,000 USDT Bonus!