What is CFD trading and how does it work?

CFD means a contract for difference. CFD trading scopes the buying and selling of derivatives based on a speculation model.

Without owning an underlying asset within financial markets, speculators open and close positions on the movement of prices for derivative products: forex, commodities, indices, and shares.

In reality, trading CFDs is an agreement to exchange a difference in the price of an asset from the point of opening to the contract’s closure.

CFDs within crypto-space are the latest products in the market. At BTCC.com, traders earn through staking on Bitcoin futures, and more include the following crypto-futures on daily, weekly or perpetual schedules: ETH, LTC, BCH, EOS, XRP, XLM, ADA, and DASH.

Tip: Trading Bitcoin Cryptocurrency CFDs – Ultimate Guide 2020

CFD trading benefits speculators under the ability to either buy or sell. The level of profit is as high as a speculator can forecast correctly.

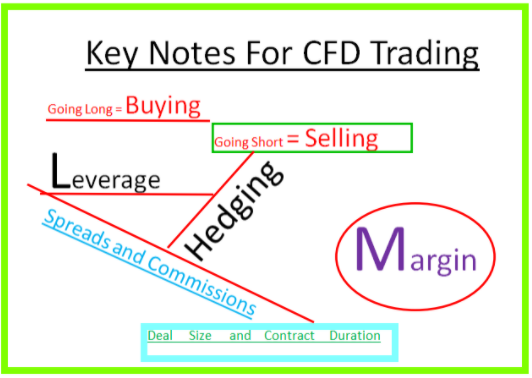

Contracts for difference have vital components that inform the nexus why they fit into financial markets. Aside from shorting or going long, CFDs trading is significantly impacted by leverage, margin, and hedging.

Shorting or longing CFDs

Actors in CFDs refer to selling as going short and buying as going long. CFD trading follows traditional trading models by speculating on price fluctuations into bullish or bearish markets.

Therefore, as a speculator, you gain or lose when your prediction is right or wrong regarding asset pricing within the time the contract is in force.

Leveraging For CFD Trades

In real CFD trading, the leveraging of positions depends on the regulations presented by your broker’s form. Therefore, you’re profiting or losing is magnified in exposures equal to the leveraging times you commit per position.

Trading without leverage means exposing yourself to commitments you can practically finance. However, when leveraging comes into the picture, traders are given a leeway to open larger positions.

In practical terms, traders only require to deposit small commitments and gain many times based on the leverage scales.

Professional traders approach leverage as a double-edged sword. Every open position is a contract whose overarching procedure is, closure determines the profits or losses which are payable there and then.

Leverage makes trading not only exciting but lucrative. Leverage ratios apply concerning platform rules or policies. Platforms leave leverage decisions upon traders’ discretion, where they make choices in line with their professional choices.

Margin in CFD Trading

In most circles, leveraging comes out as ‘trading on margin. Why so? Traders open positions with fractions of their entire deposit. Traders only require a small portion of the deposits – a margin to open any position as long as all other platform rules apply.

Trading on CFD platforms emerges with two major types of margins. For one, it’s the deposit margin, which a trader must attain to open any position.

Second is the maintenance margin. Maintenance margin is a portion required to help traders hold on to an open position with adverse price movements.

In case you open an adverse position, you stand to lose both the deposit margin and maintenance margin altogether. Traders can deposit maintenance margin at any time before the expiry of limits their deposits can hold.

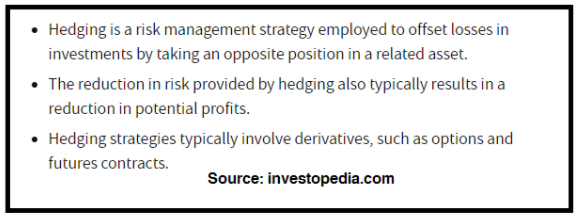

Hedging With CFDs

CFDs are also relied upon as tools for minimizing losses that may hit your portfolio.

Here’s a preview of how hedging works with CFDs. If a speculator foresees a dip in some asset prices, opening a shorting or selling a CFD will cover against the difference. Price dips occur for adverse reasons like low earnings or poor performance indicators.

Therefore, Shorting will provide a hedge or cover against the swift dip in prices. The offsetting CFD will recoup some values equal to the point of sale, down to the exit point for every committed unit or share.

The Working Model for CFDs

Now, with an overview of how CFDs function, it’s also critical to gain insights around concepts to shed light on how CFDs work. The four concepts are deal sizing, trade spreads, contractual durations, and the loss-profit axis.

Spreads and Commissions

All CFD price quotes are either of a buy price or sell price. Of course, buy price applies for bullish markets, and sell price applies for bearish markets. In more elaborate words:

· The selling or bid price opens a short/CFD of sale contract or trade

· The buying price or offer price opens a long or buying CFD trade

For short CFDs, you’ll notice that the opening price is lower than the current one. Likewise, the buying price is higher than the current price. In either case, long or short, the slight variation in the prices is known as a spread.

The reality is every trade you make, long or short, is a commitment whose cost of opening or committing is the spread. Therefore, if you open and close trades for CFDs without profits or losses, you have to pay for the spreads.

Deal sizes

CFDs trading takes place in standard contracts, best known as lots. Therefore, the sizes of contracts for any underlying asset are similar to how other markets perform. Therefore CFD trading is similar to traditional trading in many ways.

Durations of Contracts

Most of the CFD trading has no expiry dates- a case familiar with options. In a better sense, every position is closed by placing a trade opposite to it. For instance, a long position for 500 contracts of gold would close by selling 500 contracts of gold.

In case you leave your daily position open past the 24 hours trading cycle, platforms charge you an overnight fee. And the overnight fee increases per day, and it’s not part of the spreads or cost of opening a CFD trade.

Over time, the cumulative overnight charges reflect as trading costs for leveraging a position past a day’s trading cycle.

Note: Overnight charges are not the case with forward contracts. All forward contracts have the overnight charges done upfront and factored into the spread in line with the tentative closure date in the future.

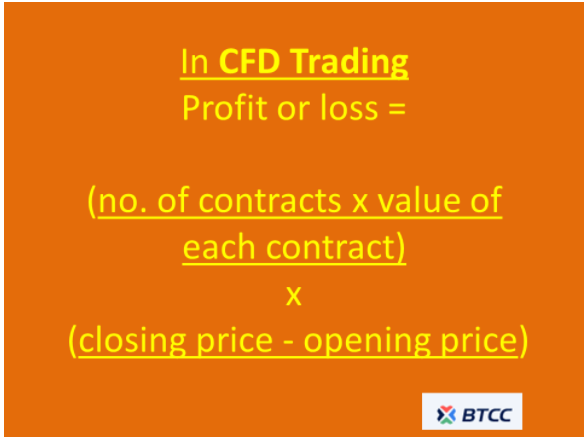

Profits and losses With CFD Trades

Calculating profits or losses with CFD trades is done by taking the deal size or total nu numbers of open contracts and multiplying that with the contracts’ value. The contract value is an expression of price points in the movement.

Next, you multiply the points in movement with the difference in opening fewer closing prices.

To get the exact value of return, you have to exclude any costs or charges in the form of spreads and overnight charges/ commissions.

Say, for example, that you go short on Bitcoin Future on the BTCC platform with one lot BTC-USDT for one contract valued at $75 at an instance when the selling price is 11400.

Therefore, suppose Bitcoin Prices dip 70 pips to $11330 and assume you close the contracts at the same price with an active contract. Your gain will be:

5250 = (75 x 1) x (11400 – 11330)

If you happen to exit at the point when BTC fluctuates as low as 11330 per unit, your gain will be at $5250.

Earn With Bitcoin and Other Crypto CFDs on BTCC.com

Open an account with us today and be a step ahead in investors’ forays with crypto CFDs.

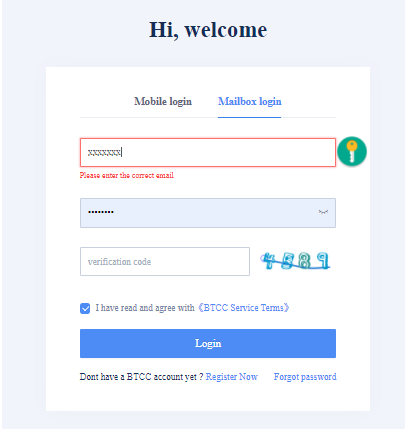

With BTCC, feel the crypto space’s freedom to advocate for the least Know Your Customer ideals. Verify your account by either a phone number or email, and you’ll be good to go.

BTCC ranks among the first exchanges alive to date (since 2011). Take advantage of bonuses, influencer programs, and referral perks. Once you open an account, follow our Twitter handle to get every announcement for your benefits.