A Beginner’s Guide to Day Trading Bitcoin and Other Cryptocurrencies

Day trading is applicable across the board refers to any trades opened and closed within the time of open and closure of a specified market within its 24 hours cycle.

With crypto, day trades have become common, with a huge cohort of traders preferring it. In better words, day traders are scalpers – preferring to benefit from the volatility of crypto values within a day.

Crypto day trading works where traders open small positions and close them while keeping an eye on the trend. Therefore, instead of speculating for a trend reversal, they trend along with the trend. Along with it, they open and close profiting positions.

Ideally, day trading is common with individuals who have a masterly of the cryptocurrency they trade.

You may wonder how they get the confidence to follow the trend. Well, it’s partly from experience and partly monitoring the sentiments around a cryptocurrency. Traders make financial news as their friends. And similar cases apply to ordinary forex.

News affects prices in only two ways; it’s either adverse or favorable. That gives a trader the confidence to either be trading or stay out of the choppy market until everything returns to relative calmness.

At best, if the direction of the trend is uncertain, there’s room for probable guesses where trades are placed with stops and limits.

Day traders like to speculate over the days with high volatility with a probable inference of the causes. Some variables that significantly shift volatility are:

- News with significant effects of stimulus packages or crypto-regulations

- Lapses in the security of platforms and actual hacks or reversals relating to them

Day trading is okay if you have small amounts of capital and have the time to study the screens for longer periods.

Online sources are accessible, and some offer premium but helpful insights for crypto traders.

How Do Crypto Day Traders Make Money?

Crypto day traders make returns by holding and closing positions from periods ranging from a few minutes to several hours. Bottom-line is, all their trades close intraday and never leave any positions overnight.

The precise thing is open trades and close them within a 24 hours cycle. Looking at the scenarios facing day crypto traders, you may feel it’s not worth it. But, there are different reasons why they take on daily trades.

One recipe to failure on crypto- trading is opening positions without trailing stops or stop losses. You may fail with three trades consecutively and win one big to compensate for the three fails in practical terms. When a trade bounces into the money, hold on to your confidence, do not stop it, rather let a trailing stop do it – you can afford to sleep comfortably in such a situation.

If you have a substantial amount of capital, you can play around with bigger lot sizes around the averages. Funny enough, one scalper can do ten lots in multiples of 0.1(totaling to 100 small trades). Even funnier, another one requires only ten trades, each going for lot size one at a time. At the end of the week, presuming all were wins, both will be at the same level.

Day trading for cryptocurrencies is one great reason you should never shy away from trading. It’s a very practical way to upscale your targets and get your feet wet at trading. Ideally, master small lot sizes, and you’ll find mastering trends an easy forte. Over time, shifting scales towards weekly or monthly trades gets easier.

It is not rare to find trades opening and closing within six months to less than a year.

The biggest enemies to day-crypto-traders are the market movers. And they comprise individuals with significantly high crypto-investments, big firms, and brokers who have massive investments in the entire market.

Crypto Day Trading Strategies

Crypto day traders must never assume that their craft requires any lesser professionalism and discipline.

Taking the points from established and successful traders, you must have two points very clear within your mind:

- One is what markets to trade

- Second is the timeframes you use

With markets comes the time zones, and simple enough, they oscillate around the daytime-hours. You’ll find most activities are highest in frequency, coinciding with ordinary Forex timelines for Tokyo, Asia, UK, and the US exchanges. Crypto has no bank, and that is a point requiring traders to find a way to get the inferences with happenings around them for best price action insights.

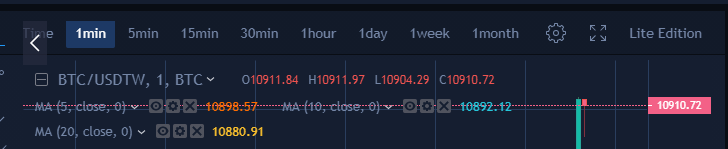

Regarding the applicable timeframes, a trader has to go with what works for them. However, work with the discipline of monitoring charts on fixed schedules in time. If you trade within an hour, master the instinct of looking at chart happenings in three-hour spans. Then, look up the three hours charts to help you figure out the happenings within each hour.

Crypto-trading is relatively very easy. But, sometimes, all a trader requires is to loosen the grip with fear. After you master the charts, you’re pretty sure of some moves – do not leave your concrete insights to waste.

Start by playing around with smaller lots and place trades within the norms of what you’ve seen happening in the past. But on a note of caution, never forget the stop losses. Your capital is more worth than the greed for a few bucks in the name of trading.

Value Benefits of Trading Bitcoin Futures on BTCC

BTCC.com ranks among the first platforms to float Bitcoin futures contracts. The truth stands that Bitcoin prices keep fluctuating. And Bitcoin futures open arrays of opportunity for speculators. All you require is to join the ranks of smart speculators.

Plenty of beauty with Bitcoin futures contracts is, you must not own it to speculate on its prices. If your instincts are right on the volatility, Voila! You win and rake in the returns.

Signup with us today and have the benefit of plenty of tools to tweak around your insights with bitcoin futures trading.

You may also go full screen if that suits your best – leaving you at maximum concentration with the charts and indicators.

Passive Incomes/Bonuses

At BTCC, there’s a more passive way to rake in more income by selling the noble idea to friends.

It’s super-easy using the referral link which you can pick from either the website or trading portal.

Platform Value Chain Benefits for Traders

Apart from ordinary business models, BTCC cares about the customers’ welfare. BTCC values every customer as each contributes to every single success that the platform witnesses since inception nine years ago.

There’s one inherent reason why you should join BTCC. In return, BTCC has ensured one great score; for close to a decade, the platform is and continues to invest in cutting edge security technology. It’s the sole reason why BTCC excels where other platforms fail.

BTCC was among the first platforms to launch Bitcoin CFD products. Over time we’ve increased the offering in periods and broadened scope with other Crypt- CFDs like Ethereum, EOS, and BCH.

Lastly, BTCC is among the few platforms that believe in tying crypto to fiat – currency verifiable in Gold terms. USDT is a great Stablecoin, and its the base cryptocurrency of every value within the platform.

| Do your first bitcoin futures trading on BTCC today. The deposit is as low as 2 USDT. And if your first deposit is over 500 USDT, you will get up to 2,000 USDT bonus. |